- Opinion: Seven reasons the beleaguered biotech sector is now a ‘buy’ (marketwatch)

- Seagen’s stock surges after WSJ reports $31 billion-valued biotech is being eyed by Merck (marketwatch)

- China’s Stocks Are Bucking Global Market Volatility. Tech Is Leading the Way. (barrons)

- Buffett’s Last Lunch Auction Draws Record $19 Million Bid (bloomberg)

- Inside IBD 50: Once-Robust Oil Stocks Fading Fast, Some Hit Sell Signals (investors)

- New York Fed Model Sees High Probability of Hard Landing for Economy (wsj)

- Self-Driving Big Rigs Are Coming. Is America Ready? (wsj)

- Retailers’ Inventories Pile Up as Lead Times Grow (wsj)

- YouTube Shorts Is Huge In India, Now It’s Going After TikTok in U.S. (wsj)

- US Open heading into epic weekend with stars atop leaderboard (nypost)

- Citigroup Stock Is the Cheapest of the Big Banks. It’s Ready to Take Off. (barrons)

- The Days of Big Pharma Are Over. What the Era of Big Biotech Means for Investors. (barrons)

- Markets Won’t Sink Forever. Asset Manager Stocks Are a Cheap Play on a Recovery. (barrons)

- Why stock-market investors are ‘nervous’ that an earnings recession may be looming (marketwatch)

- History says the next bull market is just months away, and it could carry the S&P 500 to the 6,000 level, according to Bank of America (marketwatch)

- Mereo BioPharm and Theseus Pharmaceuticals See Action From Activist Investors (barrons)

- Fed Rate Hikes Will End Sooner Than You Think. What That Means for the Stock Market. (barrons)

- Bitcoin sinks below $20,000 as crypto meltdown intensifies (cnbc)

- Is the Avalanche’s Defenseman the Stephen Curry of Hockey? (nytimes)

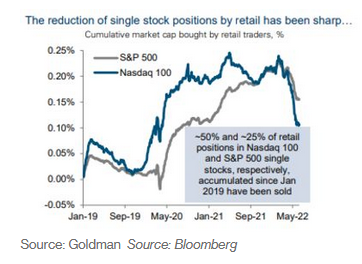

- Retail Traders Who Drove Meme Frenzy Bail Out in Bear Market (bloomberg)

Be in the know. 20 key reads for Saturday…