With the four major banks reporting earnings in the past 48 hours, the song that hit the mark for this week’s note is “I’m an Accountant” (by Rocky Paterra). This has been trending on TikTok for several weeks: Continue reading “The “I’m an Accountant” Stock Market (and Sentiment Results)…”

Category: Commentary

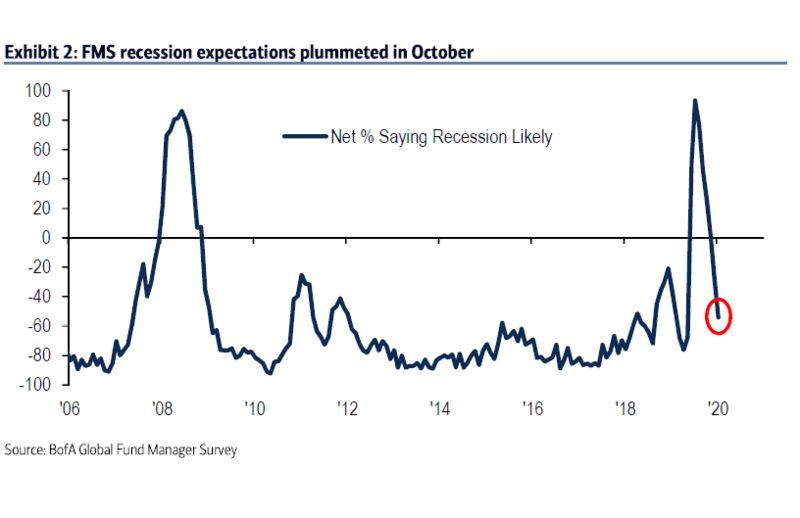

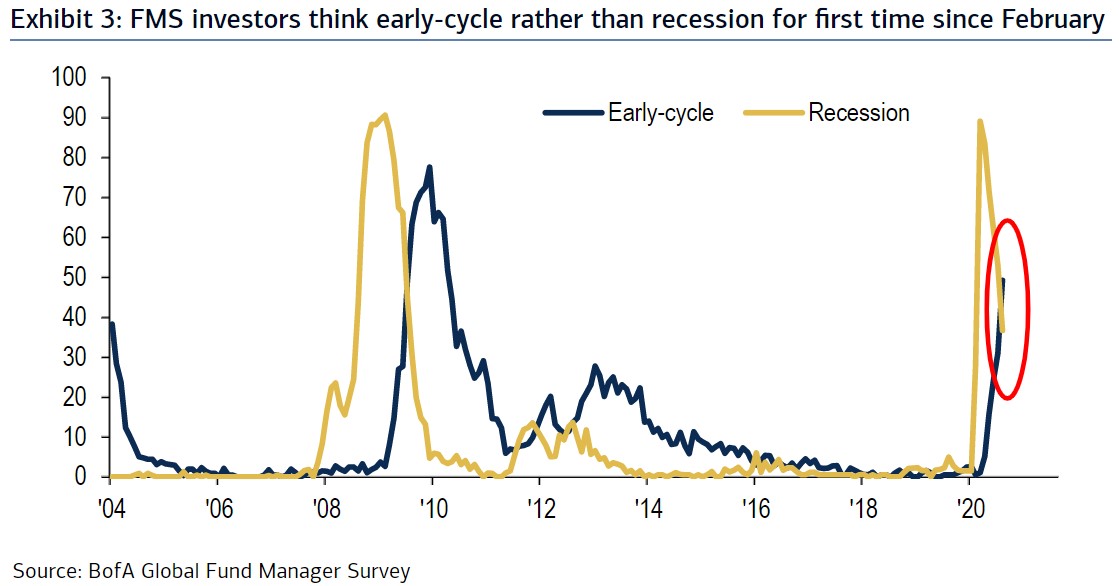

October Bank of America Global Fund Manager Survey Results (Summary)

~224 Managers overseeing ~$600B AUM responded to this month’s BofA survey. Continue reading “October Bank of America Global Fund Manager Survey Results (Summary)”

The Fleetwood Mac “Dreams” Stock Market (and Sentiment Results)…

On September 25, a man named Nathan Apodaca – from Idaho Falls, ID – posted a TikTok video of himself lip-syncing Fleetwood Mac’s legendary song, “Dreams” (while riding on a skateboard and drinking Cranberry Juice). Continue reading “The Fleetwood Mac “Dreams” Stock Market (and Sentiment Results)…”

The “Build Me Up Buttercup” Stock Market (and Sentiment Results)…

When our eldest daughter Mimi (Madeline) was 2 (she’s now 8), she would go into uncontrollable crying fits when we would drive around in the car… Continue reading “The “Build Me Up Buttercup” Stock Market (and Sentiment Results)…”

The Cobra Kai “Sweep The Leg” Stock Market (and Sentiment Results)…

If you have logged into Netflix lately, they have a new series out called, “Cobra Kai.” Continue reading “The Cobra Kai “Sweep The Leg” Stock Market (and Sentiment Results)…”

Tom Hayes – Quoted in Reuters article – 9/23/2020

Thanks to Devik Jain and Sagarika Jaisinghani for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

The Scott McCreery, “In-Between” Stock Market (and Sentiment Results)…

The song we chose this week – to embody the sentiment of the stock market – is Country Star Scott McCreery’s song, “In-Between.” Continue reading “The Scott McCreery, “In-Between” Stock Market (and Sentiment Results)…”

September Bank of America Global Fund Manager Survey Results (Summary)

~224 Managers overseeing >$600B AUM responded to this month’s BofA survey. Continue reading “September Bank of America Global Fund Manager Survey Results (Summary)”

The Barry White, “Never Gonna Give You Up” Stock Market (and Sentiment Results)…

This shortened Holiday Week, the song we chose to embody Stock Market sentiment is Barry White’s, “Never Gonna Give you Up.” Continue reading “The Barry White, “Never Gonna Give You Up” Stock Market (and Sentiment Results)…”

The Run DMC, “It’s Tricky” Stock Market (and Sentiment Results)…

This week I chose the classic 1987 rap song, “It’s Tricky” by Run DMC to embody the current status of the market. They lyrics are self-explanatory:

It’s Tricky, it’s Tricky (Tricky) Tricky (Tricky) Continue reading “The Run DMC, “It’s Tricky” Stock Market (and Sentiment Results)…”