- Michael Burry and David Tepper snapped up Alibaba during the fourth quarter (marketwatch)

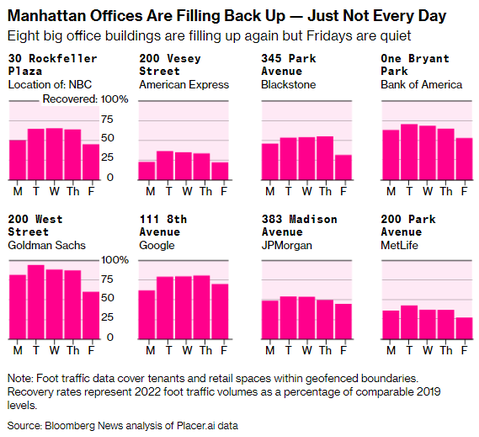

- Remote Work Is Costing Manhattan More Than $12 Billion a Year (bloomberg)

- China’s Xi Urged Stronger Measures to Boost Domestic Demand (bloomberg)

- The Most Crowded Trade Is ‘Long China Stocks,’ Says Bank of America Global Fund Manager Survey (wsj)

- Analog Devices Crushes Quarterly Targets On Strong Auto, Industrial Chip Sales (investors)

- US Retail Sales Jump by Most in Nearly Two Years in Broad Gain (bloomberg)

- ‘Big Short’ Investor Michael Burry Bets on Alibaba and JD. This Time, Wall Street Agrees. (barrons)

- Warren Buffett’s Preferred Equity Allocation Is 100%. Why the Berkshire CEO Hates Bonds. (barrons)

- Power Player Generac Beats Earnings Estimates. The Stock Is Up. (barrons)

- Bain Capital Seeks to Profit From Tech Market Reset With New $2.4 Billion Fund (wsj)

- The Recession Special That Always Satisfies (wsj)

- European Union to Ban Gas-Powered Cars by 2035 (nytimes)

- Ray Dalio Says China’s Winning Trade War With US, But a Clash Is Avoidable (bloomberg)

- New Cars Are Only for the Rich Now as Automakers Rake In Profits (bloomberg)

- China Investors counting on policies from Congress to recharge rally (bloomberg)

- Investors aren’t convinced that the stock market rally can last, Bank of America survey shows (businessinsider)

- Tepper’s Appaloosa adds Disney, Caesars stakes while boosting Salesforce position (marketwatch)

- This Is What Hedge Funds Bought And Sold In Q4: 13F Summary (zerohedge)

- Elon Musk declares cancel culture over since Twitter takeover: ‘You won’t be missed’ (foxbusiness)

- Brookfield Defaults on Two Los Angeles Office Towers (bloomberg)

Be in the know. 20 key reads for Wednesday…