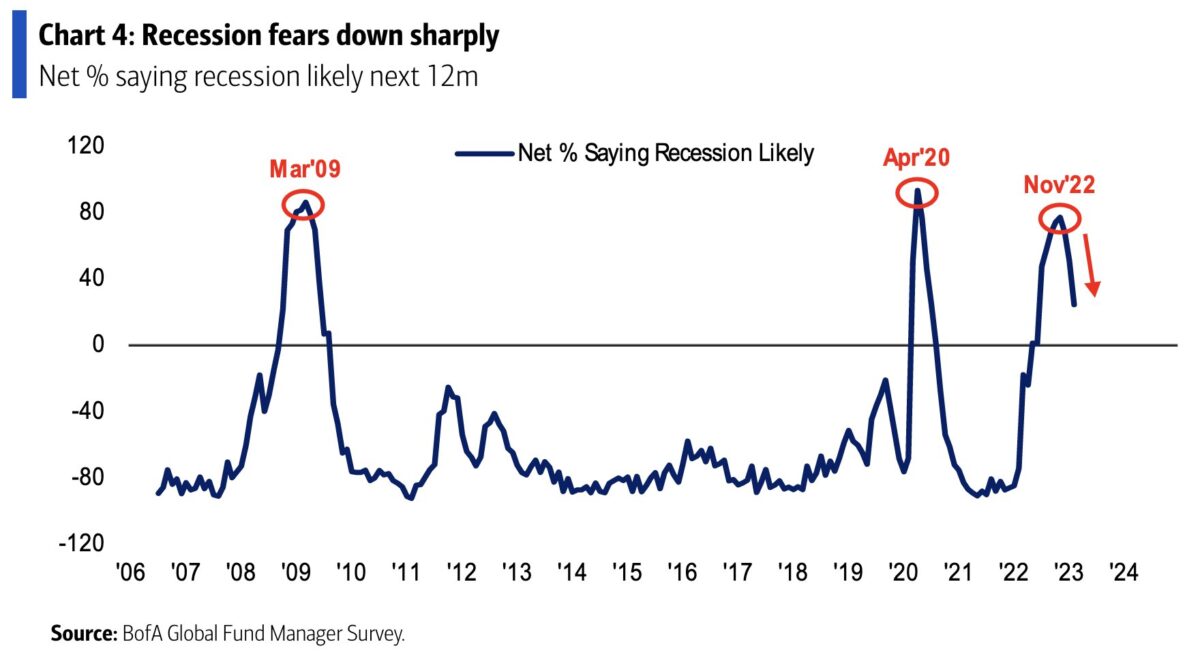

The February survey covered ~300 fund managers with ~$750 billion under management.

Continue reading “February 2023 Bank of America Global Fund Manager Survey Results (Summary)”

Category: Commentary

The “Good Time” Stock Market (and Sentiment Results)…

When I thought about sentiment for this week’s note, Alan Jackson’s legendary country song “Good Time” came to mind. The following lyrics lay out a couple of themes we want to touch on. People are, 1) spending all of their savings (bad), and (as a function of that), 2) going back to work (good):

Continue reading “The “Good Time” Stock Market (and Sentiment Results)…”

“Hawk on a Wire” Stock Market (and Sentiment Results)…

On Wednesday we got a de-clawed hawk in Chairman Powell and he treaded carefully. It was as if he was a hawk on barbed wire knowing if he swayed too far to either side he would get cut. For the first time he acknowledged we are in a dis-inflationary environment and goods inflation is coming down fast. Continue reading ““Hawk on a Wire” Stock Market (and Sentiment Results)…”

“Famous Friends” Stock Market (and Sentiment Results)…

“Famous Friends” is a song recorded by American country music singers Chris Young and Kane Brown. It was released on November 20, 2020. In December 2021, it was declared by Billboard the number one Country Airplay single of the year: Continue reading ““Famous Friends” Stock Market (and Sentiment Results)…”

Stock Market Breather (and Sentiment Results)…

After a 14%+ move off of the October lows, the market has been consolidating sideways for the past 6 weeks or so. This is a normal consolidation and will resolve it self (higher in our view) as we work through earnings and the Fed meeting in coming weeks. For the next few days, who knows…

Continue reading “Stock Market Breather (and Sentiment Results)…”

January 2023 Bank of America Global Fund Manager Survey Results (Summary)

The January survey covered ~300 fund managers with ~$750 billion under management.

Continue reading “January 2023 Bank of America Global Fund Manager Survey Results (Summary)”

“Friends in Low Places” Stock Market (and Sentiment Results)…

“Friends in Low Places” is a song recorded by American country music artist Garth Brooks. It was released on August 6, 1990 as the lead single from his album No Fences.

Continue reading ““Friends in Low Places” Stock Market (and Sentiment Results)…”

Funny How? Stock Market (and Sentiment Results)…

Santa managed to kick the Grinch out of the sleigh and deliver positive returns for the SCR period (last 5 trading days of 2022 + first 2 trading days 2023). As you can see above, we needed to close Wednesday above 3822 on the S&P. It closed at 3852. The period (from Dec. 23 thru Jan. 4) closed with a gain of +0.80%. What are the implications?

Continue reading “Funny How? Stock Market (and Sentiment Results)…”

“Damn Strait” Stock Market (and Sentiment Results)…

“Damn Strait” is a song by American country music singer Scotty McCreery. It was released on October 18, 2021. The song is a tribute to country music legend George Strait. I think as we approach the end of the year, many investors in any risk assets (stocks or bonds) can relate to his lyrics: Continue reading ““Damn Strait” Stock Market (and Sentiment Results)…”

The “3 Magic Words” Stock Market (and Sentiment Results)…

On Tuesday, I joined legendary anchor Larry Mendte (over 80 regional Emmy’s in his career) on the Mark Simone Show 710 WOR AM (iHeart Radio). This show is #1 nationwide in its daily time slot from 10am-12pm. It is heard by over 22 million radio and TV listeners a month. In this segment with Larry, I covered the “Magic 3 Words” that could change everything on a dime (hint: they are NOT Volker’s words, “keep at it”). Thanks to Larry for having me on. Listen here:

Continue reading “The “3 Magic Words” Stock Market (and Sentiment Results)…”