Key Market Outlook(s) and Pick(s)

On Tuesday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss tariffs and markets. Thanks to Stuart, Christian Dagger and Preston Mizell for having me on:

Last Tuesday, I joined Kai Hoffmann on the “Soar Financially” Podcast to discuss MAG 7, rotation, China, and stock picks. Thanks to Kai for having me on:

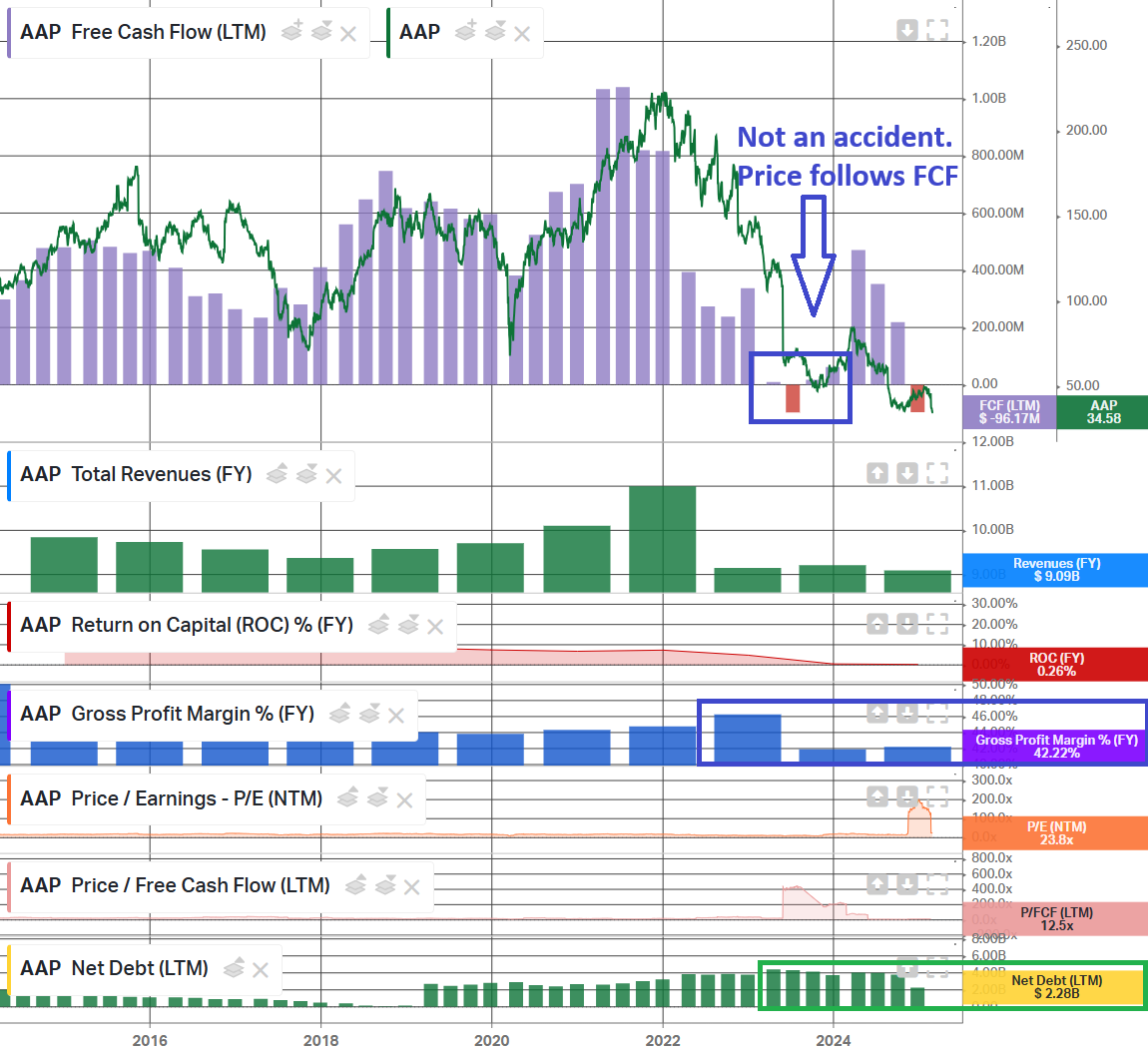

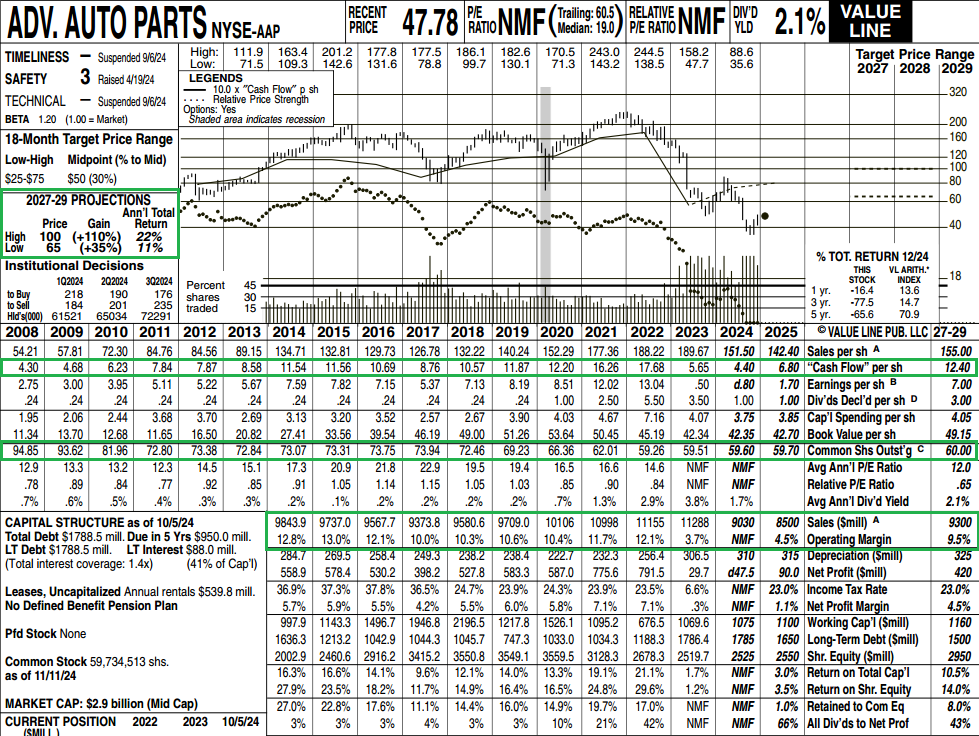

Advance Auto Parts Update

Earnings Results

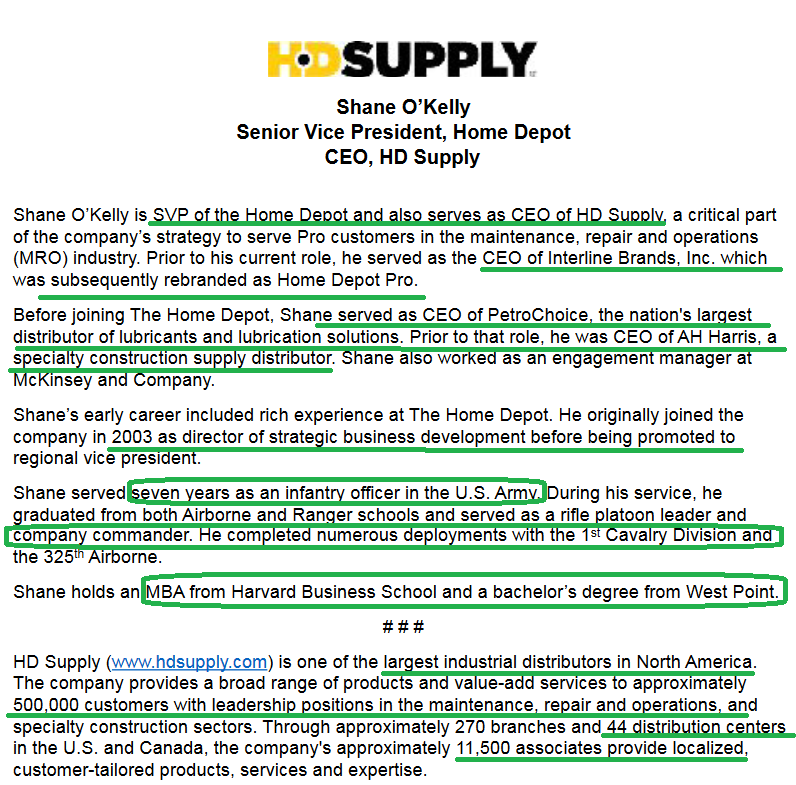

Part of our original thesis on AAP was betting on the jockey, newly appointed CEO Shane O’Kelly.

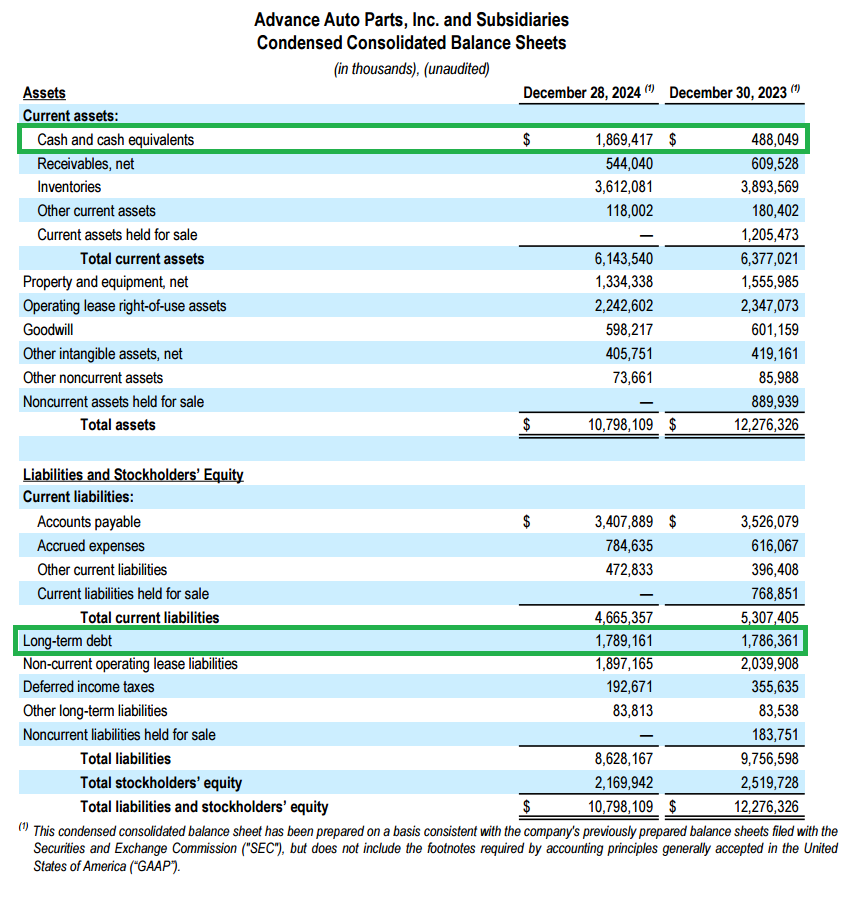

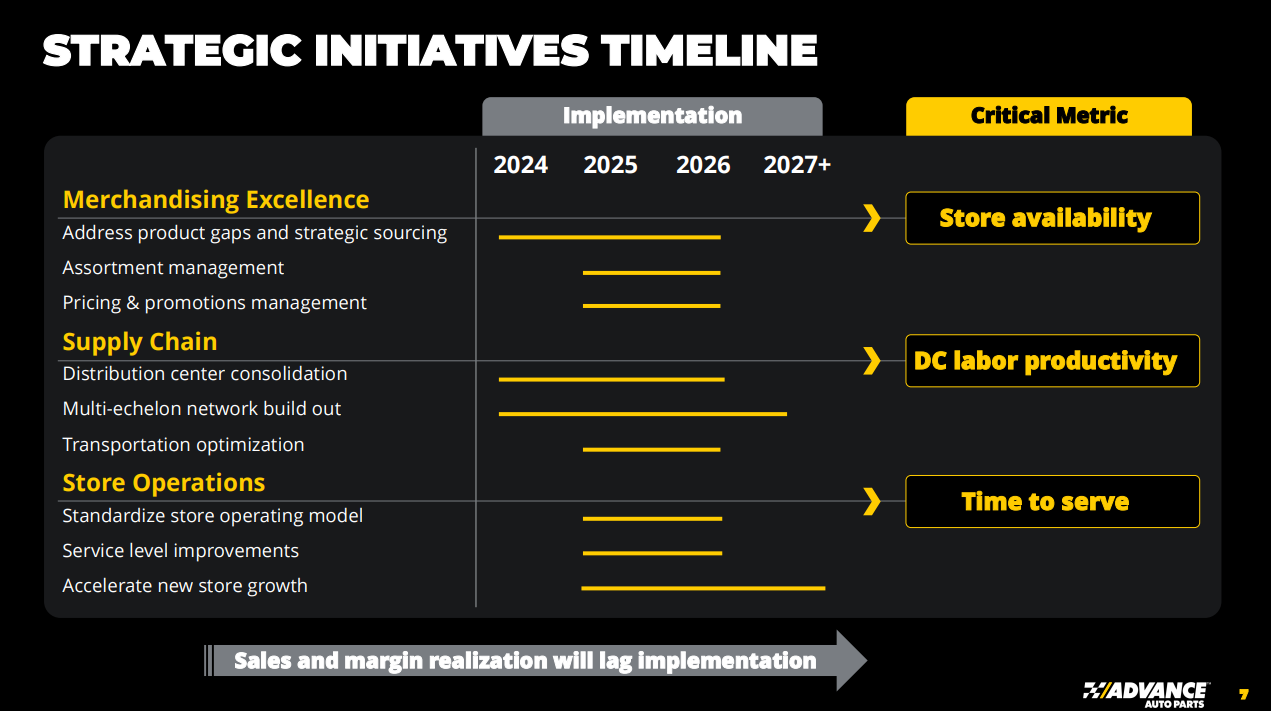

O’Kelly was appointed in September 2023, and before he even found the coffee machine, he was already ripping off the band-aid and getting to work on the turnaround. Now, a year and a half into the job, O’Kelly has already: taken solvency risk off the table with the $1.5B sale of the WorldPac Business, led a supply chain consolidation (reducing 38 DCs to 12 by the end of 2026), and optimized the store footprint by closing over 700 underperforming and unprofitable stores to concentrate on the strongest markets. The point is, he’s executing on everything he has promised (and then some). We originally got into this position expecting a solid double over the next few years. The way O’Kelly is executing, our expectations continue to MOVE UP!

This sit-down interview with Shane O’Kelly is from a few months ago, but it lays out each part of the turnaround plan: the WorldPac sale, focusing on the blended box, supply chain consolidation, and where AAP is headed. After listening, you’ll understand why we are SO CONFIDENT in him.

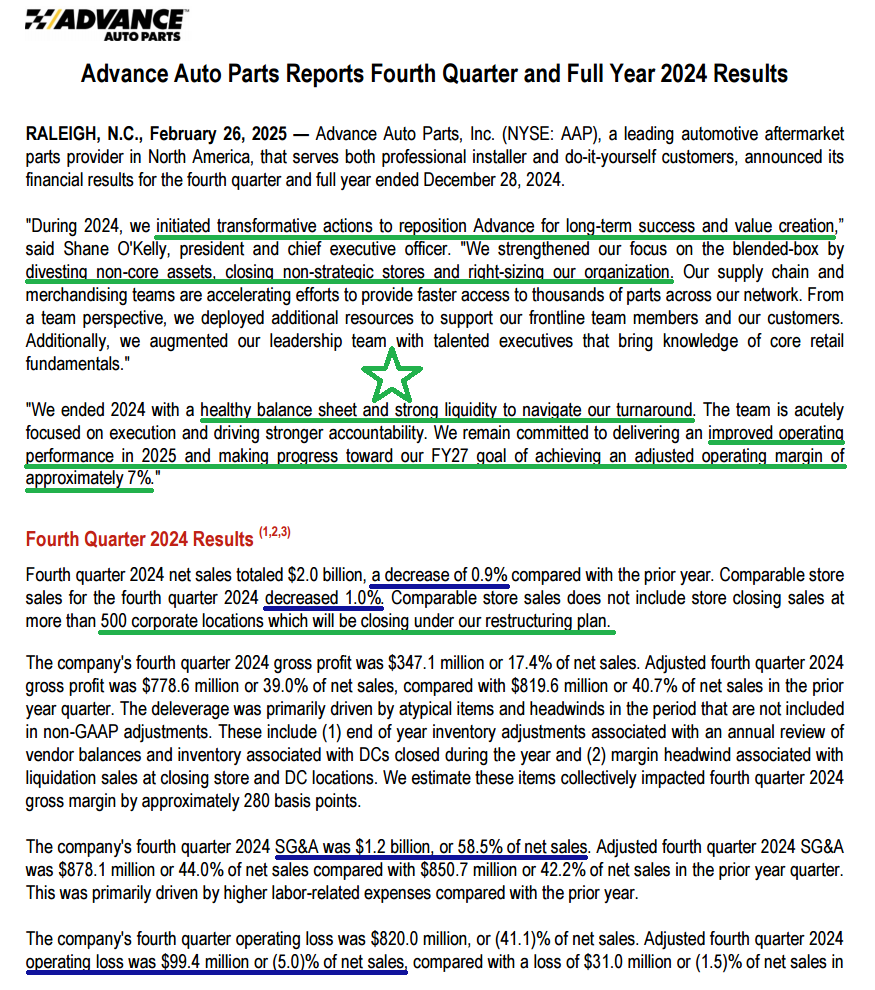

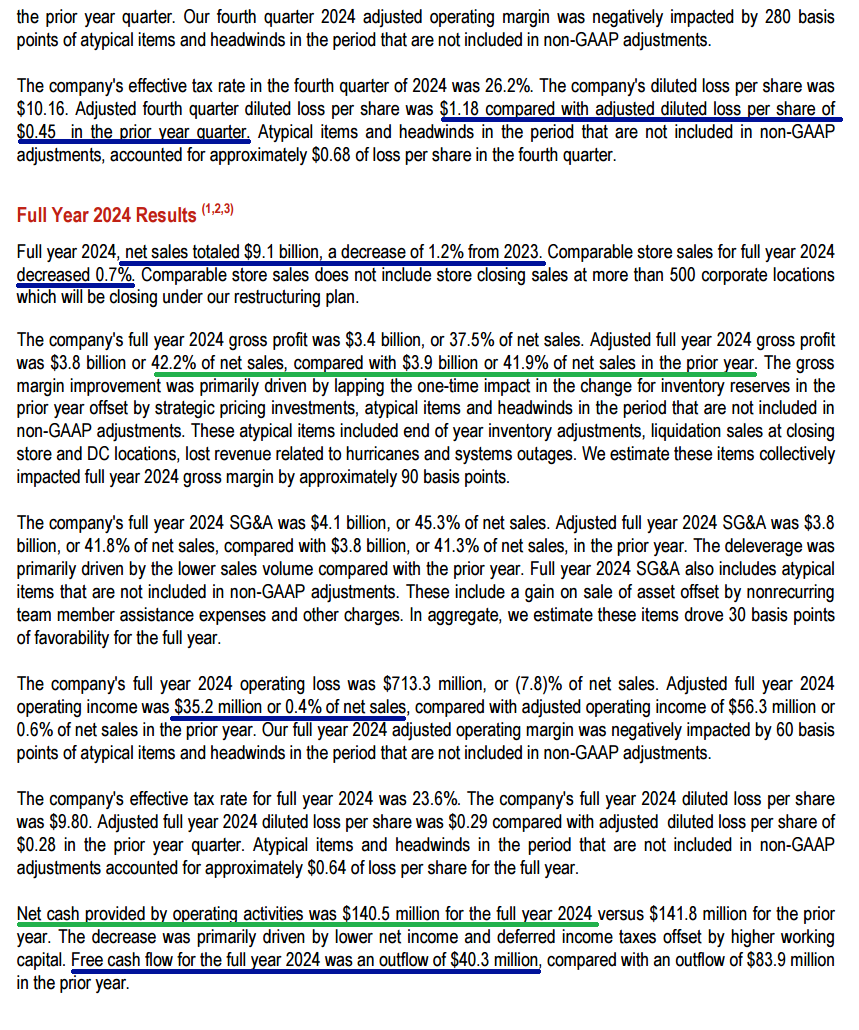

Now, onto the key takeaways from AAP’s Q4 results…

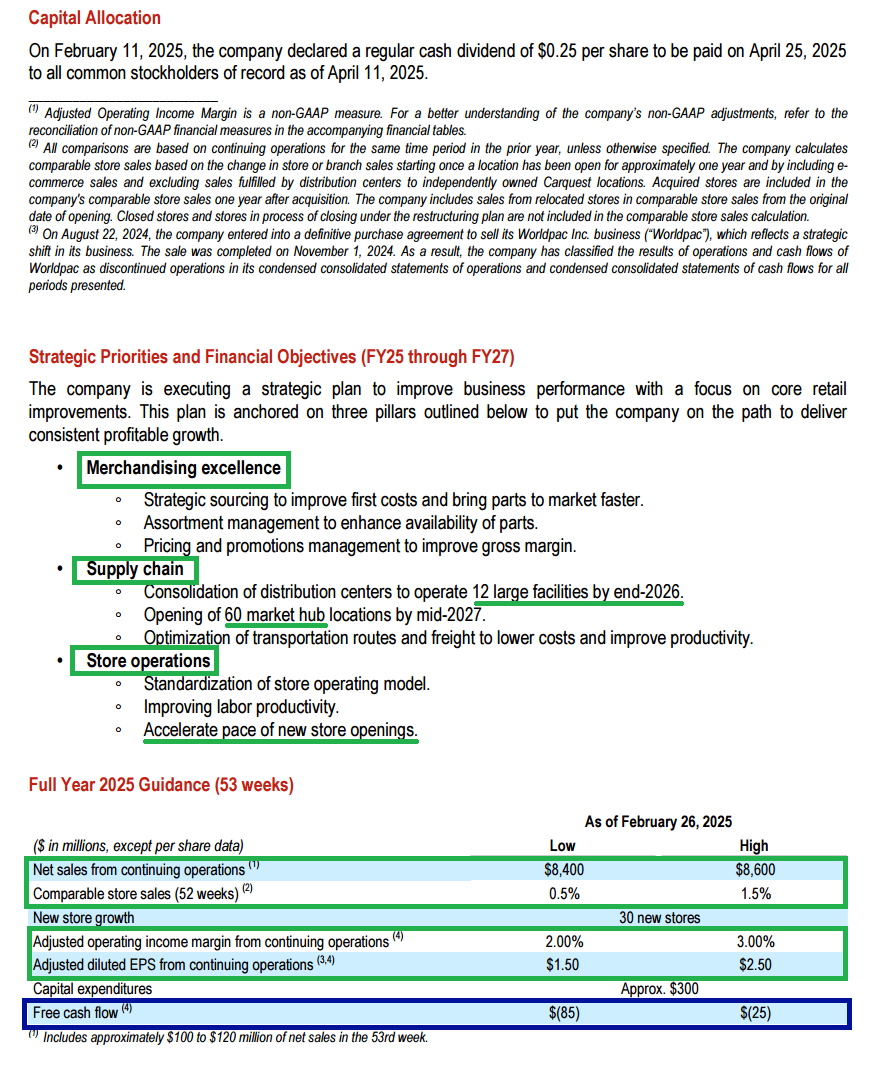

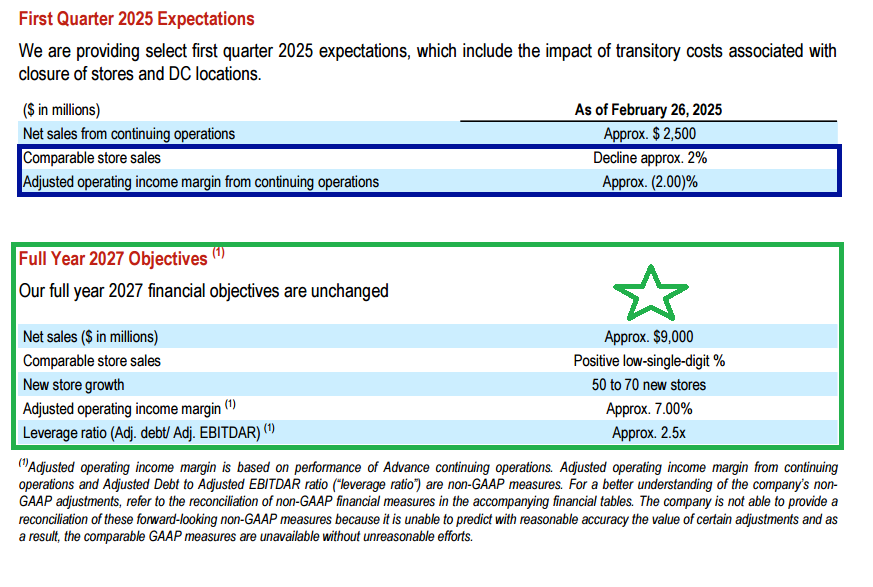

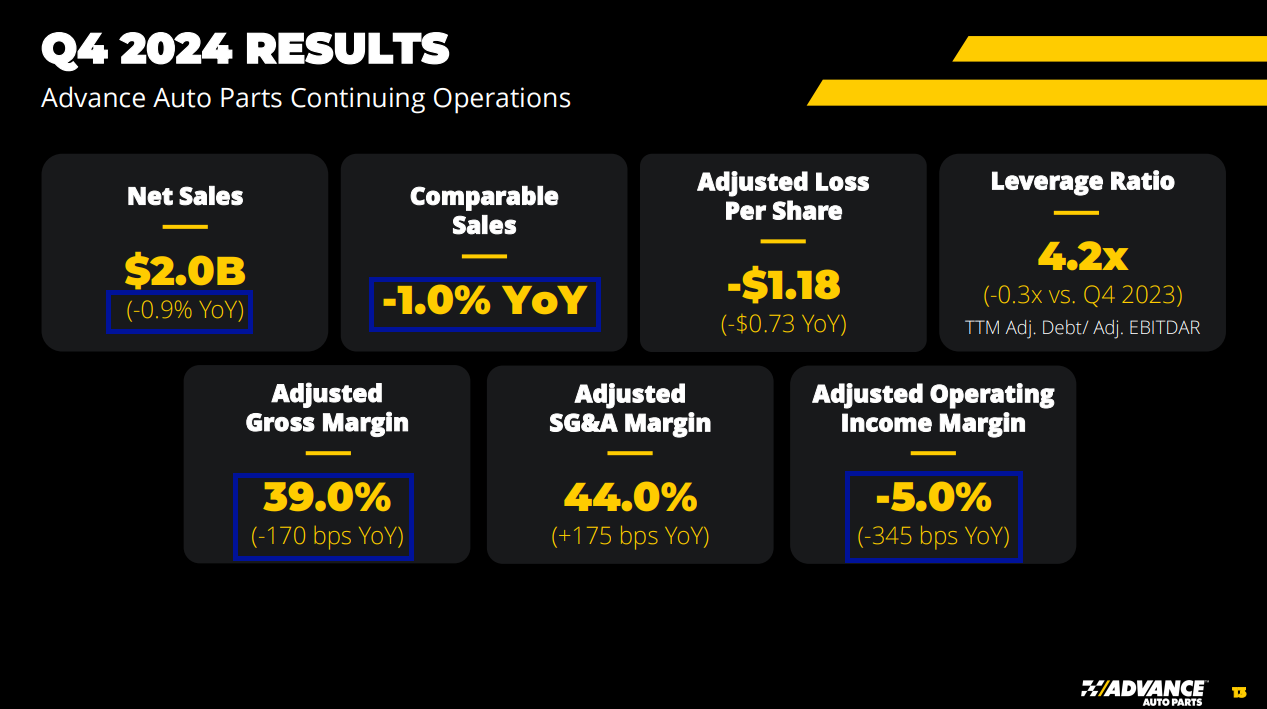

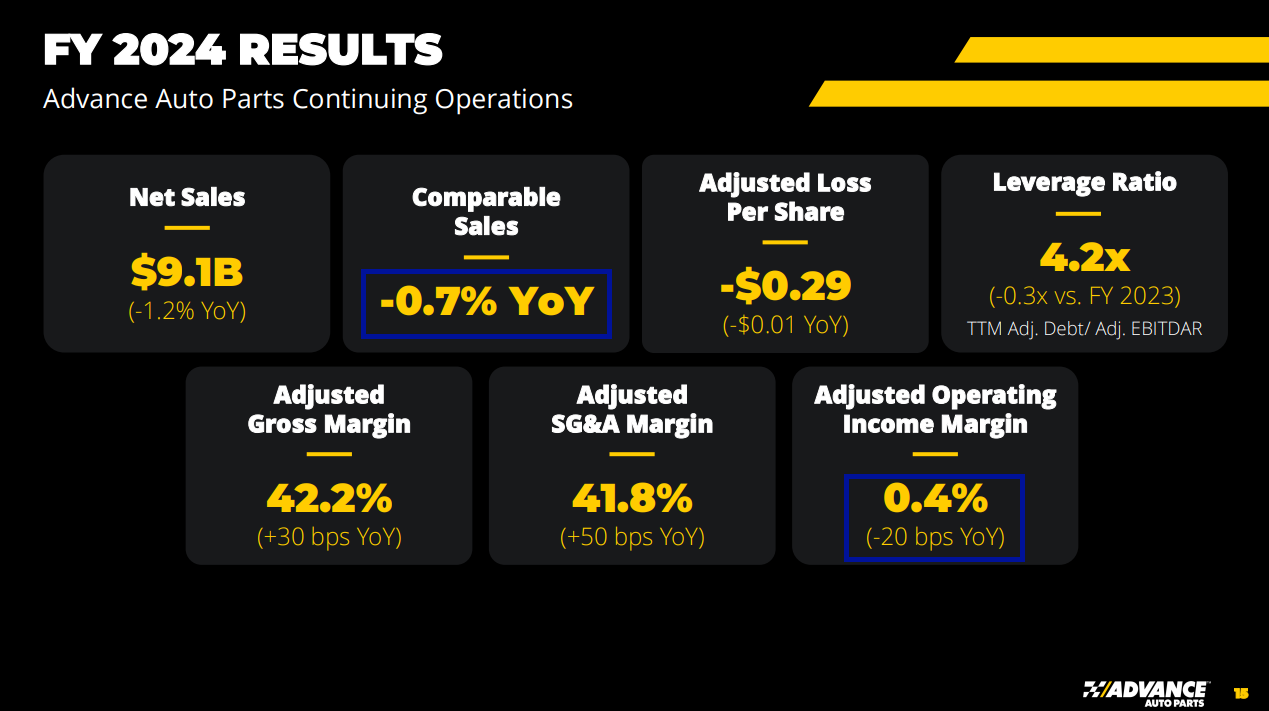

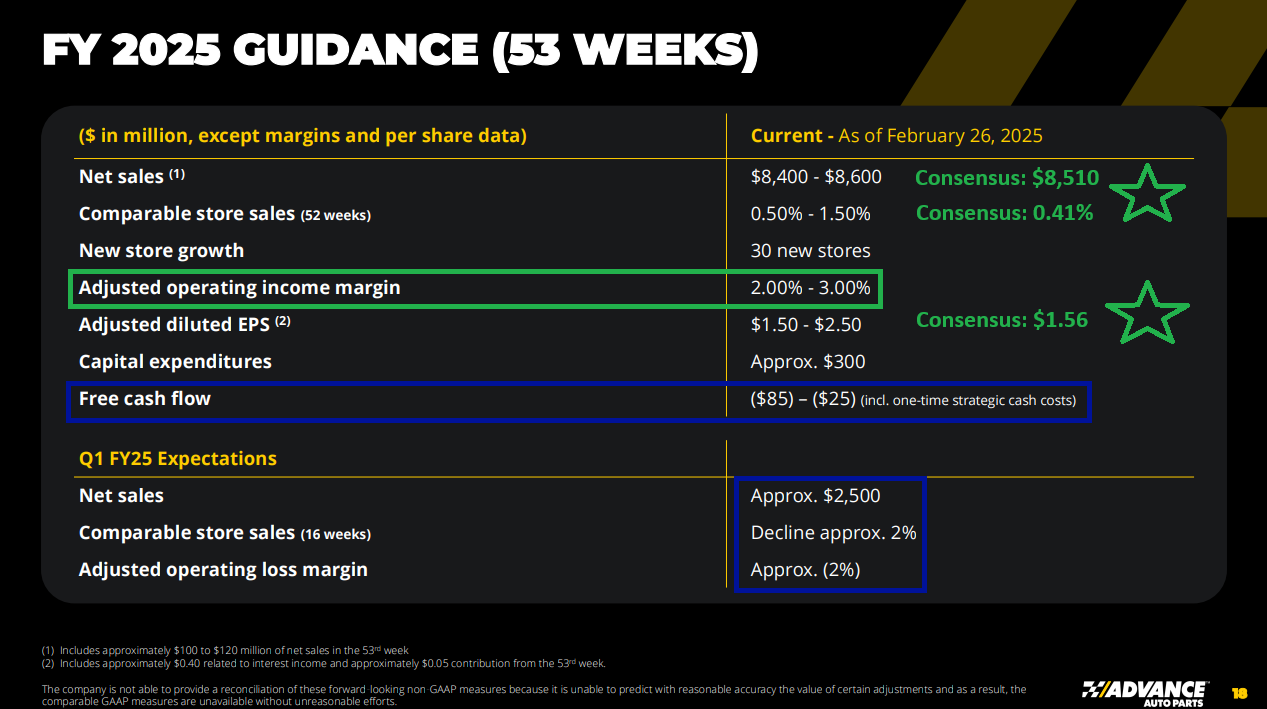

Advance Auto Parts reported Q4 earnings last week, beating both top and bottom line expectations. The “problem” for investors was soft Q1 guidance, forecasting another quarter of negative comp store sales (-2%) and negative adjusted operating margins (-2%). However, guidance for the full year came WELL ABOVE consensus. Comp store sales are expected to range from 0.50% to 1.50%, vs. consensus estimates of 0.41%. Adjusted EPS is expected to be between $1.50 and $2.50, vs. consensus of $1.56. Clearly, the market isn’t buying the story of a second-half recovery, moving from a “pressured consumer environment” to “normal market conditions” in 2H. This line from CFO Ryan Grimsland is all you need to know:

“IF THE LOWER SALES ENVIRONMENT WERE TO PERSIST LONGER THAN WE ANTICIPATE, THE LOW END OF OUR GUIDANCE RANGE WOULD BE A REASONABLE EXPECTATION FOR THE YEAR.”

Meaning, the low end of the guidance range, which was already largely in line or ABOVE consensus, would be reasonable if current headwinds persist throughout the whole year.

So, while investors puke in the hole and trip over themselves over ‘soft’ quarterly guidance, here’s what they’re ignoring:

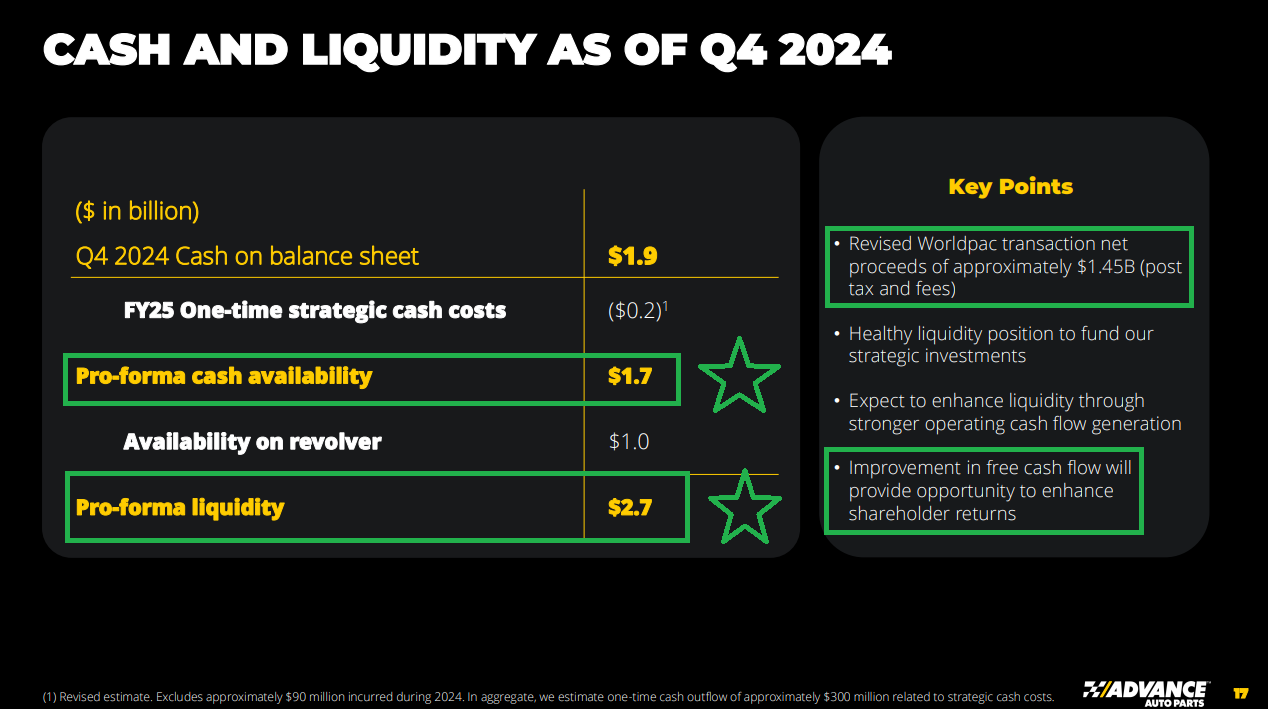

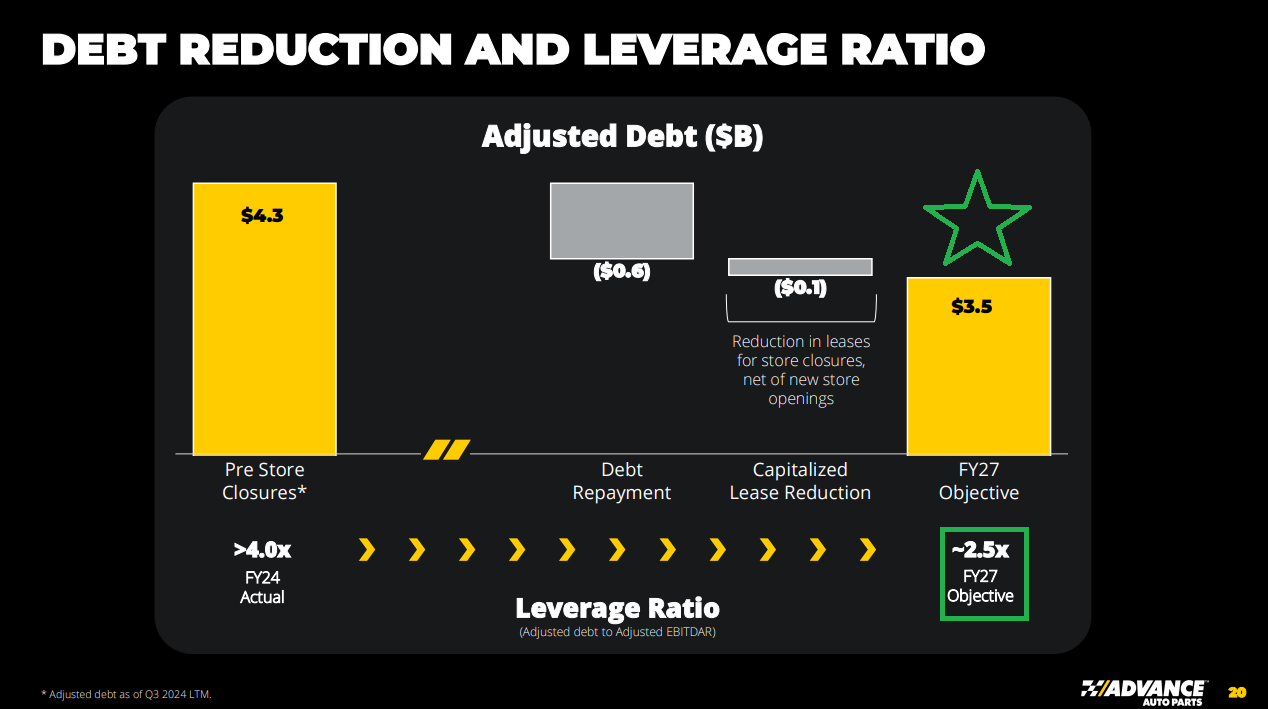

1) WorldPac net proceeds are now estimated to be $1.45B, with the tax liability expected to be around $200M LOWER than prior expectations.

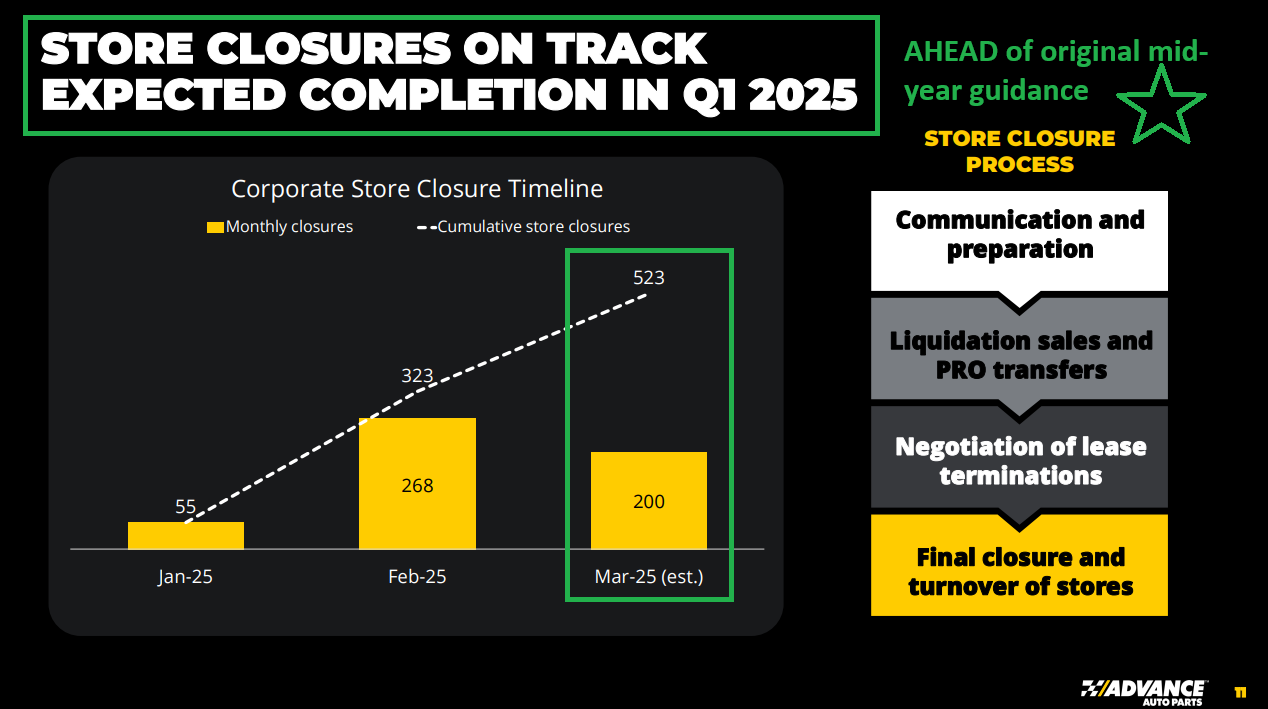

2) The store closure costs, which were originally projected to range from $350M to $750M, are now expected to be just $300M. Not only that, but they’re set to be fully completed by the end of March, well ahead of the previous mid-year timeline.

Assuming the midpoint of the prior store closure cost guidance, these two cost savings combined result in an additional $450M in cash on AAP’s balance sheet. Keep in mind, this is a ~$2B market cap company (~22% of the total market cap). This is a HUGE DEAL.

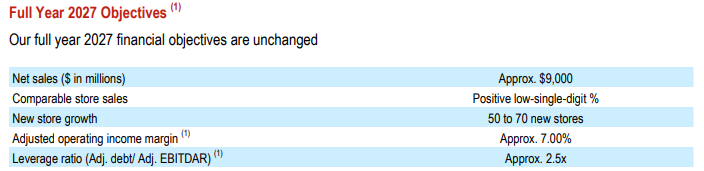

3) FY2027 objectives remained unchanged.

In our last article covering AAP back in November, we went over the implications of these 2027 targets.

“It’s all about Confidence” Stock Market (and Sentiment Results)…

When we published the article, AAP traded around $40 per share and analyst consensus estimates for 2027 were at $4.28 in EPS.

Fast forward to today, shares are down ~15%, yet analyst consensus estimates for 2027 HAVE MOVED UP TO $4.68 in EPS.

Remember: In the SHORT TERM the market is a VOTING MACHINE, in the LONG TERM it is a WEIGHING MACHINE…

Keep in mind, these estimates still look EXTREMELY CONSERVATIVE.

$9B in revenues at a 7% operating margin yields $630M of operating income.

The last 4 times they had operating income in the $600M range were 2018 ($617M), 2019 ($679M), and 2022 ($670M). In those respective years, when the share count was as much as 10.5% higher than today, the business earned $5.75, $6.87, and $7.70 per share in EPS. The stock reached highs of $186.10, $182.60, and $244.50 in each of those years. With a share count reduction of around 10% since those peaks, the EPS will increase off similar operating income in 2027. The key will be what multiple is applied?

Earnings Call + Q&A Highlights

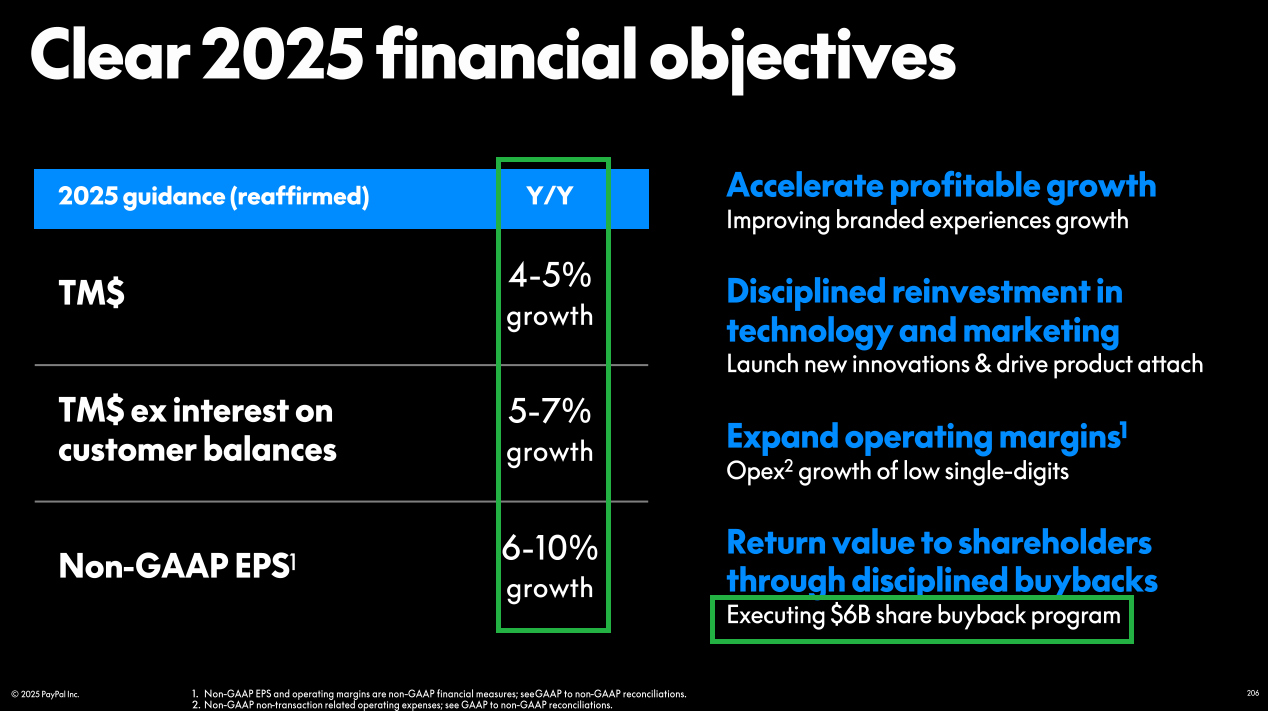

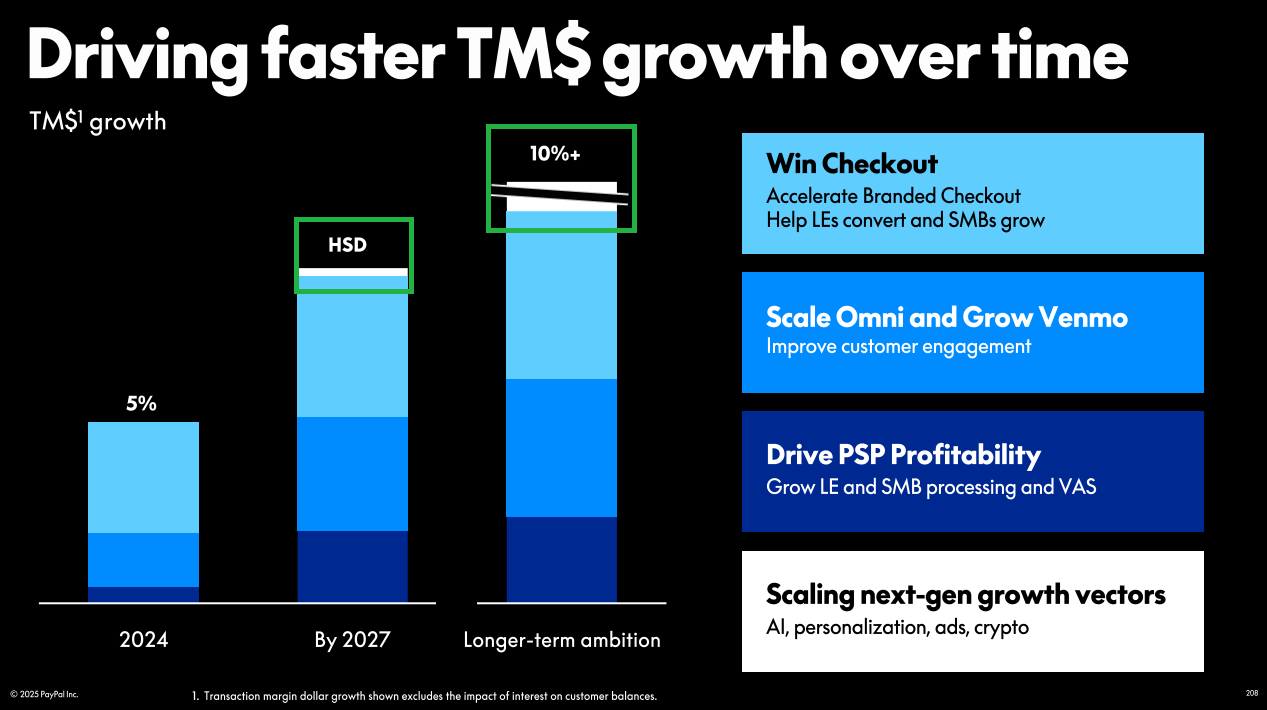

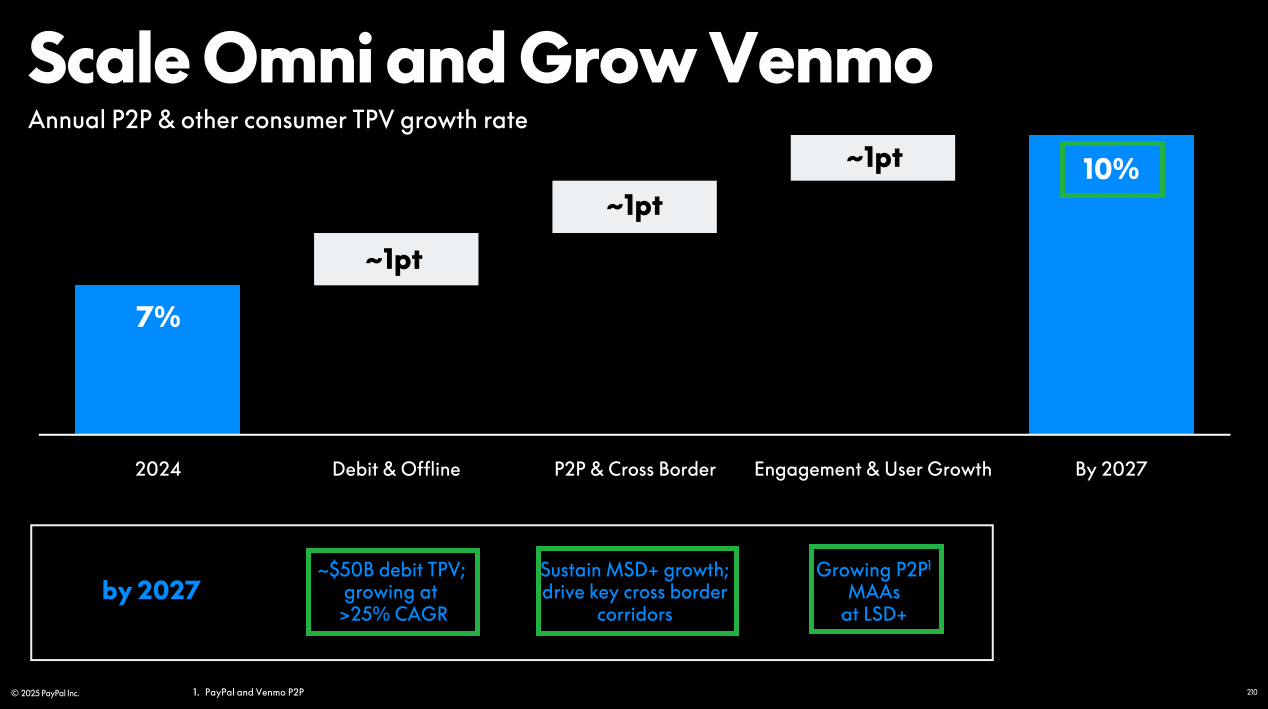

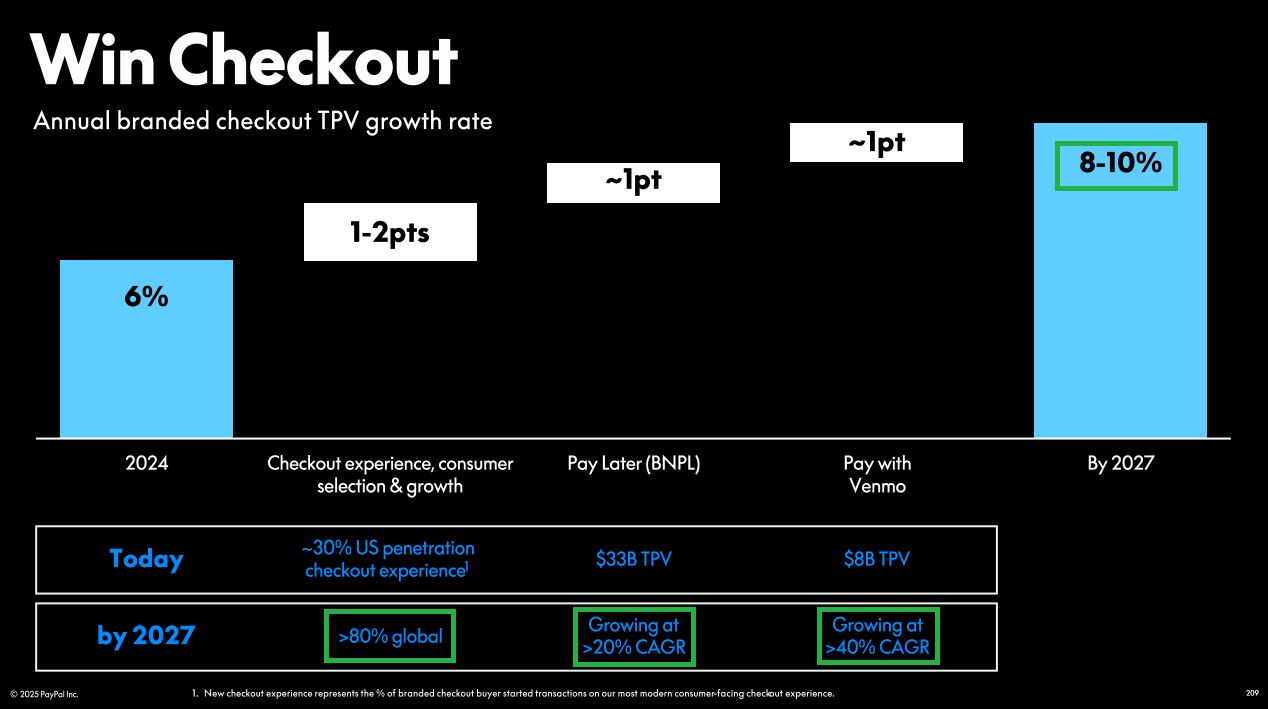

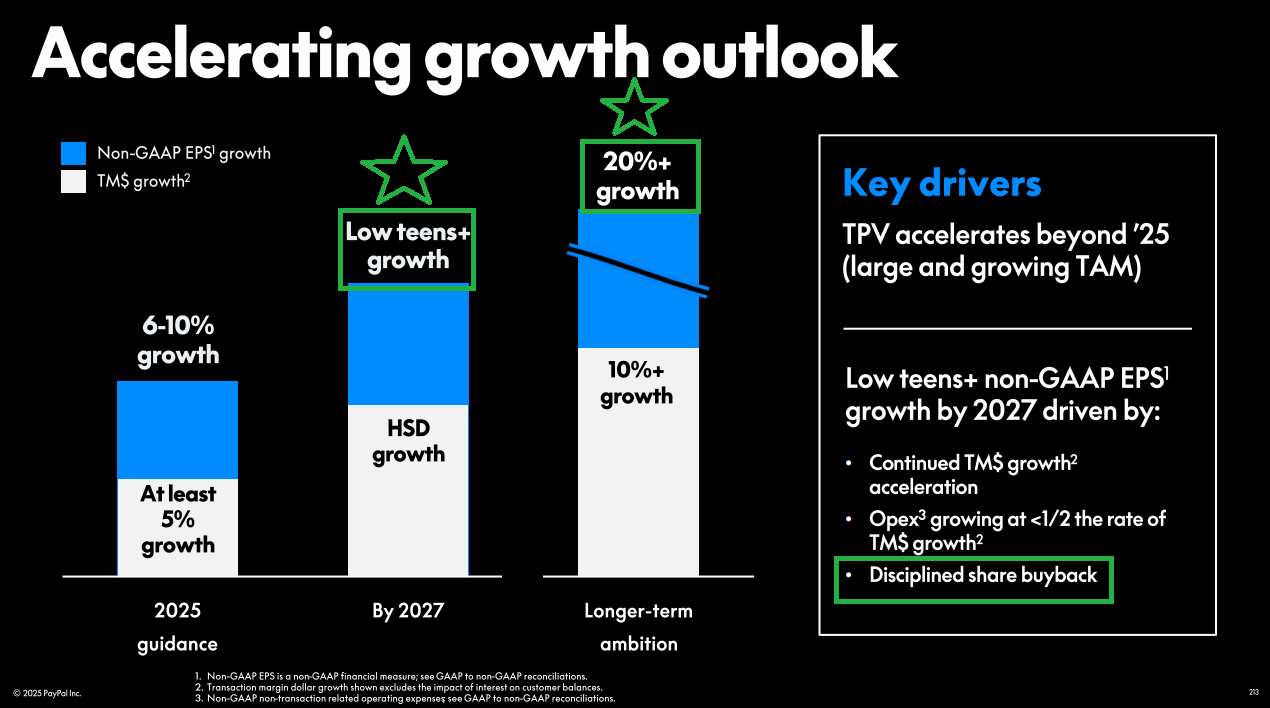

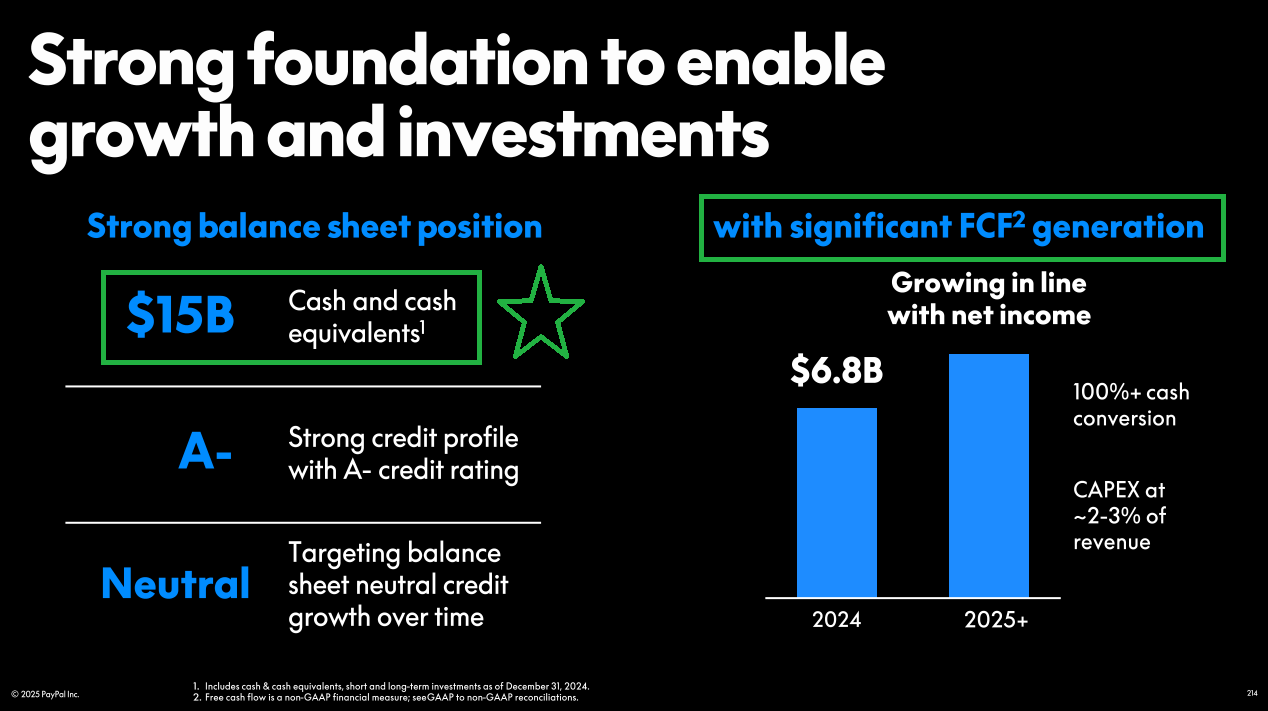

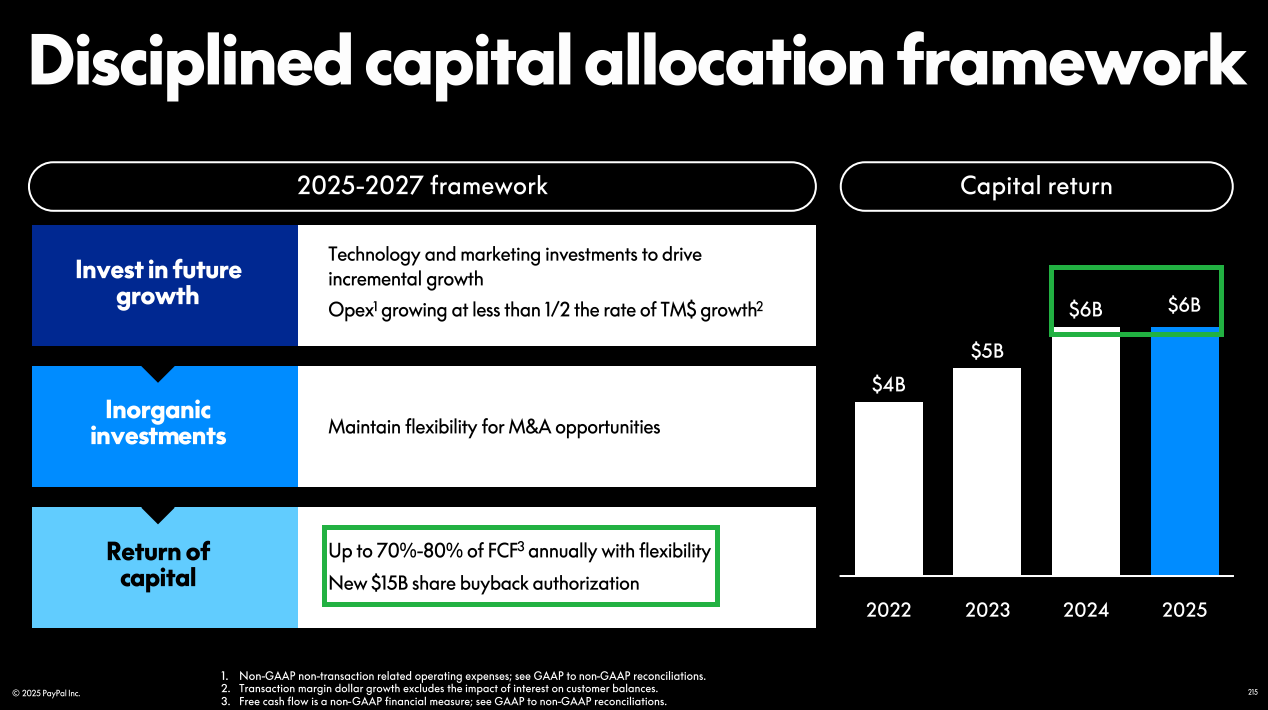

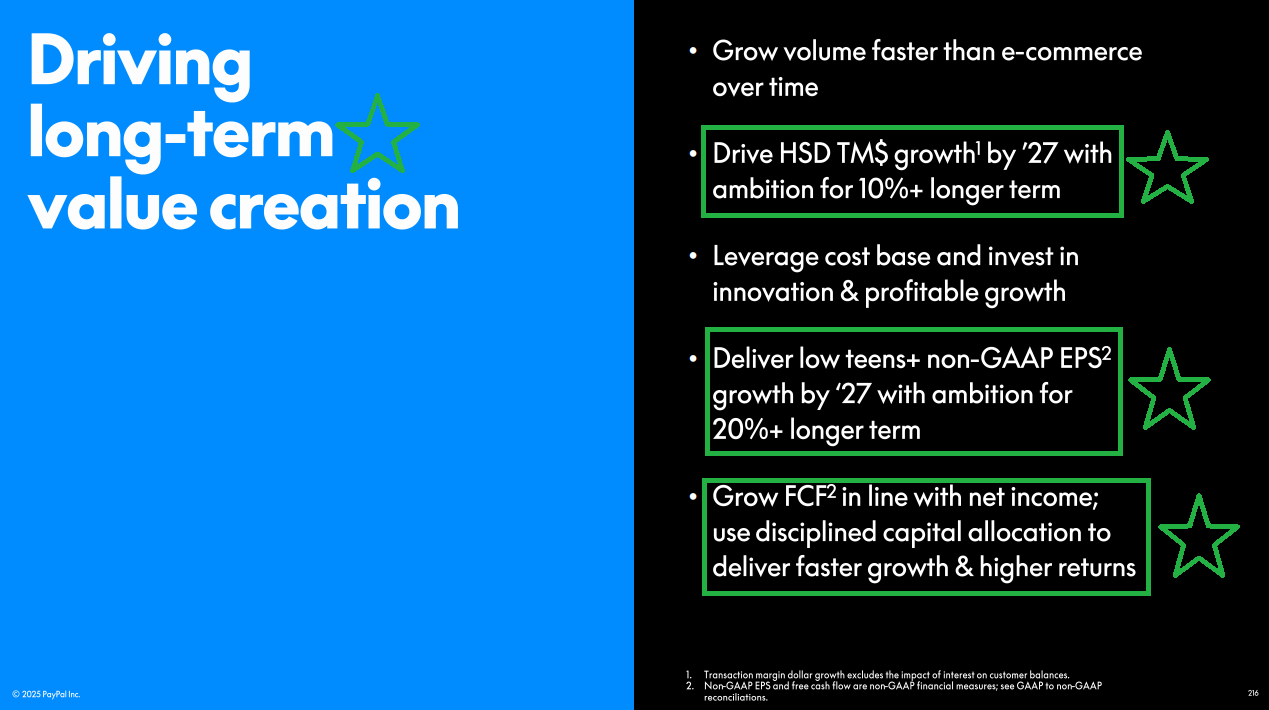

Paypal Update

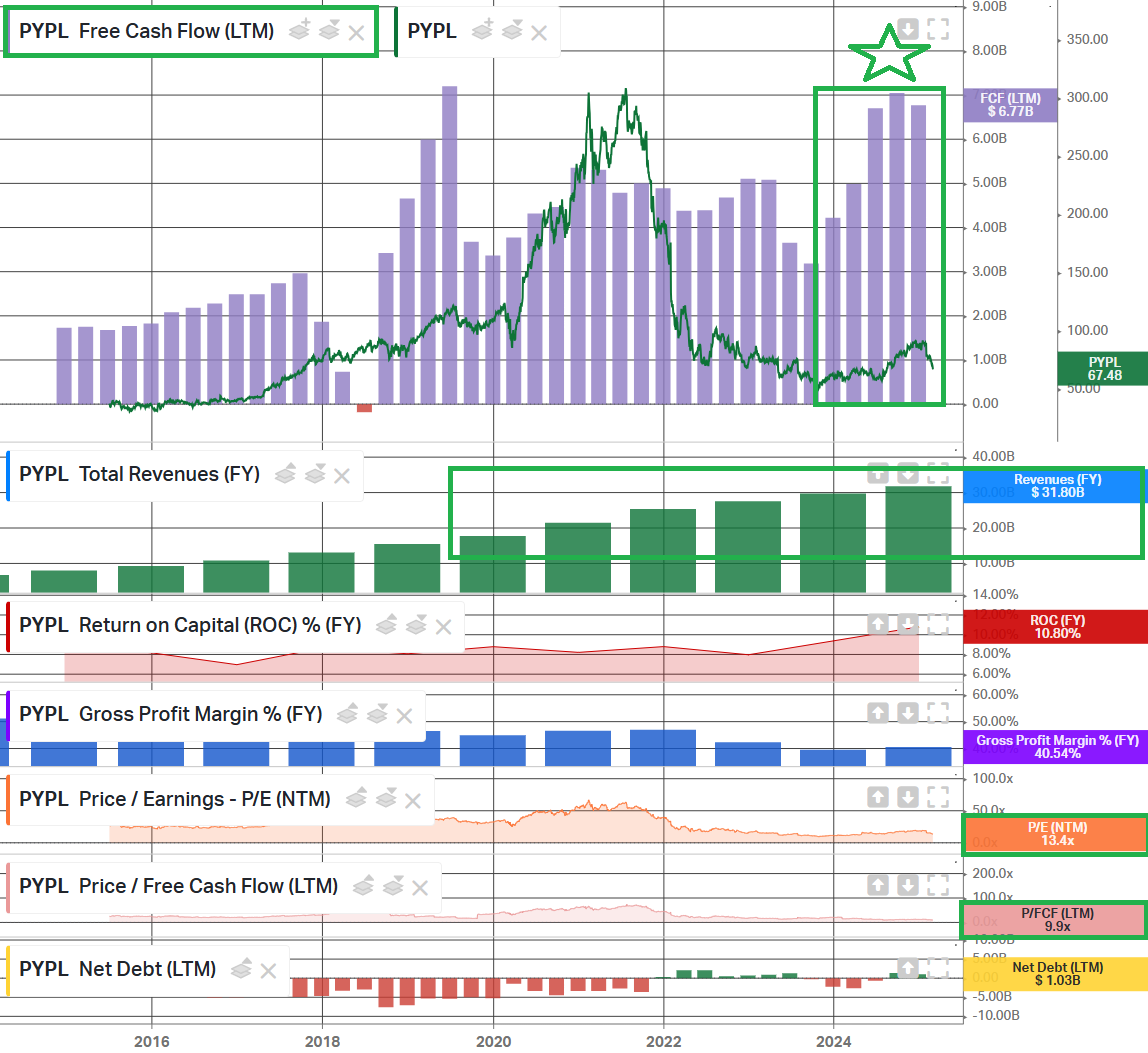

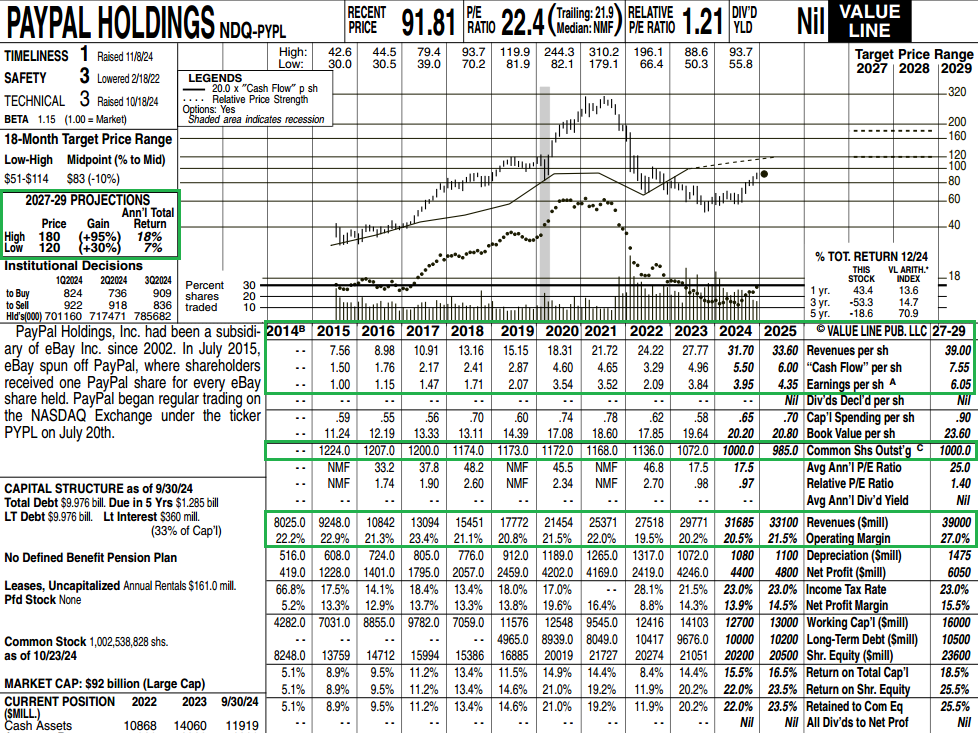

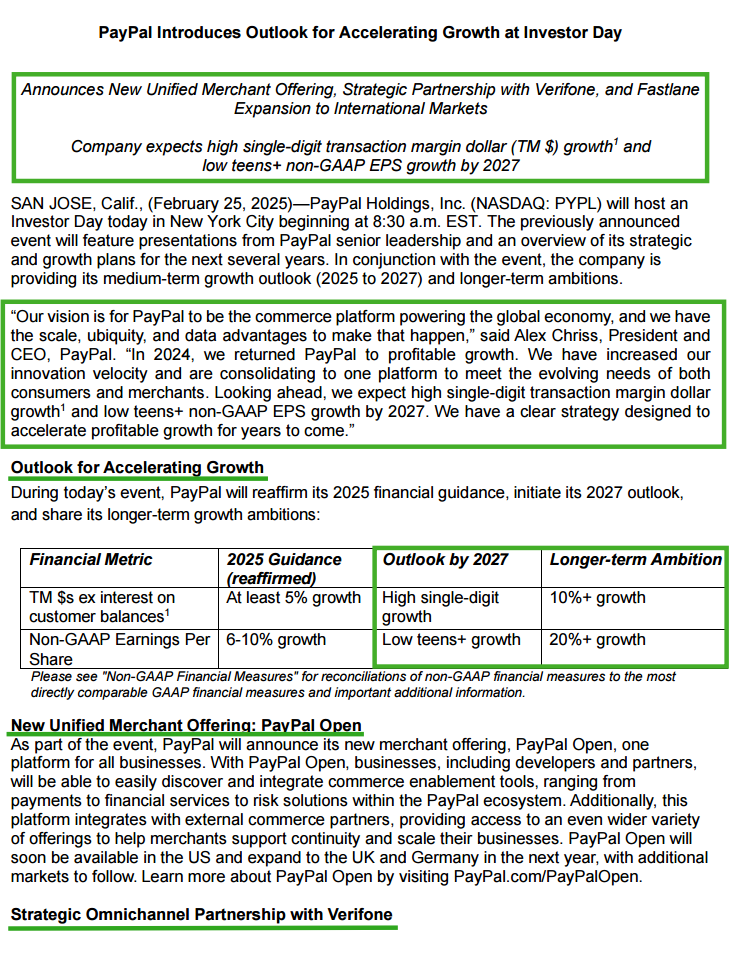

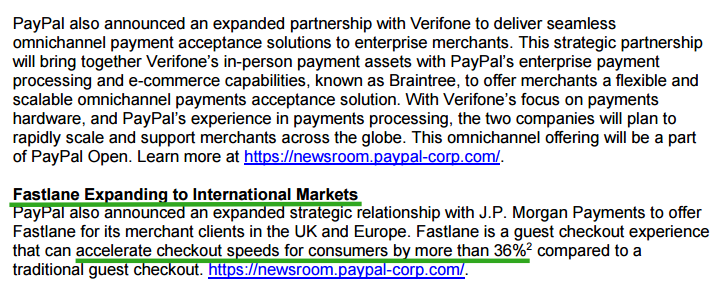

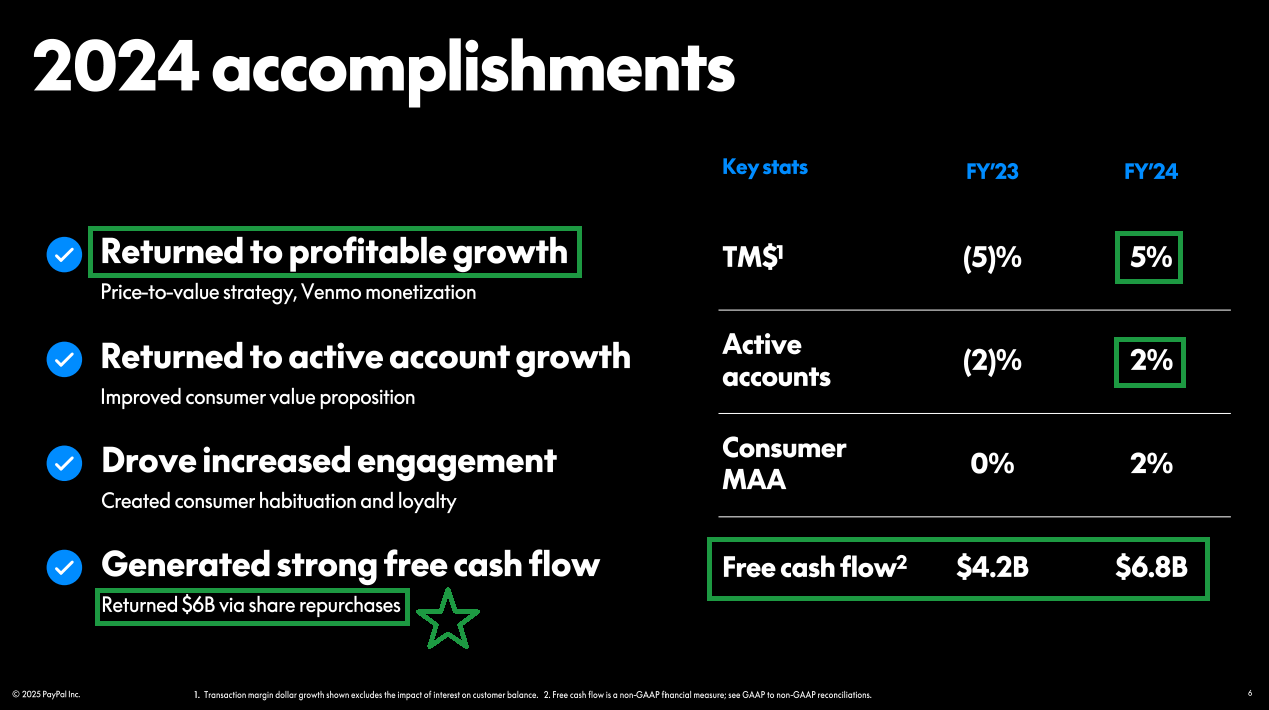

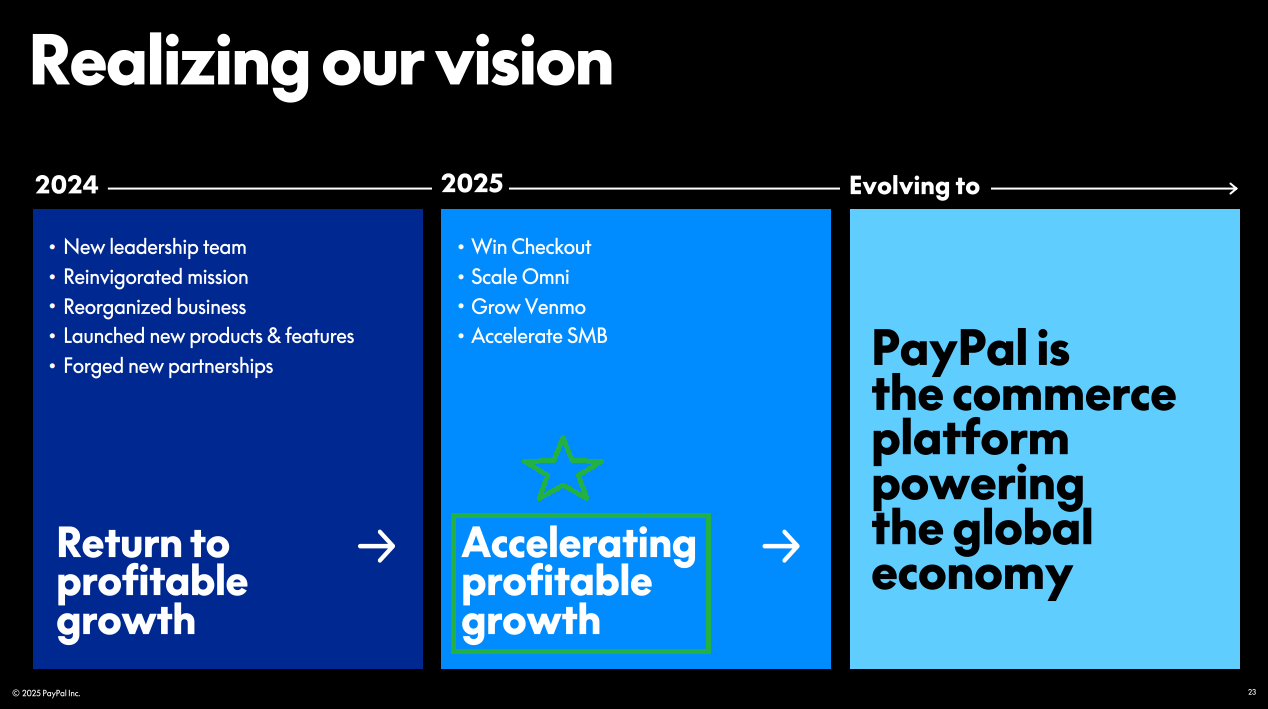

Another company with a jockey worth betting on is PayPal, led by Alex Chriss.

Before getting into the details of Paypal’s latest Investor Day, this interview with Alex Chriss was put out over the weekend. I HIGHLY recommend giving it a listen:

Looking back at one of his first interviews as CEO, the “shock the world” interview, he is indeed doing just that. He’s just not putting the investment world on notice and saying it out loud anymore. It’s clear Alex Chriss has learned the secret to happiness, both on Wall Street and in life, is LOW EXPECTATIONS.

Watch the full interview, and you’ll see just how excited and confident he is about the various initiatives. But this time, instead of shocking the world, he keeps a lid on things, saying these things just take time… works fine for us! That said, he hit on two key points that were really important: Fastlane and Advertising.

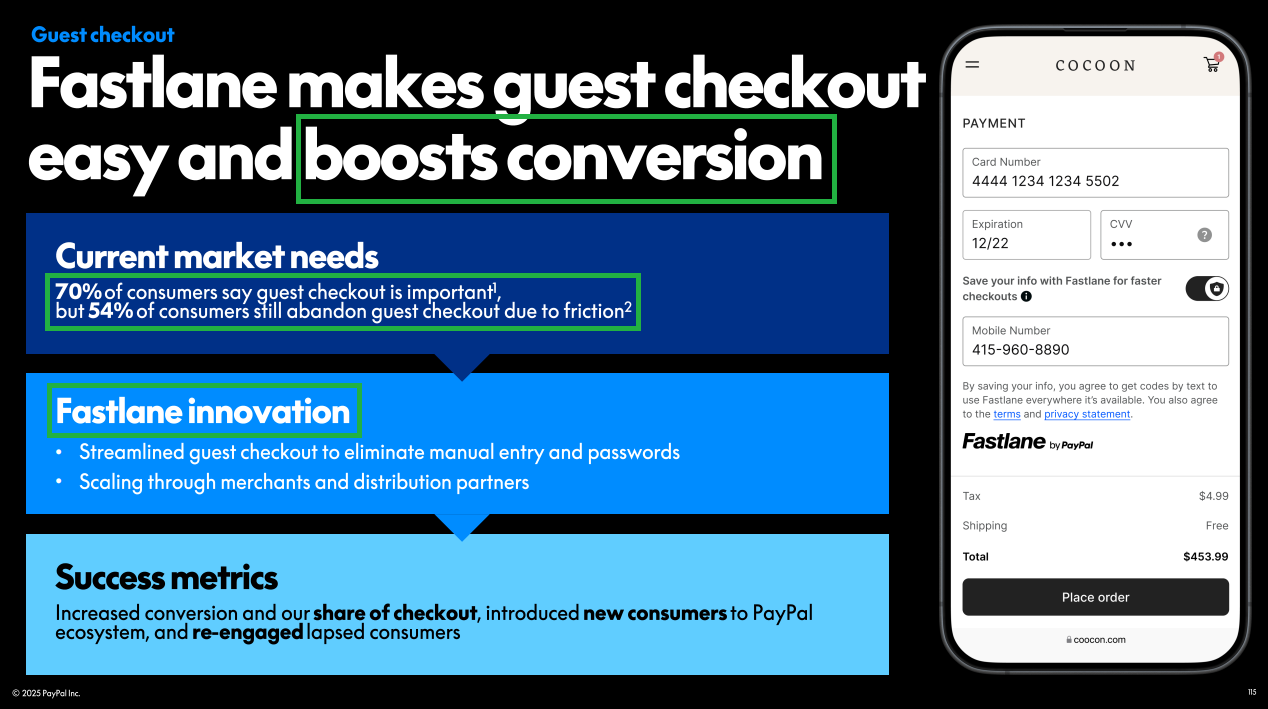

Fastlane

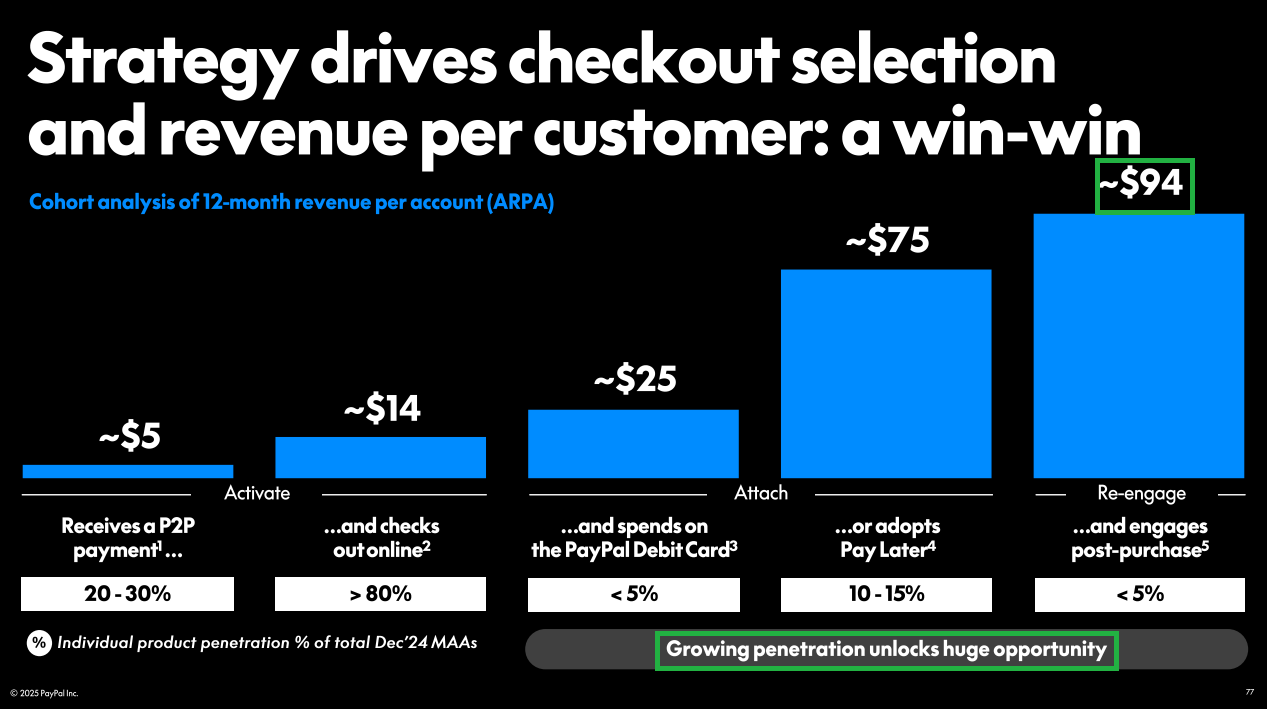

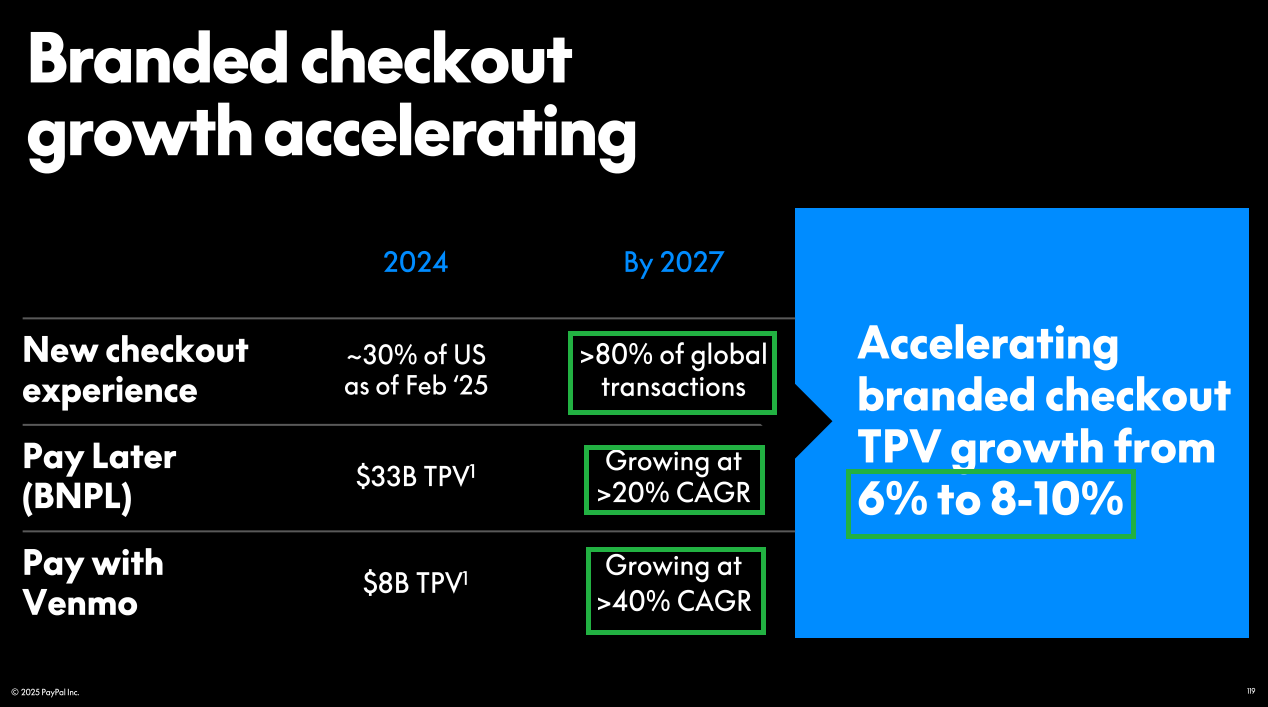

As a reminder, Fastlane is Paypal’s guest checkout service that lets customers access their payment and address information using just their email, without needing a password. By the end of Q4, PayPal had ~2,000 merchants up and running with Fastlane, many of them large-scale merchants. Adoption and demand for the product are through the roof, and it makes sense. Fastlane boosts conversions for merchants by 51% and improves checkout speed by 36%.

Here’s what stood out during the interview:

“I FUNDAMENTALLY BELIEVE GUEST CHECKOUT IS GOING TO BE A WINNER TAKE ALL MARKET” and that guest checkout is the “LARGEST UNTAPPED OPPORTUNITY.”

Right now, the focus is on scaling Fastlane and maximizing global penetration over the next 1 to 2 years. Once Fastlane is scaled, PayPal expects to have pricing power over essentially the entire guest checkout market (~40% of global ecommerce). If Alex Chriss is right about this, when monetization kicks in, it will be a game changer for PayPal…

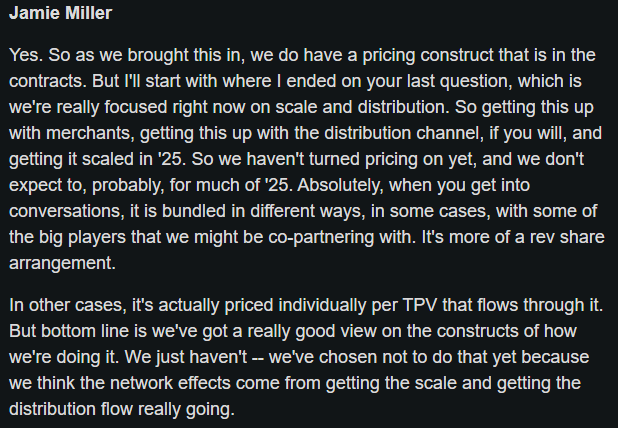

Here’s what PayPal’s CFO, Jamie Miller, said at the UBS conference in December, explaining the scaling versus monetization strategy:

Advertising

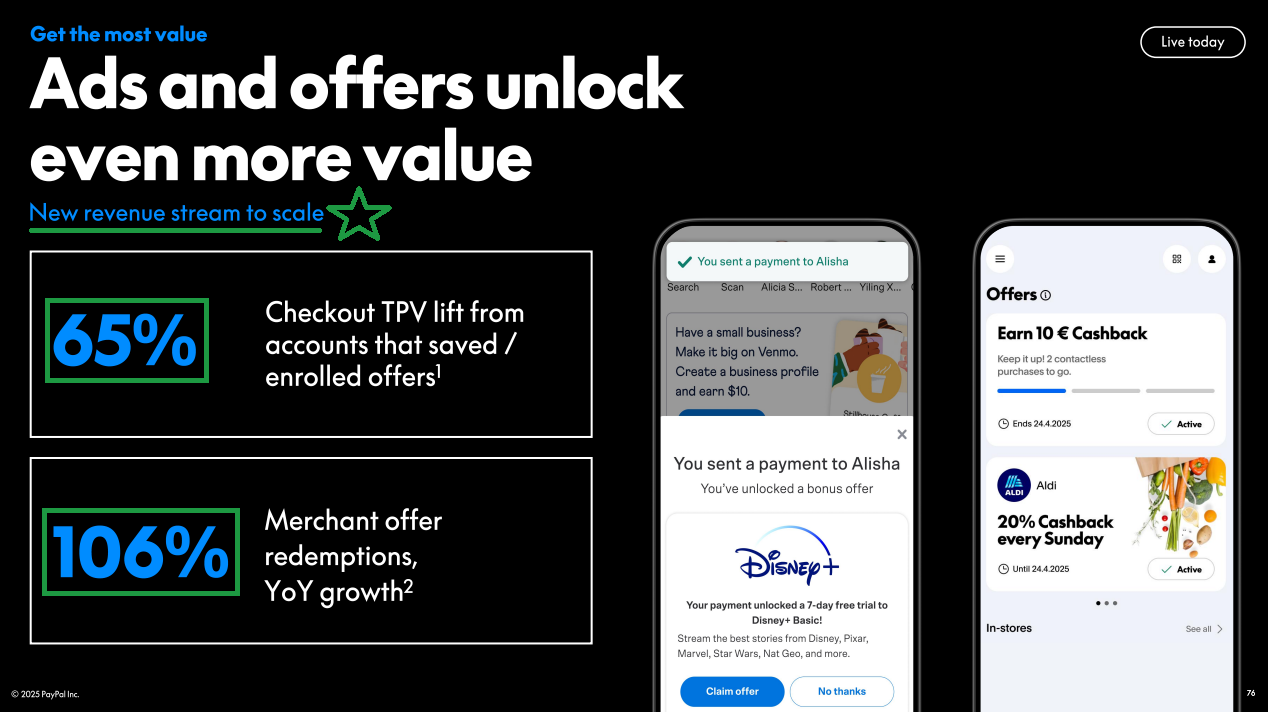

What do Amazon, Uber, and now PayPal all have in common? Mark Grether.

Grether was the CEO of Sizmek, one of the largest independent advertising platforms, until Amazon acquired it in 2019. After that, he led product strategy for Amazon’s massive ad business, which is now on a $69B revenue run rate. Then, in 2022, Uber brought him in to build their advertising business from scratch. By Q3 2024, that business had already hit a $1B annual run rate with over half a million advertisers.

Now, PayPal has tapped Grether to do the same thing.

Here’s what stood out in Alex Chriss’ interview: “OUR EFFICACY OF BEING ABLE TO CONVERT IS IN A COMPLETELY DIFFERENT PLACE” compared to peers when it comes to ROI on ads.

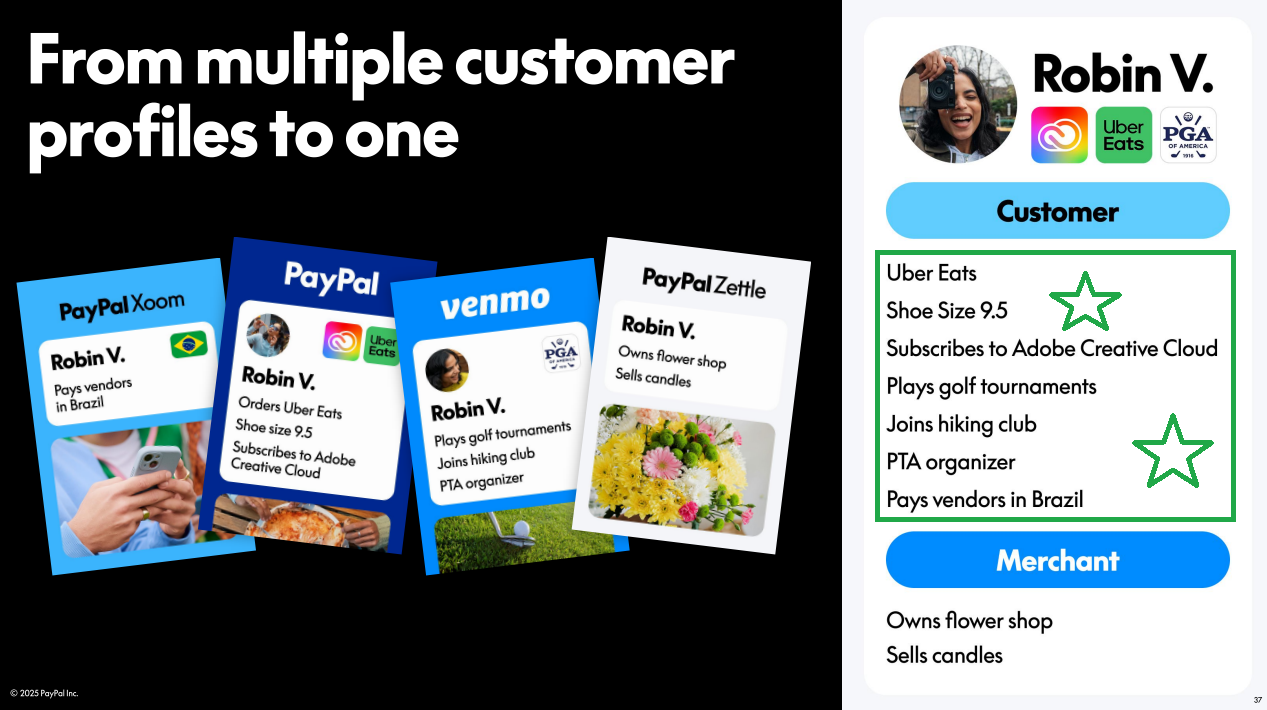

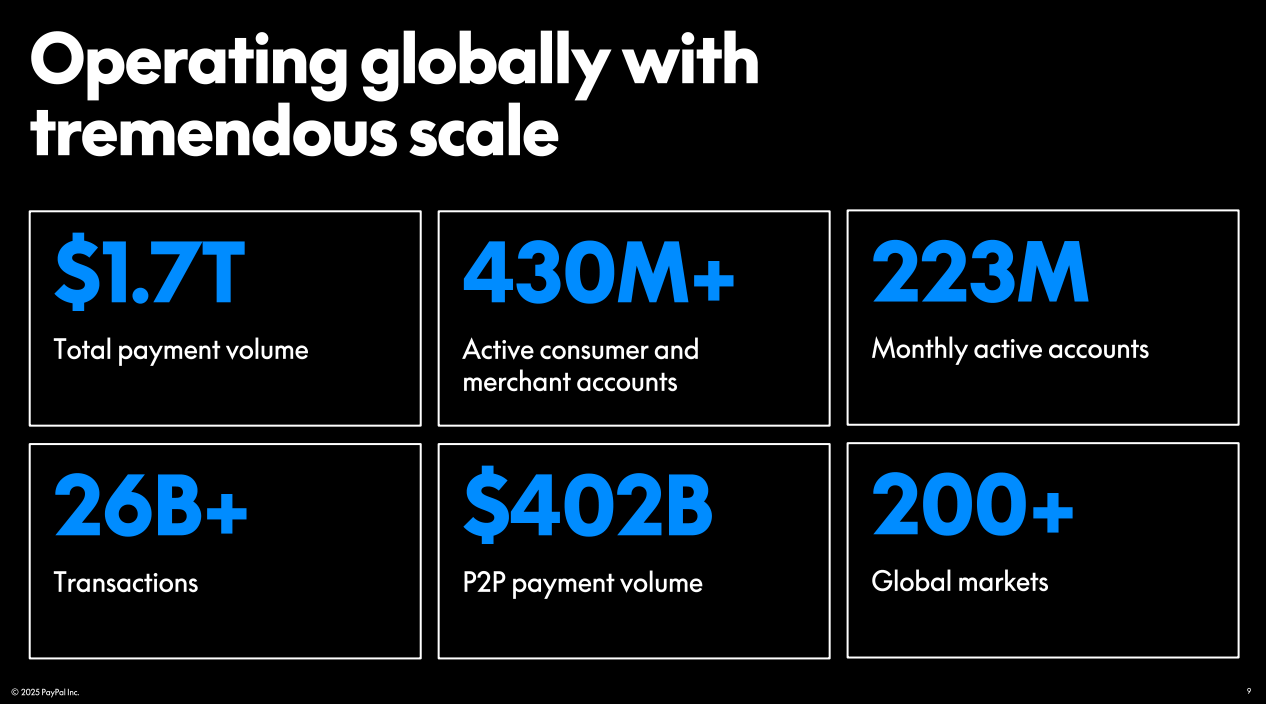

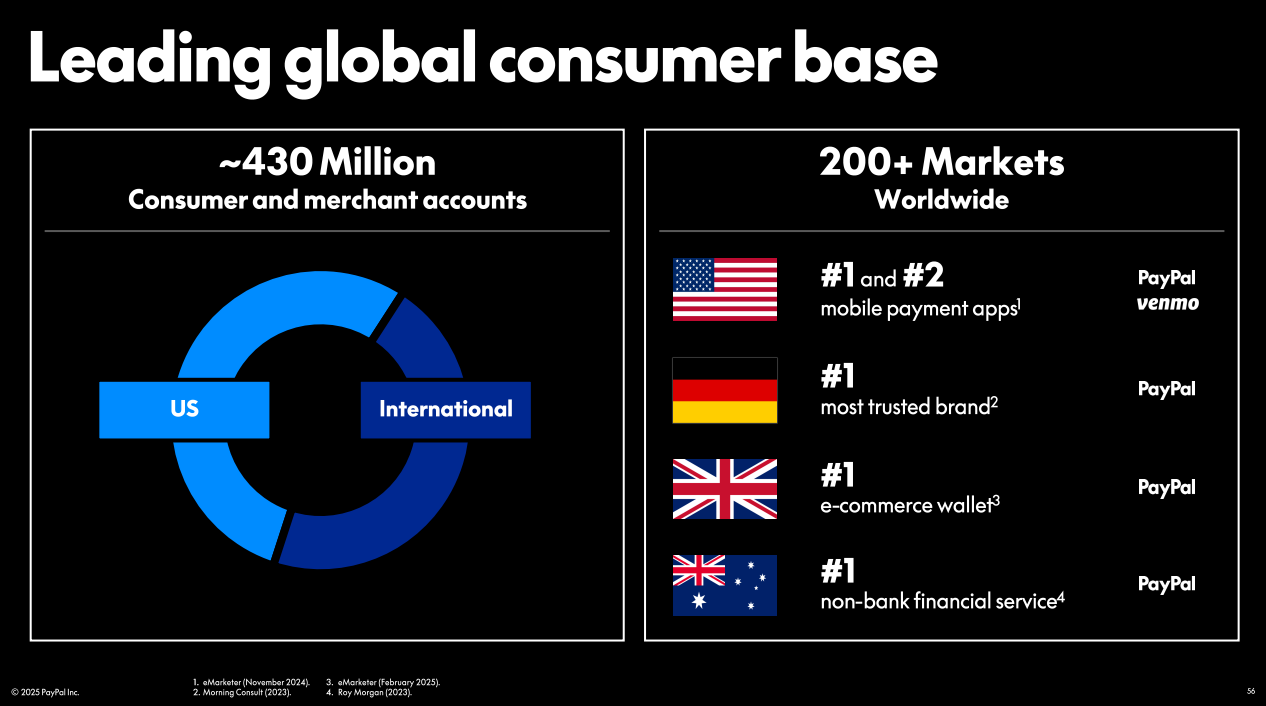

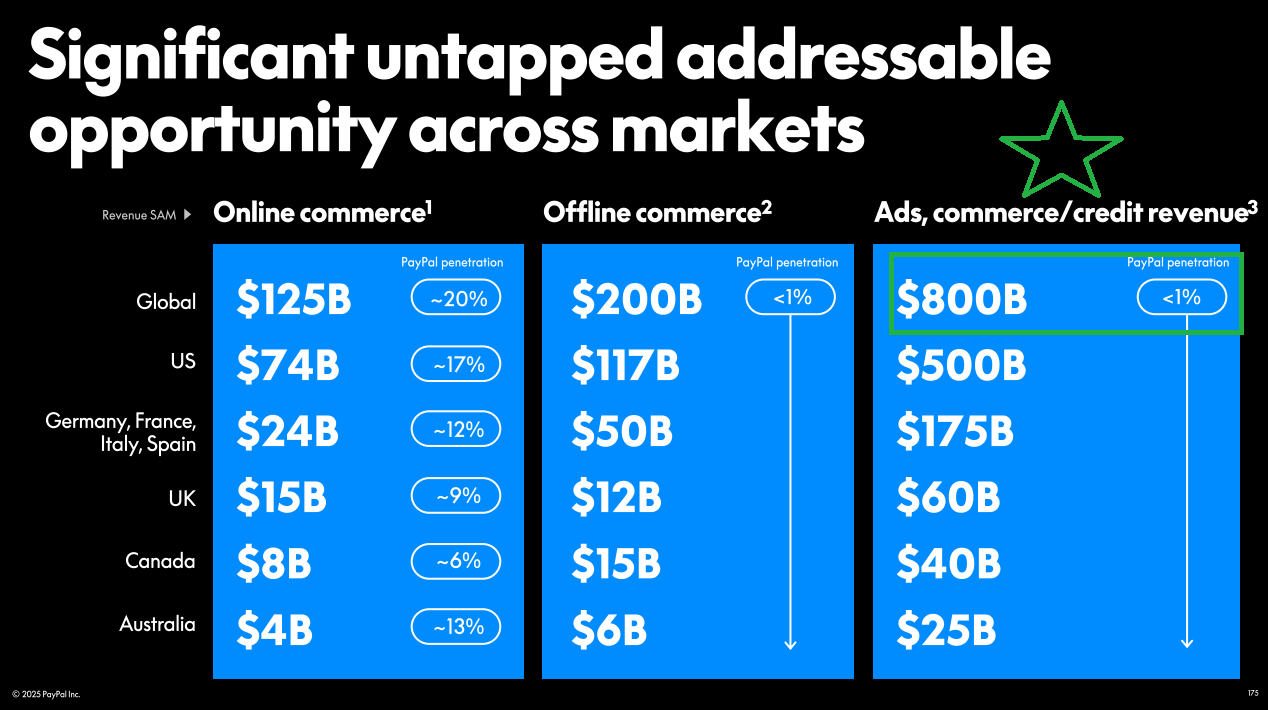

What’s driving this? PayPal’s gold mine of data: 6B vaulted financial instruments, over 430M consumer and merchant accounts, and 20 trillion customer interactions tracked.

If you look at the slides from Investor Day, you’ll see how valuable this data is. While many companies know where you live and how much you spend, PayPal knows your shoe size, hobbies, and interests.

With a global TAM of $800B, this business is definitely an opportunity to shock the world. It’s just this time, Alex Chriss is keeping a lid on it.

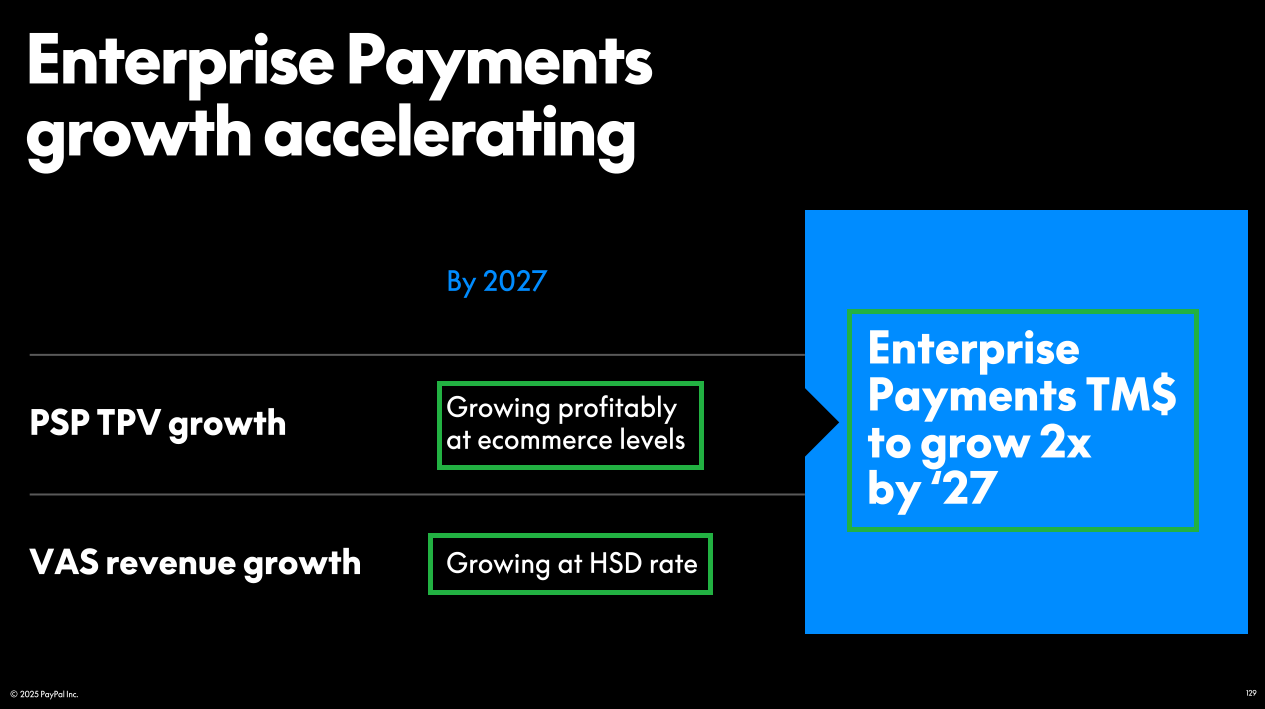

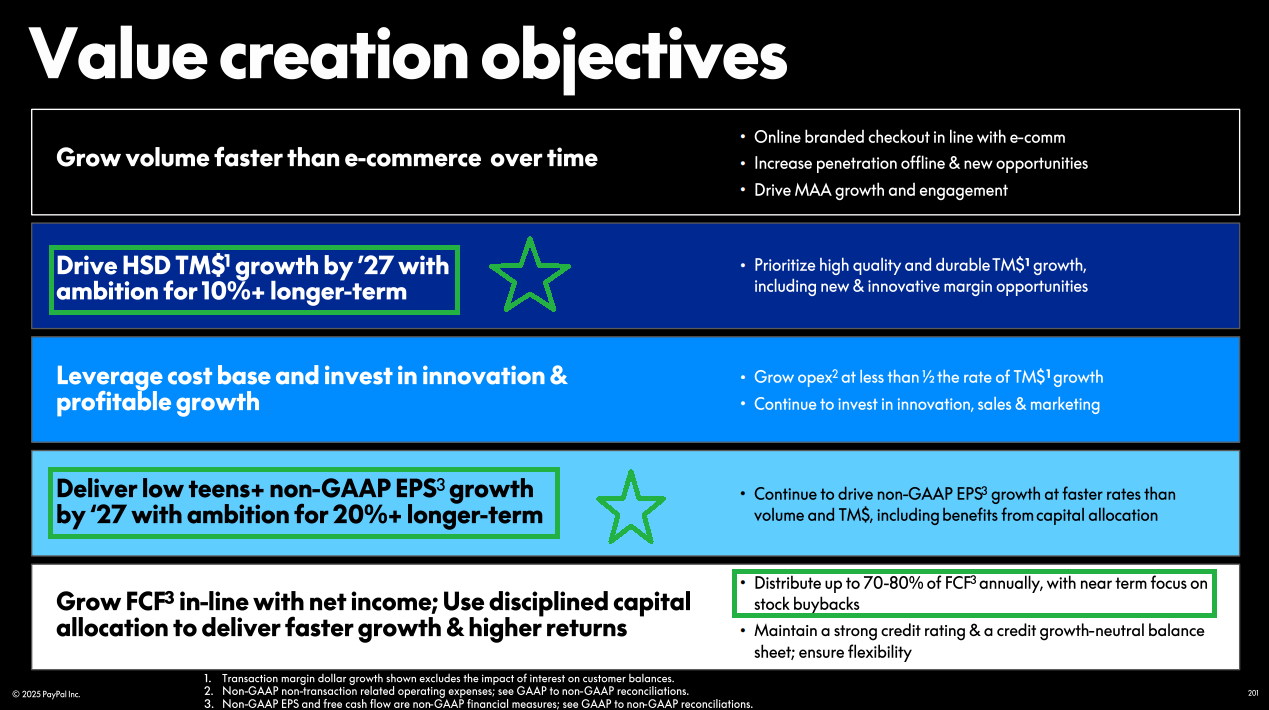

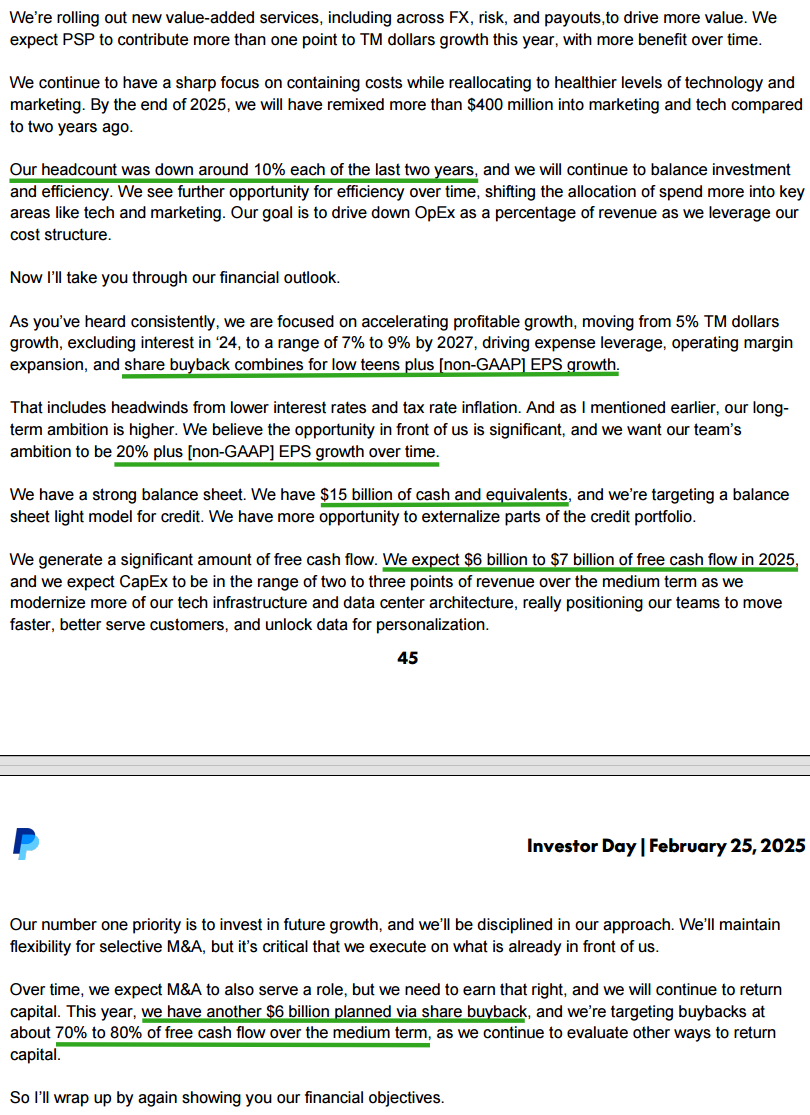

Now, onto Investor Day…

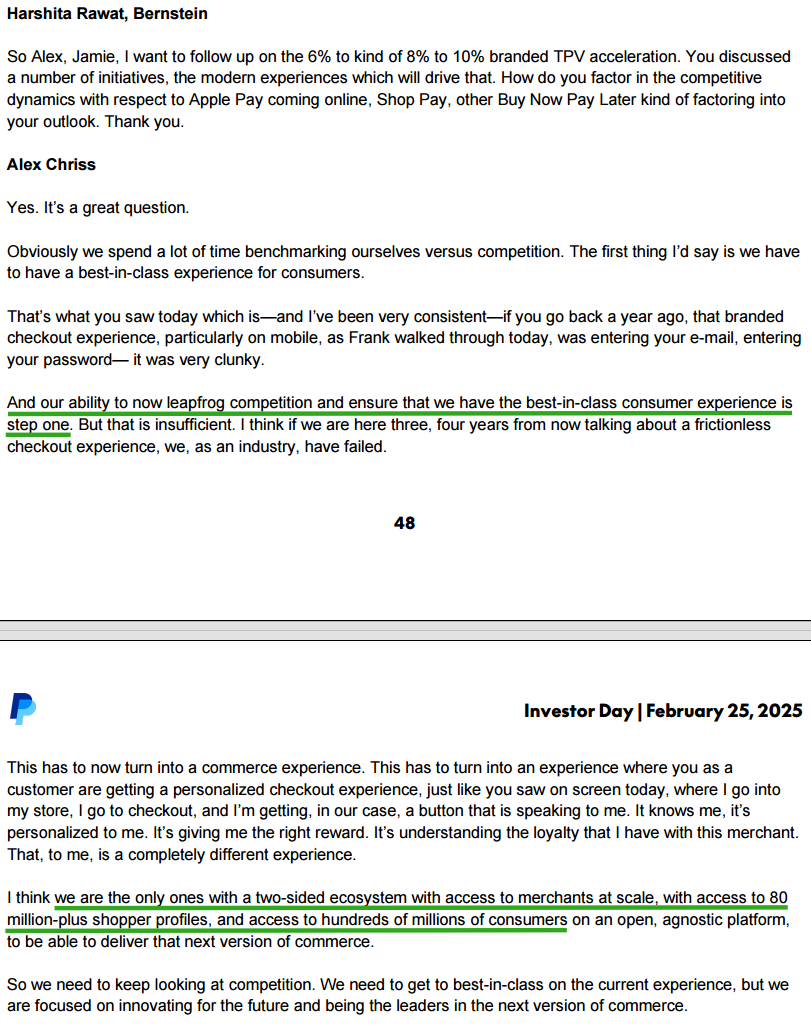

Q&A Highlights

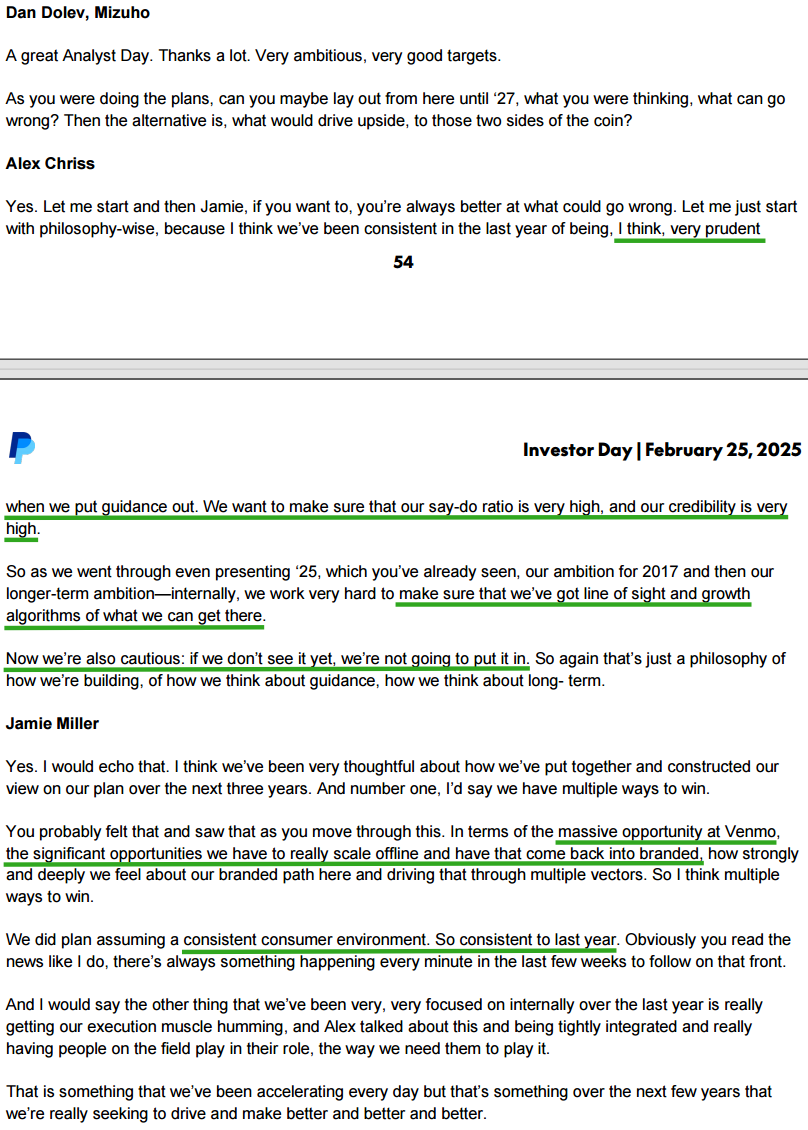

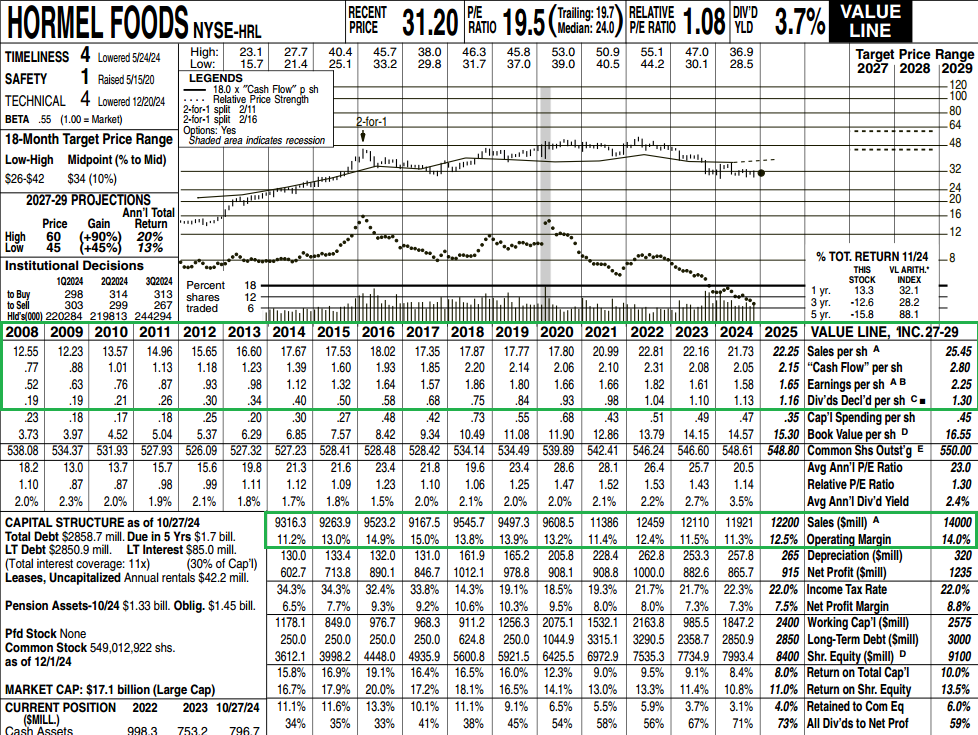

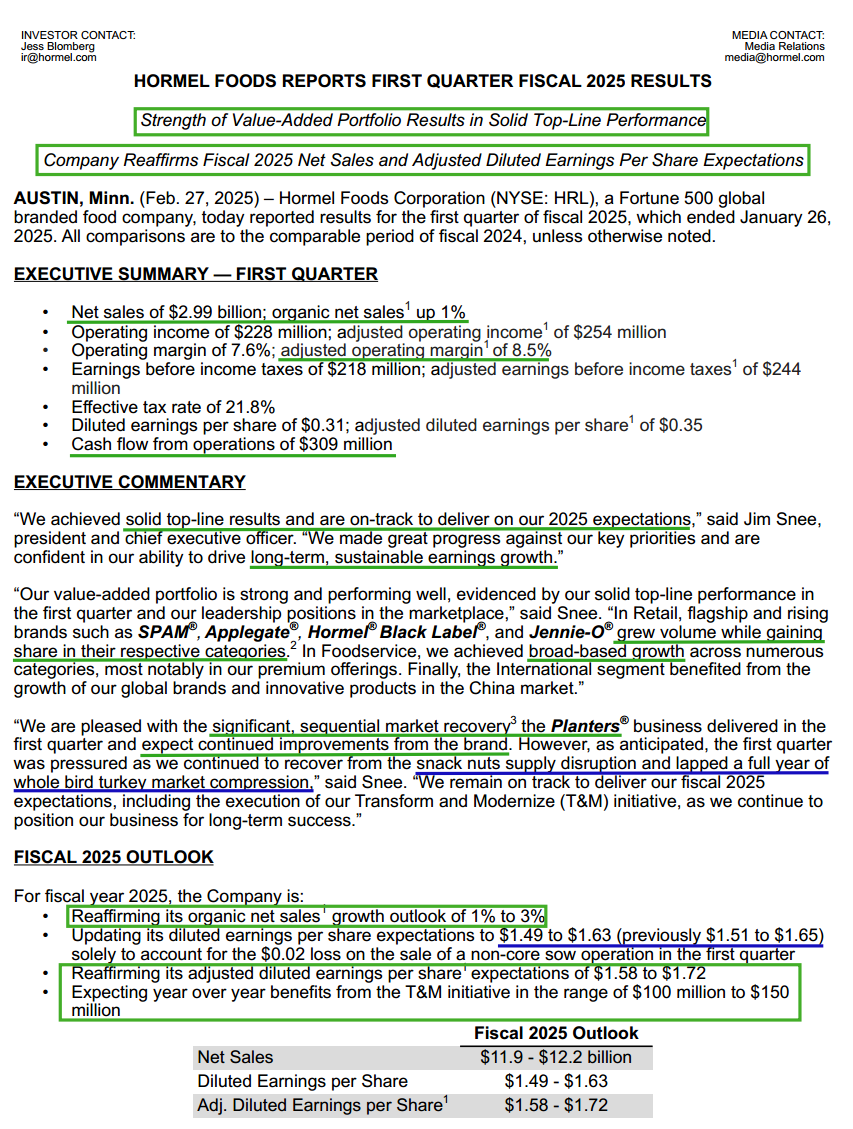

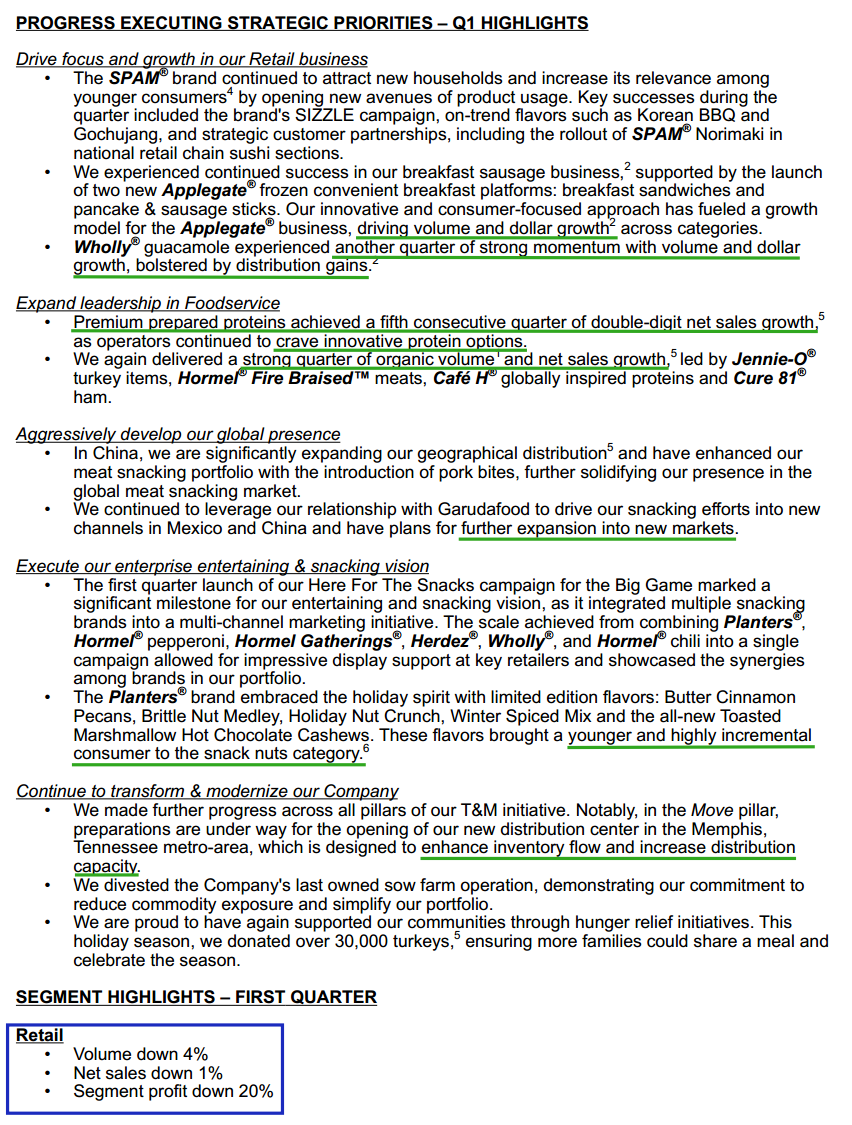

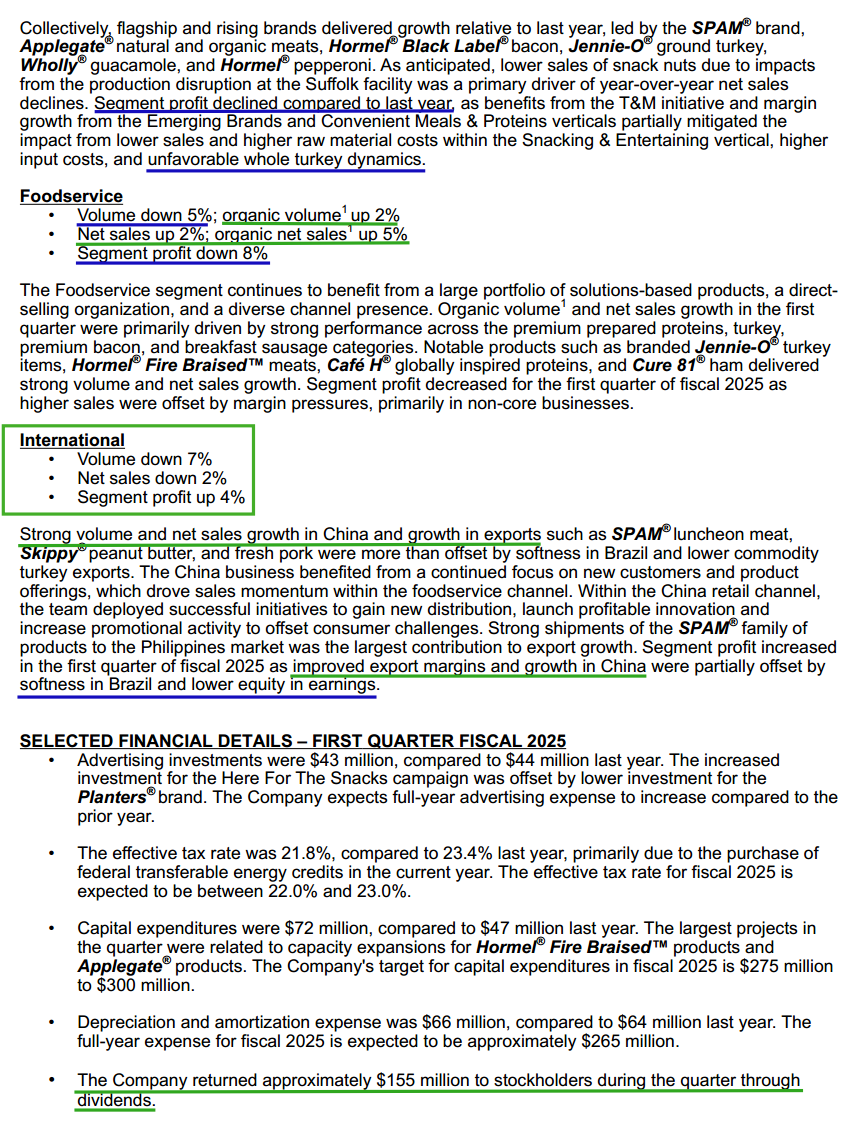

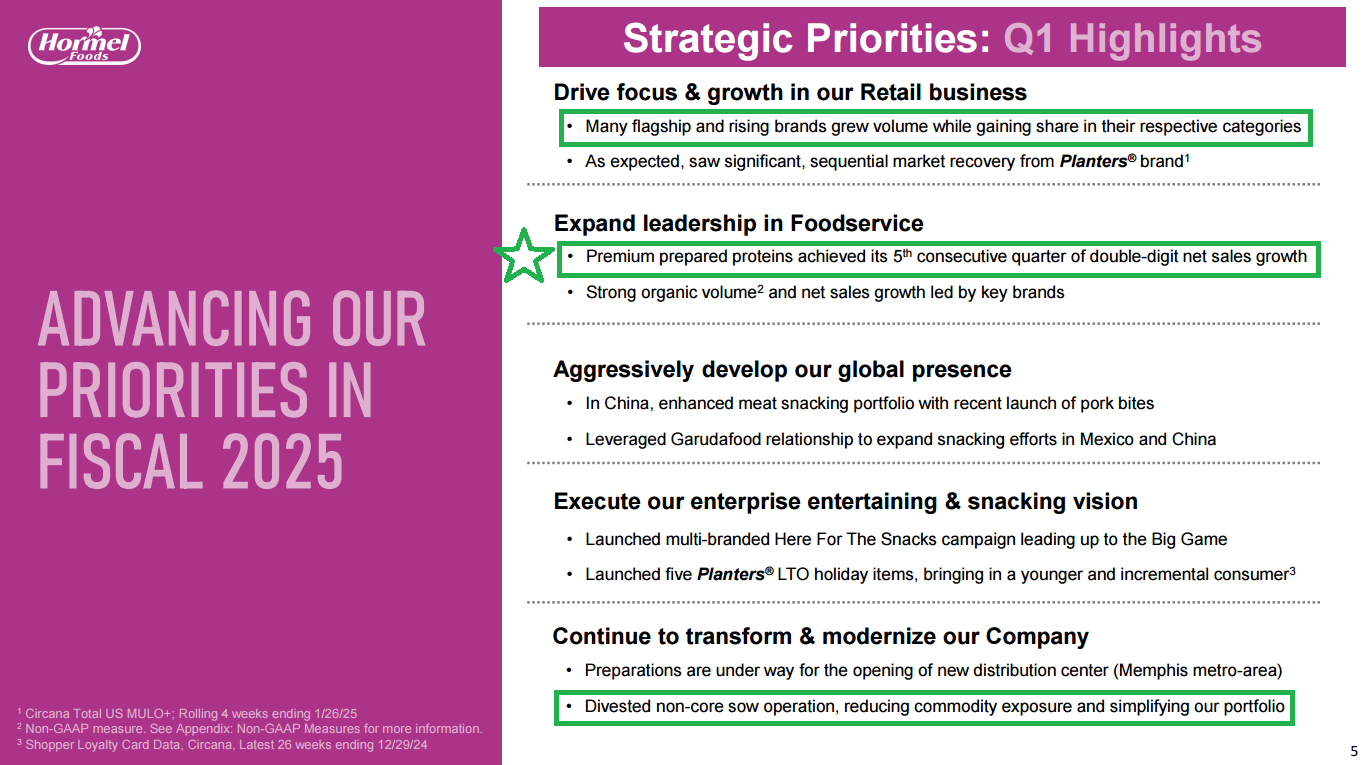

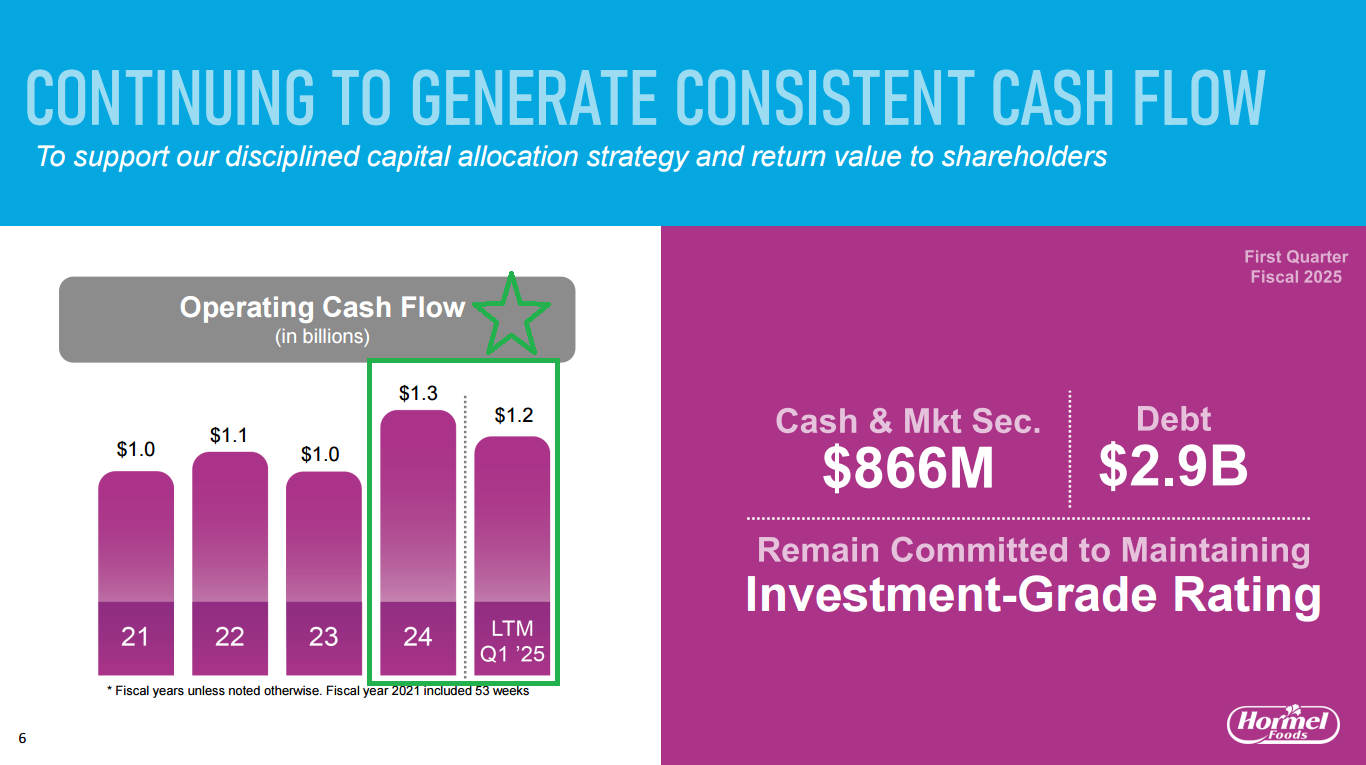

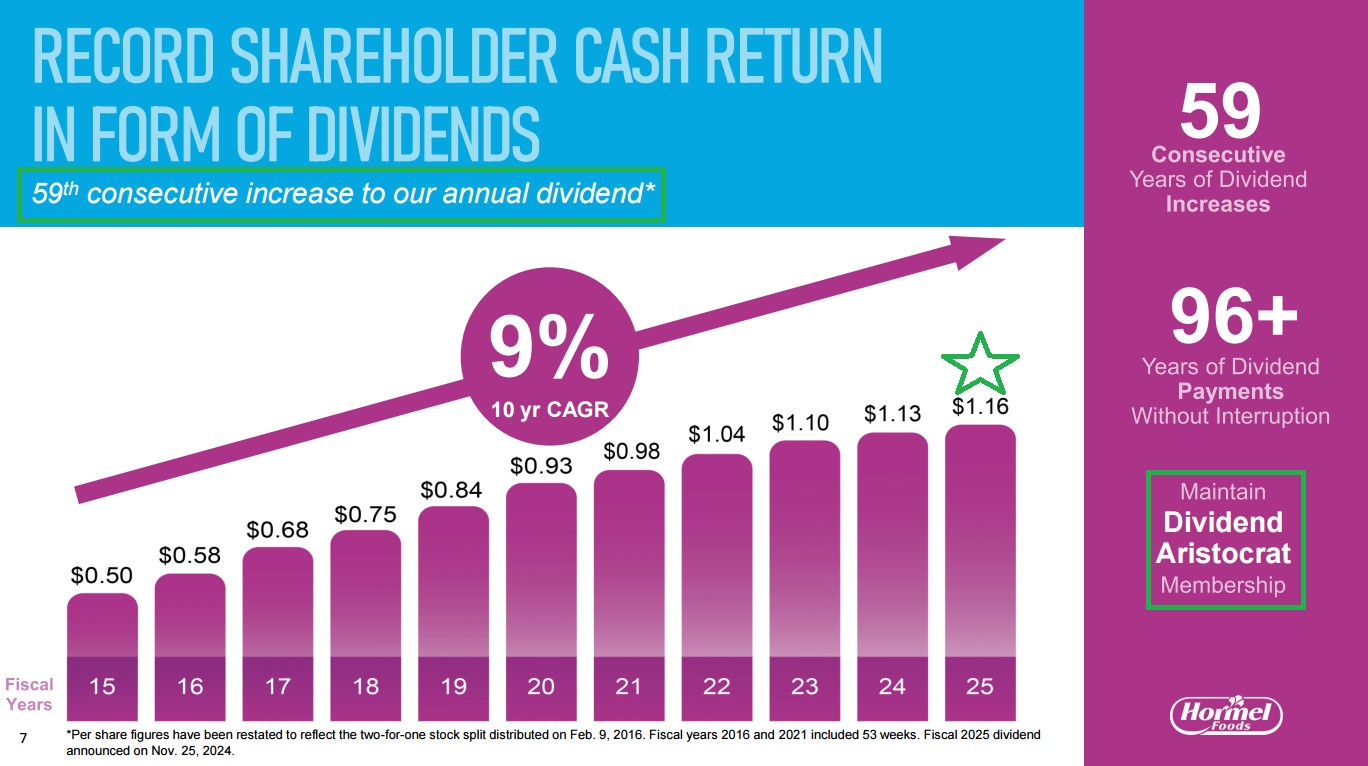

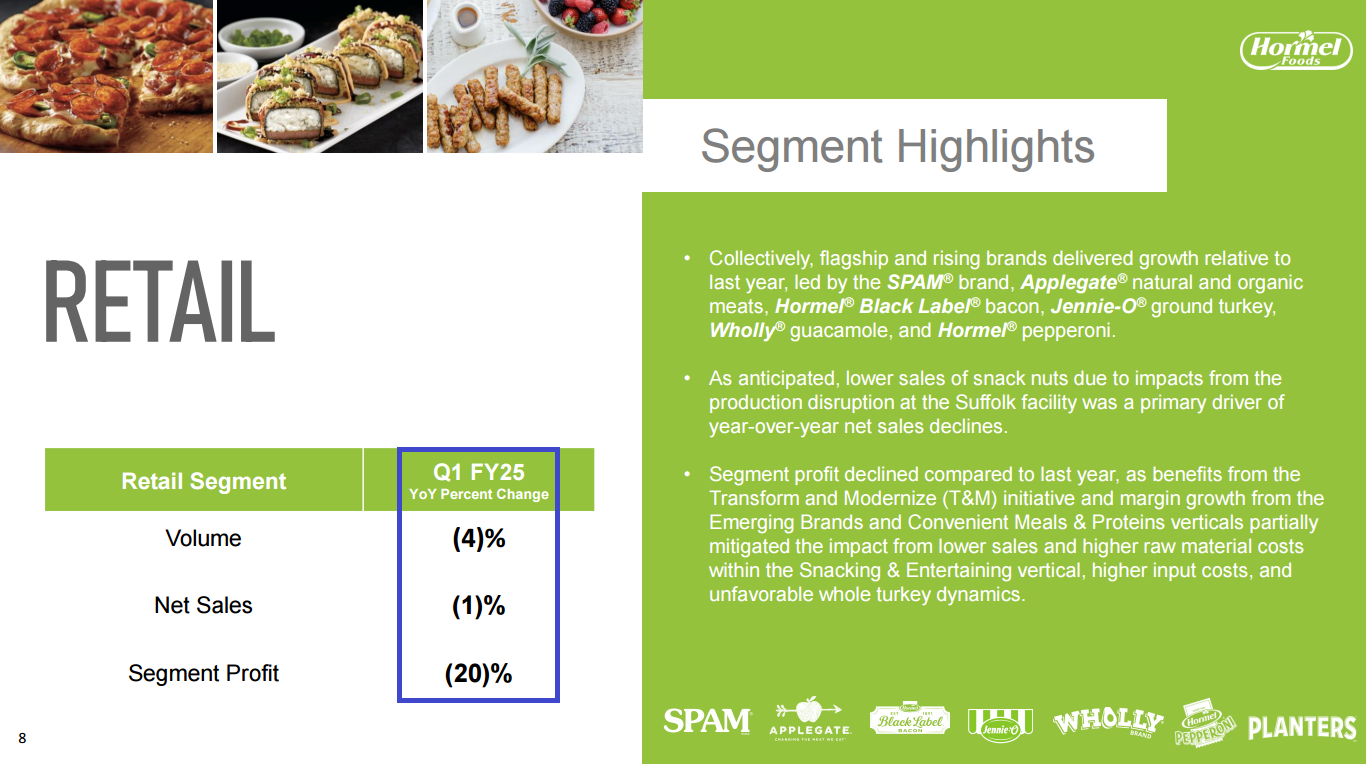

Hormel Update

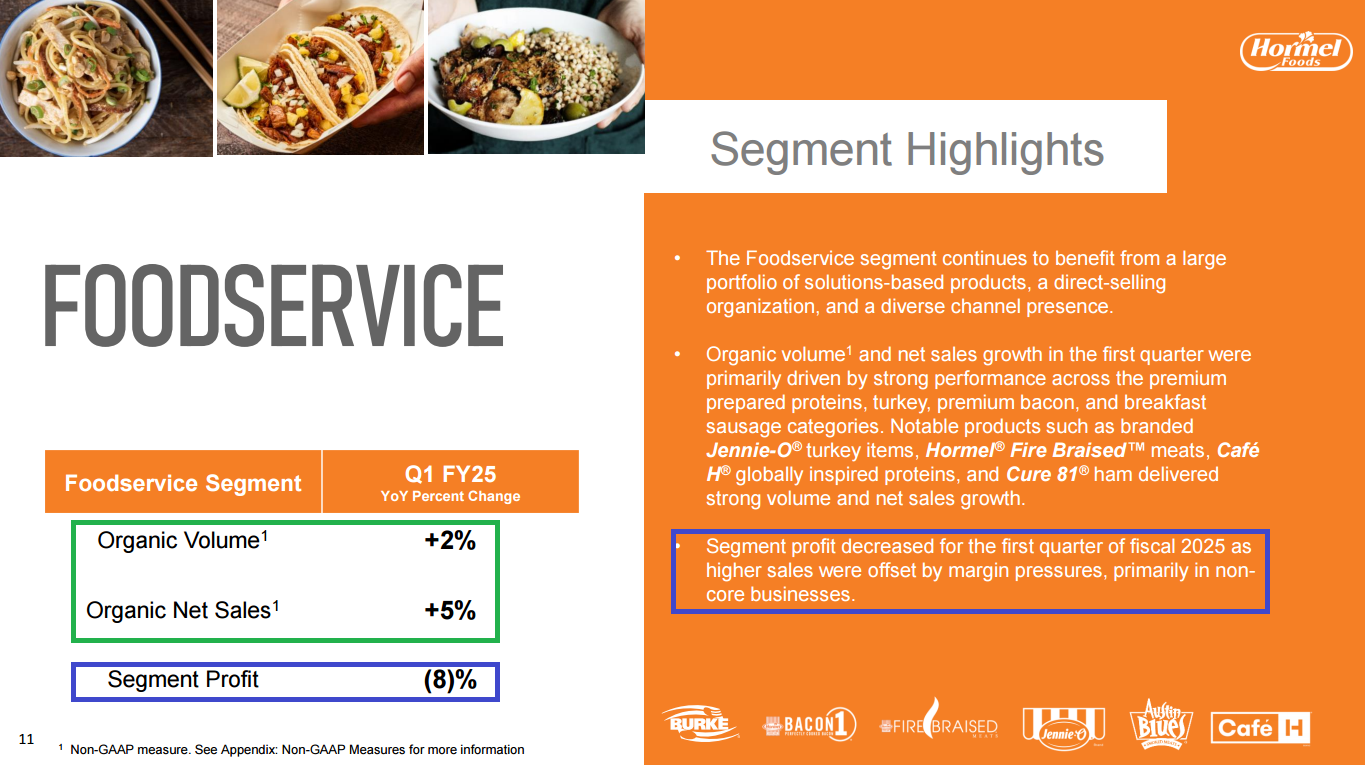

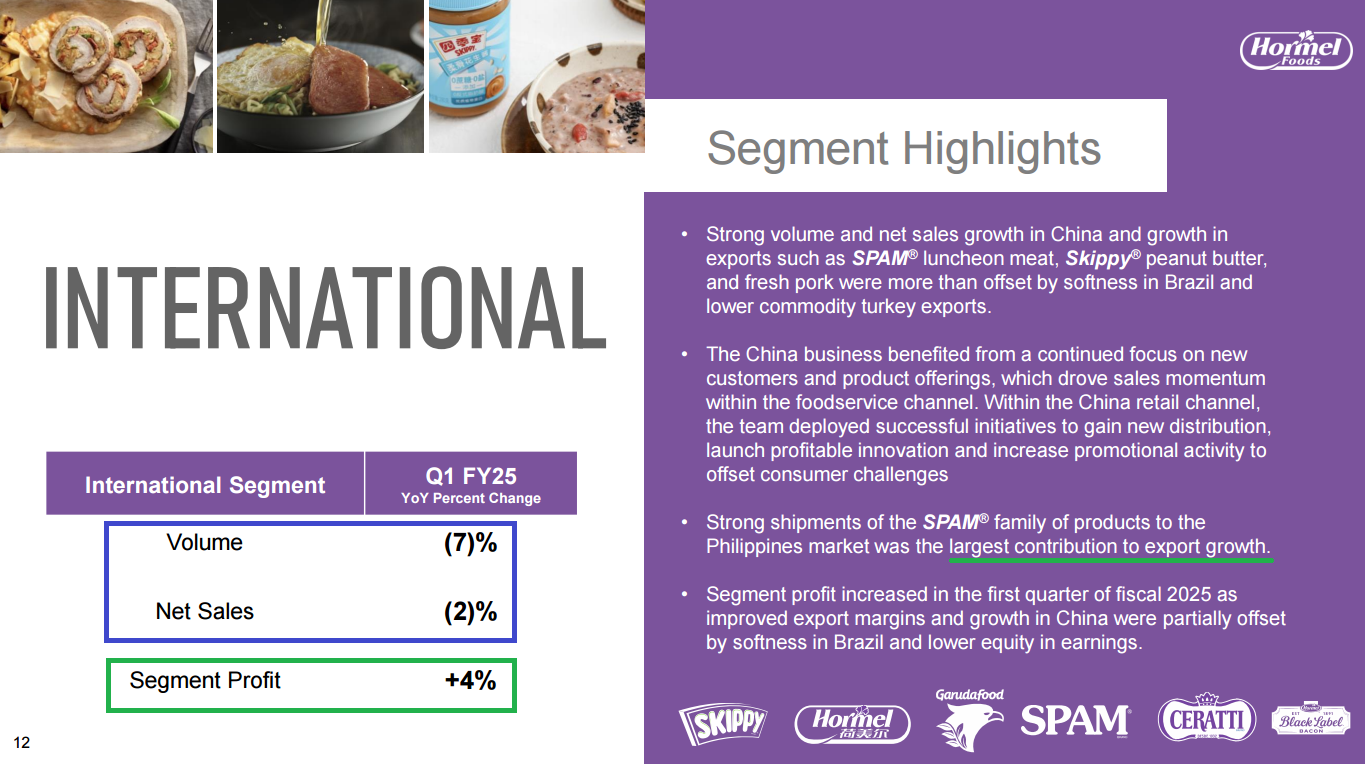

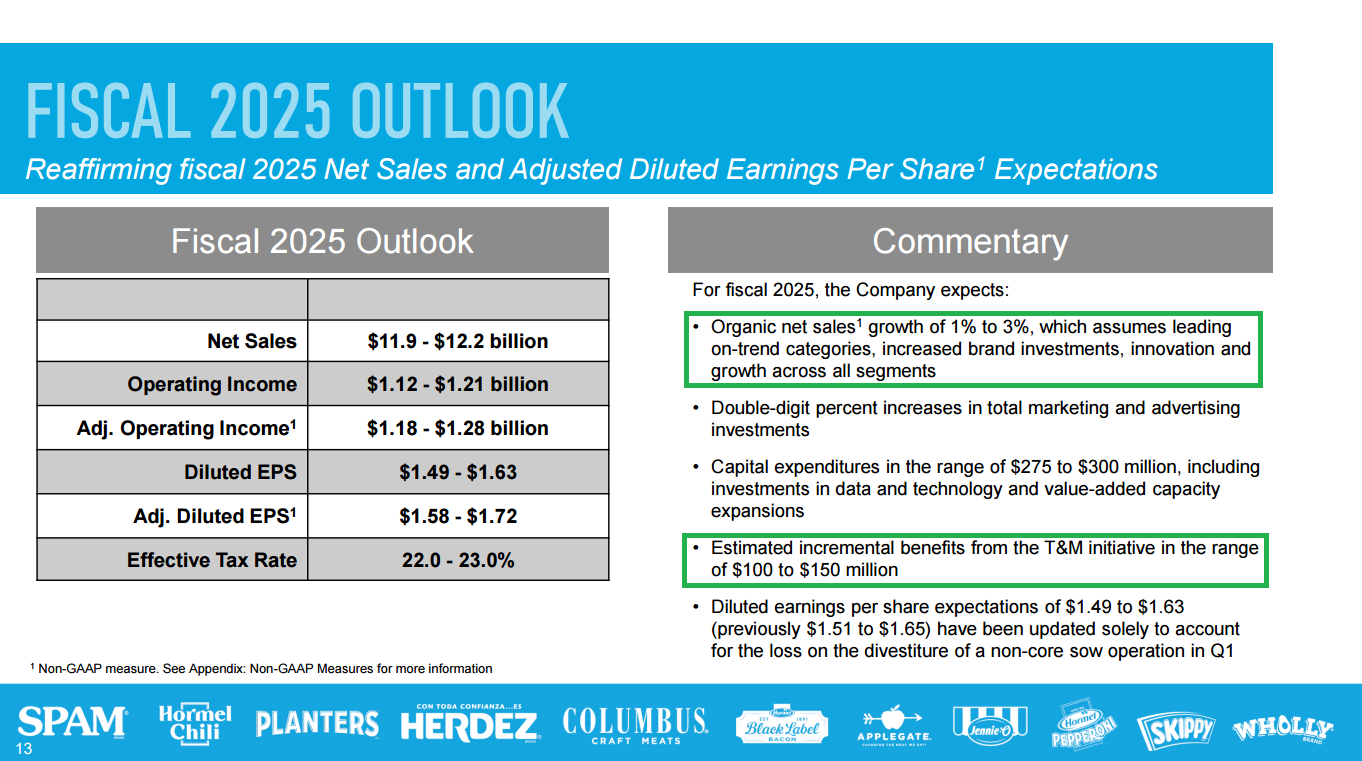

Earnings Results

General Market

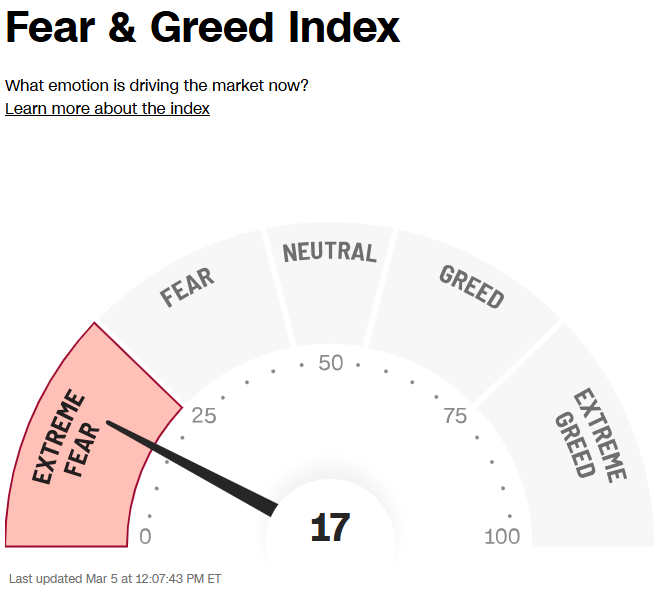

The CNN “Fear and Greed Index” ticked down from 22 last week to 17 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 87.87% this week from 91.48% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here

*Opinion, Not Advice. See Terms