- Biotech Stocks Were Tanking. The Cure? M&A. (barrons)

- Inside Saudi Arabia’s $3 Trillion Plan to Move Past Oil (barrons)

- The Fed Faces Multiple Challenges in 2024. Navigating an Election Year Is One. (barrons)

- Prices Fell for the First Time Since 2020. What Was Behind the Drop. (barrons)

- Banks Aren’t Fighting Private Credit—They’re Enabling It (barrons)

- Charlie Munger, Close Up (barrons)

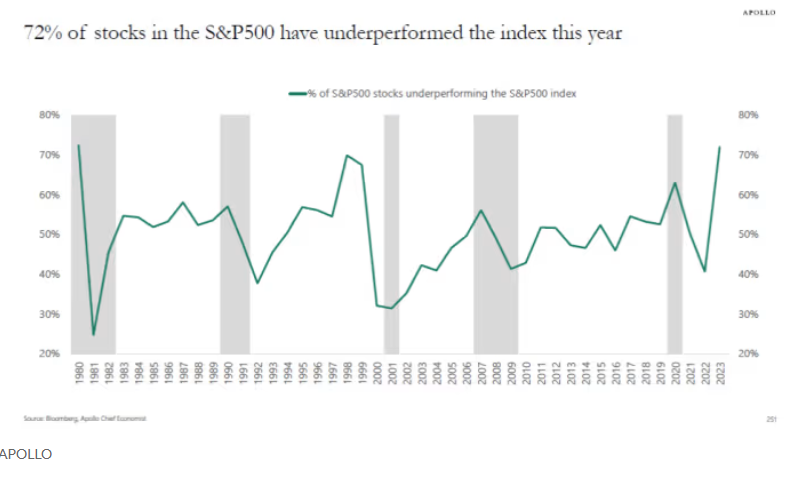

- A record share of S&P 500 stocks underperformed the index in 2023 as ‘weirdest bull market in decades’ marches on (marketwatch)

- Here are the 20 worst-performing stocks among the S&P 500 in 2023 (marketwatch)

- These 4 Economic Indicators Are Key to Watch for Fed Rate Cuts (barrons)

- Why Hertz Stock Could Be a Winner in 2024 (barrons)

- L.A. office building sells for $153.5 million — $115 million less than its sale price a decade ago (marketwatch)

- 11 dividend stocks with high yields expected to be well supported in 2024 per strict criteria (marketwatch)

- Opinion: Tax-loss selling makes these stocks in cannabis, pharma, energy and industrials worth buying (marketwatch)

- Wall Street banks propel Dallas to second behind NYC in number of finance workers (nypost)

- FT writers’ predictions for the world in 2024 (ft)

- Ant Completes Process of Removing Jack Ma’s Control (bloomberg)

- ‘Everyone Got Burned’: Wall Street Missed the Great Stock Rally of 2023 (bloomberg)

Be in the know. 17 key reads for Saturday…