- Why investors need to watch Japan as a key source of market risk in 2025 (businessinsider)

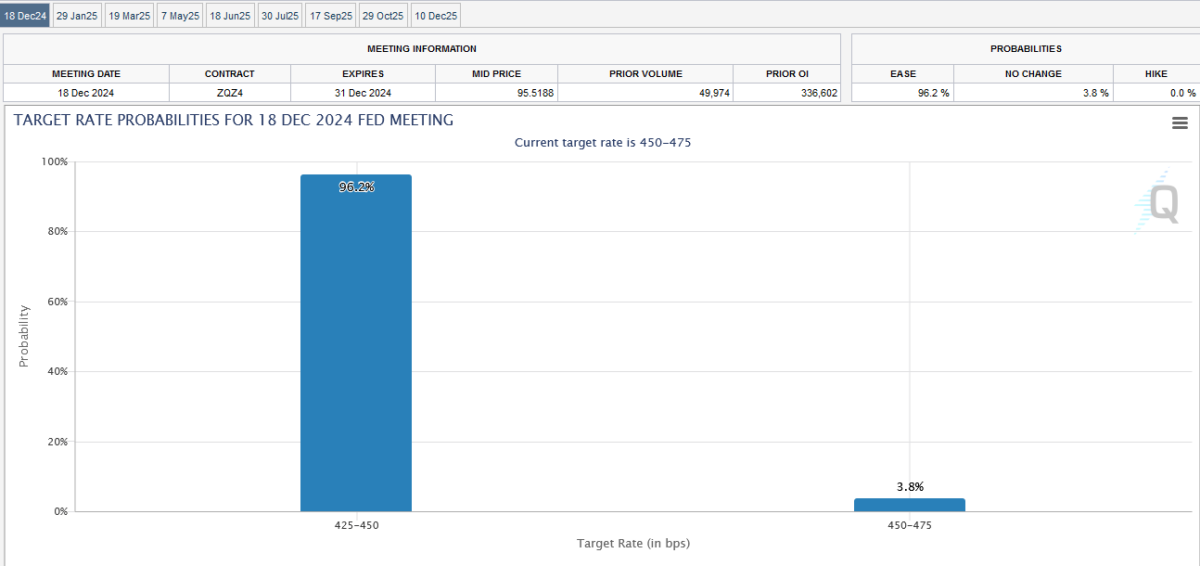

- Traders Are Betting on a Quarter-Point Rate Cut Next Week (barrons)

- US CPI Brings No Surprises, Firming Up Fed Rate-Cut Bets (bloomberg)

- Boeing Stock Is Taking Off. Here’s Why. (barrons)

- Walgreens Is in Talks to Sell Itself to Private-Equity Firm Sycamore Partners (wsj)

- The Fate of Markets Rests on Trump’s Dollar Policy (wsj)

- JetBlue’s Turnaround Plan: First-Class Seats and Fewer Routes (wsj)

- The Rise of Theo Von, the Resident Quipster of Podcasting’s ‘Manosphere’ (wsj)

- How to Get Off a Long Flight Feeling Your Best (bloomberg)

- Mortgage refinance demand surges 27%, as interest rates drop for the third straight week (cnbc)

- Fed Chair Jerome Powell can serve remainder of term, says Trump’s Treasury pick Bessent (cnbc)

- Here’s Who Owns US Debt (zerohedge)

- The 3 Highest Yielding Dogs of the Dow Are December Holiday Bargains (247wallst)

- China property: a tale of rising sales and falling prices in top cities (scmp)

- China stocks regain appeal as Xi signals major stimulus in Politburo meeting (scmp)

- Gulf financiers expect investments in China to return up to 35 per cent next year based on bets that Beijing will implement additional stimulus measures, according to speakers at a summit in the United Arab Emirates (UAE). (scmp)

- China’s yuan likely to stabilise and strengthen, central bank says (reuters)

- Trump Trolls Trudeau, Calls Him Governor of Canada (bloomberg)

- Now the Bears Are Apologizing? (carsongroup)

Be in the know. 19 key reads for Wednesday…