Snatching Defeat From The Jaws of Victory

On Wednesday, the market started up nicely on the back of the better than expected CPI prints:

Continue reading ““Snatching Defeat” Stock Market (and Sentiment Results)…”

On Wednesday, the market started up nicely on the back of the better than expected CPI prints:

Continue reading ““Snatching Defeat” Stock Market (and Sentiment Results)…”

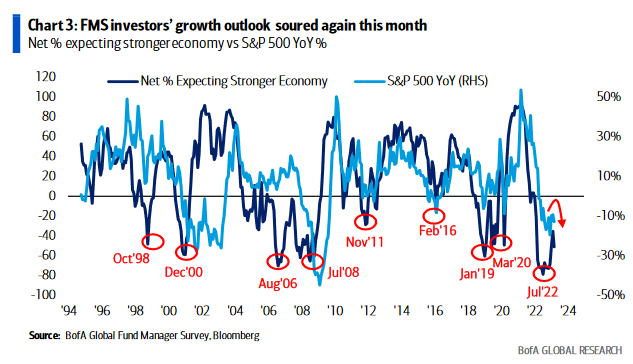

As you can see in the chart above, there have been no gains for the S&P 500 for 12 months, and there have been no gains in the S&P 500 for 24 months. It is unchanged! As the old saying goes, markets can correct in price or in time. In this case it has been working off its excess post-covid run for two years, while earnings have continued to press forward: Continue reading ““Stuck in the Middle with You” Stock Market (and Sentiment Results)…”

“Don’t Stop Believin’” is the second single from Journey’s seventh studio album ‘Escape’ released in 1981. Although the song only reached #9 on Billboard Hot 100 and #62 in the UK Singles chart, the track became a timeless classic. Today, “Don’t Stop Believin’” can be heard at just about every wedding, high school dance, and Saturday night college bar you can think of. The popularity of “Don’t Stop Believin’” in modern times started in 2007, when the song was used in the iconic final scene of The Sopranos.

Continue reading ““Don’t Stop Believin’” Stock Market (and Sentiment Results)…”

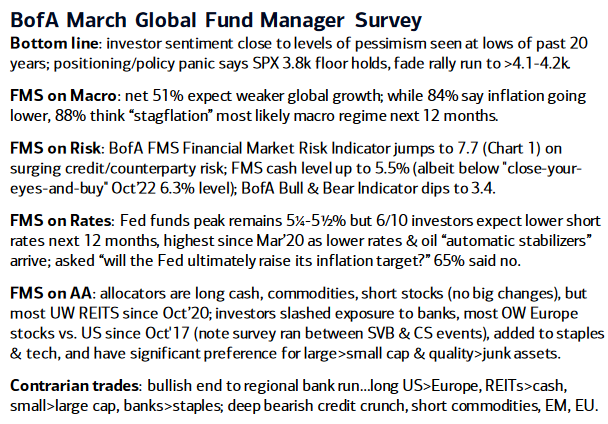

The bad news is, we have a Federal Reserve with no feel for the market or explicit understanding of “lagged effect” of tightening on the economy. To this point, the Chairman was quoted (in yesterday’s conference) as follows, “I mean the question we were all asking ourselves that first weekend was, ‘How did this happen?‘” (referring to the collapse of Silicon Valley Bank). Save the taxpayers some money and call off the “investigation.” Everyone already knows how this happened… Continue reading ““How Did This Happen?” Stock Market (and Sentiment Results)…”

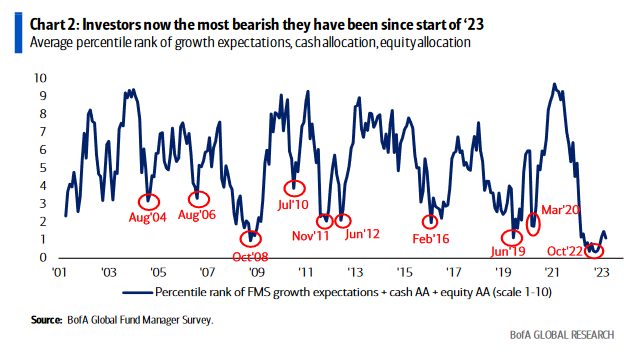

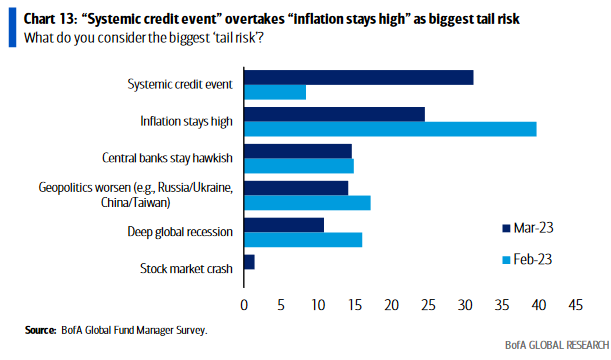

SENTIMENT:

SENTIMENT:

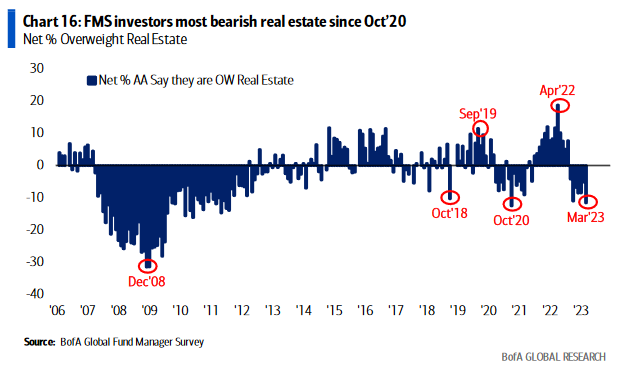

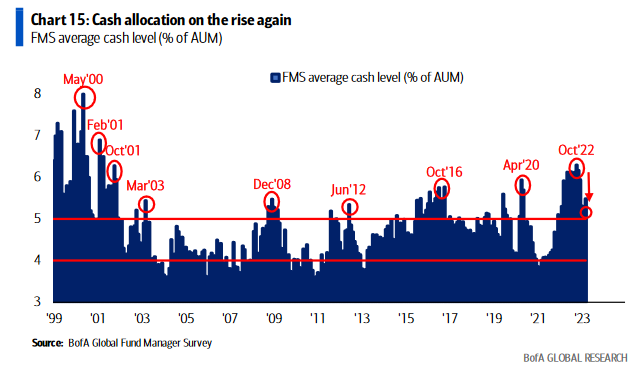

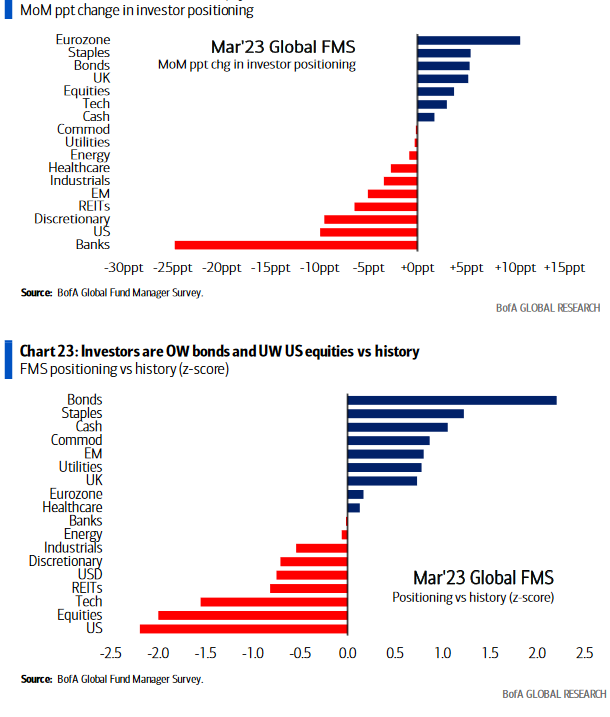

POSITIONING:

POSITIONING:

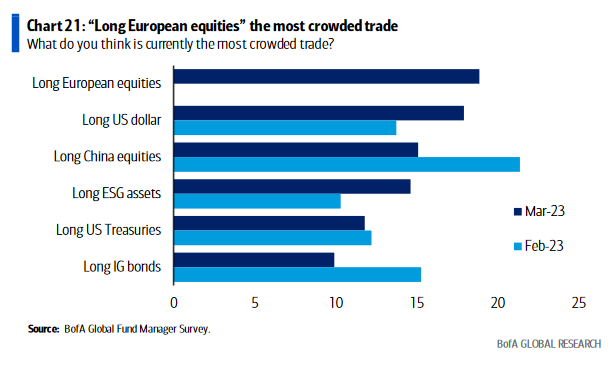

MOST CROWDED TRADES:

MOST CROWDED TRADES:

“Recency bias, or availability bias, is a cognitive error identified in behavioral economics whereby people incorrectly believe that recent events will occur again soon. This tendency is irrational, as it obscures the true or objective probabilities of events occurring, leading people to make poor decisions.” Investopedia

Continue reading “Deja Vu NOT All Over Again – Stock Market (and Sentiment Results)…”

This week I watched the classic film “Barbarians at the Gate” for the first time. It stars James Garner (of The Great Escape fame) and Peter Riegert (of Animal House fame). It chronicles the booming 80’s junk bond era when Michael Milken – at Drexel Burnham – was able to raise unlimited amounts of capital for leveraged management buyouts and corporate takeovers. No company was safe if Milken was involved.

Continue reading ““Barbarians at the Gate” Stock Market (and Sentiment Results)…”

photo credit: Lamborghini: The Man Behind the Legend – Movie

One of my favorite pastimes, when I have a little free time, is reading books and watching movies about extraordinary individuals who overcame significant obstacles to ascend to greatness. Continue reading “The Ferruccio Lamborghini Stock Market (and Sentiment Results)…”

In last week’s note we reiterated our case from October that the “pain trade” was UP in the first half of this year DESPITE the short-term seasonal headwinds and possibility of near-term weakness (read full note for context):

Continue reading ““Pretty, Pretty, Pretty Good” Stock Market (and Sentiment Results)…”

Yesterday I joined Paul Vigna on Public.com to discuss my latest views on the market as well as opportunities/risks moving forward. Thanks to Mike Teich and Paul for having me on: Continue reading “Where is “Maximum Pain?” Stock Market (and Sentiment Results)…”