- Stocks Are Pricey. Here’s Where to Find Value Now. (Barron’s)

- Nokia Is Cutting Up to 10,000 Jobs to Boost 5G Investment (Barron’s)

- What to Focus on as Fed Rate Panel Meets (Barron’s)

- ‘Taper tantrum’ worries creeping in, but equity crash not imminent: BofA (Reuters)

- Opinion: Why the health-care sector — not gold — is the best inflation hedge (MarketWatch)

- ‘Big Short’ investor Michael Burry slams NFTs with a quote warning ‘crypto grifters’ are selling them as ‘magic beans’ (Business Insider)

- Fed aims for tricky balance between wounded economy, booming outlook as it unveils new forecasts (USA Today)

- COVID-19 is no longer the biggest tail risk: BofA fund manager survey (Yahoo! Finance)

- How the U.S. Got It (Mostly) Right in the Economy’s Rescue (New York Times)

- U.S. Retail Sales Declined in February as Weather Impeded Demand (Bloomberg)

- Sucking It Down. The Energy Report 03/16/2021 (Phil Flynn)

- Xi Jinping Warns Against Tech Excess in Sign Crackdown Will Widen (Bloomberg)

- Biden’s Planned Tax Hike to Hit People Earning Over $400,000 Hardest (Bloomberg)

- The World’s Three Biggest Coal Users Get Ready to Burn Even More (Bloomberg)

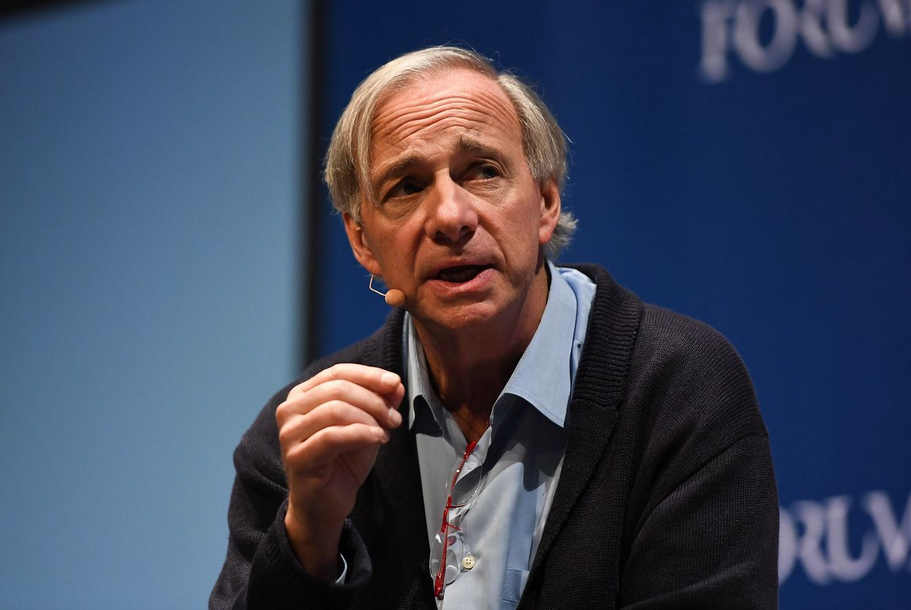

- Investing in bonds has ‘become stupid,’ Ray Dalio says. Here’s what he recommends instead (MarketWatch)

- Are Americans Ready To Travel? BofA Sees Biggest Airline Bookings Jump Since Pandemic Began (Benzinga)

- Goldman Sachs Sees a Faster than Expected Airline Recovery Suggests Buying ALK and/or UAL, Both PTs Raised (Street Insider)

- EU says Pfizer to deliver over 200 million vaccine doses in second quarter (Street Insider)

- Gilead (GILD), Merck (MRK) Announce Agreement to Jointly Develop and Commercialize Long-Acting, Investigational Treatment Combinations of Lenacapavir and Islatravir in HIV (Street Insider)

- Goldman Sachs Sees a Faster than Expected Airline Recovery Suggests Buying ALK and/or UAL, Both PTs Raised (Street Insider)

- Fed officials may talk technical rate move but delay acting for now (Street Insider)

- What Does The Olive Garden Reveal About Dining Sector Recovery? (Benzinga)

- AstraZeneca Trial Data May Not Be Impressive, Setting Up a Buying Opportunity (Barron’s)

- China’s Regulators Punished Tech Giants and Rattled Investors. What Could Come Next. (Barron’s)

- U.S. Banks Will Turn Last Year’s Fear Into This Year’s Profits (Wall Street Journal)

- Why Berkshire Hathaway Energy Is One of Warren Buffett’s 4 ‘Jewels’ (Barron’s)

- Berkshire Hathaway Proxy Shows Warren Buffett Is Old School When it Comes to Compensation, Board Makeup (Barron’s)

- Fed should ‘switch’ up its playbook and buy more Treasurys, fewer mortgage bonds, urge analysts (MarketWatch)

- Value stocks are making a comeback. Don’t get left behind, these analysts say (MarketWatch)

- Five things to watch from the Federal Reserve meeting (Financial Times)

Be in the know. 30 key reads for Tuesday…