On Wednesday morning I joined Alicia Nieves on Cheddar’s “Opening Bell.” Thanks to Alicia, Ally Thompson and Jovan Collins for having me on:

Continue reading “The Stock Market Bet You Can’t Collect On…”

Category: Commentary

The Stock Market’s Biggest Risk…

Rudyard Kipling, “If you can keep your head when all about you are losing theirs… Yours is the Earth and everything that’s in it, And—which is more—you’ll be a Man, my son!” Continue reading “The Stock Market’s Biggest Risk…”

Backward Looking Allocators, Forward Looking Opportunities…

On Wednesday afternoon (after the Fed Minutes were released), I joined Liz Claman on Fox Business – The Claman Countdown – to discuss the Stock Market, the Fed, and Russia. Thanks to Liz and Ellie Terrett for having me on: Continue reading “Backward Looking Allocators, Forward Looking Opportunities…”

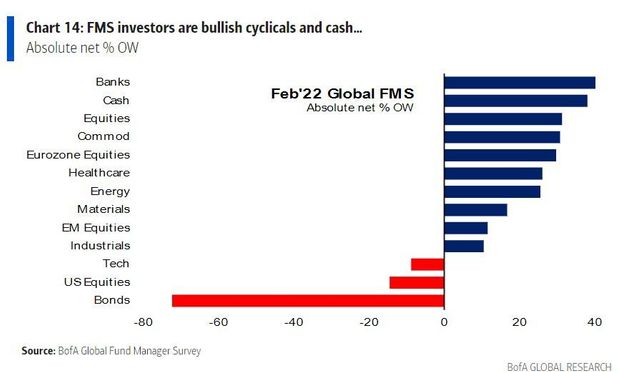

February 2022 Bank of America Global Fund Manager Survey Results (Summary)

The February survey covered 314 managers with $1 trillion in assets under management.

Continue reading “February 2022 Bank of America Global Fund Manager Survey Results (Summary)”

The Dean Martin, “You’re Nobody ‘Till Somebody Loves You” Stock Market (and Sentiment Results)…

(Image Source: Corbis)

In 1944, Russ Morgan, Larry Stock, and James Cavanaugh published the song “You’re Nobody till Somebody Loves You.” It became a hit for Morgan in 1946 – reaching No. 14 on the charts.

It became legendary 18 years later when Dean Martin recorded it (in 1964) – spending 9 weeks on the Billboard 100. 32 years after that, it was the opening track for the 1996 classic film Swingers starring Vince Vaughn, Jon Favreau and Heather Graham. One of the best movies of all time… Continue reading “The Dean Martin, “You’re Nobody ‘Till Somebody Loves You” Stock Market (and Sentiment Results)…”

“What’s Next?” Stock Market (and Sentiment Results)…

Last Tuesday – on the Claman Countdown – I laid out the 3 reasons I believed the worst (of the January correction) was in the rear view mirror (in the near term): Continue reading ““What’s Next?” Stock Market (and Sentiment Results)…”

“Go Where the Fish Are” Stock Market (and Sentiment Results)…

Last week I took the family down to Key West for a little R&R. Since we only had five days, I tried to pack in as much activity as possible: Parasailing, Jet Skiing, Snorkeling, Dolphins, and Deep Sea Fishing. Continue reading ““Go Where the Fish Are” Stock Market (and Sentiment Results)…”

Time to Cry or Time to Fly Stock Market?

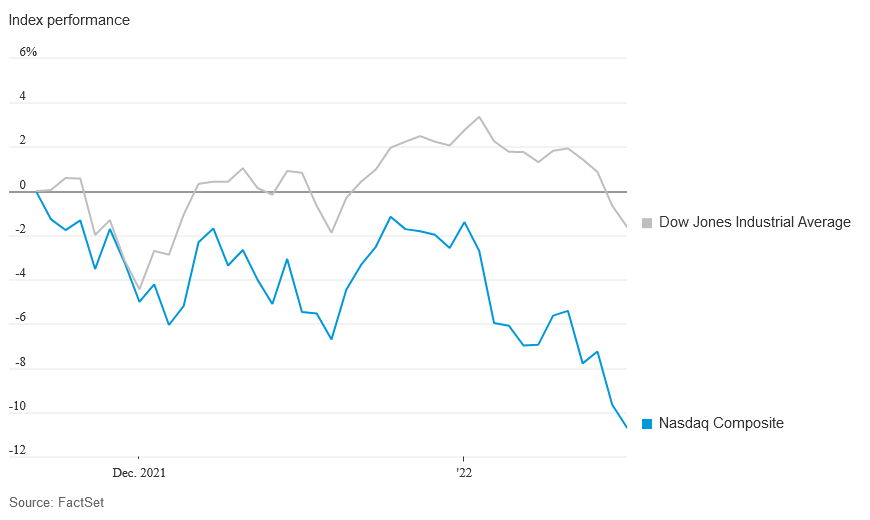

(source: WSJ)

(source: WSJ)

The Nasdaq Composite has officially fallen into correction territory – down 10.7% from its November high on Wednesday’s close. Continue reading “Time to Cry or Time to Fly Stock Market?”

“The Last Shall Be First” Stock Market…

On Friday I was on Fox Business – The Claman Countdown – with Liz Claman discussing which sector (+company) and which asset class (+company) we are focused on for 2022. Thanks to Ellie Terrett and Liz for having me on: Continue reading ““The Last Shall Be First” Stock Market…”

“I Dare You” Stock Market (and Sentiment Results)…

As I get older, I listen less to what people say and simply watch what they do. On Wednesday, the market was down as a reaction to what was said in the Fed Minutes (from the December meeting). Continue reading ““I Dare You” Stock Market (and Sentiment Results)…”