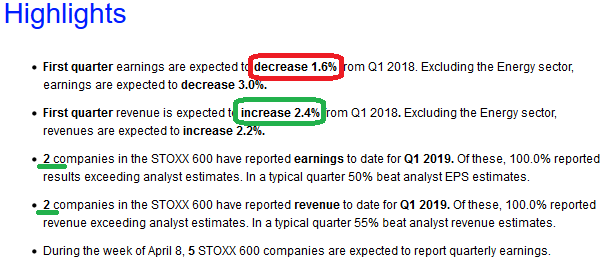

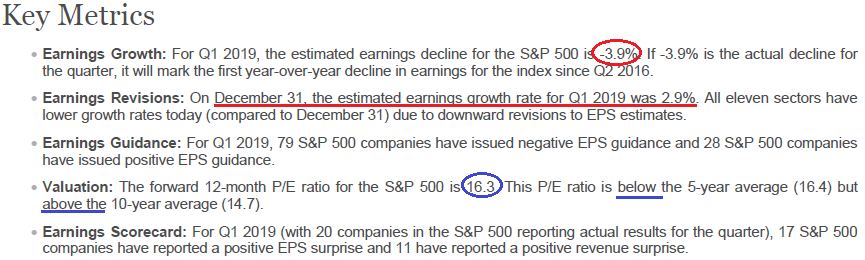

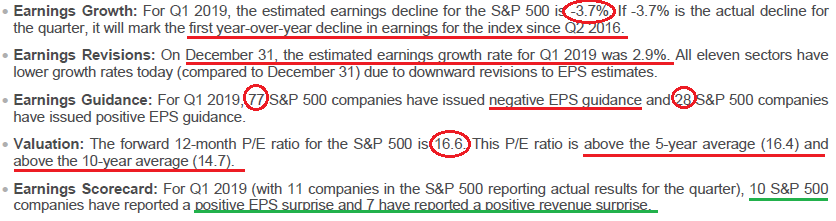

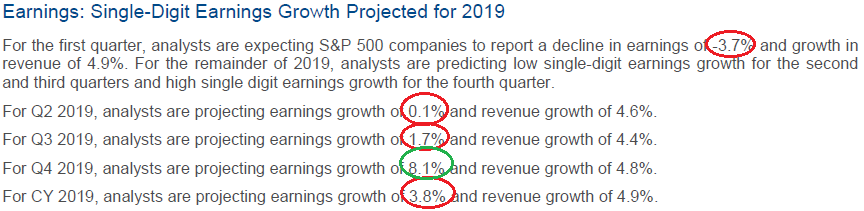

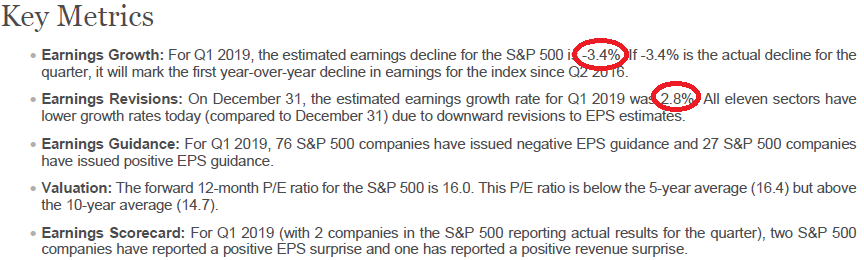

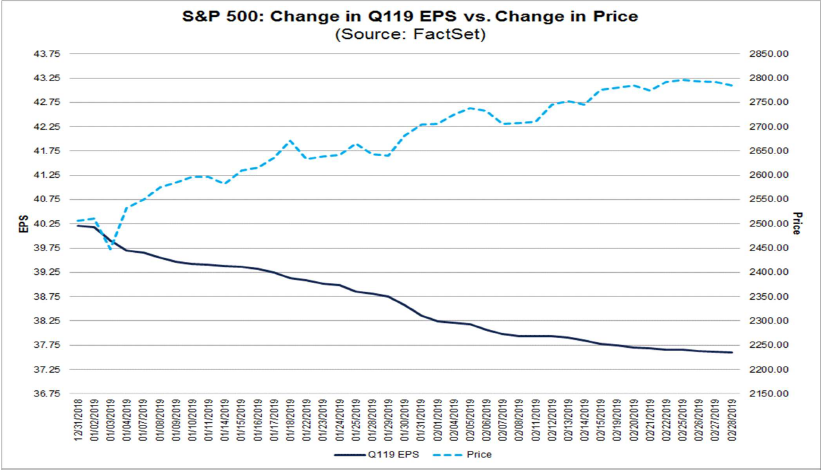

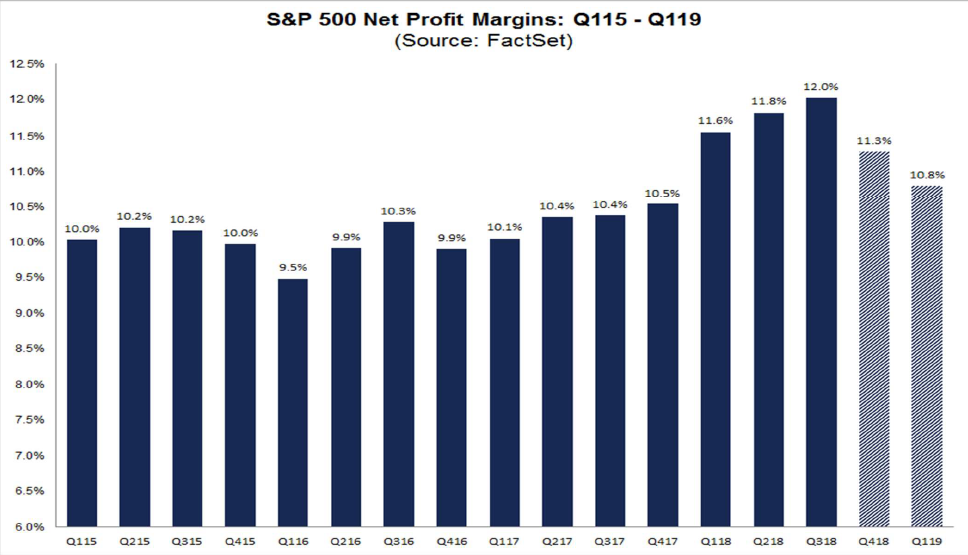

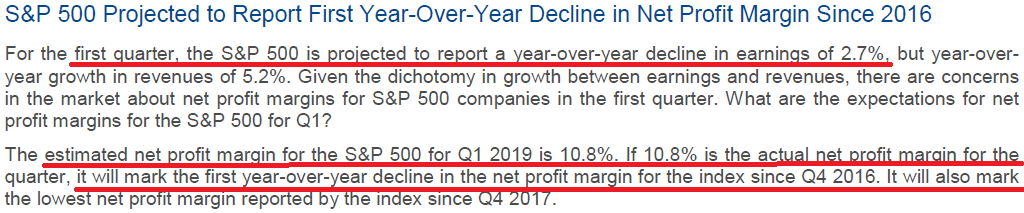

Not much has changed in the last couple of weeks on the earnings front (expectations have dropped from -3.4% to -3.7%). The good news is that Q1 2019 earnings expectations are very low and will likely be beaten. The risk (in my view) as laid out in this article I wrote 2 weeks ago is if Q1 2019 S&P 500 operating earnings come in below $34.98 (Q4 2018 Operating Earnings).

Yield Curve vs. Earnings: Bull vs. Bear DEATH MATCH!

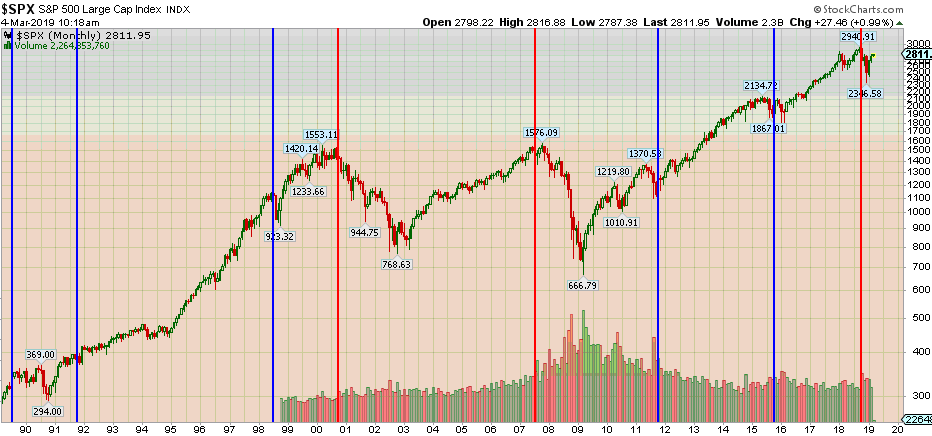

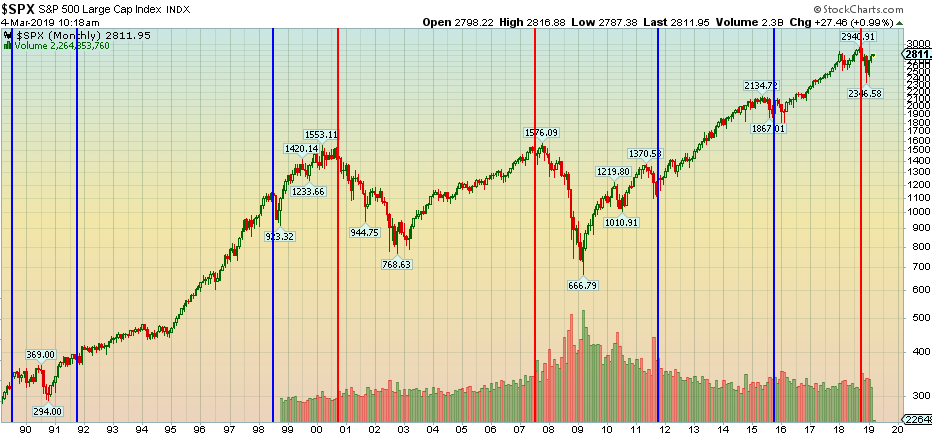

If we get a second quarter of sequential operating earnings drop, it would potentially signal an underlying deterioration in the economy last seen only in 2007 and 2000 (and preceded major lower lows in the stock market). I do not think we will get a 2nd sequential drop in Operating Earnings (Q4 2018 to Q1 2019) but it will come in close.

If we avoid the second sequential drop in operating earnings (which would require a > 4.26% drop in operating earnings yoy), that would imply the lows of December should hold for some time and if past is any prologue the peak of the market should be 1.5-2yrs after the 2yr Treasury and 10yr Treasury inverts (getting close).

Factset: “The percentage of companies issuing negative EPS guidance is 73% (77 out of 105). This percentage is above the 5-year average of 70%, as more companies have issued negative EPS guidance than average and fewer companies have issued positive EPS guidance than average. At the sector level, the Information Technology and Health Care sectors are the main contributors to the above average negative sentiment in EPS guidance for the first quarter.”

Earnings guidance for 2019 remains aggressively back-end loaded (factset):

As I said in the above-posted article Q1 earnings will be “make or break” for the market. Expectations are extremely low which creates the possibility for positive surprise but we don’t count our chickens before they hatch.