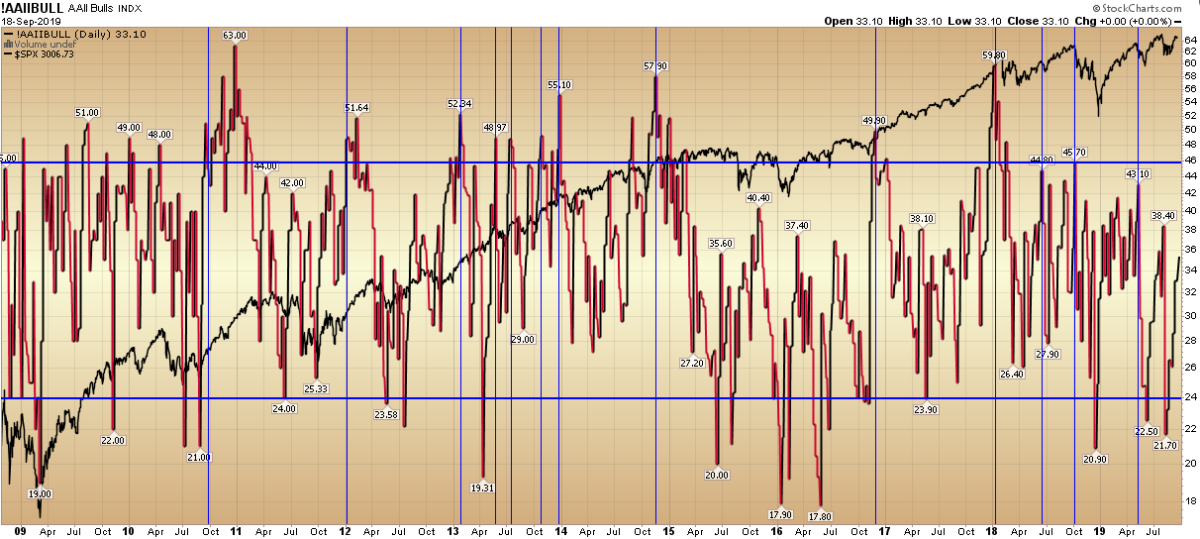

This week, AAII Sentiment Survey results edged up from 33.13% Bullish Percent to 35.34%. Since mid-August we had been suggesting stepping in as buyers of stocks when everyone else was selling and rushing to bonds. Continue reading “AAII Sentiment: Is this it?”

Category: Sentiment

AAII Sentiment Survey Results: Bulls Awakening from Siesta…

Over the past few weeks we have suggested stepping in as a buyer when everyone else was selling stocks and running into bonds. Continue reading “AAII Sentiment Survey Results: Bulls Awakening from Siesta…”

AAII Sentiment Survey Results: Pessimism Strong, Opportunity Stronger…

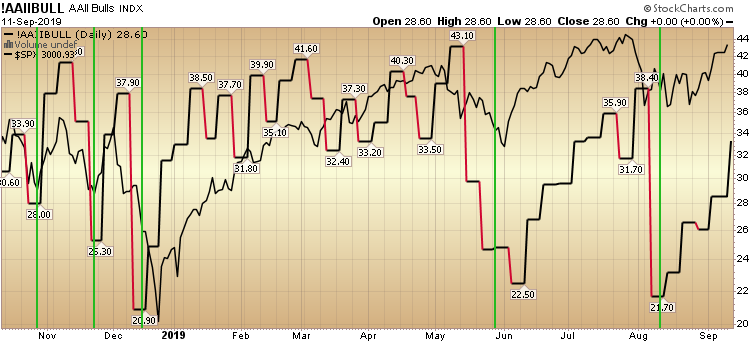

This week the AAII Sentiment Survey results came in slightly improved from last week. Bullish sentiment rose from 26.13% to 28.64% and Bearish Sentiment is beginning to thaw (dropping from 42.21% to 39.51%), but there is still a long runway of opportunity before euphoria starts to take hold – at which time we would become cautious. Continue reading “AAII Sentiment Survey Results: Pessimism Strong, Opportunity Stronger…”

AAII Sentiment Results: Pessimism Persists, Opportunity Abounds (Part Deux)

In the last two weeks we made the case that with Bullish Percent so low (now 26.13%) and Bearish Percent high (now 42.21%), history favors stepping in as a buyer – when everyone else is fearful (and underweight equities). Continue reading “AAII Sentiment Results: Pessimism Persists, Opportunity Abounds (Part Deux)”

AAII Sentiment Results: Pessimism Persists, Opportunity Abounds…

Last week we said sentiment was “As Good As it Gets” from a historical perspective to step in and buy. Continue reading “AAII Sentiment Results: Pessimism Persists, Opportunity Abounds…”

AAII Sentiment Survey Results: As Good As It Gets…

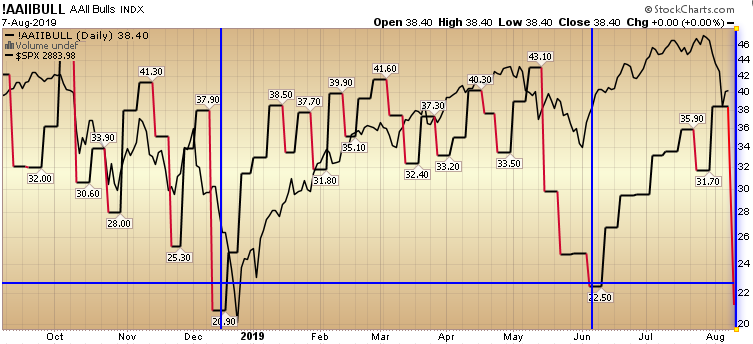

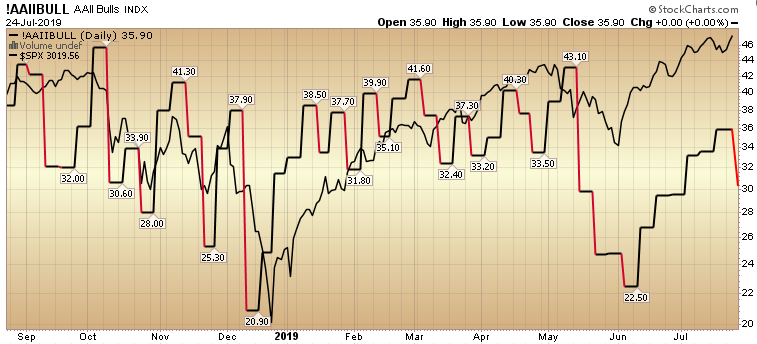

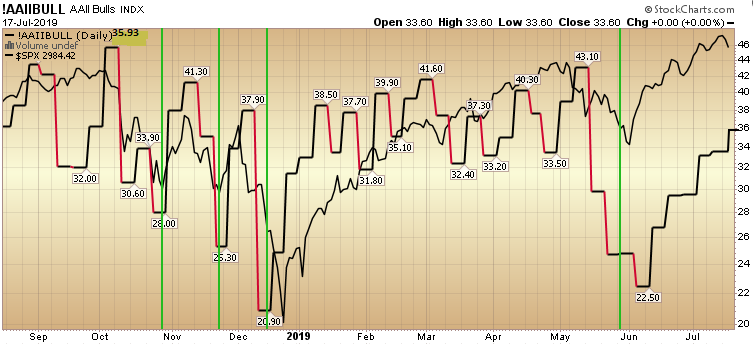

Last week we laid out the case that the AAII Sentiment Survey results were as stretched to the downside as they were a week or so before the bottom in December – and that while there could be some residual market/headline risk in the coming week – the bottom in sentiment was in (i.e. it was about as bearish as you could get – and a good environment to start to buy the fear even if you would take a bit of short term pain for intermediate term gain). Continue reading “AAII Sentiment Survey Results: As Good As It Gets…”

AAII Sentiment Survey Results: What a Difference a Week Makes…

Source: AAII

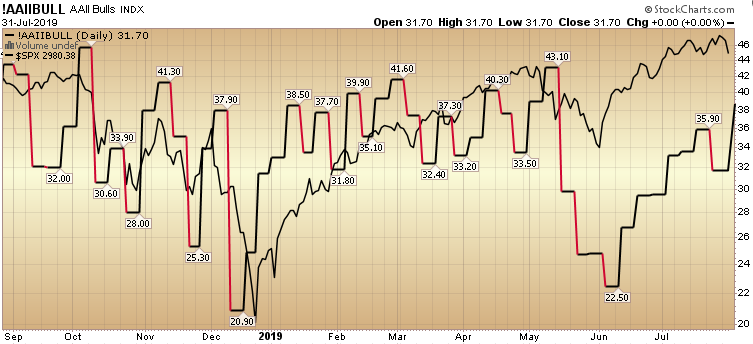

Last week we had hit full complacency levels on the Bearish Percent which had plummeted down to 24.06%. We did not however get to euphoric levels of bullishness – coming in a couple of percent shy at 38.44%. What a difference a week makes: Continue reading “AAII Sentiment Survey Results: What a Difference a Week Makes…”

AAII Sentiment Survey Results: Getting up there…

While bullish sentiment jumped in the past week from 31.74% to 38.44%, we likely still have a little room to run. This is not the level that I would be aggressively adding risk (only selectively on laggard names that haven’t participated – if at all). In the lexicon of sell side analysts we are at a “hold.” Continue reading “AAII Sentiment Survey Results: Getting up there…”

AAII Sentiment Survey Results: The Most Hated Rally…

Last week I said, “Until the bears fully capitulate, the market can keep climbing…” Continue reading “AAII Sentiment Survey Results: The Most Hated Rally…”

AAII Sentiment Survey Results: Slowly Climbing the Wall of Worry

Data Source: AAII

While the market indices all made new highs this week, sentiment did not. This is a hated rally because most institutions were caught offsides in May/June and raised too much cash. Continue reading “AAII Sentiment Survey Results: Slowly Climbing the Wall of Worry”