- Alibaba’s Cainiao Files for $1 Billion-Plus Hong Kong IPO (bloomberg)

- China’s economic situation isn’t as dire as it seems, and policymakers in Beijing were just expecting too much, economist says (businessinsider)

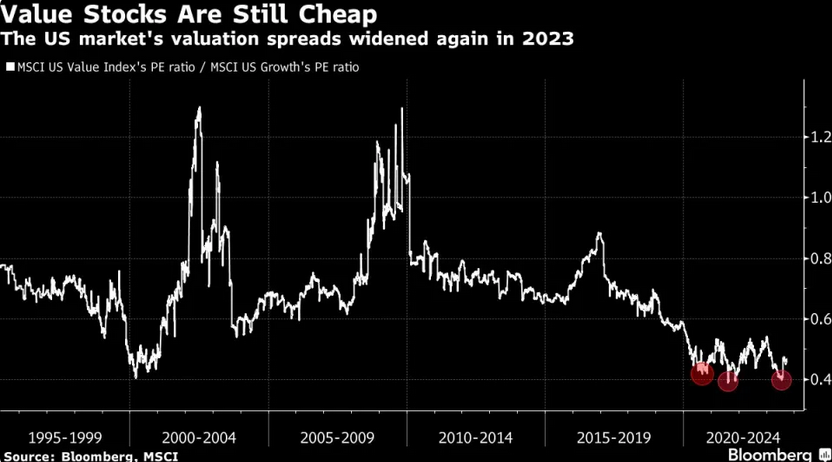

- This Is the ‘Perfect’ Time to Buy Value Stocks on Sticky Inflation, Rob Arnott Says (yahoo)

- Biden Heads to Strike. Can He Square Inflation and Unions? (barrons)

- Why Ford Struck a Deal (barrons)

- A Government Shutdown Is Close. What’s at Stake. (barrons)

- Hedge funds are boosting bets against U.S. stocks as selloff continues, Goldman Sachs says (marketwatch)

- 11 Beaten-Up Growth Stocks That Look Like Buys—and Aren’t Big Tech (barrons)

- Wall Street analysts expect the S&P 500 to rise 19% over the next 12 months. Here are their 10 favorite stocks. (marketwatch)

- Moody’s warns gov’t shutdown bad for USA’s credit — one month after Fitch downgrade (nypost)

- The Secret Ingredient of ChatGPT Is Human Advice (nytimes)

- Bond Traders Stung by Fed See US Shutdown as Next Big Wild Card (bloomberg)

- Hedge Funds Cut Stock Leverage at Fastest Pace Since 2020 Crash (bloomberg)

- Goldman Sachs: Buy these 22 stocks that will continue to outperform (businessinsider)

- Short Positions Pile Up in Nasdaq Futures, Citi Strategists Say (bloomberg)

- Government shutdown fears rattle US stocks, but history shows upside (streetinsider)

- The elusive Fed ‘soft landing’ nears. Why are Americans so mad about the economy? (reuters)

- Charlie Munger Emphasizes Self-Awareness And Strategy: ‘I Don’t Play In A Game Where The Other People Are Wise And I’m Stupid. I Look For A Place Where I’m Wise And They’re Stupid’ (yahoo)

- The Big Read. The debt-fuelled bet on US Treasuries that’s scaring regulators (ft)

- Economic & Diplomatic Progress Goes Unnoticed By Foreign Investors (chinalastnight)

Be in the know. 20 key reads for Tuesday…