A bunch of bearishness is coming in following the weaker close today. While it would be perfectly normal to take a breather here, there are a few indicators that suggest the bounce higher may be starting vs. ending. I will discuss 2 here.

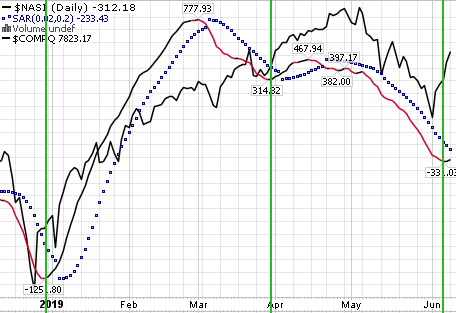

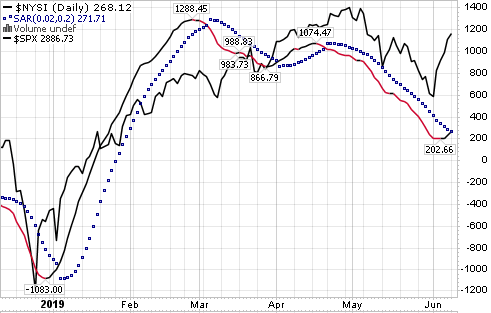

In the chart above I have the $NASI Nasdaq McClellan Summation Index (Radio Adjusted) (with Nasdaq Composite behind it). In the chart below I have the $NYSI NYSE McClellan Summation Index (Radio Adjusted) (with the S&P 500 index behind it).

The McClellan Summation Index is a breadth indicator derived from the McClellan Oscillator, which is a breadth indicator based on Net Advances (advancing issues less declining issues). The Summation Index is simply a running total of the McClellan Oscillator values. Even though it is called a Summation Index, the indicator is really an oscillator that fluctuates above and below the zero line.

I have used this NASI/NYSI along with a hand full of other indicators over the years to act as a barometer for possible turning points. I like to couple the NASI/NYSI with a Parabolic SAR trigger that gives me a better “tell” when the short term indicator is potentially turning.

There are 2 triggers I look for for a potential reversal:

1) The red NASI/NYSI turns black.

2) The Parabolic SAR dots flip from above the NASI/NYSI to under.

The parabolic SAR showed results at a 95% confidence level in a study of 17 years of data: Study by Timothy C. Pistole

So far we’ve gotten the change from red to black for a potential change in trend but are waiting for the Parabolic SAR dot flip for confirmation. It has been one of a number of indicators that I use to weigh the odds at potential inflection points.

This indicator does not “call bottoms” but it does give you an indication when the probabilities favor building your long book (it’s less effective as a short indicator). It’s a barometer, not a crystal ball, so earnings and guidance will matter in coming weeks, but worth noting where it is relative to what that portended in past instances.