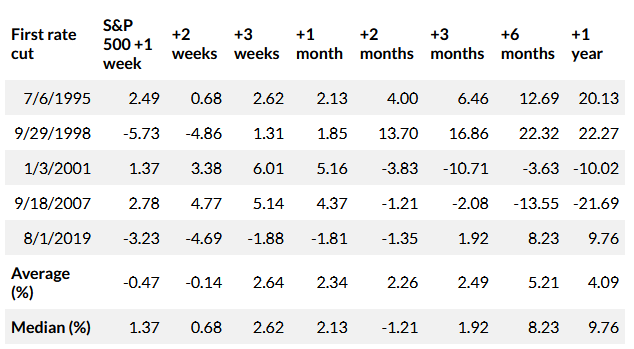

- Will stocks rally or fade after the Fed cuts rates? Here’s what history tells us. (marketwatch)

- There Are Opportunities in Beaten-Down Office Buildings. Where to Find Them. (barrons)

- Boeing Says a Travel Boom in China Will Double Demand for Planes (barrons)

- Fed Cut Could Lift Chinese Stocks. Here’s Who Could Benefit. (barrons)

- China’s PDD (Temu) suffers $55 bln market cap wipeout (reuters)

- Nvidia Earnings Arrive Tomorrow. What the Stock Needs to See. (barrons)

- Ford Says Its Pulling Back on EVs. That’s Not the Whole Story. (barrons)

- The Stock Market Rally Can Expand Beyond Big Tech. This Earnings Season Shows Why. (barrons)

- 6 Stocks That Look Like Buys for a Soft Landing (barrons)

- ‘FOMO’ returns to the options market as traders chase stocks higher (marketwatch)

- Pound hits more than two-year high, dollar back under pressure (streetinsider)

- Watch out for weaker seasonality in September, BofA says (streetinsider)

- Elliott Investment Critiques Southwest Leadership, Overdue Changes (wsj)

- Eli Lilly to sell half-price version of Zepbound weight loss drug (ft)

- China’s export curbs on semiconductor materials stoke chip output fears (ft)

- Temu’s global expansion now looks fraught with difficulty (ft)

- Investors’ expectations for European inflation fall to lowest since 2022 (ft)

- ‘T-Bill and Chill’ Is a Hard Habit for Investors to Break (bloomberg)

- JD.com Unveils $5 Billion Share Buyback as China Concerns Grow (bloomberg)

- The starter home is making a comeback as the housing market thaws for first-time buyers (businessinsider)

Be in the know. 20 key reads for Tuesday…