- Boeing’s China 737 Max completions centre ready for delivery restart (flightglobal)

- FOMC Minutes Eyed for Clues on Half-Point Hike, Runoff Plans (bloomberg)

- Buy China Stocks, Debt in ‘Dawn of Alpha,’ JPMorgan’s Santos Says (bloomberg)

- Top 15 hedge fund managers raked in $15.8 billion last year (nypost)

- Alibaba, Sands China lead gains on China easing bets (scmp)

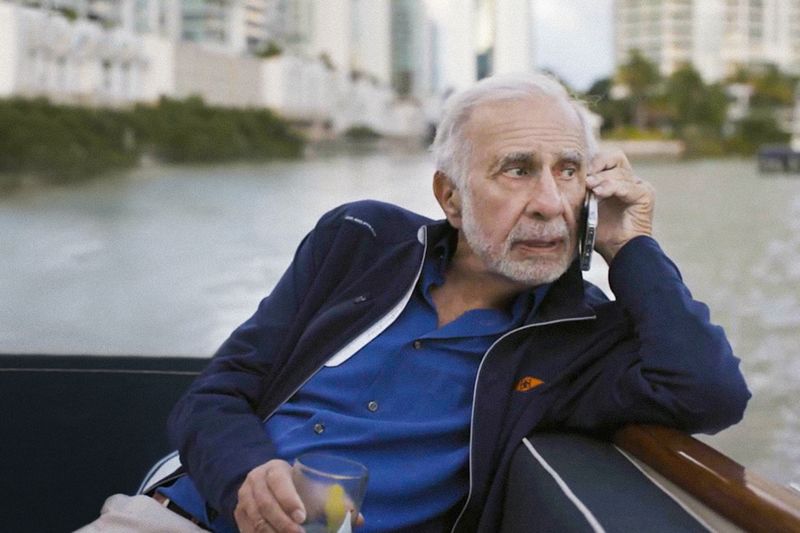

- Carl Icahn Won’t Stop Till He Gets What He Wants (bloomberg)

- Hotel Earnings Strong As Travel Headwinds Fade (investors)

- ViacomCBS Is Changing Its Name, Gaining Subscribers (barrons)

- State Street strategist says markets have got carried away on interest rate-hike expectations (marketwatch)

- ‘Facebookers’ to ‘Metamates.’ Mark Zuckerberg’s New Values Haven’t Budged the Stock. (barrons)

- Publicly Traded Companies Are Vanishing. Does Private Equity Have an Edge? (barrons)

- Why Now Is the Time to Dive Into Tech Stocks (barrons)

- Meta Stock Has Never Been Cheaper. Is It Time to Buy the Former Facebook? (barrons)

- Kraft Heinz Stock Edges Up. Sales, Earnings Beat Forecasts. (barrons)

- S. Retail Sales Rise Most in 10 Months in Broad-Based Rebound (bloomberg)

- ‘Reacher’ TV Review: Believable Brawn (wsj)

- S. Factory Output Rises as Firms Navigate Supply Constraints (bloomberg)

- China adds more companies to an industry body designed to develop the country’s metaverse (cnbc)

- ‘Bad news is already priced in’: an investment chief for BNY Mellon breaks down why he’s expecting stocks to bounce back by 8 to 10% this year despite recent volatility – and shares 3 investing strategies to excel in the current mid-cycle bull market (businessinsider)

- The bull market in stocks is ‘far from over’ and potential conflict between Russia and Ukraine could spark dovish reassessment by central banks, JPMorgan says (businessinsider)

- A value-focused portfolio manager shares 6 stocks to buy despite rising geopolitical risk — and explains why the Federal Reserve hasn’t yet made a policy error (businessinsider)

- News in-depth. Citi’s Jane Fraser ditches ambition to break into Wall Street’s big league (ft)

- Angry Oil. The Energy Report 02/16/2022 (Phil Flynn)

Be in the know. 23 key reads for Wednesday…