Short Term Pain (maybe)?

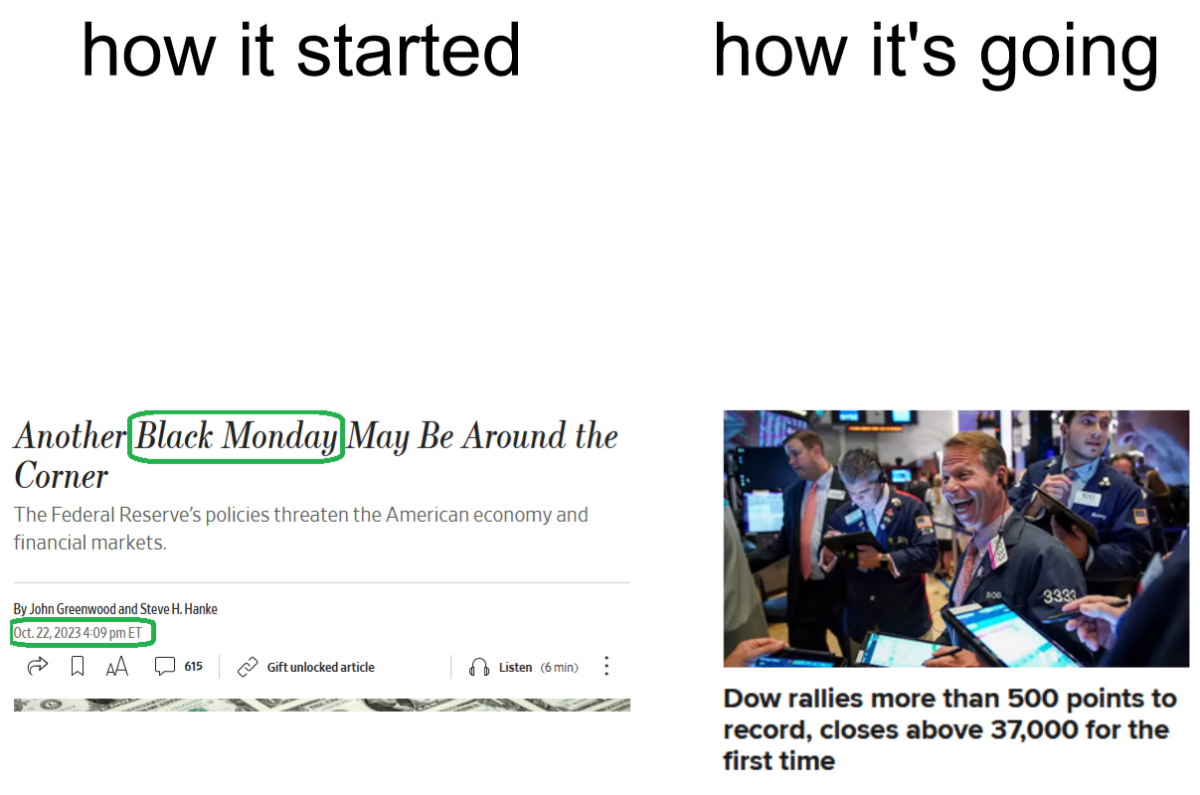

Yesterday’s sell-off in equity markets coincided with another weak Treasury bond auction. That minor catalyst was compounded by the low liquidity of holiday markets.

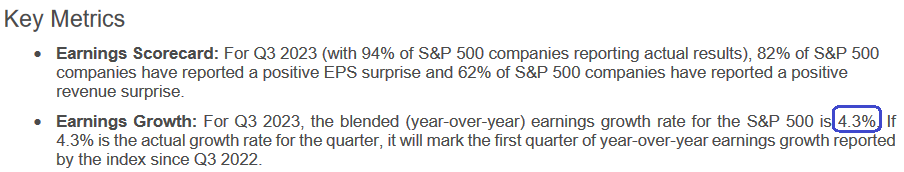

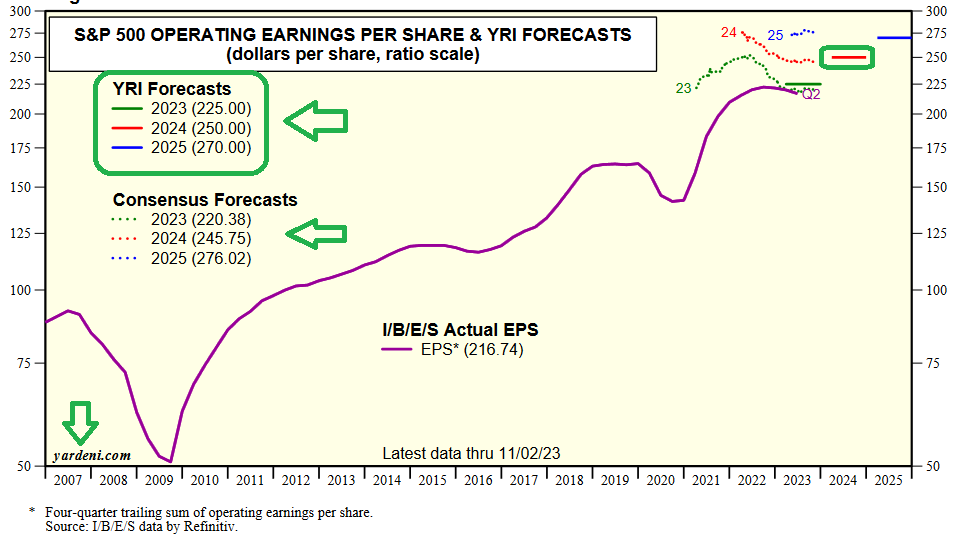

Friday’s Core PCE inflation numbers should put the final nail in the coffin for any Fed Cut doubters. I doubt you will see any more officials paraded out (with a straight face) to try to walk back Powell’s dovish pivot after Friday’s print.

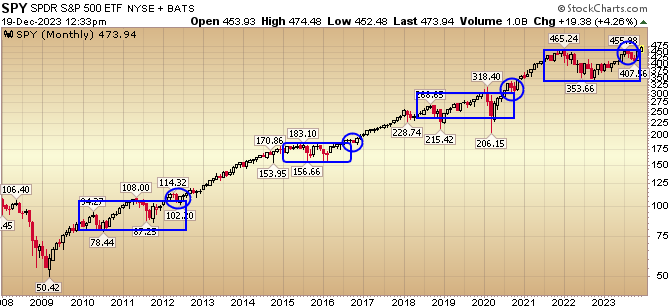

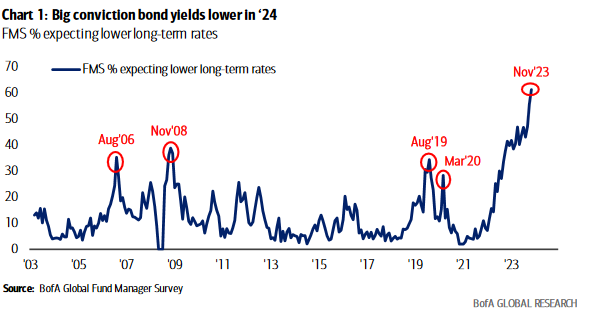

There is good instinct from many market participants that we’ve come “too far, too fast” – in recent weeks – and must now have a correction. They are probably right – to a degree… Here’s what they are looking at: Continue reading ““Rally Over or Just Beginning?” Stock Market (and Sentiment Results)…”