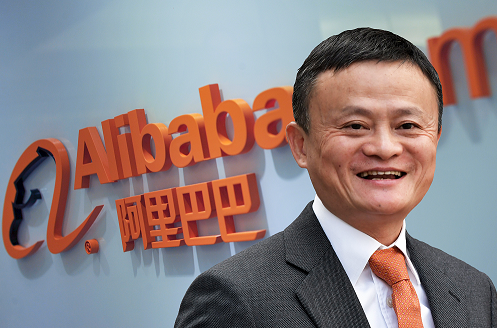

- Alibaba Stock Is Soaring After Buyback Program Boosted to $25 Billion. Here’s Why. (barrons)

- One Week After Calling Them “Uninvestable”, JPMorgan Says Chinese Stocks Are A Buy (zerohedge)

- Hong Kong to Lift Flight Bans and Shorten Quarantines From April 1 (wsj)

- What Wall Street Is Saying About Boeing After the China Plane Crash (barrons)

- This Investment Could Be the Perfect Inflation Hedge (barrons)

- Warren Buffett Does Deal Making Differently. Alleghany Acquisition Shows How. (barrons)

- How Procter & Gamble Stock Could ‘Break Away From the Pack’ This Year (barrons)

- Live updates: Zelenskyy says Ukraine ready to discuss deal (yahoo)

- Alibaba (BABA) Shares Surge on Increased Stock Buyback Plan, Goldman Sachs and Citi See Over 75% Upside (streetinsider)

- Pinduoduo Harvests Profits in Agriculture Push (chinalastnight)

- China gaming crackdown: latest freeze on new video game licences could surpass record delay in 2018, putting industry on edge (scmp)

- Hong Kong to Ramp Up Contact Tracing as Covid Cases Ease (bloomberg)

- Alibaba’s Upscaled Buyback May Be a Sign of Things to Come (bloomberg)

- Buffett Snubs Goldman Bankers With Quirky Takeover Price (bloomberg)

- China Bets on $1.5 Trillion of Tax Cuts in Quest for Growth (bloomberg)

- Christie’s Plans to Auction a Warhol for $200 Million—and Break Records (bloomberg)

- Hedge Funds Crank Up Bets on the Rand in Record Show of Support (bloomberg)

- European Union unlikely to impose an oil embargo on Russia, sources say (cnbc)

- China crash is ‘unprecedented’ given Boeing 737′s stellar safety record, says aviation analyst (cnbc)

- Goldman Sachs says these 23 stocks offer the most impressive opportunities for profit growth ahead as inflation chokes corporate margins across the board (businessinsider)

- An inverted yield curve is likely after the Fed raised interest rates. Here’s what that means and why it signals a recession may be imminent. (businessinsider)

- Russia’s economy will shrink a huge 10% this year, Goldman Sachs says — its worst contraction since the dark days of the 1990s (businessinsider)

- JPMorgan’s quant guru says he’s still bullish on stocks but admits risks are building and lowers S&P 500 price target (businessinsider)

- Cloud Shoppers Not Just Seeking Bargains (wsj)

- Koch Industries, Built on Oil, Bets Big on U.S. Batteries (wsj)

- Opinion: If you’re ready to buy China tech stocks again, these five may be the best path to outperformance (marketwatch)

- Hedge funds investing in Russia plunge amid invasion of Ukraine (yahoo)

- Powell says Fed prepared to move more aggressively to tighten policy (ft)

- 5 Tech Stocks David Einhorn Favors (gurufocus)

- Tech Billionaires Rally Around Nuclear as Energy Crisis Looms (bloomberg)

Be in the know. 30 key reads for Tuesday…