- The Fed has to start cutting rates to avoid tipping the economy over, and 8 cuts are coming in the next 2 years, Bank of America chief Brian Moynihan says (businessinsider)

- Here’s when Morgan Stanley thinks the Fed will likely start tapering QT (streetinsider)

- Chinese buyers return to Hong Kong’s luxury property market as activity picks up (scmp)

- Companies rush to bond market in record $150bn debt splurge (ft)

- I Rented a Tesla for a 1,600-Mile Road Trip. I’ll Think Twice Next Time. (barrons)

- S., Arab Allies Push Hostage-Release Plan Aimed at Ending Israel-Hamas War (wsj)

- Two important events this week could determine the future of Fed rate policy (cnbc)

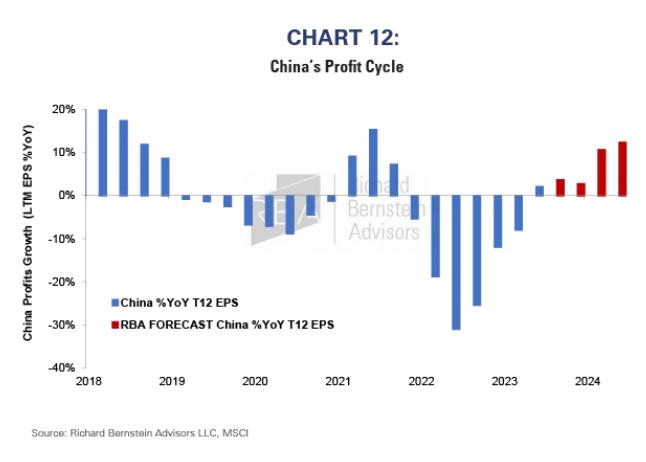

- A bearish signal is flashing for the market’s hottest stocks – and it shows there’s a can’t-miss opportunity brewing for investors, RBA says (businessinsider)

- These are the 30 best investments to make now as US stocks rally to record highs, according to bullish strategists at 3 large investment firms (businessinsider)

- 4 for ’24: Year Ahead Outlook (rba)

- Regional banks pullback is what we’ve been waiting for, says Jim Cramer (cnbc)

- S&P Earnings Estimates (Morgan Stanley)

- S&P Net Profit Margin (Goldman Sachs)

- The Cavalry Comes To Mainland Market’s Rescue, Week in Review (chinalastnight)

- American consumers haven’t been this upbeat about the economy since 2021 (businessinsider)

Be in the know. 15 key reads for Monday