- 20-Year Treasury Auction Shows Strong Demand. Bond Buyers See Opportunity. (barrons)

- Fed Faces a Big Call on Rates. Powell Will Offer Some Clues. (barrons)

- Playing It Safe With Stocks Cost You $5.9 Million In Just 10 Years (investors)

- Kellogg’s Battered Stock Offers a Cheap Play on the Cereal Business. It Could Yield 6%. (barrons)

- Ford Sterling Axle lays off 150 more workers as parts not needed for plants on UAW strike (dfp)

- Beige Book sees ‘slightly weaker’ U.S. economy — and easing inflation (marketwatch)

- Household Wealth Has Taken Off, Fed Data Show. That Explains a Lot. (barrons)

- China dumps most U.S. securities in 4 years, perhaps to defend a weakening yuan (marketwatch)

- Stanley Druckenmiller said central banks, not earnings, move markets. Today is the day to pay attention. (marketwatch)

- Pfizer Prices Covid Drug Paxlovid at $1,400 for a Five-Day Course (wsj)

- Disney Sheds New Light on ESPN’s Financial Challenges (wsj)

- Wall Street’s Latest Obsession Is an Unknowable Number (wsj)

- Obesity Isn’t a Rubber Stamp for a Weight-Loss Drug Prescription (wsj)

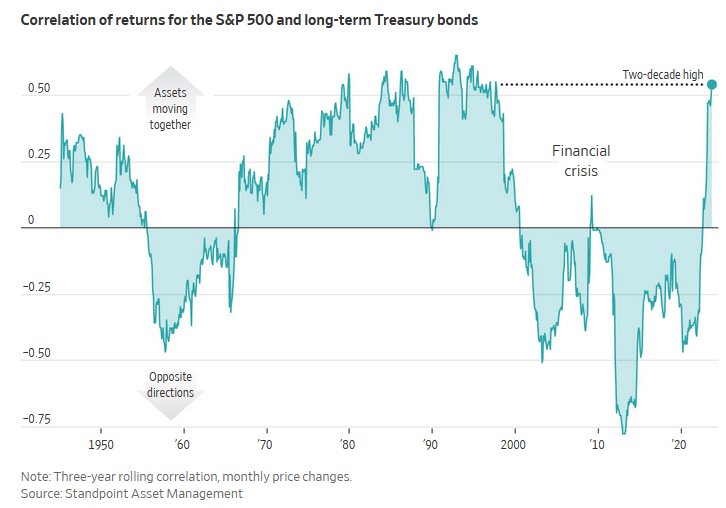

- The Trusted 60-40 Investing Strategy Just Had Its Worst Year in Generations (wsj)

- Fed’s Powell to take the stage amid a suddenly choppy landscape (reuters)

- JPMorgan Says 60/40 Portfolio Far From Dead, Set to Trounce Cash (bloomberg)

Be in the know. 16 key reads for Thursday…