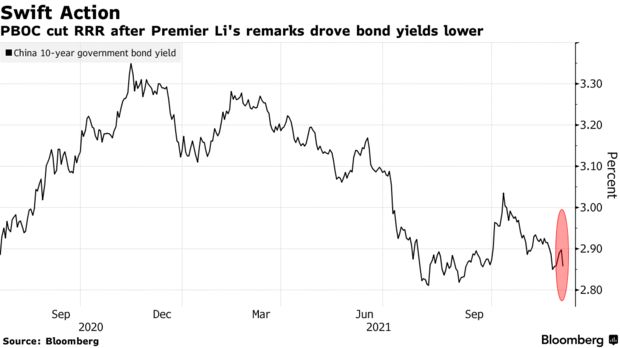

- China Cuts Reserve Requirement Ratio (bloomberg)

- China regulator says govt policies not necessarily linked to overseas IPOs (reuters)

- Chinese Internet ADRs Selloff Is ‘Overdone,’ Citigroup Says (bloomberg)

- South Africa Fuels Omicron Hope by Dodging Hospitalization Surge (bloomberg)

- What Scares the Stock Market More Than Covid? The Federal Reserve. (barrons)

- China cloud primer: Alibaba, Tencent (bloomberg)

- How TikTok Reads Your Mind (nytimes)

- The Fed Faces Another Conundrum: The Bond Market Isn’t Following Its Lead (barrons)

- Morgan Stanley Sees Fed as Bigger Threat to Stocks Than Omicron (bloomberg)

- Hedge Funds Caught Massively Offside During Last Week’s Turmoil (bloomberg)

- PBOC cuts RRR by 50 basis points, unleashing 1.2 trillion yuan (bloomberg)

- Top China Covid Expert Hints at How Sealed Off Country May Return to ‘Normality’ (bloomberg)

- This is how to play China’s tech crackdown and these are the potential winners, according to one investor (cnbc)

- Apple’s iPhone Successor Comes Into Focus (wsj)

- Alibaba Reshuffles E-Commerce Teams Amid Competition (wsj)

- AT&T Looks Better, Except for Its Stock Price (bloomberg)

- China’s government is stepping in to help Evergrande deal with its debt, as it has with previous large-scale corporate clean-ups (businessinsider)

- Omicron Away. The Energy Report 12/06/2021 (Phil Flynn)

- Jim Cramer: Buy these 4 ‘bargain basement’ stocks to take full advantage of the omicron selloff — wait too long and you’ll kick yourself (yahoo)

- China Cuts RRR By 50bps; More Easing Expected (zerohedge)

Be in the know. 20 key reads for Monday…