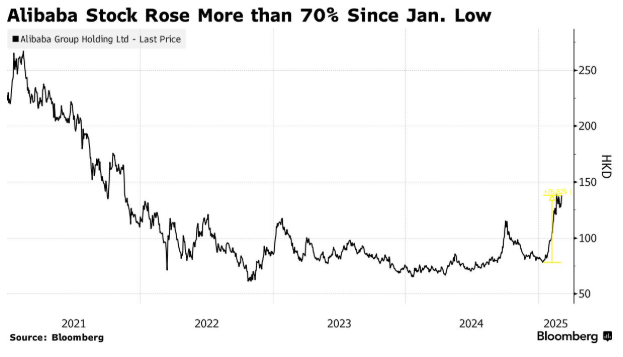

- Alibaba Stock Is Rising. The China AI Spotlight Is Shifting From DeepSeek. (barrons)

- With Trump’s tariffs paused, ‘Big Three’ automakers may race to build inventories (marketwatch)

- Japan’s 10-Year Bond Yield Reaches Highest Since June 2009 (bloomberg)

- China Steps Up Support for Tech Sector as AI Enthusiasm Soars (bloomberg)

- AI-led boom of Chinese stocks revives refinancing activities in Hong Kong (scmp)

- ‘Better than DeepSeek and OpenAI’: Alibaba touts open-source AI model that beats rivals (scmp)

- NPC’s Government Work Report Reviewed – Consumption, Consumption, Consumption & AI (chinalastnight)

- China’s Commerce Chief Wrote to US Seeking Dialogue Last Month (bloomberg)

- JD.com Sales Rise Most in Years After China Consumers Awaken (bloomberg)

- Euro touches 4-month peak; eyes on ECB policy meeting, outlook (streetinsider)

- US stocks struggle as ‘America First’ bets backfire (ft)

- ECB Cuts Again and Signals Easing Phase Is Nearing Its End (bloomberg)

- Hot Stocks from 2024 Have Grown Cold (morningstar)

- Hims & Hers Stock Is Due for a Crash Diet. The GLP-1 Surge Is Fading Fast. (barrons)

- US Employers Announce Most Job Cuts Since 2020 Amid DOGE Layoffs (bloomberg)

- One big takeaway from Trump’s speech? He needs a weak dollar. (marketwatch)

- Market Turmoil Pushes Low-Volatility Stocks Into Driver’s Seat (bloomberg)

- Home Builders Are Hurting. Their Stocks Are Good Buys. (barrons)

- Tariffs Won’t Slam the Economy. Not Unless Consumers Panic. (barrons)

- The spring could have huge rallying months, says Fundstrat’s Tom Lee (youtube)

Be in the know. 20 key reads for Thursday…