Skip to content

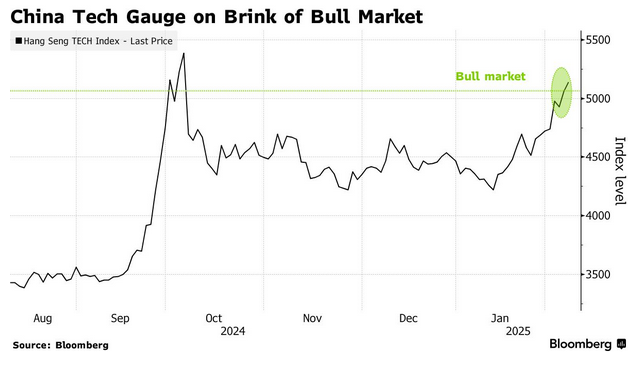

Chinese Tech Stocks Near Technical Bull Market (bloomberg )

European Stocks Hit Record as Upbeat Earnings Temper Trade Fears (bloomberg )

DeepSeek’s emergence is a ‘Sputnik moment’ not just for AI, but for China, which is ‘outcompeting the rest of the world’, bank says (scmp )

Trump’s focus on 10-year Treasury yield to cut borrowing costs raises curiosity — and problems (marketwatch )

One of the few surviving Gilded Age mansions designed by a revered NYC architect has listed for a massive discount (nypost )

Trump is ‘not bluffing’ on Gaza takeover, will do ‘what it takes,’ sources close to prez say (nypost )

C.A.A., Following Trump’s Order, Excludes Transgender Athletes From Women’s Sports (nytimes )

Bessent Projects Normalcy While ‘Completely Aligned’ With Musk (bloomberg )

Trump Will Seek to End Carried Interest, Expand SALT in Tax Bill (bloomberg )

Amazon plans to spend $100 billion this year to capture ‘once in a lifetime opportunity’ in AI (cnbc )

Amazon fourth-quarter cloud revenue falls just shy of Wall Street estimates (cnbc )

Japan’s household spending massively beats expectations, boosting case for further BOJ hikes (cnbc )

Amazon’s outlook underwhelms as tech giant forecasts ‘lumpy’ cloud growth in years ahead (marketwatch )

Tech Giants Double Down on Their Massive AI Spending (wsj )

Amazon Earnings: Shares Fall After Sales Outlook Is Weaker Than Expected (wsj )

Former UPenn Athletes Sue To Expunge Trans Swimmer Lia Thomas’ Records (zerohedge )

Trump administration to keep only 294 USAID staff out of over 10,000 globally, sources say (reuters )

BOJ’s fresh take on labour crunch opens door for more rate hikes (reuters )

XPO Stock Soars. Freight Demand Is Looking Up. (barrons )

Mortgage Rates in US Decrease for Third Week, Slipping to 6.89% (bloomberg )

Alibaba’s updated Qwen AI model overtakes DeepSeek’s V3 in chatbot ranking (scmp )

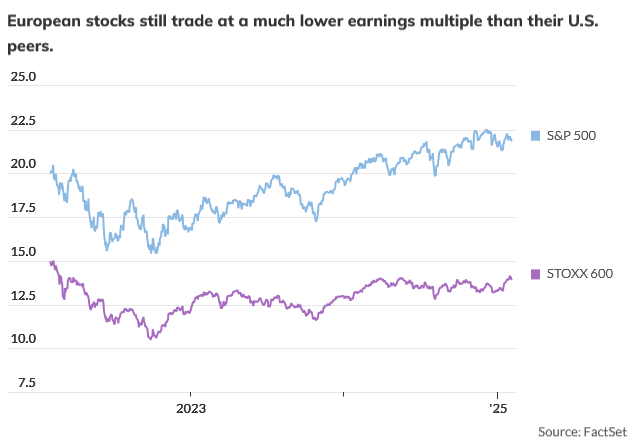

European stocks are beating the U.S. so far this year. Is American exceptionalism dead? (marketwatch )

What Do Trump’s First Weeks Tell Us About His China Strategy? (wsj )

Disney to Centralize Streaming Offerings Within Disney+ (wsj )

Options Traders Bet the Rally in Big Tech Stocks Has More Room to Run (wsj )

Starboard Launches Proxy Fight at Kenvue (wsj )

Honeywell to Break Up in Bid to Recreate Some GE Magic (wsj )

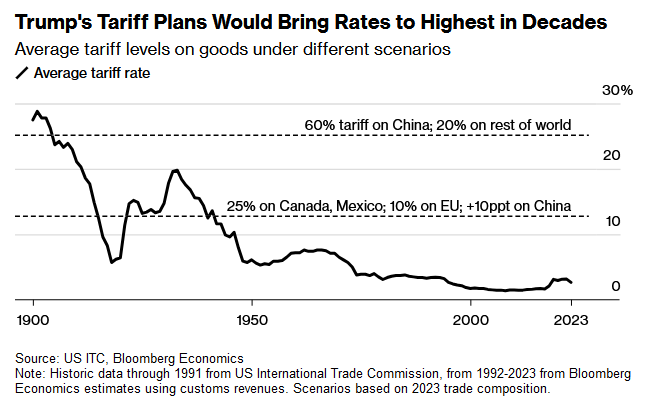

Trump Gets McKinley’s Tariffs Wrong (wsj )

In the deep end Former UPenn athletes sue to vacate Lia Thomas’ records as Trump signs order banning transgender athletes from women’s sports (nypost )

Trump lays out exactly how he plans for US to seize control of Gaza (nypost )

Disney Returns to Its Steamrolling Self (nytimes )

Bessent says Trump is focused on the 10-year yield, won’t push the Fed to cut (cnbc )

Opinion: DeepSeek could sink Big Tech’s AI growth plans (marketwatch )

Doubts about ‘Magnificent Seven’ AI spending plans are creeping in (marketwatch )

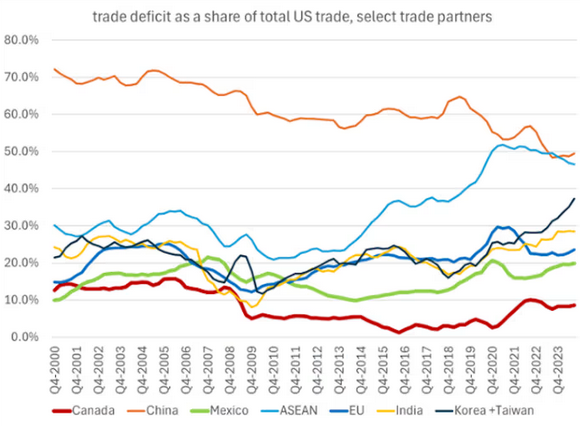

Trump has less leverage over China than during prior trade war – Wells Fargo (streetinsider )

Chinese tech stocks get DeepSeek bump, narrow valuation gap vs ‘Magnificent Seven’ (scmp )

Alibaba bolsters consumer AI team with expert Steven Hoi amid race for top tech talent (scmp )

Markets Shrug Off Tariffs, AI Optimism Fuels Rally (chinalastnight )

Trump’s de minimis cancellation is bad news for Temu, but worse for Shein (reuters )

Disney posts a big profit beat amid strength in sports and experiences (marketwatch )

Say Goodbye to Temu’s Cheap Thrills (bloomberg )

USPS suspends inbound packages from China, Hong Kong Posts (foxbusiness )

Opinion: AMD stops giving AI-chip revenue forecast. History says that’s not a great sign. (marketwatch )

Alphabet’s stock slides in the wake of a revenue miss and huge AI spending target (marketwatch )

Trump Tariffs Risk $29,000 Rise in US Home Building Costs (bloomberg )

Should Comcast split into three? This analyst says a breakup would mean big upside. (marketwatch )

Opinion: Trump has two strong options to defuse the U.S. debt time-bomb. He should use them. (marketwatch )

Trump says US will ‘take over’ and develop Gaza Strip (ft )

Spring Festival boosts travel, consumption as 8-day holiday nears end (cn )

Alphabet Slides After Cloud Sales Fall Short of Expectations (bloomberg )

AMD Tumbles After Giving Disappointing Outlook for AI Growth (bloomberg )

Are Markets Underestimating the Tariff Problem? (wsj )

Disney Earnings Are Up Next. Watch for This Number. (barrons )

Chipotle Revenue Falls Short (barrons )

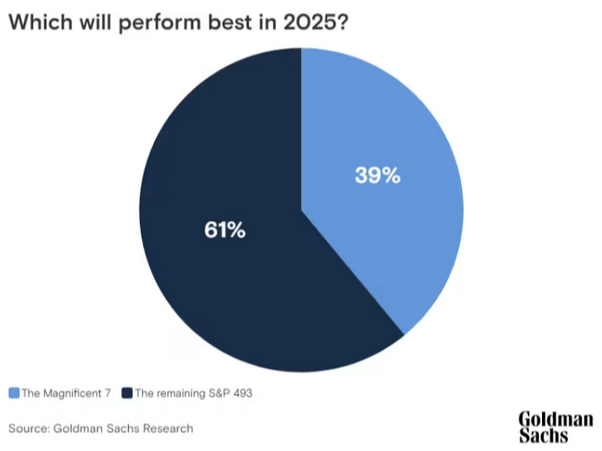

Strategist Who Coined the Magnificent Seven Warns US Tech Is Set to Lag (bloomberg )

Alibaba Stock Is a Winner—If It Can Survive Trump Tariff Turbulence (barrons )

Estée Lauder Stock Is Tumbling. Blame a Huge Charge and Disappointing Outlook. (barrons )

PayPal Earnings Show Refresh Is Working. Why the Stock Is Dropping Anyway. (barrons )

China Hits Back at Trump With U.S. Tariffs. Why Google Is in Its Crosshairs. (barrons )

Strategist Who Coined the Magnificent Seven Warns US Tech Is Set to Lag (bloomberg )

Xi’s Careful Reply to Trump Tariffs Shows China Has More to Lose (bloomberg )

Estée Lauder to Cut Up to 7,000 Jobs in Corporate Overhaul (bloomberg )

PayPal posts an earnings beat, but another metric is weighing on its stock (marketwatch )

How Trump’s tariffs closed the loophole used by Chinese retailers (foxbusiness )

S. Frackers and Saudi Officials Tell Trump They Won’t Drill More (wsj )

Trudeau Bends The Knee: Canada Will Send 10,000 Troops To Border, Name Fentanyl Czar To Delay Trump Tariffs (zerohedge )

Alibaba offers DeepSeek on cloud service after Microsoft, Amazon and Huawei (scmp )

Trump’s 2.0 trade war is already ‘fundamentally different’ from 1.0 (yahoo )

Opinion: ‘Buy the dip and sell the rips’ — stock traders are counting on the ‘Trump put’ (marketwatch )

“Combining these modeled EPS and valuation sensitivities suggests near-term downside of roughly 5% to S&P 500 fair value if the market prices the sustained implementation of the newly-announced tariffs,” says Goldman. (marketwatch )

Barclays assigns 45% probability to courts stopping tariffs (marketwatch )

Tom Lee gives five reasons to buy the dip after tariff announcement (marketwatch )

MarketWatch Today U.S. stock indexes trim losses and dollar pares gain as Mexico touts one-month tariff delay (marketwatch )

Trump’s tariffs could hurt Temu and Shein. Here’s which stocks stand to gain. (marketwatch )

Trump gives a lift to healthcare stocks with comments on Medicare and Medicaid (marketwatch )

U.S. booze stocks tumble as Canada retaliates against Trump tariffs (marketwatch )

UBS Wealth reiterated its 6,600 target for S&P 500. ‘Tariffs unlikely to be sustained.’ (marketwatch )

China Reportedly Preparing Trade Talks With Trump After Weekend Tariff Shock (zerohedge )

US Manufacturing Activity Expands for First Time Since 2022 (bloomberg )

China Prepares Trade Deal for Trump to Avoid Tariffs, WSJ Says (bloomberg )

What Trump Aims to Achieve With His New Tariff Plans (bloomberg )

Stop Panicking Over Teens and Social Media (wsj )

Retail investors pour $900mn into Nvidia as they chase ‘buying opportunity’ (ft )

China Vows Measures Against US Tariffs, Threatens WTO Action (bloomberg )

Here’s how tariffs on Canada, China and Mexico may impact U.S. consumers (cnbc )

Canada and Mexico Move to Retaliate on Tariff Orders (nytimes )

Trump’s Tariffs Put China in a Difficult Spot (nytimes )

Ray Dalio | The All-In Interview (youtube )

Dollar General Is No Walmart. Buy the Stock Anyway. (barrons )

Tech stocks have worst week in months after ‘nobody saw DeepSeek coming’ amid AI mania (marketwatch )

Investors snap up stocks outside of the ‘Magnificent Seven’ in January (marketwatch )

Tech giants to turn into ‘Lagnificent 7’ as U.S. exceptionalism peaks, say Bank of America strategists (marketwatch )

Don’t count on ‘Magnificent Seven’ stocks repeating their winning streak this year, these Wall Street gurus warn (marketwatch )

Intel’s forecast missed by a mile. Here’s why the stock is ‘numb’ to the problem. (marketwatch )

Mexico, Canada Work Against the Clock to Avert Trump Tariffs (bloomberg )

Canada Resorts to Chopper-Video Diplomacy to Halt Trump Tariffs (bloomberg )

Fed’s Goolsbee Lauds Inflation Progress But Supports Slower Pace (bloomberg )

Here’s what Trump’s tariff threats look like on the ground in China (cnbc )

Intel Fourth-Quarter Sales Beat Estimates During Turnaround (bloomberg )

Intel shows signs of progress (marketwatch )

Don’t count on ‘Magnificent Seven’ stocks repeating their winning streak this year, these Wall Street gurus warn (marketwatch )

Inside China, DeepSeek Provides a National Mic Drop Moment (nytimes )

CVS Knows You Hate Those Locked Cabinets (nytimes )

Why Chinese Tech Keeps Surprising the West (bloomberg )

Nvidia retail investors told us why they’re unfazed by DeepSeek’s market disruption and refusing to sell (businessinsider )

Novo Nordisk Shares Still Have a Long Road Back from 40% Slump (bloomberg )

Markets (and the world) on edge as Trump’s tariff deadline approaches (yahoo )

Alibaba springs a Lunar New Year surprise on DeepSeek, global AI market (scmp )

GDP grew at a 2.3% pace in the fourth quarter, less than expected (cnbc )

10-year Treasury yield slides after weaker-than-expected GDP (cnbc )

Fed holds rates steady, takes less confident view on inflation (cnbc )

“Alibaba on Jan. 29 unveiled a new version of its AI model called Qwen2.5 Max that it claims has performance comparable or better than OpenAI, DeepSeek, Google and Meta models.” (investors )

Nvidia Stock Falls. What Microsoft and Meta Earnings Mean for the AI Chip Maker. (barrons )

Fed Stands Pat on Rates, Entering New Wait-and-See Phase (wsj )

OpenAI says DeepSeek stole its AI data, but how common is ‘distillation’? (scmp )

Chinese tech giant flexes its muscles in global race for AI dominance (foxbusiness )

They Invested Billions. Then the A.I. Script Got Flipped. (nytimes )

Why blocking China’s DeepSeek from using US AI may be difficult (reuters )

Most Popular Hedge Funds Don’t Want Your Money But Smaller Firms Might (bloomberg )

The White Lotus Is Already Driving a Travel Boom in Thailand (bloomberg )

ECB warns of ‘headwinds’ to Eurozone economy as it cuts rate to 2.75% (ft )

Why some ‘Magnificent Seven’ companies could be earning less in 2050 than today (marketwatch )

Boeing CEO Sees Company Reaching Key 737 Milestone This Year (bloomberg )

If you liked deepseek you’re going to LOVE Alibaba’s Qwen 2.5-Max, the #1 performing AI globally. (Alibaba )

Boeing’s Rosy Outlook Negates the Need for a Fire Sale (bloomberg )

U.S. manufacturers show signs of recovery from 2-year slump. (marketwatch )

GM sees fatter profits ahead on strength of gas-powered SUVs and electric cars (marketwatch )

DeepSeek Challenges Everyone’s Assumptions About AI Costs (bloomberg )

Billionaire Castel to Acquire Diageo’s Unit And Expand in Ghana (bloomberg )

US Consumer Confidence Drops to Four-Month Low on Job Market (bloomberg )

Billionaire Beal’s Bank Scored Record Year After Tapping the Fed (bloomberg )

GM Earnings Beat Expectations. Why the Stock Is Getting Crushed. (barrons )

Boeing Confirms Its Bad Earnings. Why the Stock Is Higher. (barrons )

Bets on Bigger Treasuries Rally Are Booming Before Fed Decision (bloomberg )

New US Transportation Chief Orders Fuel Economy Rule Rewrite (bloomberg )

Fed’s Balance-Sheet Plans Mystify Wall Street as Officials Meet (bloomberg )

Yahoo’s big bet (businessinsider )

Boeing CEO: Don’t expect a major restructuring, but maybe a ‘pruning’ (marketwatch )

Wall Street’s AI ‘bubble’ echoes dotcom excesses, Ray Dalio warns (ft )

Wynn looks to Vegas to help revamp Macau’s US$28 billion casino economy (scmp )