“Crazy Rich Asians” is a 2018 American romantic comedy film directed by Jon M. Chu. The film chronicles a Chinese-American professor who travels to meet her boyfriend’s family and is surprised to discover they are among the richest in Asia. Continue reading “The “Crazy Rich Asians” Stock Market (and Sentiment Results)”

Category: Commentary

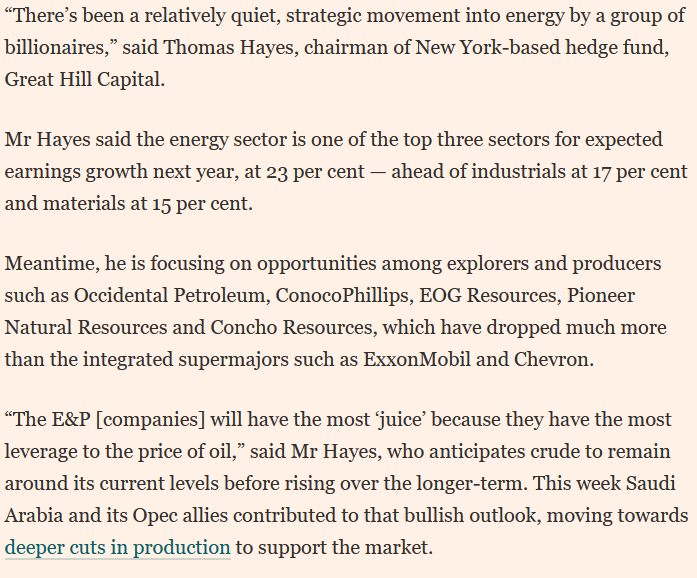

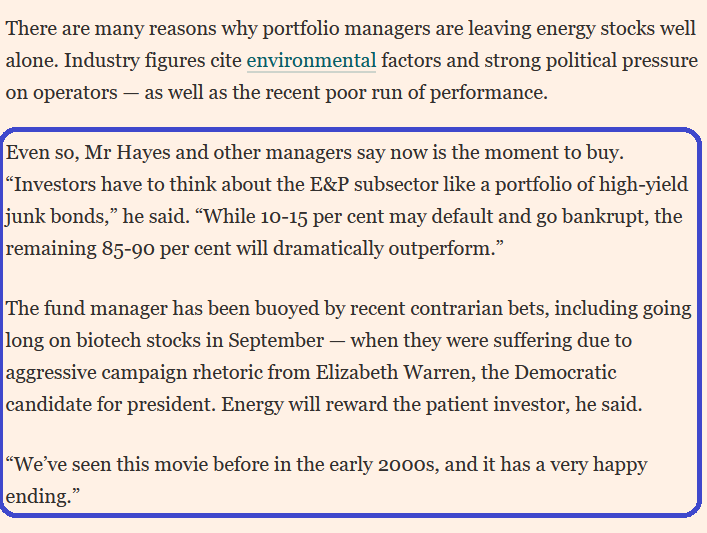

My quotes in the Financial Times today:

Source: Financial Times 12/7/2019 Weekend Edition (link below)

I was quoted in the Financial Times today. Thank you Jennifer! Please check out Jennifer Ablan’s (U.S. Markets Editor) full article, “Big-name US investors take aim at beaten-up energy sector” here:

The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)

In previous weeks we discussed being bullish on the general market over the intermediate term, while recognizing and respecting a short term “overbought” condition that could either be worked off in time (grind sideways) or price (short term pullback) to shake out the “late money” that missed the rally from Aug/Sept lows.

Continue reading “The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)”

My quote in the Financial Times:

I was quoted in the Financial Times today. Thank you Jennifer! Please check out Jennifer Ablan and Eric Platt’s comprehensive article on M&A trends, “US merger rush stirs debate over equities bull market” here:

The Stealers Wheel, “Stuck in the Middle with You” Stock Market (and Sentiment Results)

The Stealers Wheel classic song “Stuck in the Middle with You,” from 1972, was co-written by the group’s guitarist Gerry Rafferty and keyboard player Joe Egan. Continue reading “The Stealers Wheel, “Stuck in the Middle with You” Stock Market (and Sentiment Results)”

The TikTok “Git Up” Stock Market (and Sentiment Results)

This week, nearly every headline was, “TikTok is too Chinese” or “TikTok is not Chinese enough” so I had to take a second to find out what the heck is TikTok? Continue reading “The TikTok “Git Up” Stock Market (and Sentiment Results)”

Fox Business Appearance on Friday (Video)

On “The Claman Countdown” this Friday I discussed Warren Buffett’s additional equity investment in Occidental Petroleum (OXY).

The Lil Nas X – “Old Town Road” Stock Market (and Sentiment Results)

This week we are going to discuss the Stock Market in the context of Lil Nas X’s Billboard #1 hit – “Old Town Road.” In the ever popular lyrics he makes the case: Continue reading “The Lil Nas X – “Old Town Road” Stock Market (and Sentiment Results)”

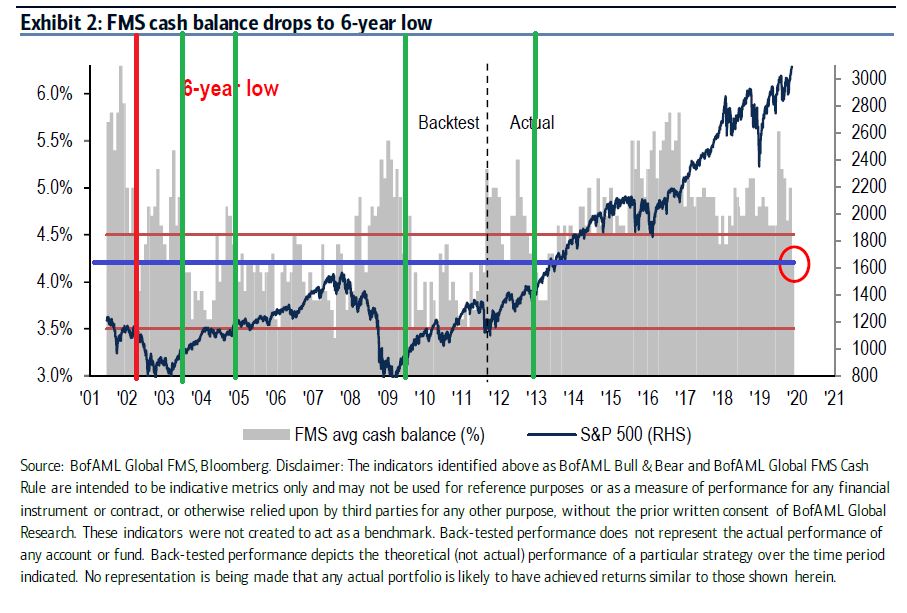

Global Fund Manager Survey (BAML): Bullish or Bearish?

Data Source: Bank of America Merrill Lynch

This morning, the monthly Bank of America Merrill Lynch Global Fund Managers Survey was published. The key point that is being focused on is the fact that cash levels have dropped dramatically in the past 30 days (from 5% to 4.2%). Additionally, equity positioning jumped 20% – to 21% overweight. This was a one year high. Continue reading “Global Fund Manager Survey (BAML): Bullish or Bearish?”

The Katy Perry “Hot ‘N Cold” Stock Market (and Sentiment Results)

In last week’s note on stock market sentiment, we laid out a bullish case over the next 6 months, and simultaneously cautioned against possible mini-shakeouts in the short term designed to take out the late money – that has just joined the party off of the August lows (in recent days/weeks). Continue reading “The Katy Perry “Hot ‘N Cold” Stock Market (and Sentiment Results)”