- China Weighs Cutting Mortgage Rates in Two Steps to Shield Banks. Officials proposed rate cuts of about 80 basis points. Move to boost household consumption, ease pressure on banks (bloomberg)

- Nvidia Stock Drops Again. ‘Its Valuation Is Out of Control.’ (barrons)

- Boeing Speeds 737 Deliveries to China in Respite for New CEO (bloomberg)

- The average analyst price target for Boeing shares is about $214. (barrons)

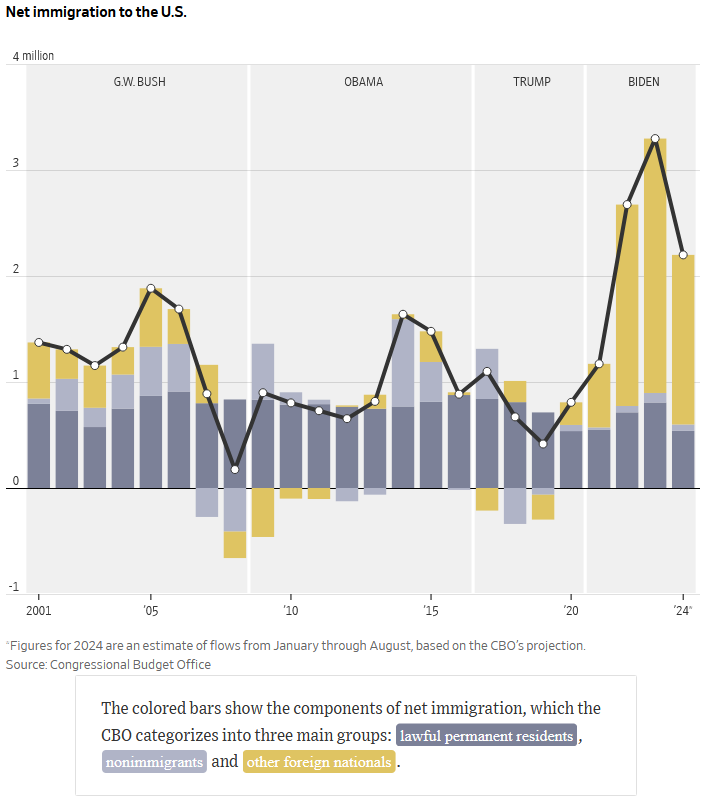

- How Immigration Remade the U.S. Labor Force (wsj)

- Qualcomm-Arm processor chips have compatibility problems with ‘Fortnite’ and other titles (wsj)

- Intel will evaluate its next steps at a board meeting in mid-September, according to people familiar with the matter. (bloomberg)

- China Is Trading Its Own Bonds to Stifle a Runaway Bond Rally (bloomberg)

- The Black Hole of Private Credit That’s Swallowing the Economy (bloomberg)

- China Stocks Listed in US Near Cheapest Ever Versus Nasdaq Peers (bloomberg)

- Alibaba Embraces Tencent’s WeChat Pay as China’s Tech Walls Fall (bloomberg)

- Atlanta Fed President Bostic says officials can’t wait for inflation to hit 2% before cutting (cnbc)

- Nvidia, beware — the top spot in S&P 500 valuations is often a slippery slope (marketwatch)

- Temu’s Parent, a Victim of Competition or Its Own Success? (wsj)

- Fed’s Bostic: Economy is ‘losing momentum’ but there is no sense of looming crash or panic from business leaders (marketwatch)

- Alibaba sets up new ‘digital technology’ firm under e-commerce unit Taobao and Tmall Group (scmp)

- Growth Stocks Rebound As Banks’ Balance Sheets Face Mortgage Refinancing (chinalastnight)

Be in the know. 17 key reads for Wednesday…