- Intel Bulls Have Given Up. Why There May Still Be Hope for The Stock. (barrons)

- ‘The Claman Countdown’ panelists Thomas Hayes and Nick Timiraos evaluate the state of the U.S. economy. (foxbusiness)

- ‘I’m really desperate now’: Temu sellers revolt against fines and withheld pay (cnn)

- The government—either a Harris or Trump administration—will need Intel to thrive if the U.S. has any hope of achieving chip making independence. (barrons)

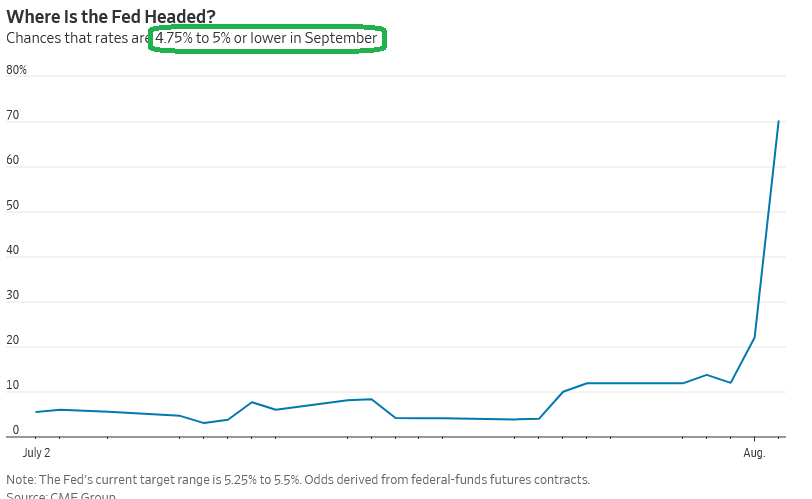

- Job Slowdown Will Ignite Debate Over Larger Half-Point Rate Reduction (wsj)

- How a Jobs Report Sent the Fed From a Soft Landing to Behind the Curve (barrons)

- What 100 Years of Rate Cuts Says Happens Next (barrons)

- Amazon’s Jeff Bezos Stopped Selling Stock When It Dipped Below $200 (barrons)

- Pump Up the Value. Fed Rate Cuts Will Boost These Stocks. (barrons)

- Wall Street’s Year of Calm Snaps as Most Reliable Trades Flop (bloomberg)

- Dollar Eyes Worst Day This Year as Jobs Data Boosts Expectations for Fed Cuts (barrons)

- Mortgage rates plunge to lowest level in more than a year after weak jobs report (cnbc)

- Tech companies show no signs of slowing spending on artificial intelligence, even though a payoff looks a long way away. (nytimes)

- Japan stocks plunge by nearly 6% in biggest drop since start of pandemic (cnn)

- The 10 Best Companies to Invest in Now (morningstar)

Be in the know. 15 key reads for Saturday…