- Hong Kong Stocks Cap Biggest Post-Lunar Holiday Gain Since 2009 (bloomberg)

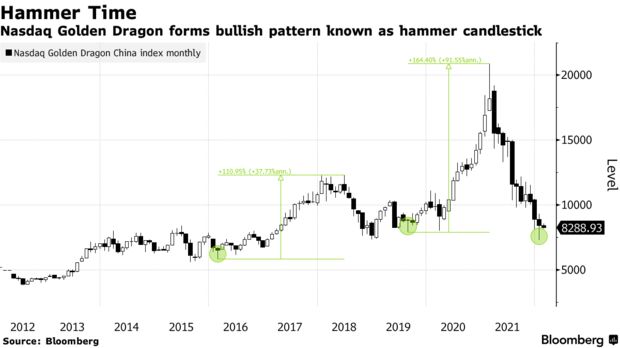

- Nasdaq Index of China Stocks Shows Signs of Life After Pummeling (bloomberg)

- Amazon Stock Soars on Good Enough Earnings. Plus, the Price of Prime Is Going Up. (barrons)

- S. Added 467,000 Jobs in January. Omicron’s Impact Was Less Than Feared. (barrons)

- Expect a Post-Omicron Boom as Americans Binge on Services. Workers Are the Wild Card. (barrons)

- Wall Street Is Trying to Make Sense of Meta’s Earnings. It Isn’t Easy. (barrons)

- Emerging Market Value Stocks Look Ready to Run (barrons)

- The Right Way to Read Unemployment Data (barrons)

- The Growth Scare Is Receding. The Fed Policy Scare Is Here. What That Means for Investors. (barrons)

- This way of picking value stocks has actually worked — and Berkshire Hathaway screens the best (marketwatch)

- Opinion: This market-timing model has made stock investors more money than the ‘Super Bowl Predictor’ (marketwatch)

- S. Sees Iran’s Nuclear Program as Too Advanced to Restore Key Goal of 2015 Pact (wsj)

- Why the World’s Biggest Ocean Shipping Lines Are Buying Cargo Planes (wsj)

- BofA Strategists See Surging Equity Flows While Bonds Get Dumped (bloomberg)

- A fund manager whose energy bets have placed him in the top 4% of fund managers this year shares 6 stocks to watch in 2022 — and why oil is destined to slip to $65 per barrel (businessinsider)

- Why US workers will return to the labour market (ft)

- Meta’s dramatic fall masks strong earnings week across Big Tech (ft)

- S. 30-Year Real Yield Turns Positive as Fed Hike Bets Increase (bloomberg)

- Flatter U.S. Yield Curve Dominates Emerging-Market Trader Minds (bloomberg)

- Rate-Hike Bets Wipe Out $1.5 Trillion of Sub-Zero Debt in a Day (bloomberg)

Be in the know. 20 key reads for Friday…