- China Mulls New Stimulus, Higher Deficit to Meet Growth Goal (bloomberg)

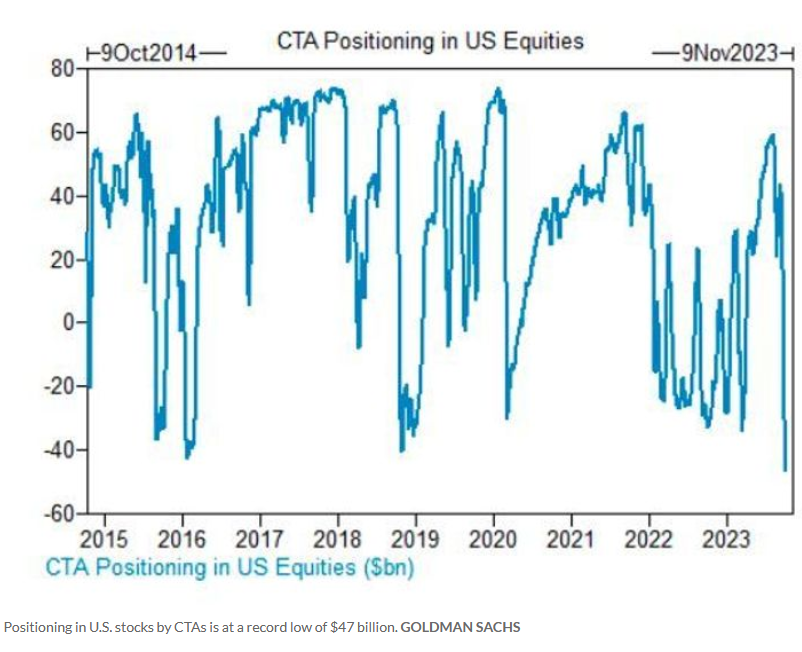

- Momentum traders set to buy the S&P 500 ‘in every scenario,’ says Goldman Sachs (marketwatch)

- Charlie Munger Says, “The Big Money Is Not In The Buying And The Selling But In The Waiting” — High Returns Don’t Actually Require High Effort (yahoo)

- Alibaba, More China Stocks Jump Amid Stimulus Hopes. This Time May Be Different. (barrons)

- Pepsi Stock Rises After Earnings Beat (barrons)

- Why a Mideast Crisis Doesn’t Shock Energy as Much as It Used To (barrons)

- GM Is Facing Another Union Strike. Ford Might Be to Blame. (barrons)

- Lockheed Martin and Other Defense Stocks Have Soared. Why the Rally Can Keep Going. (barrons)

- Should the NFL buy ABC from Disney? One analyst makes the case. (marketwatch)

- Why Nelson Peltz Grew Impatient With Disney’s Turnaround Efforts (wsj)

- Times Square Goes From Deserted to Bustling (wsj)

- Americans Have Saved Hundreds of Billions More Than Previously Thought (bloomberg)

- Housing industry urges Powell and the Fed to stop raising interest rates (cnbc)

- Goldman Sachs: Buy these 12 stocks for double-digit earnings upside in 2024 as markets rebound from a lost year for profit growth (businessinsider)

- NHL sees ticket sales surge ahead of 2023-2024 season start (foxbusiness)

- ‘Modest’ China Stimulus May Bolster Growth Goal, Analysts Say (bloomberg)

- Fed’s Presidents Agree: Soaring 10Y Yields Means No Need For Further Rate Hikes (zerohedge)

Be in the know. 17 key reads for Tuesday…