- “Understandably, really outstanding businesses are very seldom offered in their entirety, but small fractions of these gems can be purchased Monday through Friday on Wall Street and, very occasionally, they sell at bargain prices.” (ap)

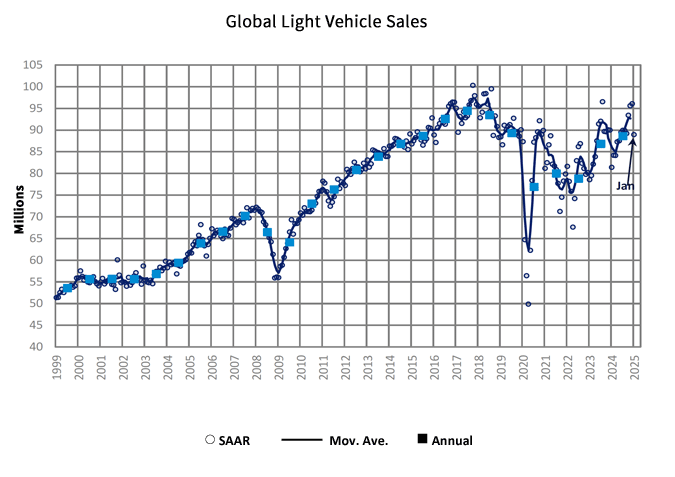

- GlobalData Global Light Vehicle Sales Update (January 2025) (marklines)

- S. Market: New Vehicle Sales Recover, BEV Expansion Slows (marklines)

- Options Traders Line Up Hedges Before Pivotal Nvidia Earnings (bloomberg)

- The Three Names You Need to Know to Understand the Future of the International Monetary Order (bloomberg)

- China Developers Buy Land at 20% Premium in Bet on Market Bottom (bloomberg)

- This Chinese AI Bet Has Outperformed Magnificent Seven Names Like Meta and Google This Year. Alibaba stock soared after a strong earnings beat, bringing its year-to-date gains to 60 percent. (inc)

- The rise and fall of Long Term Capital Management (npr)

- Can the president override Congress on spending? (npr)

- The Brain Science of Elusive ‘Aha! Moments’ (scientificamerican)

- James Bond Works for Jeff Bezos Now. What Does That Mean For 007’s Future? (gq)

- Ferrari’s Classiche Division Is the Master of Rebuilding Icons, Even Wrecked F40s (rt)

- Alibaba’s Core Businesses Reignite Growth as AI Strategy Delivers Strong Results (alizila)

- AliViews: Eddie Wu on Alibaba’s Q3 Earnings (alizila)

- Oil Speculators Turn Sour as Bullish Wagers Get Trimmed Back (bloomberg)

- Trump Targets China With Biggest Salvo So Far in Second Term (bloomberg)

- Zelenskiy Says He Would Be Ready to Quit for Sake of Ukraine Peace (bloomberg)

- Alibaba to Spend $53 Billion on AI Infrastructure in Big Pivot (bloomberg)

- Alibaba CEO Wu Says AGI Is Now Company’s ‘Primary Objective’ (bloomberg)

- Shein’s annual profit down by more than a third, FT reports (nypost)

Be in the know. 20 key reads for Monday…