- China state firms plan US$547 million stock purchases to shore up market (scmp)

- The worst may be over for China, says former FTSE chief (cnbc)

- Disney Is 100 Now. How Magical Has the Stock’s Performance Been? (barrons)

- Ozempic Fears Hammered DexCom Stock. The Concerns Are Overblown. (barrons)

- Retail sales rise on strong car sales and internet buying, U.S. economy not slowing much (marketwatch)

- Pfizer Looks for a Covid Bottom (wsj)

- Apple’s Tim Cook makes second China visit in 2023 amid tough iPhone 15 market (scmp)

- Vornado reels in Blue Ribbon for Penn 1 mega-project in former dining wasteland (nypost)

- Buybacks Become Too Big to Ignore (chinalastnight)

- Lockheed Martin beats on top and bottom lines (cnbc)

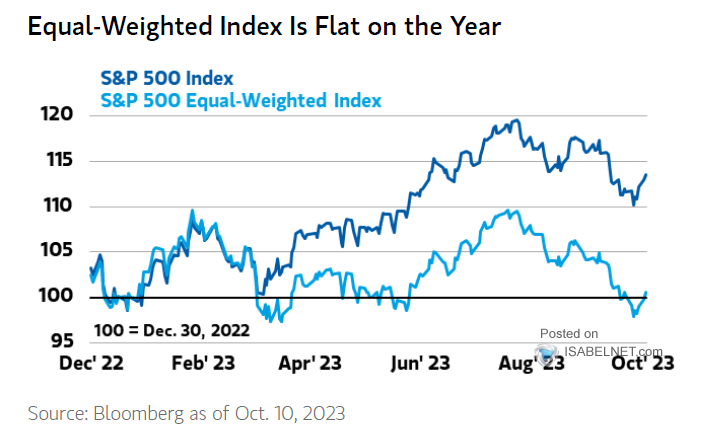

- S&P 500 Annual Buybacks (isabelnet)

- Lee: Markets are dealing with a lot of uncertainty from rates to earnings and geopolitics (cnbc)

- US Stocks Are Ripe for Earnings-Led Rally as Rates Angst Settles (bloomberg)

- Johnson & Johnson (JNJ) gains on another beat and raise quarter (streetinsider)

- Americans are spending more than expected as inflation continues to rise (foxbusiness)

- Ford chairman calls for deal to end UAW strike, warns US auto industry at stake (foxbusiness)

- Kellogg’s Battered Stock Offers Cheap Play on Cereal Business; Could Yield 6% (barrons)

- Invest in millennials and these ‘once-in-a-lifetime opportunity’ stocks, says this fund manager (marketwatch)

- Snap Buoyed by Report of CEO’s Bullish Note to Staff (barrons)

- Rolls-Royce Reaches for the Private Equity Playbook (bloomberg)

- AI Could Spur an Economic Boom. Humans Are in the Way (wsj)

- The $1.5 Trillion Private-Credit Market Faces Challenges (wsj)

Be in the know. 22 key reads for Tuesday…