When our eldest daughter Mimi (Madeline) was 2 (she’s now 8), she would go into uncontrollable crying fits when we would drive around in the car… Continue reading “The “Build Me Up Buttercup” Stock Market (and Sentiment Results)…”

Category: Sentiment

The Cobra Kai “Sweep The Leg” Stock Market (and Sentiment Results)…

If you have logged into Netflix lately, they have a new series out called, “Cobra Kai.” Continue reading “The Cobra Kai “Sweep The Leg” Stock Market (and Sentiment Results)…”

The Scott McCreery, “In-Between” Stock Market (and Sentiment Results)…

The song we chose this week – to embody the sentiment of the stock market – is Country Star Scott McCreery’s song, “In-Between.” Continue reading “The Scott McCreery, “In-Between” Stock Market (and Sentiment Results)…”

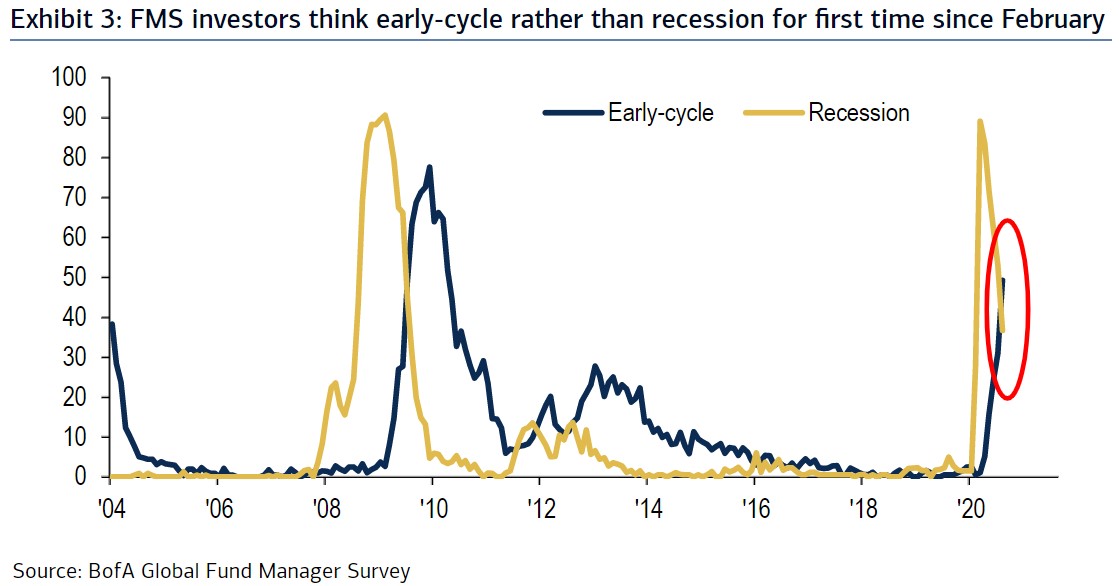

September Bank of America Global Fund Manager Survey Results (Summary)

~224 Managers overseeing >$600B AUM responded to this month’s BofA survey. Continue reading “September Bank of America Global Fund Manager Survey Results (Summary)”

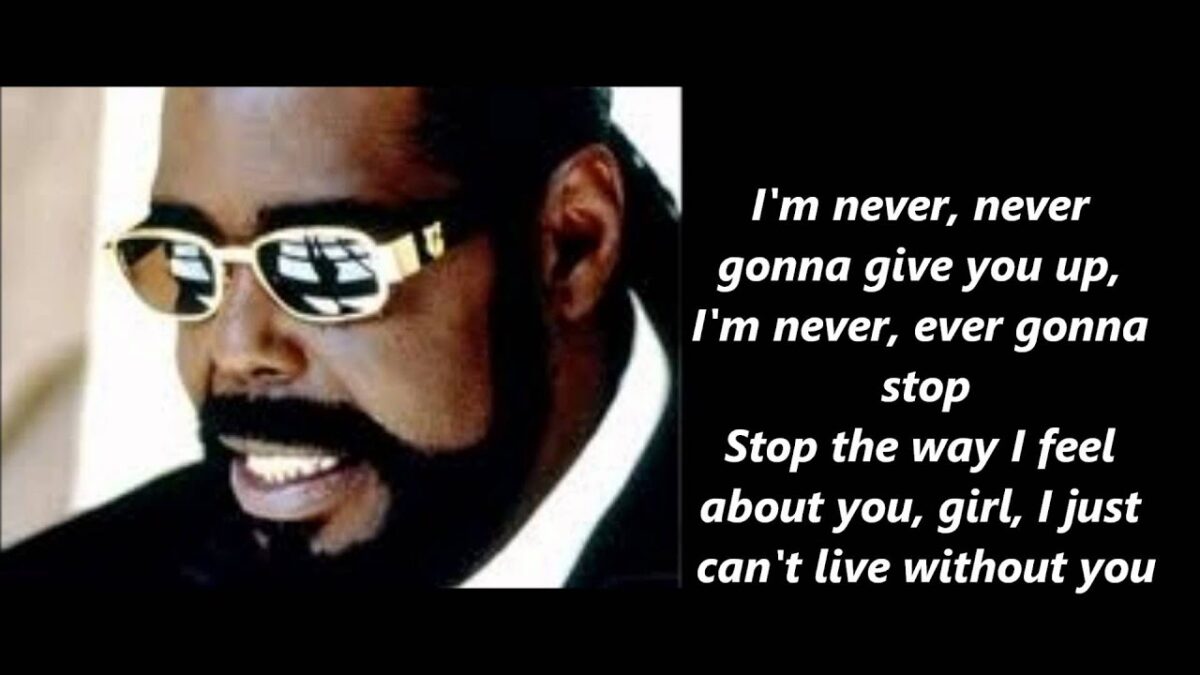

The Barry White, “Never Gonna Give You Up” Stock Market (and Sentiment Results)…

This shortened Holiday Week, the song we chose to embody Stock Market sentiment is Barry White’s, “Never Gonna Give you Up.” Continue reading “The Barry White, “Never Gonna Give You Up” Stock Market (and Sentiment Results)…”

The Run DMC, “It’s Tricky” Stock Market (and Sentiment Results)…

This week I chose the classic 1987 rap song, “It’s Tricky” by Run DMC to embody the current status of the market. They lyrics are self-explanatory:

It’s Tricky, it’s Tricky (Tricky) Tricky (Tricky) Continue reading “The Run DMC, “It’s Tricky” Stock Market (and Sentiment Results)…”

The Stevie Wonder, “Faith” Stock Market (and Sentiment Results)…

If you don’t have 6 and 8 year old daughters like I do, you may not be aware that Stevie Wonder recorded a song called “Faith” (with Ariana Grande) in 2016, for the musical animated film “Sing.” The lyrics from his song that embody the sentiment of this week’s stock market (and its participants) are: Continue reading “The Stevie Wonder, “Faith” Stock Market (and Sentiment Results)…”

The Lionel Richie “Dancing on the Ceiling” Stock Market (and Sentiment Results)…

This week we chose Lionel Richie’s classic song, “Dancing on the Ceiling” to embody the sentiment of the Stock Market. The salient lyrics are as follows: Continue reading “The Lionel Richie “Dancing on the Ceiling” Stock Market (and Sentiment Results)…”

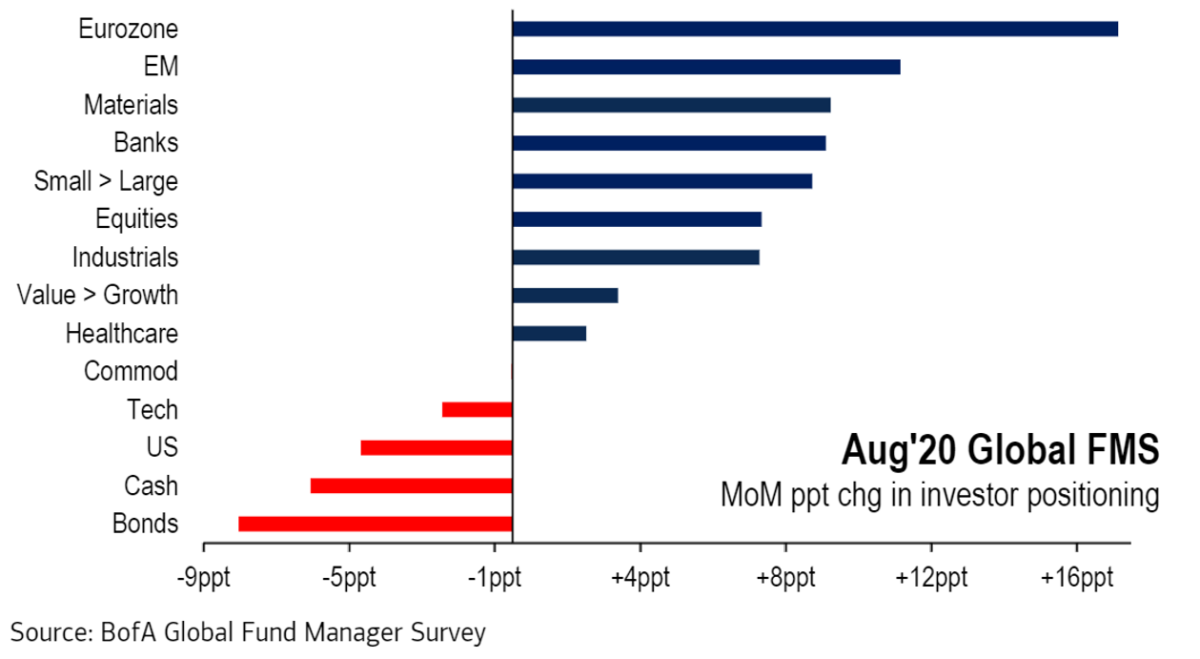

August Bank of America Global Fund Manager Survey Results (Summary)

~200 Managers overseeing $500B AUM responded to this month’s BofA survey. Continue reading “August Bank of America Global Fund Manager Survey Results (Summary)”

The Gordon Gekko, “Gridlock is Good” Stock Market (and Sentiment Results)…

Each week, I usually choose a song that embodies the theme of the Stock Market. This week, I chose a character that Wall Street knows all too well, Gordon Gekko (from the 1987 classic film Wall Street). Continue reading “The Gordon Gekko, “Gridlock is Good” Stock Market (and Sentiment Results)…”