- Supply-Chain Constraints Were Harsh. Profit Margins Grew Anyway. (barrons)

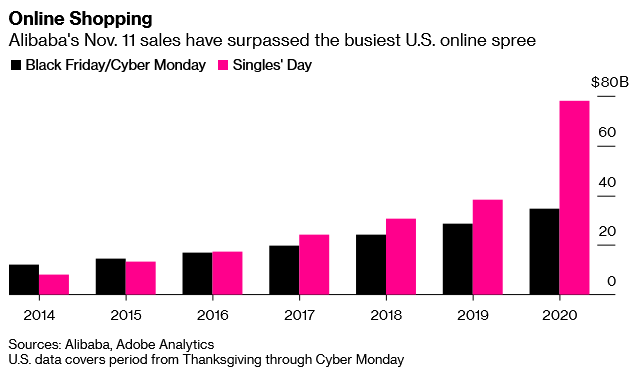

- What China’s Tech Squeeze Is Doing to Singles’ Day (bloomberg)

- Nasdaq 100’s Sizzling Run to Record Flashes Warning (bloomberg)

- GE Will Split Into Three Units, Ending Conglomerate for Good (bloomberg)

- Not So Funny. The Energy Report 11/09/2021 (Phil Flynn)

- SoftBank Sells Off Portfolio of Large-Cap Tech Stocks (Barron’s)

- Larry Culp Is Building a Leaner, Meaner, More Profitable GE (Barron’s)

- Bank Stocks Have Been Big Winners. There’s More Upside in 2022. (Barron’s)

- Beam Gets FDA Nod for First Gene-Editing Trial (Barron’s)

- Following COP26? Look at These 3 Sustainable Investing Strategies and 40 Stock Picks. (barrons)

- Regeneron’s Antibody Drug Cut Risk of Covid-19 by 82%, Company Says (Wall Street Journal)

- S. Opens Borders to Vaccinated Europeans, Others, After More Than 18 Months (Wall Street Journal)

- Chinese Junk Bond Yields Top 25% as Property-Market Strains Intensify (Wall Street Journal)

- Infrastructure Projects to Boost Sales and Prices, Industry Executives Say (Wall Street Journal)

- Brainard Interviewed by Biden for Fed Chair as Search Heats Up (Bloomberg)

- Xi’s Expanding Power Is a Growing Risk for China’s Economy (bloomberg)

- Market bull Tony Dwyer sees the record breakout running through year end (CNBC)

- Wealth management products like Evergrande’s are a big hidden risk for China’s troubled property market, economists say (businessinsider)

- Rolls-Royce mini-nuclear power plant design gets UK state backing (Financial Times)

- China struggles to regulate house prices despite glut of controls (Financial Times)

Be in the know. 20 key reads for Tuesday…