- Fed’s Barkin Says Soft Landing Looks More Likely, But Not Inevitable (bloomberg)

- China’s Commodities Demand Remains Resilient Despite Factory Slump (bloomberg)

- Disney Stock Rises on Deal to Share Information With Activist Investor (barrons)

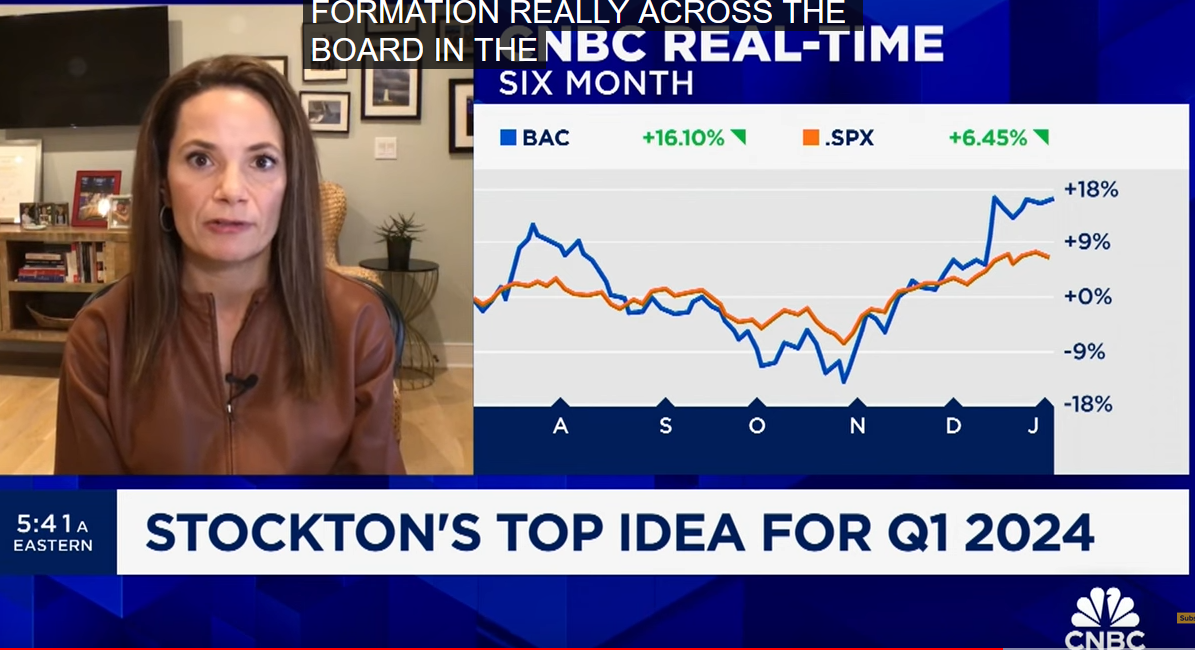

- There’s a meaningful momentum shift in the financial sector, says Katie Stockton (cnbc)

- Apple Downgrades Are Piling Up. The Latest One Hit the Stock Harder. (barrons)

- Alibaba’s Stock Buybacks Rise in 4th Quarter to $2.9 Billion; Investors Want to See More (barrons)

- Poor Charlie’s Almanack (stripe)

- Home Builders’ Stocks Soared in 2023. Brace for a Dip. (barrons)

- How December Fed minutes could shake up investors’ rate-cut expectations (marketwatch)

- Value Stocks Shine in Year’s First Trading Day in Big Reversal From 2023 (barrons)

- Britain’s Economy Is ‘Not Working.’ Here Are 2 Key Reasons. (nytimes)

- It Takes at Least 200 Hours to Make a Close Friend, and More to Maintain It (wsj)

- Job openings slide to 32-month low as U.S. hiring boom fades (marketwatch)

- Manhattan Home Prices Rise in Early Sign of a Market Rebound (bloomberg)

- ISM Manufacturing Contracts For 14th Straight Month, New Orders Sink (zerohedge)

- Analysts are increasingly bullish on Amazon stock for 2024. Here’s why (streetinsider)

- US auto sales likely jumped in 2023 (reuters)

- US companies dive into convertible debt to hold down interest costs (ft)

- Mike Mayo ❤️ Citi (ft)

- Top 5 E-Commerce Trends To Watch In 2024 (alizila)

- Sanctioned Chinese companies, shunned by foreign funds, are top picks and winners at local funds (scmp)

Be in the know. 21 key reads for Wednesday…