The bad news is, we have a Federal Reserve with no feel for the market or explicit understanding of “lagged effect” of tightening on the economy. To this point, the Chairman was quoted (in yesterday’s conference) as follows, “I mean the question we were all asking ourselves that first weekend was, ‘How did this happen?‘” (referring to the collapse of Silicon Valley Bank). Save the taxpayers some money and call off the “investigation.” Everyone already knows how this happened… Continue reading ““How Did This Happen?” Stock Market (and Sentiment Results)…”

Category: Commentary

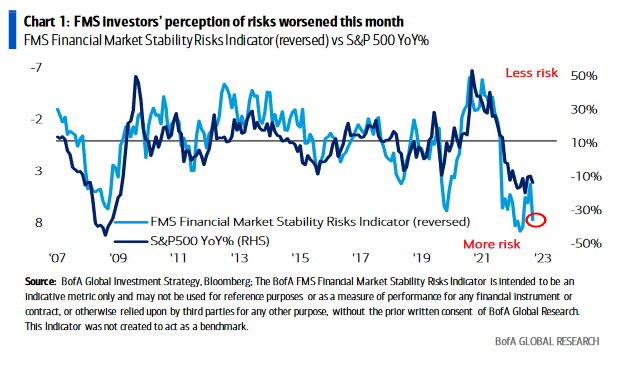

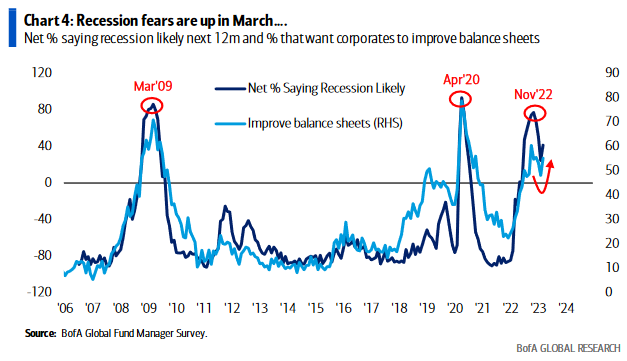

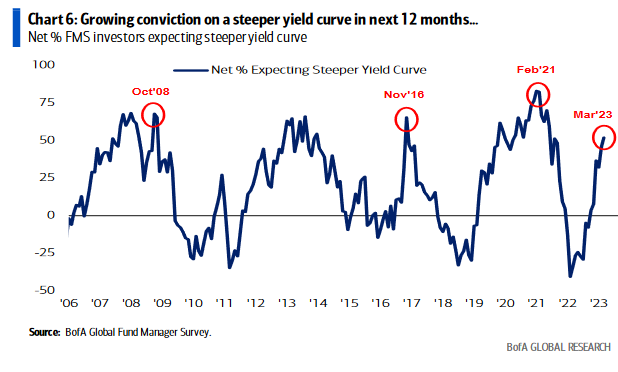

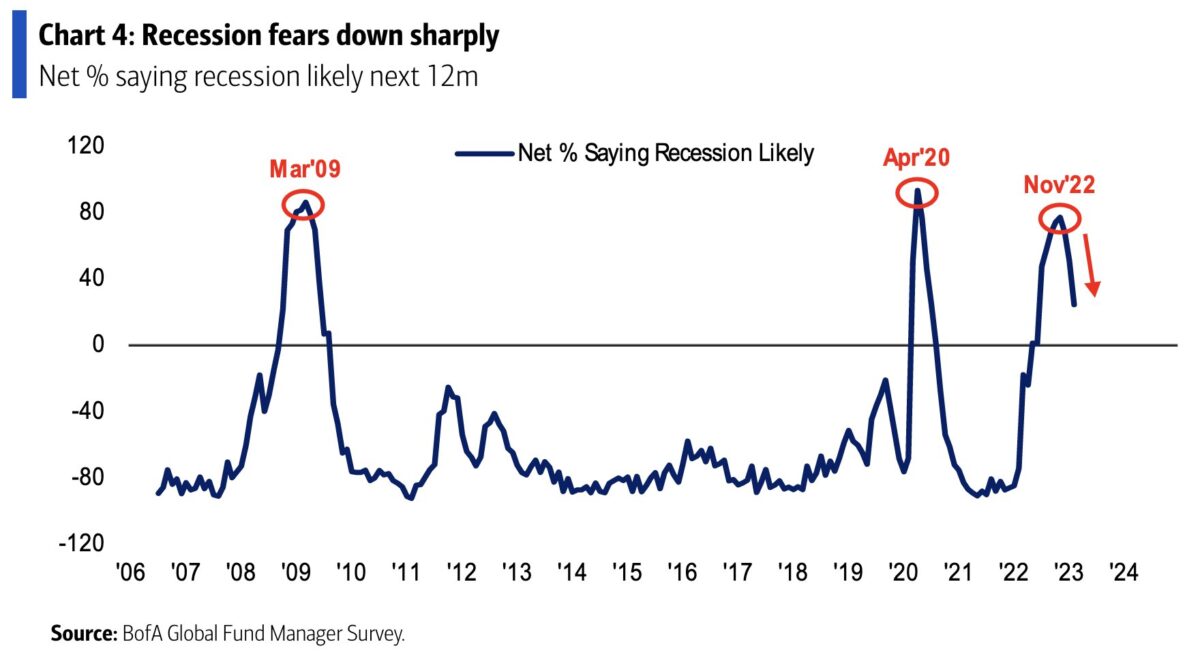

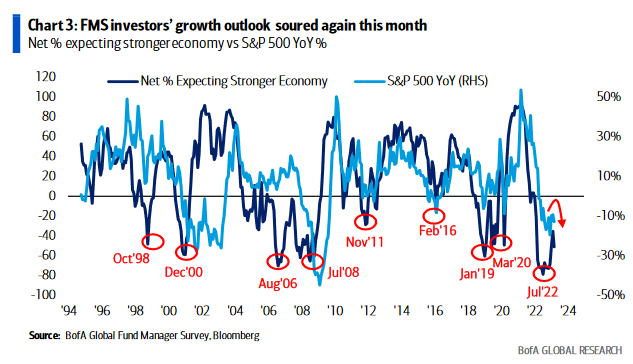

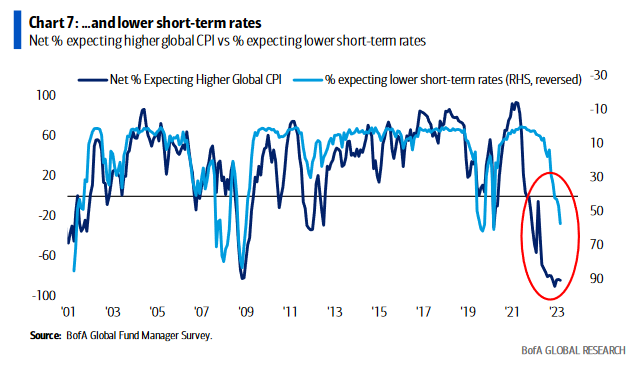

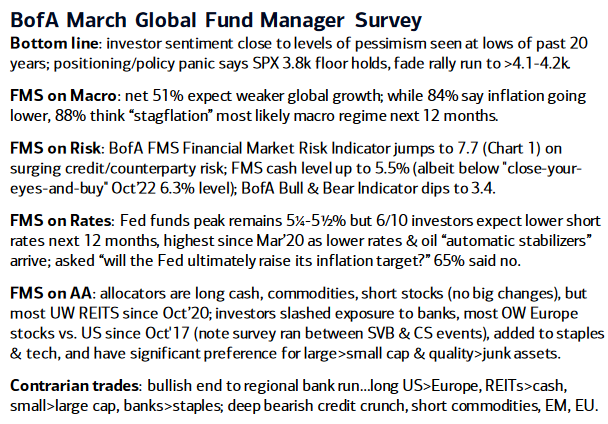

March 2023 Bank of America Global Fund Manager Survey Results (Summary)

OUTLOOK:

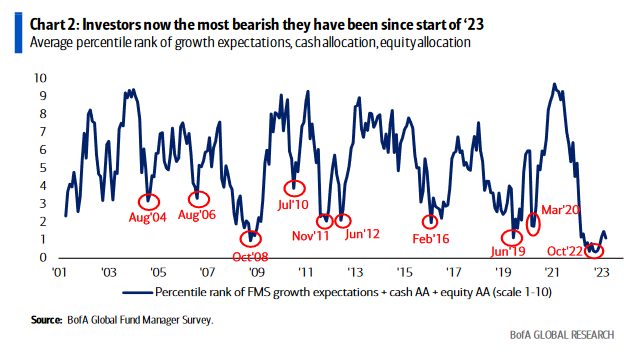

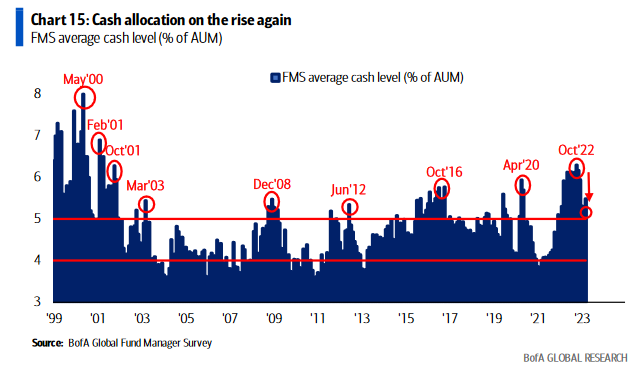

SENTIMENT:

SENTIMENT:

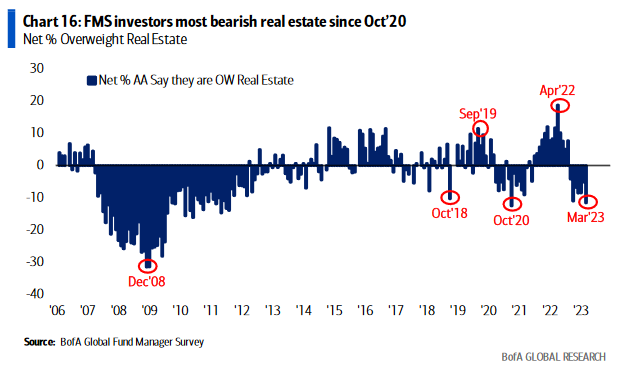

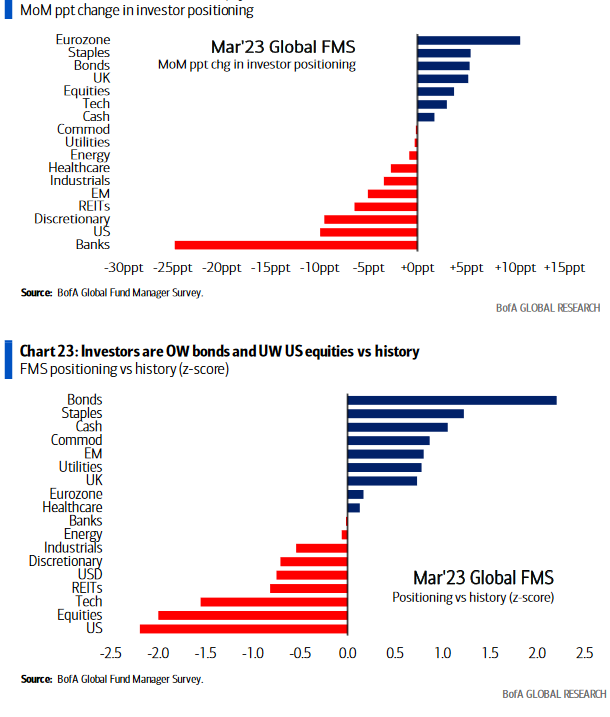

POSITIONING:

POSITIONING:

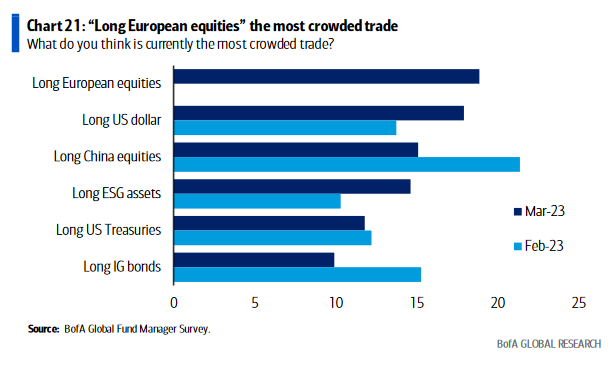

MOST CROWDED TRADES:

MOST CROWDED TRADES:

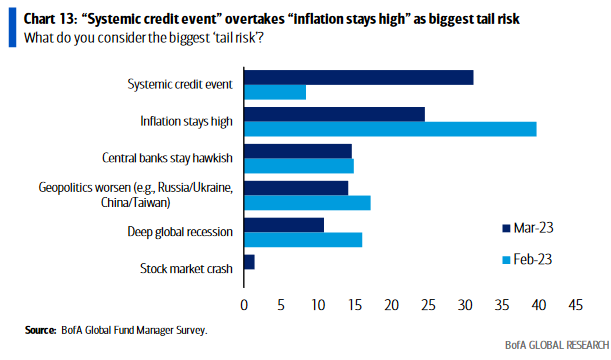

BIGGEST TAIL RISKS:

BANK OF AMERICA COMMENTARY:

Deja Vu NOT All Over Again – Stock Market (and Sentiment Results)…

“Recency bias, or availability bias, is a cognitive error identified in behavioral economics whereby people incorrectly believe that recent events will occur again soon. This tendency is irrational, as it obscures the true or objective probabilities of events occurring, leading people to make poor decisions.” Investopedia

Continue reading “Deja Vu NOT All Over Again – Stock Market (and Sentiment Results)…”

“Barbarians at the Gate” Stock Market (and Sentiment Results)…

This week I watched the classic film “Barbarians at the Gate” for the first time. It stars James Garner (of The Great Escape fame) and Peter Riegert (of Animal House fame). It chronicles the booming 80’s junk bond era when Michael Milken – at Drexel Burnham – was able to raise unlimited amounts of capital for leveraged management buyouts and corporate takeovers. No company was safe if Milken was involved.

Continue reading ““Barbarians at the Gate” Stock Market (and Sentiment Results)…”

The Ferruccio Lamborghini Stock Market (and Sentiment Results)…

photo credit: Lamborghini: The Man Behind the Legend – Movie

One of my favorite pastimes, when I have a little free time, is reading books and watching movies about extraordinary individuals who overcame significant obstacles to ascend to greatness. Continue reading “The Ferruccio Lamborghini Stock Market (and Sentiment Results)…”

“Pretty, Pretty, Pretty Good” Stock Market (and Sentiment Results)…

In last week’s note we reiterated our case from October that the “pain trade” was UP in the first half of this year DESPITE the short-term seasonal headwinds and possibility of near-term weakness (read full note for context):

Continue reading ““Pretty, Pretty, Pretty Good” Stock Market (and Sentiment Results)…”

Where is “Maximum Pain?” Stock Market (and Sentiment Results)…

Yesterday I joined Paul Vigna on Public.com to discuss my latest views on the market as well as opportunities/risks moving forward. Thanks to Mike Teich and Paul for having me on: Continue reading “Where is “Maximum Pain?” Stock Market (and Sentiment Results)…”

February 2023 Bank of America Global Fund Manager Survey Results (Summary)

The February survey covered ~300 fund managers with ~$750 billion under management.

Continue reading “February 2023 Bank of America Global Fund Manager Survey Results (Summary)”

The “Good Time” Stock Market (and Sentiment Results)…

When I thought about sentiment for this week’s note, Alan Jackson’s legendary country song “Good Time” came to mind. The following lyrics lay out a couple of themes we want to touch on. People are, 1) spending all of their savings (bad), and (as a function of that), 2) going back to work (good):

Continue reading “The “Good Time” Stock Market (and Sentiment Results)…”

“Hawk on a Wire” Stock Market (and Sentiment Results)…

On Wednesday we got a de-clawed hawk in Chairman Powell and he treaded carefully. It was as if he was a hawk on barbed wire knowing if he swayed too far to either side he would get cut. For the first time he acknowledged we are in a dis-inflationary environment and goods inflation is coming down fast. Continue reading ““Hawk on a Wire” Stock Market (and Sentiment Results)…”