- Party Like It’s 1983 (Wall Street Journal)

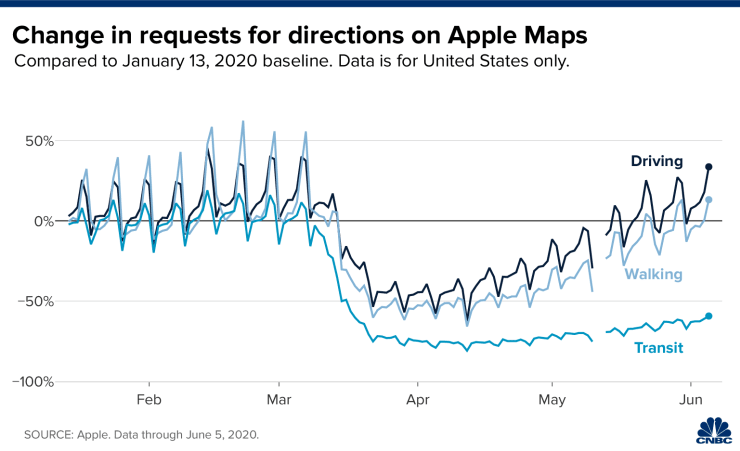

- Five charts that track the U.S. economy amid reopening progress (CNBC)

- Hospitals Got Bailouts and Furloughed Thousands While Paying C.E.O.s Millions (New York Times)

- Chimerica Isn’t Dead, but the Pandemic Wounded It (Wall Street Journal)

- Oil prices motor to levels not seen in months as OPEC+ extends historic cuts (Fox Business)

- AstraZeneca contacted Gilead over potential megamerger: Bloomberg News (Street Insider)

- Las Vegas Is Open for Business Again: 4 Top Gaming Stocks (24/7 Wall Street)

- New York City reopens under Phase One on Monday (New York Post)

- Bull, bear, bull, bear and now a new bull market — whatever’s next, these stocks will outperform, strategist says (MarketWatch)

- Japan Bankruptcies Hit Lowest Since the 1960s: What Gives? (Bloomberg)

- Fed Debates Whether to Reinforce Low-Rate Pledge With Yield Caps (Wall Street Journal)

- Saudi Arabia’s Secret Plans to Unveil Its Hidden da Vinci—and Become an Art-World Heavyweight (Wall Street Journal)

- U.S. Fed’s Main Street lending facility likely to start with a whimper (Reuters)

- Stanley Druckenmiller says he’s been ‘humbled’ by market comeback, underestimated the Fed (CNBC)

- New CEO Bought Stock in UPS (Barron’s)

- Barron’s Daily: Travel Stocks Continue Their Rebound. Not Even a Tropical Storm Can Stop the Rally. (Barron’s)

- HP Stock Is Slumping. The CEO and a Director Made the First Insider Buys in Years. (Barron’s)

- Emerging-Market Rally Seen Unstoppable as Traders Turn to Powell (Bloomberg)

Be in the know. 18 key reads for Monday…