- China’s Consumers Are Ready to Spend (barrons)

- Politburo Emphasizes Domestic Consumption (chinalastnight)

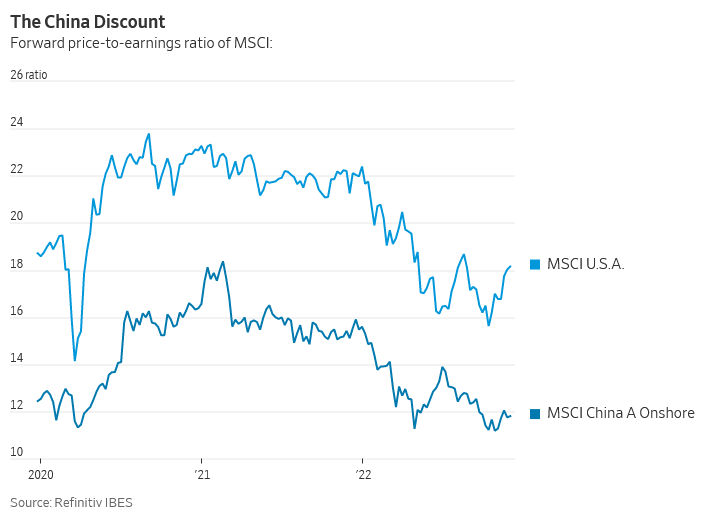

- What China’s Covid-19 Reopening Means for Markets (wsj)

- Continuing Jobless Claims Surge To 10-Month Highs (zerohedge)

- How Amazon Could Get Back Into the Trillion Dollar Club (barrons)

- Almost everyone is expecting a recession next year, but the market is forecasting earnings growth, this model finds (marketwatch)

- ‘Anti-woke’ reaction? Fund giant Vanguard quits net-zero climate alliance. (marketwatch)

- Hong Kong Stocks Advance on China’s Relaxed Covid-19 Rules. Macau Casinos Surge. (barrons)

- Oil Prices Were Set to Soar. Now They’re Falling Fast. (barrons)

- China Scraps Most Covid Testing, Quarantine Requirements in Policy Pivot (wsj)

- Letter From Top Apple Supplier Foxconn Prodded China to Ease Zero-Covid Rules (wsj)

- BlackRock CEO Larry Fink pushed to exit over ESG ‘hypocrisy’ (nypost)

- Hong Kong May End Outdoor Mask Rule, Relax Covid Tests, Report Says (bloomberg)

- China Mulls More Property Easing at Economic Meeting Next Week (bloomberg)

- The Federal Reserve Is Deflating Financial Bubbles, Without a Crash (bloomberg)

- Cathie Wood May Be Right About Jay Powell Being Wrong (bloomberg)

- How Will China Turn Its Economy Back On? The World Is About to Find Out. (nytimes)

- Keystone pipeline shut after oil release into Nebraska creek (reuters)

- FT Magazine. Exclusive: The secret lives of MI6’s top female spies (ft)

- China’s Gen-Z consumers prep for bout of ‘revenge’ spending on personal care (scmp)

Be in the know. 20 key reads for Thursday…