- US Inflation Shows Signs of Moderating, Giving Fed Room to Pause (bloomberg)

- Alibaba cancels chief technology officer position, spins off in-house tech service provider in sweeping overhaul (scmp)

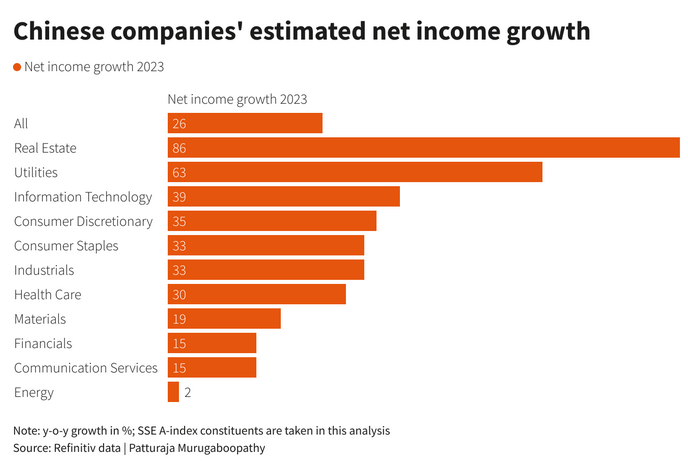

- Chinese company earnings reveal lopsided economic recovery (reuters)

- New York’s Empty Office Buildings Lure Rich Families Hunting Bargains (bloomberg)

- CPI: U.S.’s headline annual inflation rate, at 4.9%, is lowest in two years (marketwatch)

- Meta-backed study says metaverse will be 2.4 per cent of US GDP by 2035 (scmp)

- PayPal Stock Is Sliding. Why Analysts Are Sticking With the Company After Earnings. (barrons)

- PayPal Is Growing, but Not the Way It Used To (wsj)

- Li Auto Sees EV Deliveries Surging. The Stock Is Rising. (barrons)

- Home Prices Fell in Third of the U.S. During First Quarter (wsj)

- ChatGPT Is Causing a Stock-Market Ruckus (wsj)

- Chinese export growth slowed in April as global trade cooled, underlining the importance of domestic spending as the main engine for the world’s second-largest economy after three years of strict Covid-19 controls. (wsj)

- Fox tops profit predictions as revenue jumps nearly 20% in Q3 (nypost)

- Biden, McCarthy Vow More Debt-Limit Talks as US Default Looms (bloomberg)

- Bank Bears Are Screening for the Wrong Factors: Report (barrons)

- A Small-Cap Rally Is Both Closer and Farther Away (barrons)

- Retailers Ramp Up Discounts to Try to Bring In Shoppers (barrons)

- Investment managers are most bearish on financials and real estate but tilt bullish on healthcare and consumer staples (marketwatch)

- The Post-Covid Spending Spree Is Dwindling. Why That Could Benefit The Fed. (barrons)

- Upstart Stock Soars. The Beaten-Down AI Company Delivers an Outlook Surprise. (barrons)

- First-to-Hike Emerging Markets Are Now Looking to Cut Interest Rates (bloomberg)

- Treasury yields tumble after April’s CPI increase is less than feared (cnbc)

- The chief investment strategist of JPMorgan Global Wealth explains why the worst thing investors can do right now is sit on cash — and shares 5 other high-conviction investment ideas (businessinsider)

Be in the know. 23 key reads for Wednesday…