- Federal Reserve loosens restrictions on big bank stock buybacks (MarketWatch)

- U.S. liquefied natural gas exports set a record in November (EIA)

- The S&P 500 Could Gain Another 10% Next Year, Experts Say (Barron’s)

- Washington avoids government shutdown, but no stimulus vote until Sunday at earliest (MarketWatch)

- Why the Future Now Looks Brighter for Value Investing (troweprice)

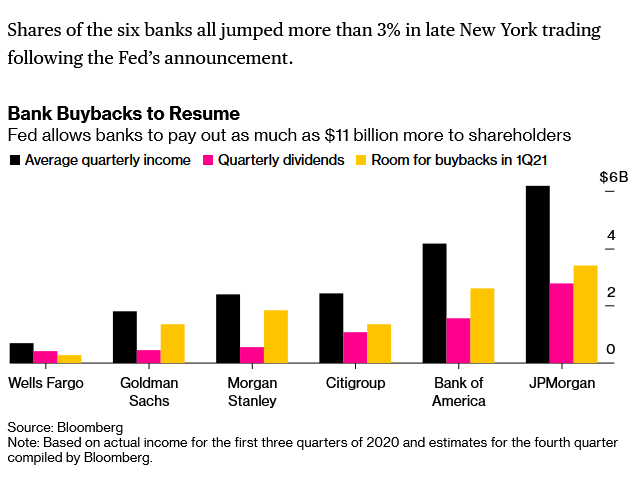

- The Fed Just Said Banks Could Buy Back Stock Again. (Barron’s)

- Banks Have Begun to Merge Again. Next Year Could See Even More Deals. (Barron’s)

- FDA approves second Covid vaccine for emergency use as it clears Moderna’s for U.S. distribution (CNBC)

- Fed allows banks to resume share buybacks, JPMorgan stock jumps 5% (CNBC)

- While you’re buying value stocks for your portfolio, add some diversity too (MarketWatch)

- JPMorgan, Goldman to Restart Buybacks as Fed Gives Green Light (Bloomberg)

- Why Natural-Gas Prices Could Continue to Rise (Barron’s)

- The Last 10 Years and the Next 10 (compoundadvisors)

- Fed Stress Tests Show U.S. Banks Can Withstand Covid-19 Pandemic (Wall Street Journal)

- Wells Fargo to Sell Student Loan Book to Apollo, Blackstone (Bloomberg)

- The Transcript 12.14.20 (theweeklytranscript)

- Roblox and the Dispersal of Creativity (profgalloway)

- What Do We Mean By Reinvestment? (akrecapital)

- Siren Songs: IPOs & SPACs (investoramnesia)

- Charlie Munger Interview (CalTech)

Be in the know. 20 key reads for Saturday…