Rotation

I had the pleasure to join David Lin on “The David Lin Report” this week. Our view is that conditions are similar to Oct 2023 where laggards abruptly flipped from non-stop pain to gaining massively in the following few months. I go into detail with David as to why we have this outlook and what are the explicit catalysts for a similar abrupt turnaround. You can watch it here:

Cash Flow

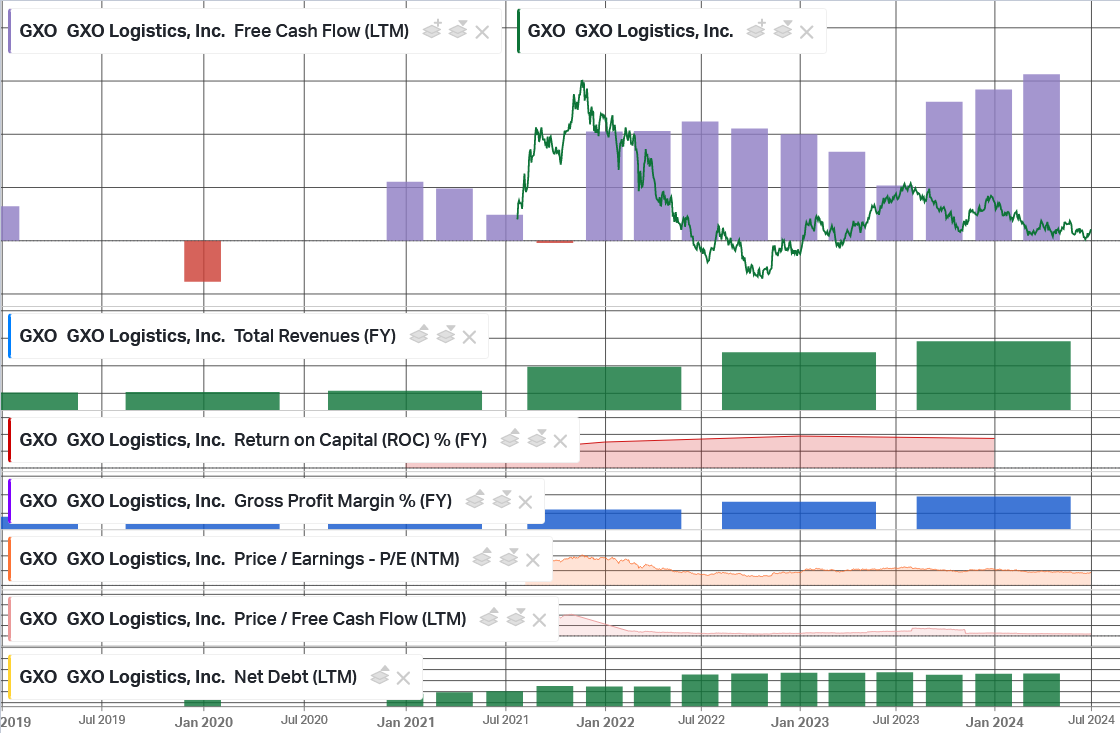

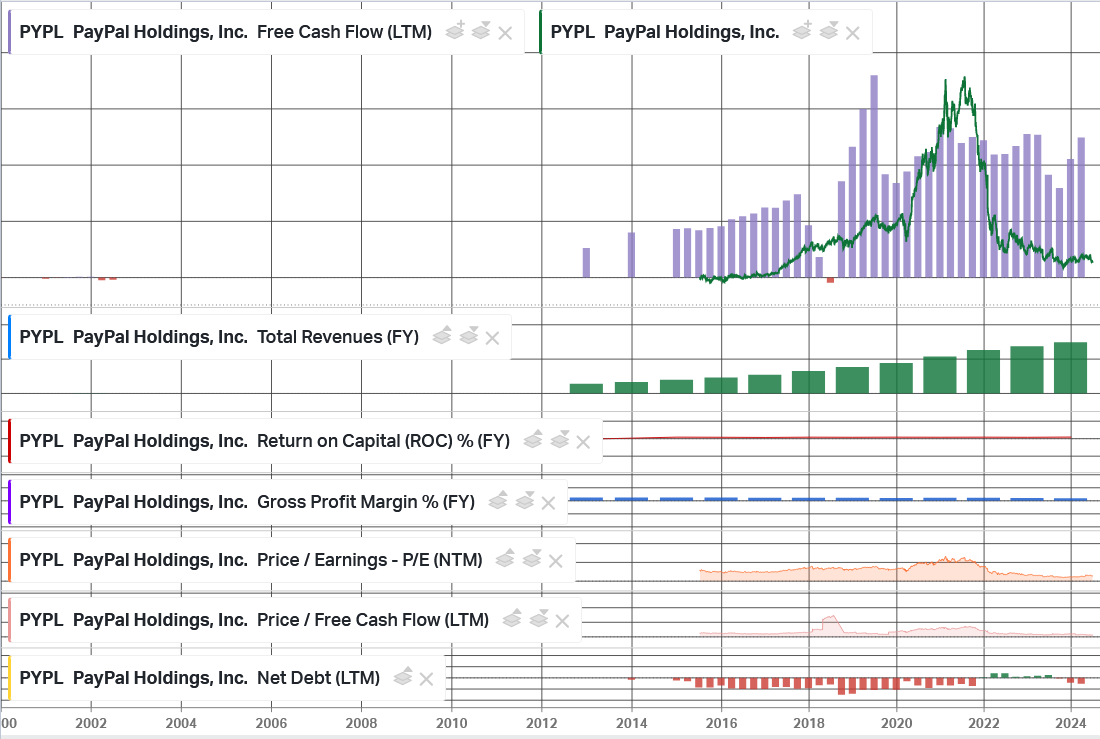

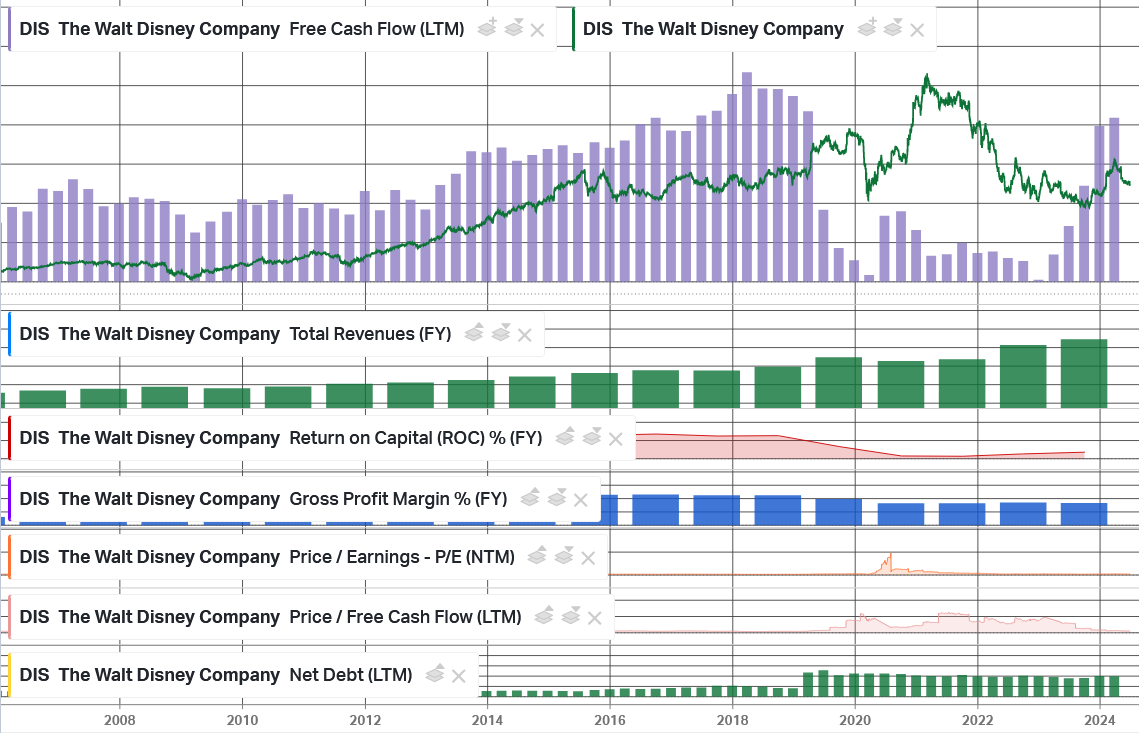

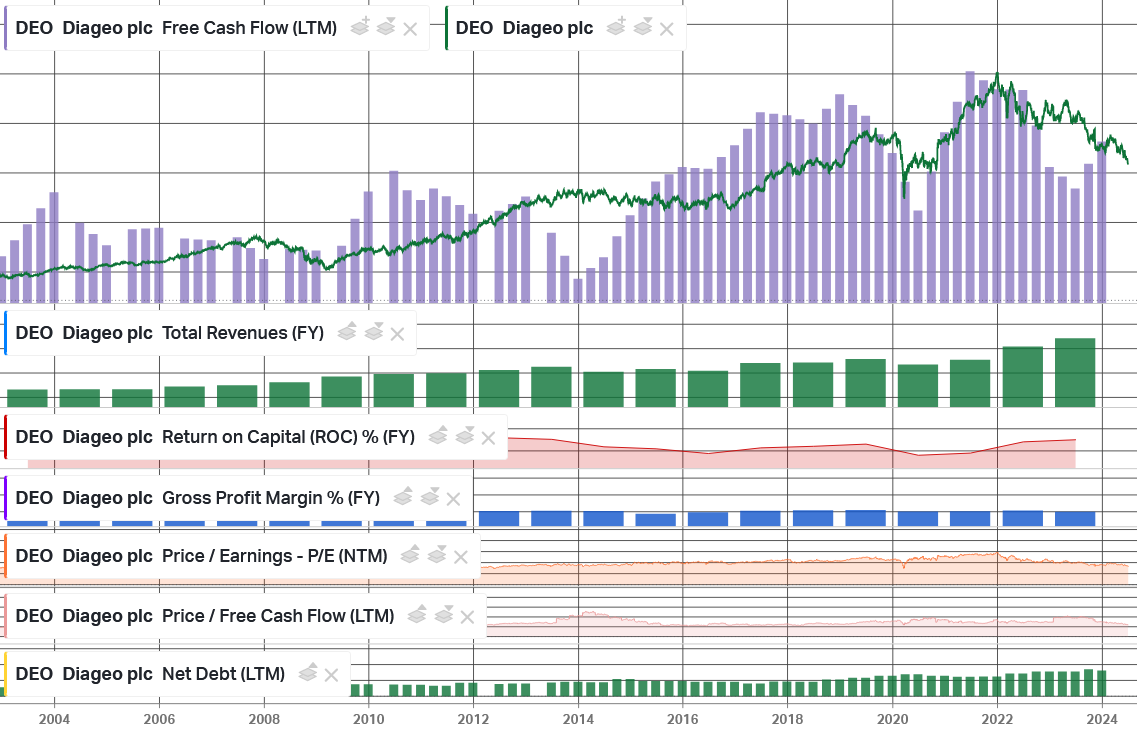

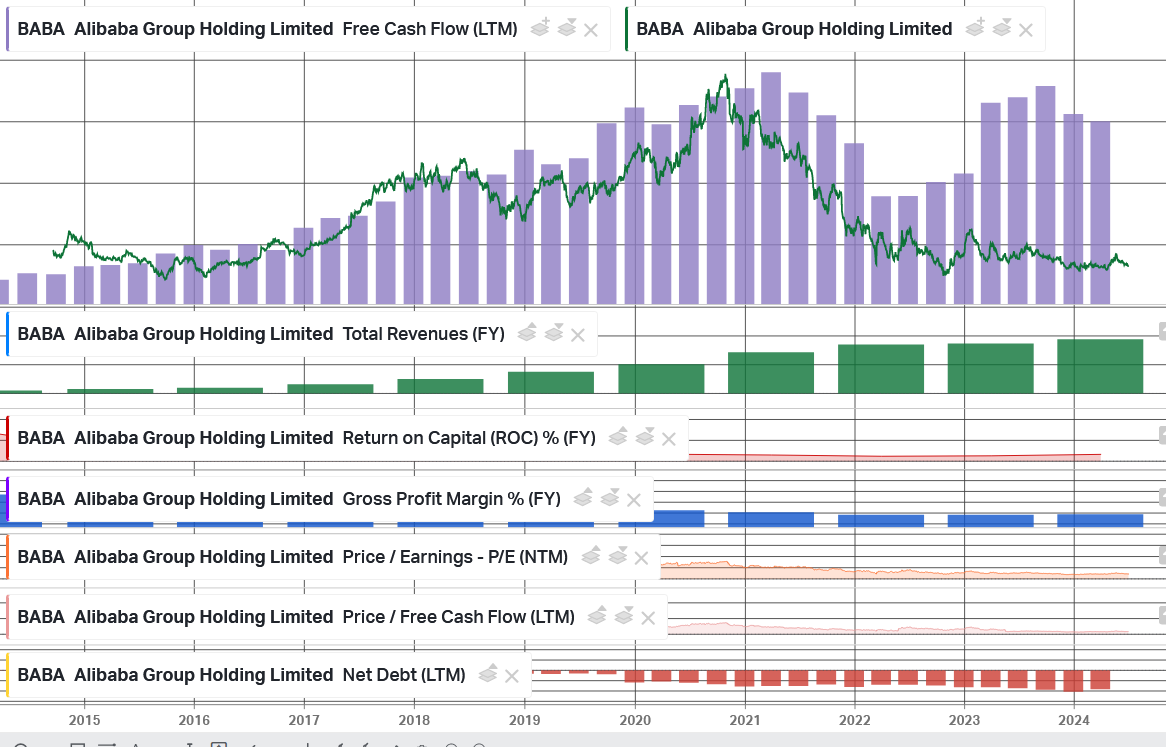

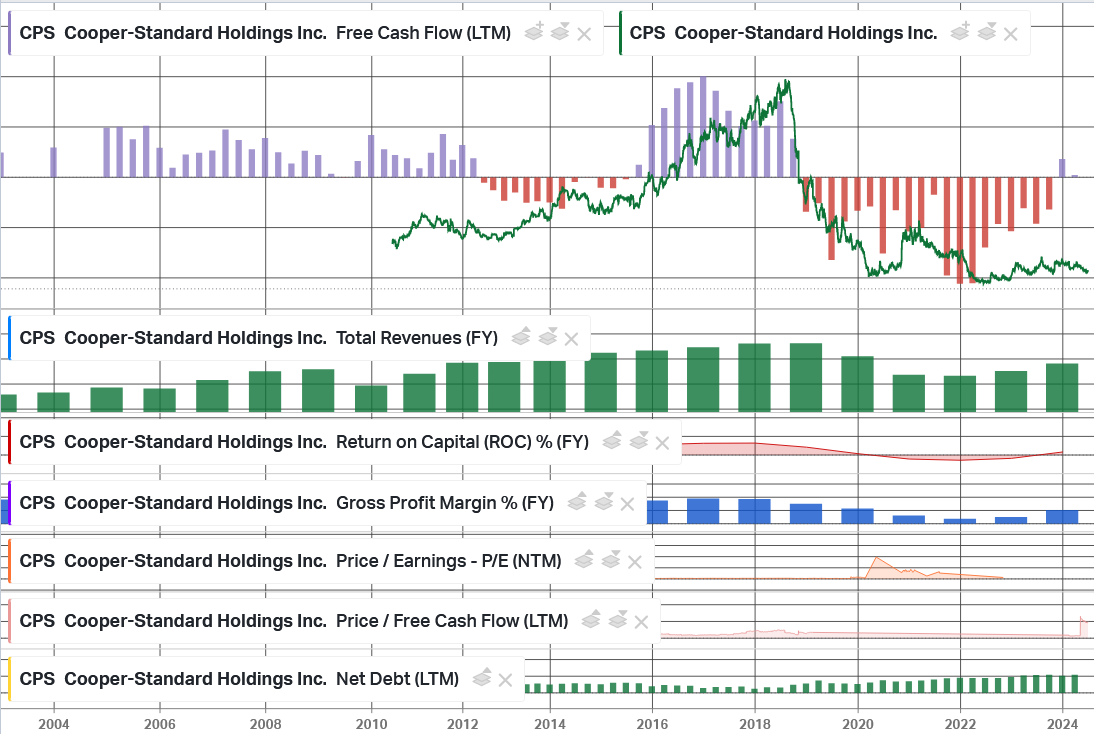

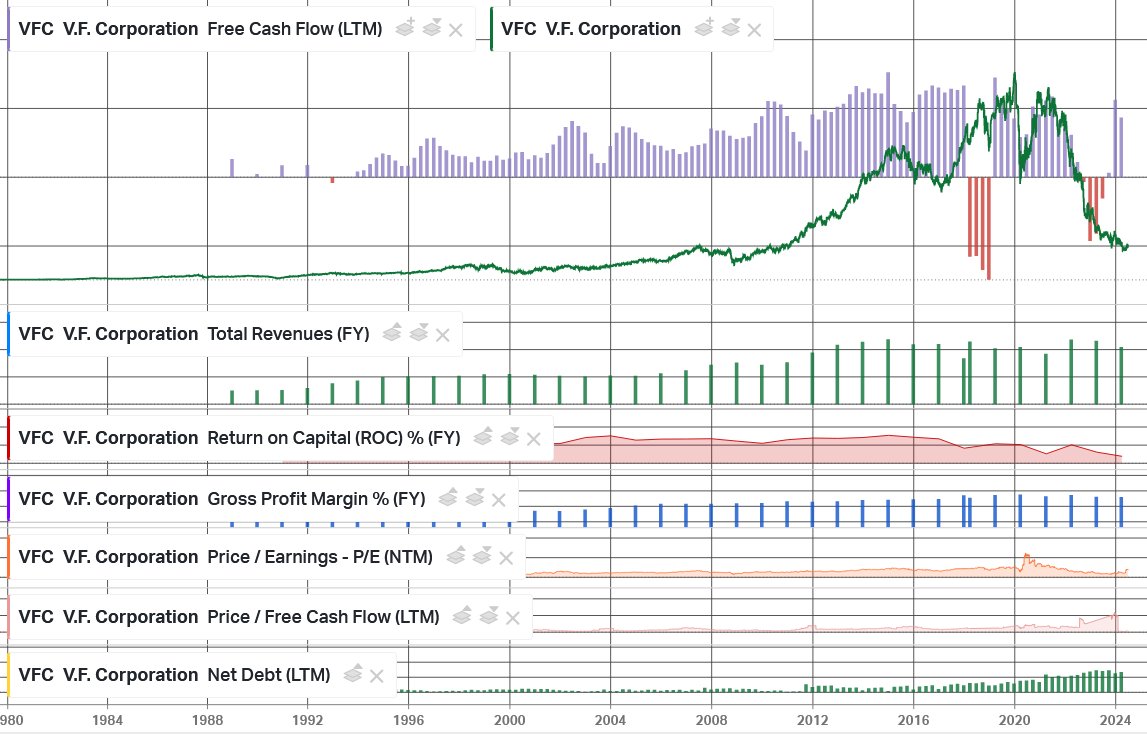

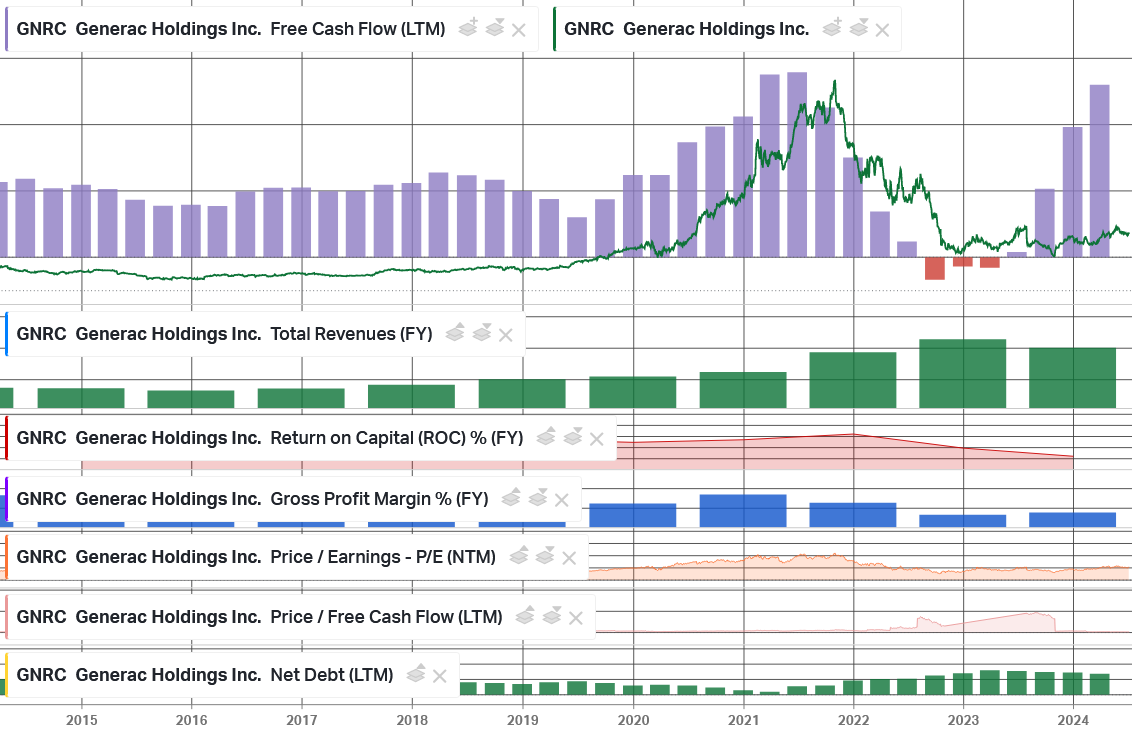

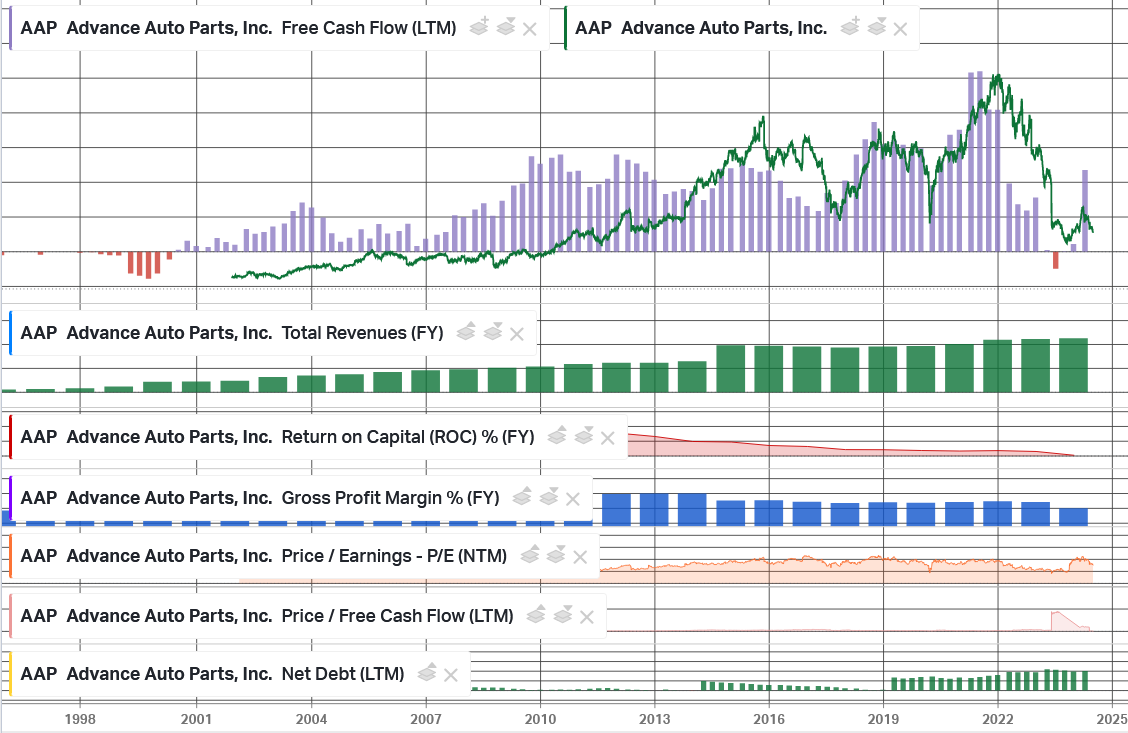

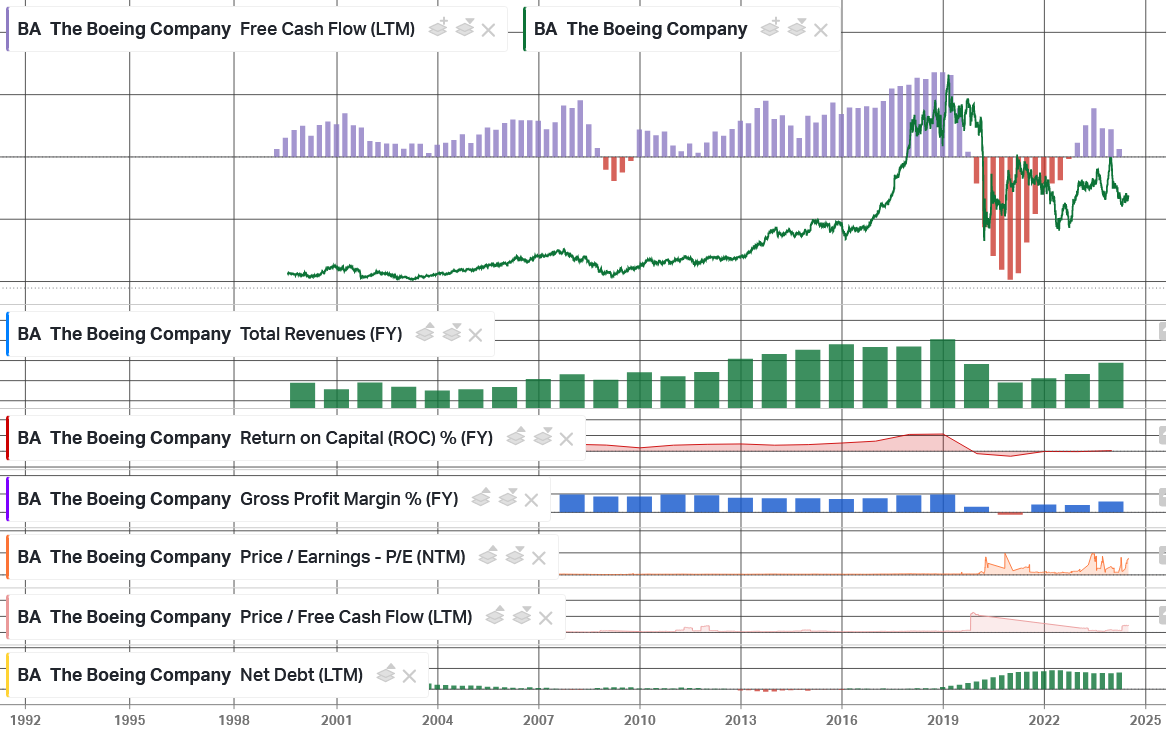

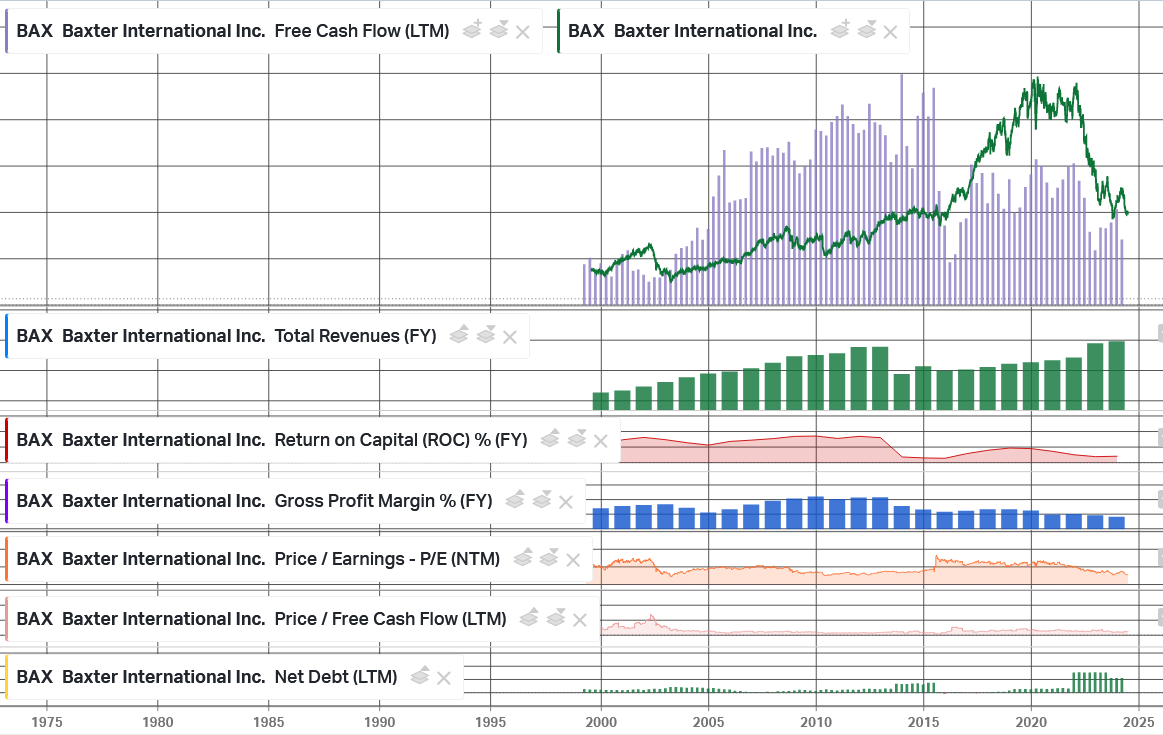

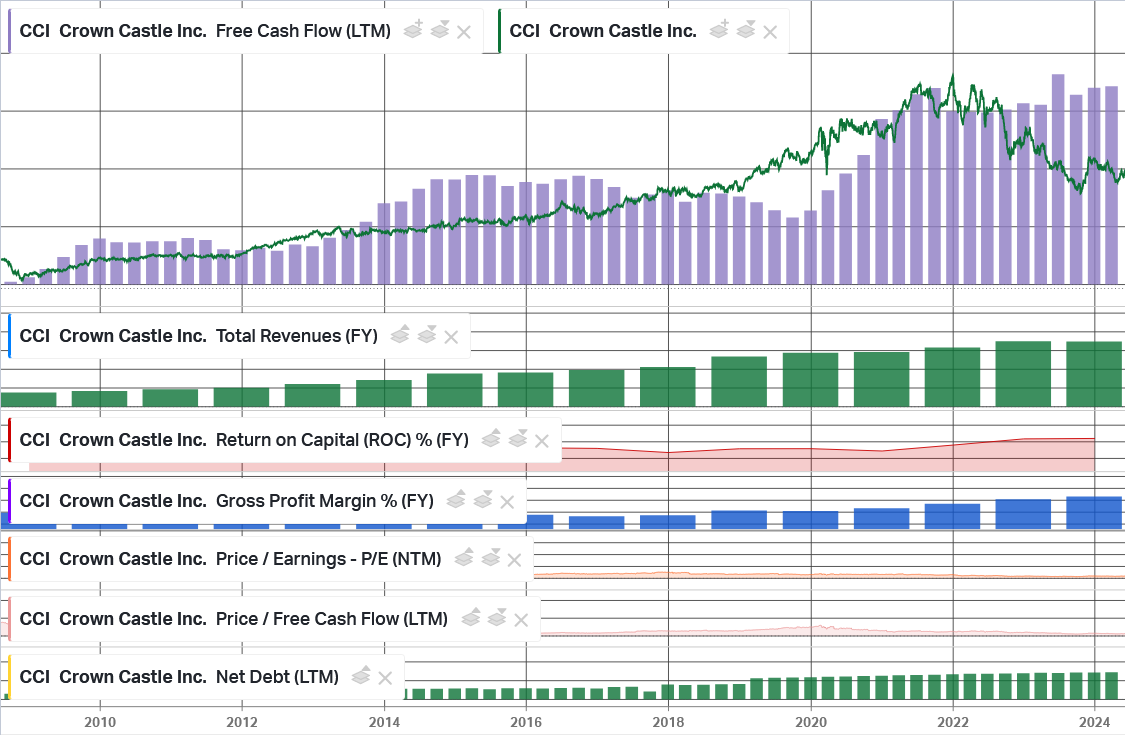

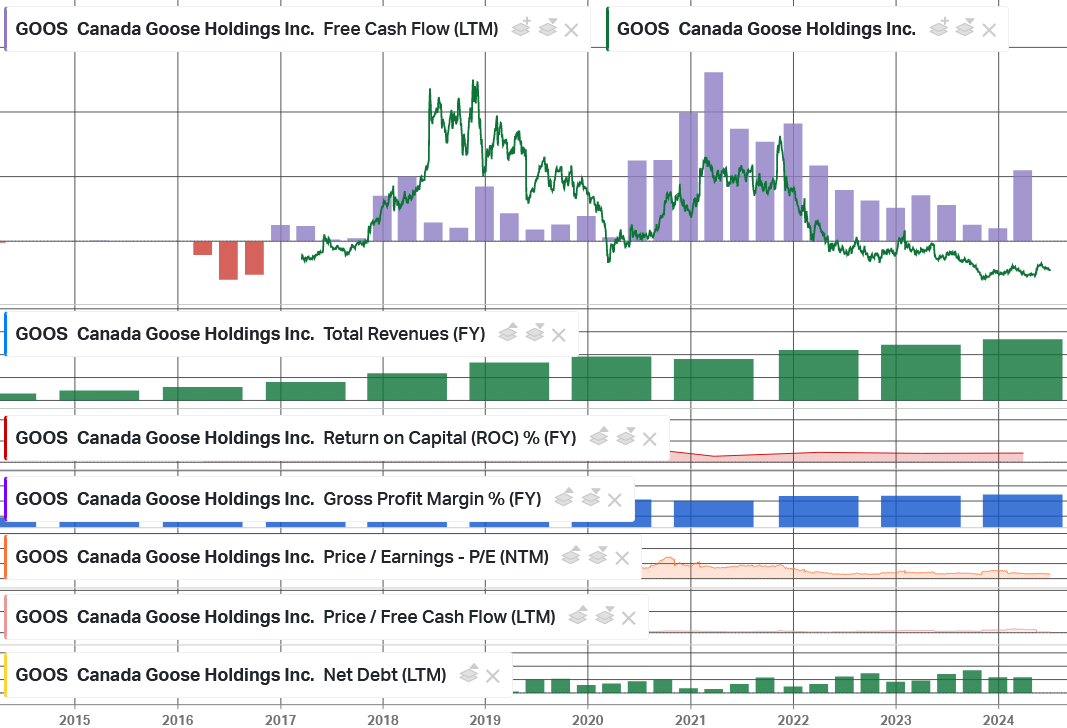

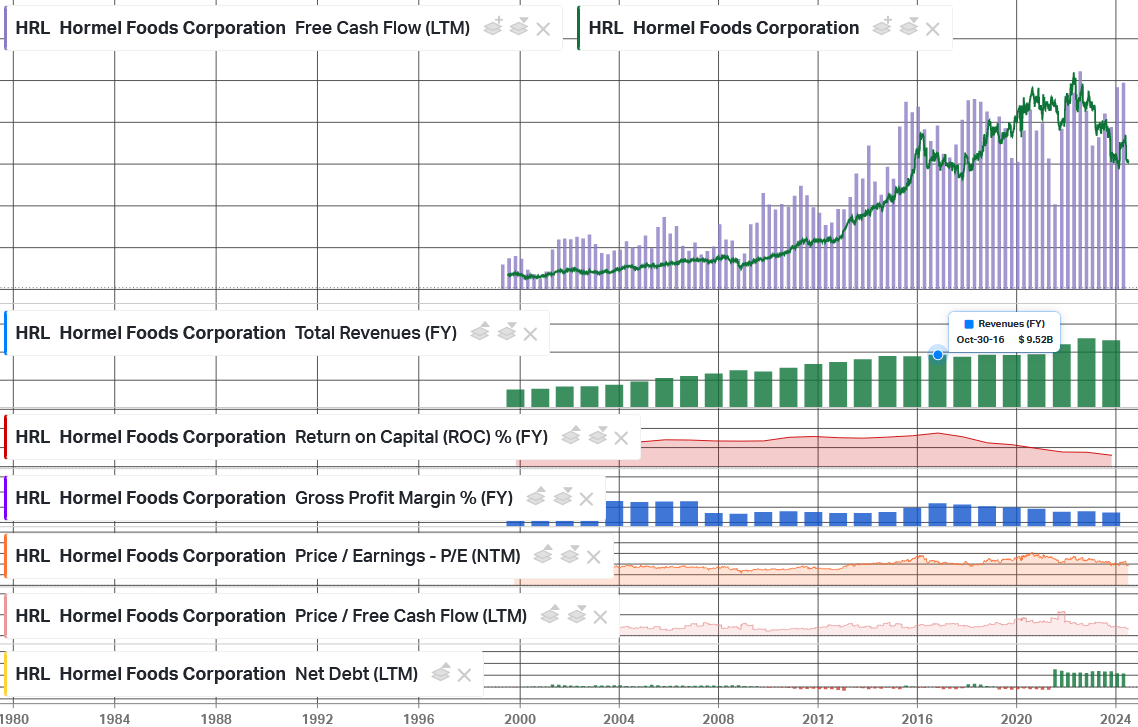

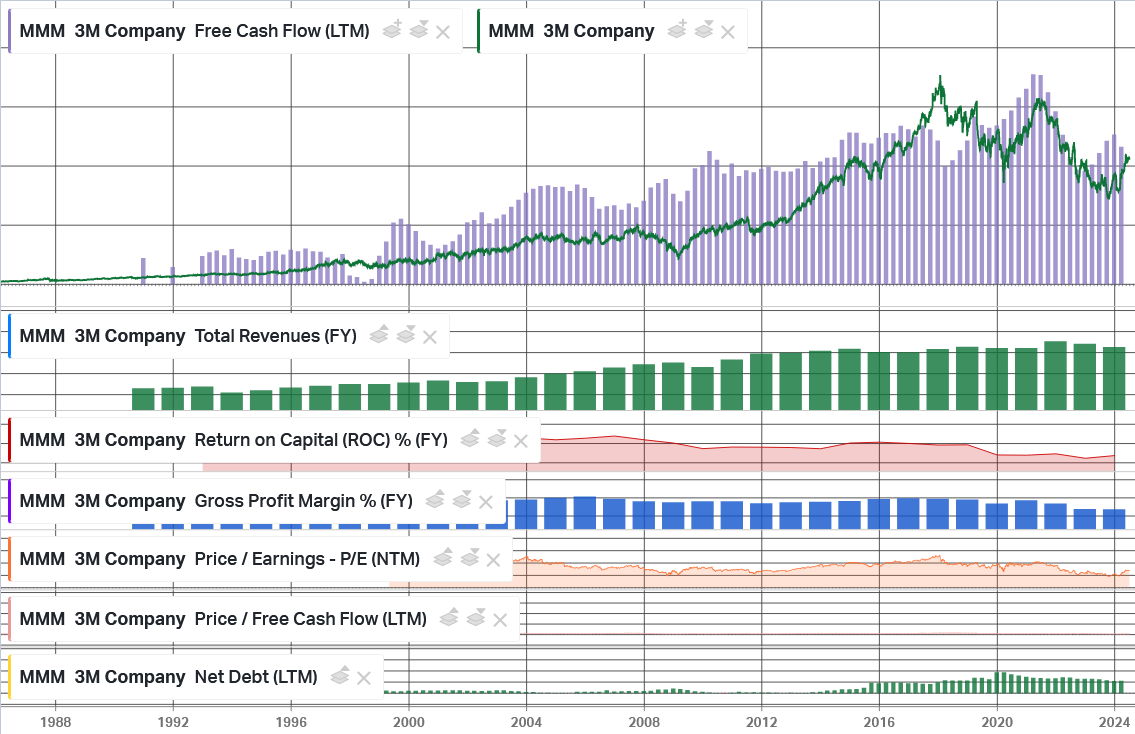

I spent the last weekend going through a number of positions as well as other stocks we have covered in past podcast|videocast episodes. The conclusion I came to is that we don’t own enough of of them! I’ve rarely seen periods where price has lagged a turn or recovery in free cash flow to such an extent. The last time I saw anything like this was Oct 2023. Then we got 2+ years of gains in 2 months! I cover some of the catalysts in the last 2 weeks podcasts (245 and 244). Here are some sample tables to illustrate the point (Free cash flow is the purple bars at top. Stock price is green line):

The Fed

Liquidity is becoming a problem and the Fed (and other Central Bankers) know it. Higher for longer is a luxury they can no longer afford. Chicago Fed President laid out the case this week:

The “Fed Whisperer” (Nick Timiraos) at the WSJ started to lay the groundwork this week:

We will cover 80+ economic data points on this week’s podcast|videocast – which will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients who came in so far this year during our Q1 and Q2 openings. We still closed to smaller accounts ($1M+) again as of ~2.5 months ago and will remain closed to smaller accounts until sometime in Q3. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.