- China’s Alibaba beats quarterly revenue estimates (up 7% yoy), profit drops primarily due to valuation changes from equity investments (reuters)

- Alibaba sees most profitable year since 2021 amid a refocus on e-commerce, AI businesses and rising competition at home (scmp)

- Alibaba sees AI traction. “During the quarter, our core public cloud offerings, which include products such as elastic compute, database and AI products, recorded double-digit year-over-year growth in revenue,” Alibaba said. Alibaba’s board of directors has approved a dividend consisting of two parts. This includes an annual cash dividend of $1.00 per ADS and a “one-time extraordinary cash dividend” of 66 cents per ADS. (marketwatch)

- BofA Strategist Hartnett Warns Stock Rally Is Exposed to Stagflation Risk (bloomberg)

- BofA’s Moynihan Talks US Economy, Lending and M&A (bloomberg)

- BABA-SW (09988.HK) Expects to Finish Conversion to Dual Primary Listing in HK by End-Aug 2024 (aastocks)

- Alphabet to spotlight AI innovations at developer conference (reuters)

- The Fed Depends on Data but Numbers Are Getting Shakier. That’s a Problem. (barrons)

- Berkshire Hathaway’s Mystery Stock Purchase Could Be Revealed on Wednesday (barrons)

- Wholesale inflation surges again, PPI shows. Takeaway: Inflation remains sticky. (marketwatch)

- Money managers are more bullish than at any point since November 2021, survey shows (marketwatch)

- Temu Cools on the U.S. After Shelling Out Billions (wsj)

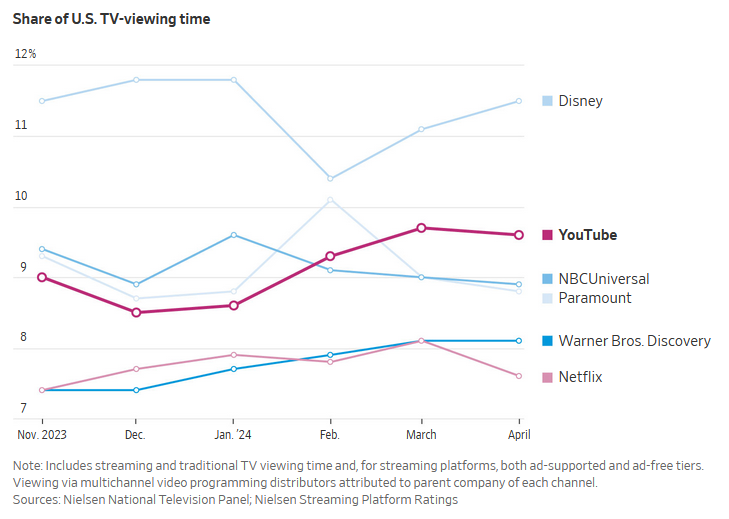

- What’s on TV? For Many Americans, It’s Now YouTube (wsj)

- Investors Crowd Into Soft-Landing Trade Ahead of Crucial Inflation Data (wsj)

- The UK Is No Longer the Most Hated Market (bloomberg)

- Israel’s Once-Dominant Drugmaker Is Revived by Innovation (wsj)