Skip to content

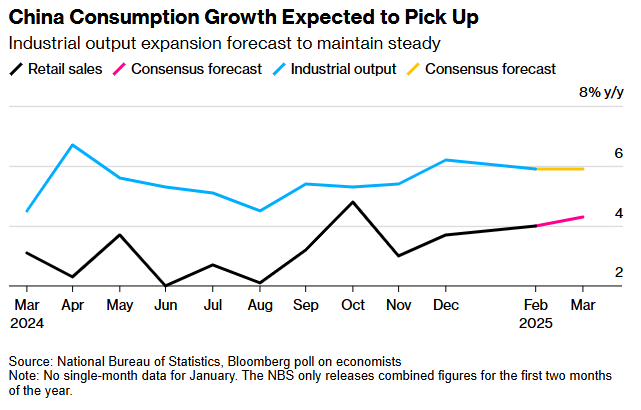

China’s Economy Likely Grew 5.2% in Months Before US Tariffs ( bloomberg ) Alibaba-Backed AI Startup Zhipu Targets IPO as Soon as 2025 ( bloomberg ) Barclays maintains Alibaba stock Overweight with $180 target ( investing ) China Limits Stock Sales To Maintain Impression Of Stability, As Bessent Hints At Boosting Treasury Buybacks If Fed Does Nothing ( zerohedge ) Tariff Reprieve Is Grand Slam For Markets ( chinalastnight ) Ford and GM Stocks Pop After Trump Says He’s Looking at Auto Tariff Pause ( barrons ) Stock Investors Cheer Tariff Exemptions ( wsj ) ‘Good chance’ of U.K.-U.S. trade deal, JD Vance says, as Trump ‘really loves’ Britain ( cnbc ) Japan Tariff Team Aims for Early Results From US Negotiations ( bloomberg ) Honda to make 90% of US sales locally by relocating Mexico, Canada production, Nikkei reports ( reuters ) Goldman Sachs chief optimistic Trump will listen to corporate America ( ft ) Bessent Says Treasury Has Big Toolkit If Needed for Bonds ( bloomberg ) Dark days for the less-mighty dollar ( ft ) Manufacturing and the Dollar ( wsj ) The Mag 7 Still Aren’t Cheap. These Stocks Are Better Plays. ( barrons ) 10 Best Blue-Chip Stocks to Buy for the Long Term ( morningstar ) This Chemicals Stock Looks Like a Buy Now, Analyst Says. Thank Tariffs. ( barrons ) Investors Haven’t Been This Bearish in 30 Years, BofA Poll Shows ( bloomberg ) Fund managers have never turned so pessimistic this quickly on U.S. stocks, a survey finds ( marketwatch ) China Orders Boeing Jet Delivery Halt as Trade War Expands ( bloomberg ) UK Consumer Spending Remains Strong in Boost for Growth Hopes ( bloomberg ) Global electric vehicle sales up 29% in March, researchers find ( reuters ) Intel Stock Is Rising on Altera Sale Deal. What It Needs to Do Next. ( barrons ) Intel’s new CEO isn’t wasting time trying to enact a turnaround ( marketwatch ) Nvidia to produce AI servers worth up to $500 billion in US over four years ( reuters ) Lowe’s Bets on Pro Market in Billion-Dollar ADG Acquisition (barrons )

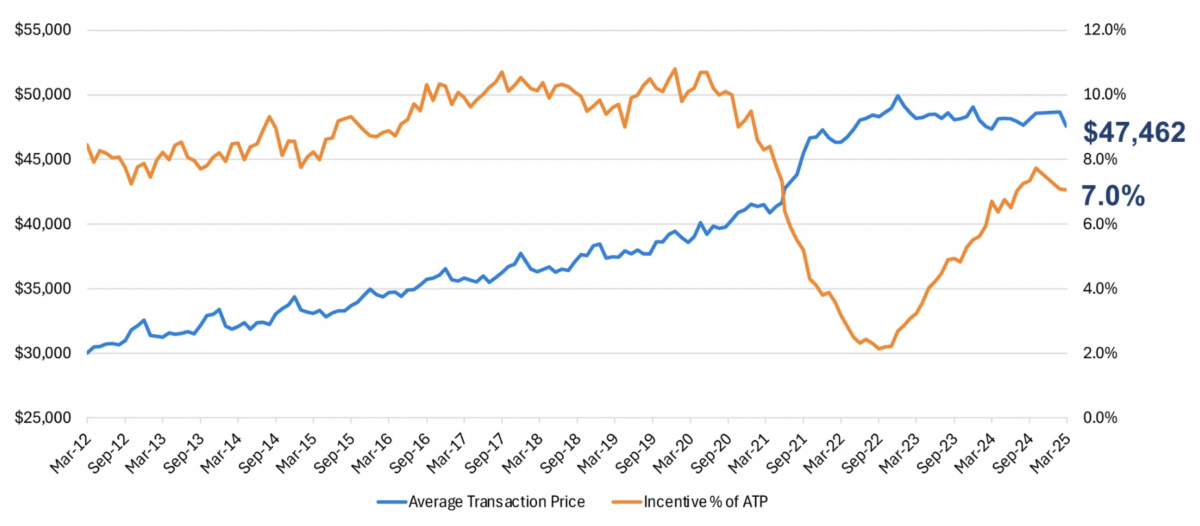

Intel to sell 51% stake in Altera to Silver Lake ( reuters ) Trump spares smartphones, computers, other electronics from China tariffs ( reuters ) China launches all-out effort to boost consumption as US trade war boils over ( scmp ) Alibaba steps up AI adoption in auto industry with Nio, BMW deals ( scmp ) China’s Stock Rescue in Full Swing as ETF Inflows Hit Record ( bloomberg ) China’s Exports Surge as Orders Front-Loaded Before Tariffs ( wsj ) U.S. Stocks Downgraded on Tariffs Risk. Where Citi Says to Invest Instead. ( barrons ) Investors look to Europe as US market confidence wanes ( yahoo ) Bruised dollar languishes near three-year lows on tariff anxiety ( streetinsider ) Dollar Fears Grow as Traders Increase Hedges to Five-Year High ( bloomberg ) Fundstrat’s Tom Lee: Good stock opportunities emerging despite market zigzags ( youtube ) How the U.S. Lost Its Place as the World’s Manufacturing Powerhouse ( wsj ) Average new car price held steady in March, but pre-tariff inventory is selling fast ( marketwatch ) Pfizer Halts Development of Weight-Loss Pill ( wsj ) Rory McIlroy Wins the Masters to Complete a Career Grand Slam (wsj )

If Wall Street CEOs See a Recession, Their Guidance Isn’t Showing It. Yet. ( barrons ) Trump exempts smartphones, laptops, and semiconductors from new tariffs ( techcrunch ) China’s March Lending Jumped on Government Stimulus Push ( wsj ) Can China fight America alone? ( economist ) Trump’s Tariffic Mistake ( scottgrannis ) The tricky task of calculating AI’s energy use ( economist ) Alibaba’s Quark surpasses ByteDance’s Doubao, DeepSeek as China’s top AI app ( scmp ) Intel Is Retooling Its Board. Big Changes Could Come in May. ( barrons ) Etsy marries AI and human touch with curated collections ( yahoo ) Logistics giant GXO is going big on humanoid robots ( businessinsider ) PayPal Teams With Will Ferrell To Promote Updated Pay-Later Program ( pymnts ) Kelley Blue Book Report: New-Vehicle Prices Hold Steady in March As Sales Increase Ahead of Anticipated Tariff-Driven Price Hikes ( coxauto ) U.S. Electric Vehicle Sales Increase More Than 10% Year Over Year in Q1: GM Drives EV Growth While Tesla Declines ( coxauto ) Housing market inventory is rising just about everywhere—just look at this map ( fastcompany ) Is This Finally Rory McIlroy’s Moment at the Masters? ( wsj ) Masters 2025: Rory vs. Bryson could join these final-round showdowns among Augusta’s all-time greatest (golfdigest )

Trump Has a $350 Billion Deal for Europe: Buy Our Energy ( wsj ) Trump pushes trade partners to buy more U.S. energy as a way to avoid higher tariffs ( cnbc ) Trump optimistic on reaching deal with China, White House says ( reuters ) China Raises Tariffs on the U.S. Again. Currencies Are a New Concern. ( barrons ) China Market Update: China ADR Delisting ‘Sources’ Ignore Facts ( forbes ) Some Americans are stockpiling $220 sneakers before Trump’s tariffs raise prices even higher ( marketwatch ) Cheap things from China are poised to get pricey. Secondhand retailers are ready to take advantage ( cnn ) Wall Street’s Best Hope to End Trump’s Global Trade War Is One of Its Own ( wsj ) What’s the Basis Trade and What Role Did It Play in Market Volatility? ( bloomberg ) The Simple Explanation for This Week’s Treasury Market Mayhem ( wsj ) Long-Term Treasury Bond Yields Are Spiking. Why It Won’t Last. ( barrons ) Federal Reserve ‘absolutely’ ready to help stabilise market if needed, top official says ( ft ) How One of the Wildest Weeks in Market History Unfolded ( wsj ) America’s Heartland Is Coming Back. Can the Recovery Last? ( barrons ) 22 Best Healthcare Companies to Invest In ( morningstar ) Nobody Knows (Yet Again) (oaktree )

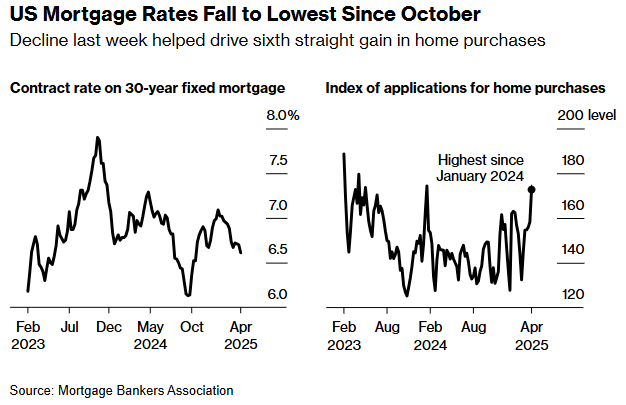

Why We Think the Market’s Outlook for Housing Stocks Is Overly Bearish ( morningstar ) US Mortgage Rates Fall for Third Week to Lowest Since December ( bloomberg ) 30-Year Treasury Auction Showed Strong Demand. What It Means for the Bond Market. ( barrons ) Dollar Slides to Multiyear Lows as U.S.-China Tariff War Escalates ( wsj ) Trump Team Races to Cut Piecemeal Tariff Deals With More Than 70 Countries ( wsj ) Bessent Emerges as Wall Street Man-of-the-Hour Trade Negotiator ( bloomberg ) Einhorn Says Tariff ‘Attacks’ to Force More Fed Cuts This Year ( bloomberg ) White House Official Says More Than 15 Countries Have Made Trade Deal Offers ( zerohedge ) Vietnam Envoy Meets Bessent, Lutnick to Push Trade Deal ( bloomberg ) US power use to reach record highs in 2025 and 2026, EIA says ( reuters ) Forget the Market Roller Coaster. Theme-Park Stocks Could Be a Tariff Beater ( barrons ) Wall Street Pulls Back on the Weight-Loss Drug Hype ( barrons ) Market Rout Shatters Long-Held Beliefs on Investing ( wsj ) UK Growth Surges as Factories Boost Output Before US Tariffs ( bloomberg ) Stifel maintains GXO stock Buy rating, $66 target amid acquisition delay ( investing ) PayPal Doubles Down on Checkout and Pay Later with New Will Ferrell Campaign and Biggest Sweepstakes Ever ( investing ) 2 Countries in Trump’s Tariff Crosshairs Are Bargains. You’ll Be Surprised. ( barrons ) China’s Tech Giants Move to Support Exporters as Trade Tensions Rise ( wsj ) Shein’s Bargain-App Formula Crumbles Under Trump ( wsj ) Alibaba’s Jack Ma Wants AI to Serve, Not Lord Over, Humans ( bloomberg ) China Stocks Extend Gains as Stimulus, Deal Hopes Get Upper Hand ( bloomberg ) China unlikely to aggressively devalue yuan to offset impact of U.S. tariffs, economists say (cnbc )

‘This Is a Great Time to Buy’: Tariff Pause Sparks Historic Rally ( wsj ) Trump Pauses ‘Reciprocal’ Tariffs, but Hits China Harder ( wsj ) The U.S. and China Are Still in a Trade War. Here’s How Much Business They Do. ( wsj ) Trump Ups the Tariffs Ante on China. What Moves Beijing Has Left. ( barrons ) European Union to put countermeasures to U.S. tariffs on hold for 90 days ( cnbc ) Ray Dalio says Trump should negotiate a ‘win-win’ trade deal with China ( cnbc ) As U.S. Buyers Cancel Orders, Chinese Factories Say No More Discounts ( wsj ) Taiwan Aims to Triple US Share of LNG to Avoid Tariffs ( bloomberg ) Vietnam, US to Start Trade Deal Talks After 46% Tariff Pause ( bloomberg ) Trump’s latest China move called ‘art of the deal’ masterstroke ( streetinsider ) EU weighs buying more US gas due to Trump tariff pressure ( ft ) China Leaders to Meet on Stimulus After Trump’s Tariff Shock ( bloomberg ) China’s Stock Investors Show Faith in Beijing as Trump Ups Ante ( bloomberg ) Jack Ma’s Alibaba Cloud visit a sign of support as tech giant accelerates adoption of AI ( scmp ) Largest Southbound Connect Buying EVER In Hong Kong: Alibaba & Tencent Significant Benefactors ( chinalastnight ) China musters ‘national team’ to fight on front line in trade war ( ft ) US tripling of small-package duties delivers further blow to Shein and Temu ( ft ) AI Data Center Growth Means More Coal and Gas Plants, IEA Says ( bloomberg ) Is the US power grid ready to meet the demands of data centres? ( ft ) Texas Is Ground Zero for the US Battery Boom ( bloomberg ) PC Shipments Jumped Most In Years Ahead Of Tariff Blitz ( zerohedge ) Behind Stocks’ Big Bounce: Sudden Short Covering, Low Liquidity ( bloomberg ) Bond Market Calms as 10-Year Treasury Auction Sees ‘Very Strong’ Demand ( barrons ) Boeing Stock Takes Off as Trump Mitigates Tariff Risk ( barrons ) Vietjet signs $300 million finance deal, in talks to expand order with Boeing ( investing ) Bernstein maintains Disney stock Outperform with $120 target ( investing ) Why Dividend Stocks Are the Ones to Buy in Periods of Turmoil ( barrons ) Retail investors started to favor S&P 500 put options. Then the market surged. (marketwatch )

Investors Fear Another Big Blowup of Basis Trade as Treasuries Lose Haven Status (bloomberg ) Weekly mortgage demand jumped 20% last week, as tariff volatility briefly tanked rates ( cnbc ) US Mortgage Rates Drop to Lowest Since October, Spurring Demand ( bloomberg ) US houses are shrinking as inflation pushes ‘McMansions’ out of reach ( ft ) Tariffs Are Coming for the AI Boom ( wsj ) Trump Must Deregulate U.S. Energy to Unleash AI Dominance ( wsj ) Traders boost bets Fed will start cutting rates in May ( reuters ) Companies’ rush to promise new US factories threatened by Trump tariff chaos ( ft ) Asian Nations Promise to Buy More US Gas to Win Tariff Relief ( bloomberg ) South Korea Eyes ‘Big’ Trade Deal After Long Awaited Trump Call ( bloomberg ) Vietnam’s deputy PM to meet US’s Bessent, Boeing on Wednesday, schedule shows ( reuters ) India Says Tariff Strategy Is to Seek US Trade Deal ( bloomberg ) The Treasury basis trade rears its head again ( ft ) Record-Breaking $1 Trillion Defense Budget: Trump, Hegseth Say It’s Happening ( zerohedge ) Boeing Closes In on Airbus With Strong First-Quarter Deliveries ( bloomberg ) Boeing deliveries in March jump by 41% compared to a year earlier ( reuters ) Pfizer Stock’s Fall to ’97 Level Lifts Yield Near 8%. Dividend Looks Safe. ( barrons ) Honeywell and 11 Other Stocks to Considering Buying After the Tariff Turmoil ( barrons ) If Tariff Deals Happen, These Stocks Could Pop ( barrons ) The 10 Best Dividend Stocks ( morningstar ) Disney Offers Discounts, Shows as New Universal Theme Park Looms ( bloomberg ) Alibaba executive sees ‘explosive growth’ in AI applications in China in 2025 ( scmp ) National Team Cavalry Arrives ( chinalastnight ) China slaps 84% retaliatory tariffs on U.S. goods in response to Trump ( cnbc ) Chinese Stocks Bounce Back as Stimulus Bets Counter Tariff Blow ( bloomberg ) China Has Readied a Trade-War Arsenal That Takes Aim at U.S. Companies ( wsj ) China Auto Sales Rose Sharply in March on Subsidies, Softer Price Competition (wsj )

Scott Bessent says up to 70 nations want to negotiate over Trump’s tariffs ( foxbusiness ) Musk made direct appeals to Trump to reverse new tariffs, Washington Post reports ( reuters ) Bessent Sees ‘Good Deals’ Potential as US Works Priority List ( bloomberg ) Top Vietnam Official Rushes to Washington for Talks on Trade ( bloomberg ) Bessent Says Everything Is on Negotiating Table With Tariffs ( bloomberg ) Can companies exploit differences between Trump’s tariff rates? ( ft ) Vietnam to buy US defence, security products to tackle trade gap ( reuters ) Watch CNBC’s full interview with Treasury Secretary Scott Bessent ( youtube ) The False Tariff Headline That Sent Stocks on a $2 Trillion Ride ( wsj ) Some US consumers stockpile goods ahead of Trump’s new tariffs ( reuters ) Levi’s Earnings Beat Forecasts. Tariffs to Have ‘Minimal Impact’ This Quarter. ( barrons ) “Risk-Reward is Skewed To The Upside”: Goldman Traders Turn Bullish ( zerohedge ) Hedge funds pile up record short bets against stocks as traders go into ‘self-protection mode’ ( cnbc ) US Stock Market Outlook: From ‘Priced to Perfection’ to Time to Buy ( morningstar ) 3 Reasons for Hope as the Market Selloff Continues ( barrons ) 124 Stocks Hit Undervalued Territory in Tariff Selloff ( morningstar ) 3 Stocks to Buy and Hold During Tariff Chaos ( morningstar ) Bank of America, Chewy, and 16 More Stocks to Help You Hide From Tariff Chaos ( barrons ) Alibaba Chases International AI Users With New Qwen Upgrades ( bloomberg ) DeepSeek, Alibaba help China narrow gap with US in leading AI models: Stanford report ( scmp ) China state firms pledge to boost share purchases to calm markets ( reuters ) China Traders Boost Monetary Easing Bets as Tariffs Roil Markets ( bloomberg ) China’s Record Equity Risk Premium Bodes Well for State Buying ( bloomberg ) China Readies Policies To Counter Tariffs ( chinalastnight ) Many U.S. Companies Plan to Keep China Ties, Survey Finds ( wsj ) Americans Have $35 Trillion in Housing Wealth—and It’s Costing Them ( wsj ) Jeep Maker Stellantis Offers to Help Suppliers Pay Tariff Costs ( bloomberg ) Diageo Reaches Ciroc Deal With LeBron James-Backed Tequila ( bloomberg ) Generac’s new line of generators targets growing data center demand ( reuters ) Advanced Micro Devices Stock Gets a Downgrade. Nvidia and Intel Are Part of the Problem. (barrons )

China Discusses Accelerating Stimulus to Counter Trump Tariffs ( bloomberg ) Yuan Devaluation Market Chatter Grows as Trade War Worsens ( bloomberg ) China sovereign fund steps in to support stocks plunging on trade war ( reuters ) Goldman Sachs expects significant Chinese fiscal easing to offset tariffs ( reuters ) Vietnam Offers to Remove Tariffs on US After Trump’s Action ( bloomberg ) India Seeks US Trade Talks, Signaling No Retaliatory Tariffs ( bloomberg ) Trump says he can’t say what will happen to markets as his team claims 50 countries are seeking tariff deals ( marketwatch ) South Korea’s Trade Minister Heads to US After Hit by 25% Tariff ( bloomberg ) Philippines Mulls Cutting Tariffs on US Products, Its Trade Chief Says ( bloomberg ) Ishiba to Talk With Trump as Japan’s Nikkei Enters Bear Market ( bloomberg ) Hedge funds capitulate, investors brace for margin calls in market rout ( reuters ) Americans Are Sitting on a Cash Pile as Stocks Reel ( wsj ) The Stock Market’s Fear Gauges Point to a Bounce, Not a Bottom ( wsj ) Treasury Yields Fall. Why They Could Have Further to Drop. ( barrons ) Automakers seek ‘opportunity in the chaos’ of Trump’s tariffs ( cnbc ) Trump’s Trade War Raises Bar for Fed Rate Cuts ( nytimes ) Wall Street Starts to Speak Out Against Trump’s Tariffs ( wsj ) How Global Trade Could Survive Trump’s Tariffs ( wsj ) Warren’s Winning ( zerohedge ) Hisense Partners with GXO to Manage its Logistics Operations in Spain (investing )

As Donald Trump’s trade war heats up, China is surprisingly confident ( economist ) China and America are racing to develop the best AI. But who is ahead in using it? ( economist ) Alibaba’s Qwen2.5-Omni tops Hugging Face’s open-source Ai model list ( technode ) Employee Pricing Returns at Stellantis and Ford Amid Customer Uncertainty ( thedrive ) Automakers jump on Tesla’s brand woes with discount EV offers ( techcrunch ) New Auto Tariffs Are Now in Place, Driving the Industry into Uncharted Territory ( coxautomotive ) Are there any business winners in Trump 2? ( economist ) Cautious Optimism for Building Products Distribution Rising as Sustained Demand for New Residential Construction Expected ( morningstar ) More homes are finally hitting the spring market. Will buyers take the plunge? ( npr ) How Investing Will Change if the Dollar No Longer Rules the World ( wsj ) The Complicated Relationship Between Consumer Sentiment and Stocks ( wsj ) ‘Keep Your Head When All About You Are Losing Theirs’: Here’s Warren Buffett’s Classic Advice As Stock Market Plunges on Tariff Announcement ( entrepreneur ) Alex Ovechkin has tied Wayne Gretzky’s all-time NHL goals record ( npr ) The Launch of the Torpedo Bat ( newyorker ) 5 collector cars to put into your garage this week ( classicdriver ) 5 holes that will decide the Masters (hint: not on the back 9) (golf )