- Alibaba’s AI model outperforms Chinese rivals, ranks just behind OpenAI, Anthropic (scmp)

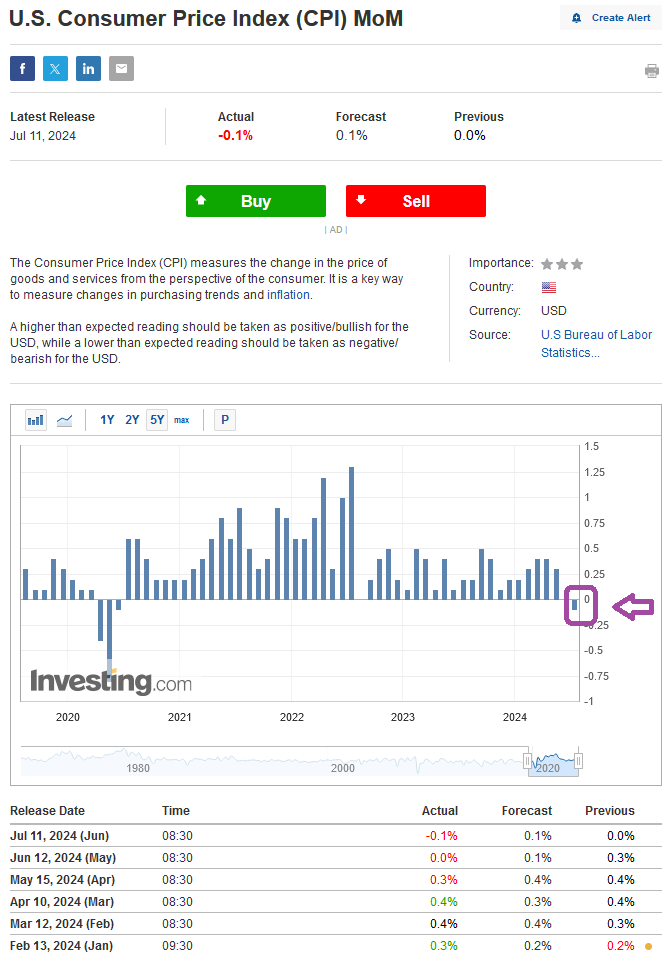

- Traders boost bets on Fed rate cut in Sept after CPI data (reuters)

- Goldman Strategists Say Big Tech’s AI Splurge Worries Investors (bloomberg)

- PepsiCo Earnings Beat Expectations. Why the Stock Is Dropping. (barrons)

- Glamorous Garages and Beautiful Barns: The New Must-Have Amenities (barrons)

- Ford Is Making a Comeback. It’s Time to Buy the Stock. (barrons)

- Pfizer Moves Forward With Weight-Loss Pill. The Stock Is Rising. (barrons)

- There’s a very short window to bet against the dollar, says Goldman Sachs. (marketwatch)

- The Golf Putter That Works So Well, ‘It Feels Like Cheating’ (bloomberg)

- The Risky-Loan Trade Is Back (wsj)

- Tony Robbins Bet $200 Million on a Green-Energy Breakthrough. Proof It Works Remains Elusive. (wsj)

- What’s Behind Powell’s Latest Shift on Rates (wsj)

- American Workers Have Quit Quitting, for Now (wsj)

- How Drug Middlemen Keep Beating the System (wsj)

- Apple Settles E.U. Case by Opening Its Payment Service to Rivals (nytimes)

- Private Equity’s Creative Wizardry Is Obscuring Danger Signs (bloomberg)

- China’s plenum must offer action not rote slogans (ft)

- Hong Kong stocks rise after China unveils fresh curbs on short-selling to lift confidence (scmp)

- 3 Reasons to Buy Intel Stock Like There’s No Tomorrow in 2024 (fool)

- Treasury yields fall on rate-cut optimism (wsj)