- Alibaba’s cloud services unit expands business with China’s data exchanges under major new deal in southern tech hub Shenzhen: “In 2022, Alibaba Cloud remained the top cloud infrastructure services provider in mainland China, with a 36 per cent share of the market’s US$30.3 billion overall revenue that year, according to research firm Canalys. It ranked Alibaba Cloud ahead of the rival cloud services units of Huawei Technologies Co, Tencent Holdings and Baidu in the same period.” (scmp)

- Corporate Insiders Increase Stock Buying After Banking Turmoil (wsj)

- Larry Summers Rejects De-Dollarization Hype (bloomberg)

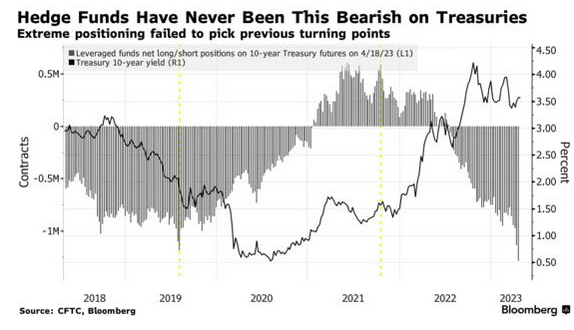

- Hedge Funds Place Biggest Ever Short on Benchmark Treasuries (bloomberg)

- Stock-market investors get a new ‘fear gauge’ Monday. What you need to know (marketwatch)

- Big Tech Is Carrying Stocks on Its Shoulders. Why AI Will Be Critical. (barrons)

- How Hyundai Motor Rose to Number 3 In the U.S. Vehicle Market (barrons)

- Drew Maggi, 33, gets second chance at MLB debut with Pirates: ‘Let’s f–king go!’ (nypost)

- As Big Tech determines the course of Wall Street, here is why Amazon will hold the most sway (marketwatch)

- Vehicle inventory is nearly back at pre-pandemic levels; these are the brands with the most and least supply (marketwatch)

- Big Tech Earnings Are Coming. What to Know About Amazon, Microsoft, Alphabet, and Meta. (barrons)

- Carbon Capture Is Set to Take Off. These Companies Are Ahead of the Game. (barrons)

- J&J Consumer-Health IPO Process to Kick Off Key Test for Moribund New-Issue Market (wsj)

- Why the Banking Mess Isn’t Over (wsj)

- Four Reasons Why Investors Expect US Dollar to Keep Sliding (bloomberg)

- ExxonMobil unleashing affordable energy with refinery expansion (foxbusiness)

- Tech investors focus on profits after layoffs; companies to highlight AI (reuters)

Be in the now. 17 key reads for Monday…