- Multiplying Crackdowns Haven’t Stopped Cash Pouring Into China (Bloomberg)

- Millions of Americans Travel Over Holiday Weekend Despite Covid Outbreaks (Barron’s)

- Tired of Losing Yet? The Energy Report 09/07/2021 (Phil Flynn)

- China’s economy gets welcome boost from surprisingly strong Aug exports (Reuters)

- COLUMN-Hedge funds in historic double-down on higher U.S. yields: Jamie McGeever (Reuters)

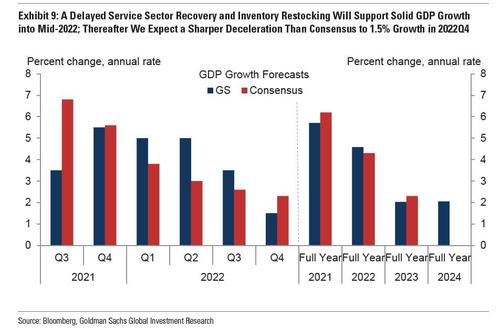

- Goldman Cuts Its US GDP Forecast For The Third Time In The Past Month (ZeroHedge)

- From Cradle to Grave, Democrats Move to Expand Social Safety Net (New York Times)

- China and Big Tech: Xi’s blueprint for a digital dictatorship (Financial Times)

- Famed Wharton professor says the next inflation reading is more important than the monthly jobs report. (Business Insider)

- Taper your pessimism — Fed’s actions won’t derail U.S. stocks, Barclays strategists say (MarketWatch)

- Boeing Now Has an Airbus Problem to Add to the List (Barron’s)

- Disney’s ‘Shang-Chi’ Flies to a Record Labor Day at the Box Office (Wall Street Journal)

- China’s Industrial Planning Evolves, Stirring U.S. Concerns (Wall Street Journal)

- Warning of Income Gap, Xi Tells China’s Tycoons to Share Wealth (New York Times)

- Consumers and Companies Are Buying In on Paying Later (New York Times)

- Xi Jinping May Be Leading China Into a Trap (Bloomberg)

- Chinese Technology Stocks Jump After Tencent Buys Back Shares (Bloomberg)

- Hong Kong Move to Reopen China Border Boosts Retail Stocks (Bloomberg)

- China’s ‘Mr. Income Distribution’ Explains Common Prosperity (Bloomberg)

- Xi’s Common Prosperity Drive Triggers a Rare Debate in China (Bloomberg)

- China Freezes Tutoring Firms’ Fees, Enrollment Pending Approvals (Bloomberg)

- Goldilocks Has Equity Investors In a Headlock (Bloomberg)

Be in the know. 22 key reads for Tuesday…