- Chinese gaming stocks jump after Beijing approves new titles in a sign scrutiny is easing (cnbc)

- Brussels calls on EU to turn down heat to resist Russian gas curbs (ft)

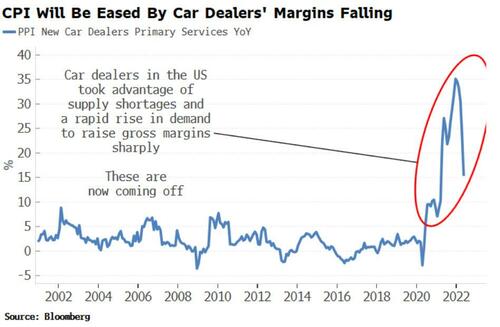

- Transport Holds The Key To A Lower CPI (zerohedge)

- S. inflation climbs to 41-year high of 9.1%, CPI data show, as gas prices surge (marketwatch)

- Fed funds futures traders now see 42% chance of full percentage point Fed rate hike on July 27 after June CPI data (marketwatch)

- White House calls attention to falling gas prices not reflected in June CPI data (marketwatch)

- Taiwan National Fund Intervenes to Stop Market Slide (wsj)

- New Video Game Approval Lifts Hong Kong Internet Stocks (chinalastnight)

- Netflix (NFLX) is a ‘Show-me’ Story with a Light Catalyst Path – Goldman Sachs (streetinsider)

- Boeing deliveries reach highest monthly level since March 2019 (streetinsider)

- Citi Offers 5 Reasons Why Investors Should Still Buy Apple (AAPL) Stock (streetinsider)

- 12 Battered Stocks That Could Be the Next Amazon (barrons)

- Bank Earnings Will Give Clues About Possible Recession (wsj)

- These high-yield stocks are down as much as 58% this year. But their inflation-fighting dividends have room to grow. (marketwatch)

- Everything to know as Joe Biden heads to Saudi Arabia (businessinsider)

- Chinese companies are going global as growth slows at home (cnbc)

- Dividend Payouts Hit Record Despite Rocky Stretch in Markets (wsj)

- One of Retail’s Worst Performers Gets a New Bull (barrons)

Be in the know. 18 key reads for Wednesday…