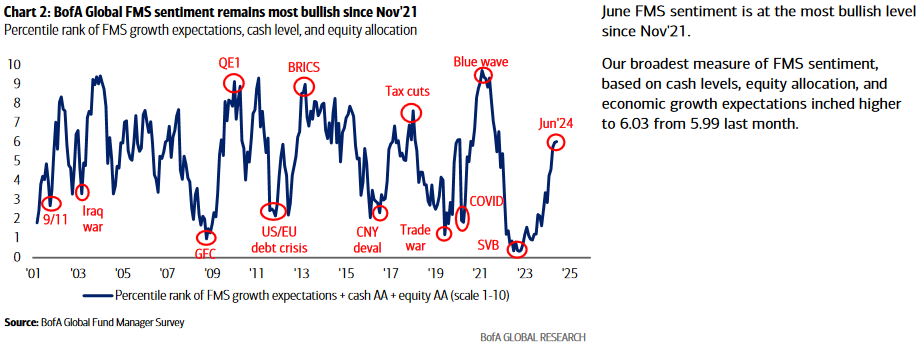

The June survey covered 206 fund managers with $640 billion under management.

Continue reading “June 2024 Bank of America Global Fund Manager Survey Results (Summary)”

Category: Commentary

What I’m Thinking About Now – Stock Market (and Sentiment Results)…

Each week during earnings season we try to update readers on a few of the positions we have discussed in our weekly notes and podcast|videocast(s). Continue reading “What I’m Thinking About Now – Stock Market (and Sentiment Results)…”

Trucks and Towers Stock Market (and Sentiment Results)…

During earnings season we try to cover 1-2 companies we have discussed in previous podcast|videocast(s). Continue reading “Trucks and Towers Stock Market (and Sentiment Results)…”

Should I Be Worried? Stock Market (and Sentiment Results)…

Yesterday I joined Neil Cavuto on “Cavuto Coast to Coast” – Fox Business. Thanks to Neil and Jenna DeThomasis for having me on. In this segment we discussed Markets, the Fed, the American Consumer, Inflation and a lot more. You can watch here: Continue reading “Should I Be Worried? Stock Market (and Sentiment Results)…”

Boring Business Stock Market (and Sentiment Results)…

While most managers/investors like to talk about their winners (in hindsight), we prefer to spend the bulk of our time on ideas that have not yet left the station or are stalling before takeoff. In other words, things we can make money with prospectively versus ideas we have already made big money from. Continue reading “Boring Business Stock Market (and Sentiment Results)…”

BABA Bad or BABA Beautiful? Stock Market (and Sentiment Results)…

Is Alibaba…?

-

The best A.I. play in China right now.

-

The “equivalent to owning a ‘China A.I. ETF.'”

-

The cheapest way to play A.I. globally. Continue reading “BABA Bad or BABA Beautiful? Stock Market (and Sentiment Results)…”

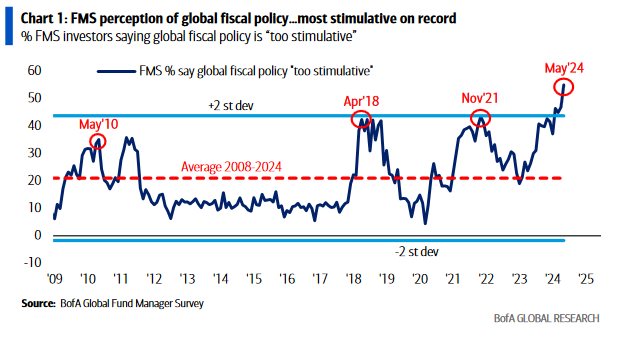

May 2024 Bank of America Global Fund Manager Survey Results (Summary)

Are you Mad or Glad? Stock Market (and Sentiment Results)…

During earnings season we try to cover 1-2 companies we have discussed in previous podcast|videocast(s). This week, Cooper Standard (CPS) reported results. We originally initiated this position in May of 2022 ~$5.50. You can see our original and time-stamped historic commentary in our note last quarter here.

Continue reading “Are you Mad or Glad? Stock Market (and Sentiment Results)…”

Powell’s, “Let There Be Light” Stock Market (and Sentiment Results)…

image source: Reddit

Chair Powell came to play yesterday and the market liked it. Is this the bottom in the short term 3-8% pullback we started calling for in Q1 on our podcast|videocast(s)?

Continue reading “Powell’s, “Let There Be Light” Stock Market (and Sentiment Results)…”

More Work To Do? Stock Market (and Sentiment Results)…

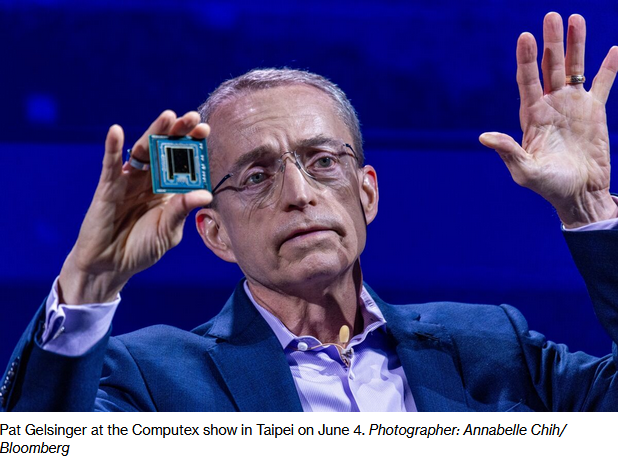

As I stated in recent weeks’ podcast|videocast(s), we continue to maintain 100% of our tactical semiconductors short/hedge and added a “long bonds” TLT call spread (out of our derivative bucket). The combined positions have EV (expected max value) of between 5x-8.45x.

When we zoomed out weeks ago, it was our view that the semiconductor sector had gotten a bit ahead of itself – in the short term. When everyone starts chasing the same “shiny objects” pain is bound to come. It’s has: Continue reading “More Work To Do? Stock Market (and Sentiment Results)…”