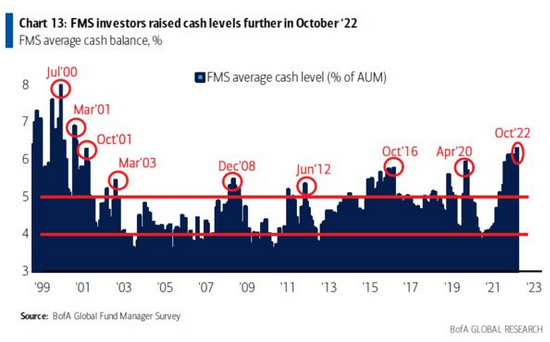

- BofA Survey ‘Screams’ Capitulation Among Investors (bloomberg)

- Are Chinese stocks set for a 2015-style rebound? A pick-up in margin trading volume offers good leading signal (scmp)

- Key Takeaways from President Xi’s Speech at China’s Party Congress (chinalastnight)

- China’s Economy Is Recovering and Improving, Premier Li Says (bloomberg)

- BofA’s Moynihan Says Consumers Are Showing Little Weakness (bloomberg)

- JPMorgan’s Kolanovic Trims Risk as He Turns More Wary on Economy (bloomberg)

- Forecast for US Recession Within Year Hits 100% in Blow to Biden (bloomberg)

- White House Planning Oil Reserve Release Announcement This Week (bloomberg)

- China Wants to Be Part of Global Economy Despite Domestic Focus (bloomberg)

- Small-Time Options Traders Bet Big on US Stocks Falling Further (bloomberg)

- Fund managers ‘scream capitulation’ as cash levels rise to highest in 21 years, Bank of America says (marketwatch)

- The Fed Is Playing With Fire (barrons)

- Xi’s Contradictory Vision for China (wsj)

- Even as US Inflation Climbs, Wall Street Sees Steep Fall Coming (bloomberg)

- Consumer Banking Props Up Wall Street as Markets Slump (bloomberg)

- Xi Must End Covid-Zero Shadow Over World Economy (bloomberg)

- AT&T Is Counting on Government Stimulus Dollars to Help Fund Its Broadband Future (bloomberg)

- China delayed the release of key economic data to avoid distraction amid the Communist Party Congress, not to conceal data, analysts say (businessinsider)

- Dan Loeb’s Third Point builds stake in Colgate, sees value in pet food business in potential spinoff (cnbc)

- Gilts and pound rally as Hunt aims to steady market with fiscal plans (ft)

Be in the know. 20 key reads for Tuesday…