- Pound Climbs as U.K. Scraps Tax Cut for Highest Earners (barrons)

- This big tech stock looks way oversold. Here’s your best strategy for buying it now in this volatile market. (marketwatch)

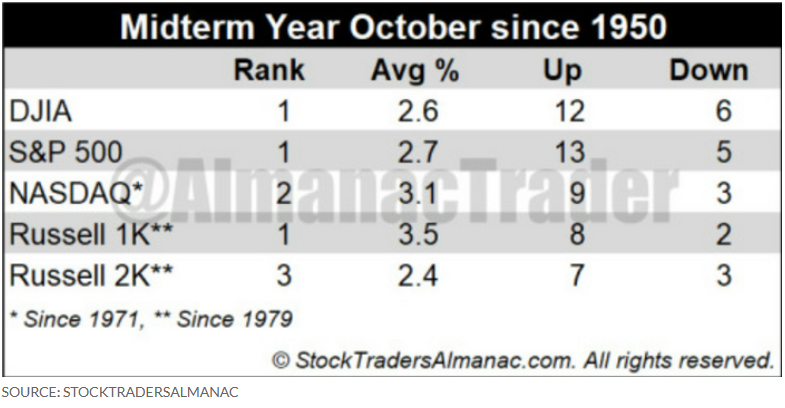

- What investors need to know about October’s complicated stock-market history (marketwatch)

- The bear market may not be over, but corporate insiders are acting like it is (marketwatch)

- An Alzheimer’s Drug’s Big Surprise: What It Means (barrons)

- It’s Time to Buy Tech Again. Here Are 20 Stocks to Start With. (barrons)

- Russia’s War on Ukraine Is Escalating. It’s Time to Buy Defense Stocks. (barrons)

- Central Banks’ Higher Rates, Bond Sales Clash With Government Needs (wsj)

- Builders Offer Homes at Discount to Investors (wsj)

- US Home Prices Now Posting Biggest Monthly Drops Since 2009 (bloomberg)

- JPMorgan Is Worried About Who’s Going to Buy All the Bonds (bloomberg)

- ‘The Fed is breaking things’ – Here’s what has Wall Street on edge as risks rise around the world (cnbc)

- David Rubenstein sees Warren Buffett as the ultimate investor. The private equity billionaire lays out the 12 traits and habits that are key to Buffett’s success. (businessinsider)

- Macau’s Recovery Is Far Off—But Now Possible to Imagine (wsj)

- China Is Rerouting U.S. Liquefied Natural Gas to Europe at a Big Profit (wsj)

- China’s new tax cuts for private pensions likely to lure participants (scmp)

- News in-depth. China’s demographic crisis looms over Xi’s third term (ft)

- Bill Gates rejects climate ‘moral crusade,’ says telling people not to eat meat won’t help solve ‘crisis’ (foxbusiness)

- Ukraine Recaptures Key Eastern Town Of Lyman A Day After Putin’s Annexation Speech (zerohedge)

- Stocks Climb After Selloff as Yields Get Respite: Markets Wrap (bloomberg)

Be in the know. 20 key reads for Monday…