Skip to content

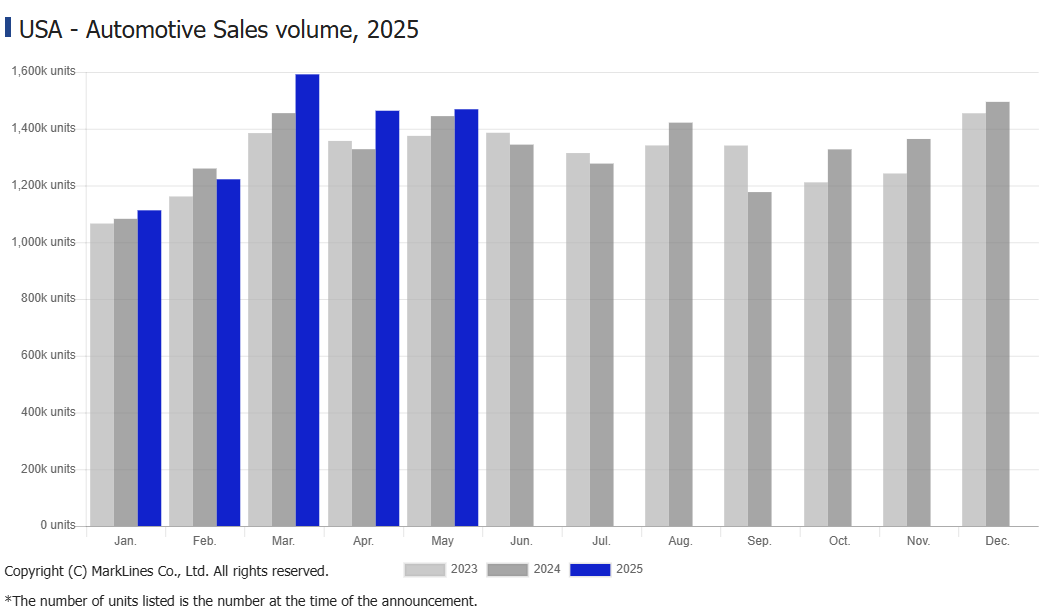

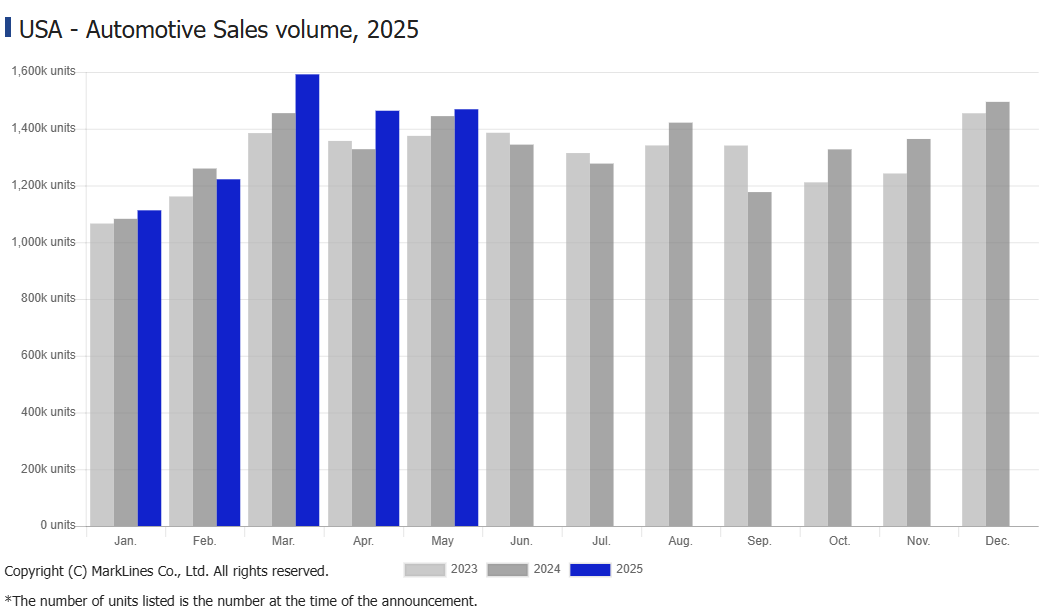

- Ford reports 16% sales increase in May amid employee pricing, tariffs (cnbc)

- U.S. auto sales up 1.4% in May, rush buying before tariff hikes slows (marklines)

- Proposed new auto loan tax deduction could help buyers get break on interest (usatoday)

- Alibaba, JD.com sales surge during 618 shopping festival on the back of subsidy programme (scmp)

- China stocks benefit from shift away from US assets: Natixis (scmp)

- Hong Kong’s Hopes Hinge On Trump-Xi Call & Policy Meeting Stimulus (chinalastnight)

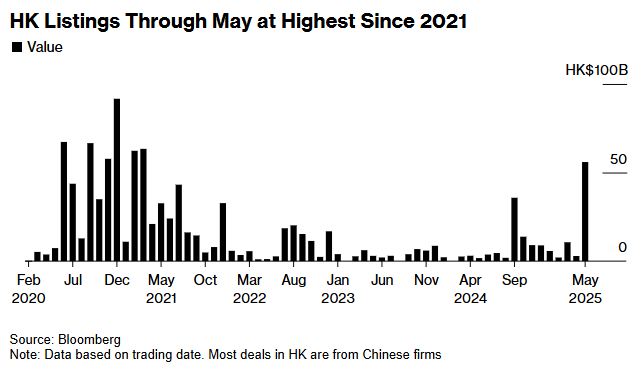

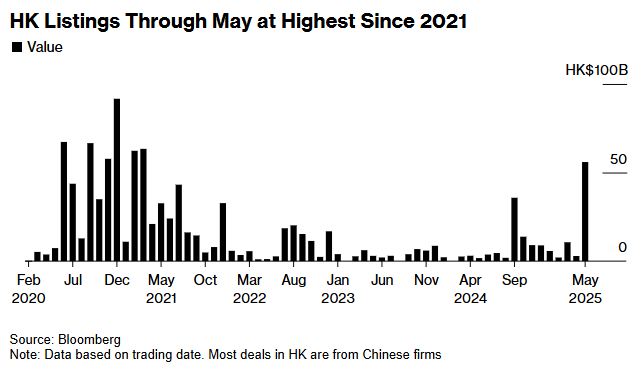

- Action in Hong Kong Equity Markets Stirs Most Excitement in Years (bloomberg)

- Chinese Firms Brush Off US Tariff Risks With Domestic Confidence (bloomberg)

- The U.S. and China Are at Loggerheads Over Tariffs. Why a Trump-Xi Call Is Likely. (barrons)

- The Bull Market Is Being Powered by Stocks Outside the US (bloomberg)

- US Woes Spark Pivot to Europe, Safer Sectors, BC Partners Says (bloomberg)

- AI Data Center Boom Requires A Lot Of Natural Gas (zerohedge)

- Data Centers Added $9.4 Billion in Costs on Biggest US Grid (bloomberg)

- It’s Treasury Vs The Fed: With Fed Sidelined, Bessent Unleashes Record $10 Billion Bond Buyback (zerohedge)

- US Job Openings Unexpectedly Rose in April and Hiring Picked Up (bloomberg)

- Interest rates are normal, the world is not (ft)

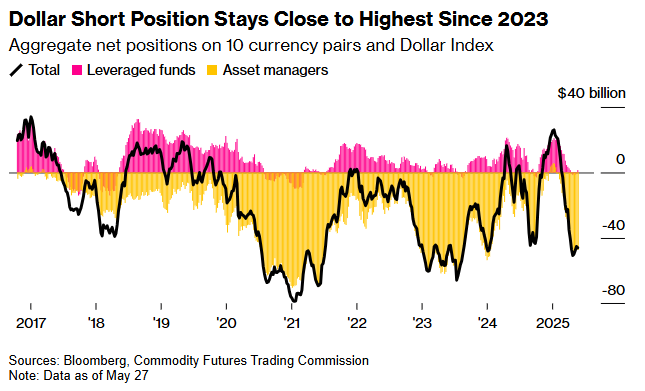

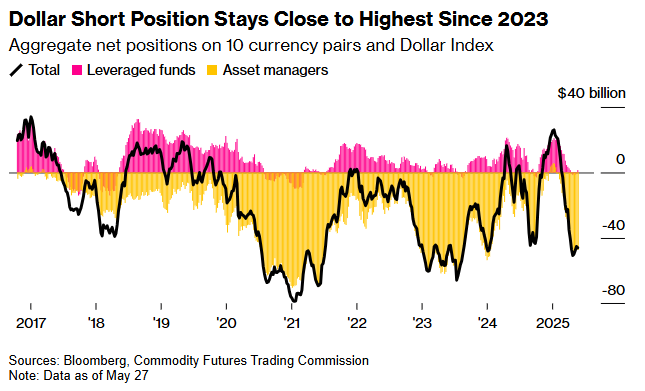

- How Low Will the Dollar Go? (nytimes)

- PayPal Unveils Another Credit Card for In-Person Shopping Push (bloomberg)

- Tom Lee: Risk is now of a substantial leg-up rally from here (youtube)

- Buy ‘Defensive’ Stocks. You’ll Be Glad You Did. (barrons)

- Boeing CEO Ortberg is winning hearts on Wall Street. Here’s the latest vote of confidence. (marketwatch)

- Boeing 737 MAX Production Tops 38 Jets Per Month For First Time In Years (zerohedge)

- Why Bernstein thinks Boeing stock is the best idea in Aerospace & Defense (investing)

- The Dollar Had Its Biggest Drop to Start the Year. It Could Get Worse. (barrons)

- FX options market positioned for further dollar weakness (reuters)

- 2025 Biopharma Industry Outlook: Growth, Innovation, and Emerging Risks (morningstar)

- Biotech M&A shows signs of life (ft)

- Emerging-Market Stocks Gain as China Data Refuel Stimulus Hopes (bloomberg)

- Hong Kong stocks near 2-month high on ‘likely’ Trump-Xi trade talks (scmp)

- Temu’s daily US users cut in half following end of ‘de minimis’ loophole (nypost)

- Walt Disney Co. to Lay Off Hundreds (wsj)

- Fed’s Goolsbee Says Rates Can Fall If Trade Policy Is Resolved (bloomberg)

- White House ‘close to the finish line’ on some trade deals, says Treasury official (cnbc)

- 3 reasons it’s a great time to buy a home, according to Compass’ CEO (businessinsider)

- Recession? Atlanta Fed Hikes US Q2 Growth Outlook To Highest Since 2021 (zerohedge)

- Deutsche Bank lifts S&P 500 year-end target amid Wall Street upgrade wave (streetinsider)

- How ‘Lilo & Stitch’ Became One of the Most Profitable Movies in Years (nytimes)

- Boeing Stock Can Gain 25%, Says Analyst. Thank President Trump. (barrons)

- BofA lifts Boeing to Buy, sets a new Street high price target (investing)

- Emirates airline boss sees positive progress at troubled Boeing (nypost)

- The global economy faces many headwinds, but the aviation industry is expected to defy them (cnbc)

- Mainland Chinese households set to buy another US$100 billion of Hong Kong stocks: HSBC (scmp)

- UBS upbeat on China stocks, citing tariff pause with US and potential Beijing stimulus (scmp)

- Trump and Xi are likely to talk soon about trade, though no date has been set, Hassett says (cnbc)

- Chinese Stocks Score Over Indian Peers on Tally of Analyst Bets (bloomberg)

- Why Nvidia Can’t Just Quit China (wsj)

- Hedge funds buy stocks at quickest pace since Nov 2024, Goldman Sachs says (reuters)

- Hedge Fund Bears Capitulate, Buy Most Tech Stocks On Record (zerohedge)

- UBS: Bull case scenario for global stock market gaining traction (streetinsider)

- Fed’s Waller Highlights a Path to 2025 Rate Cuts (wsj)

- Wall Street Sees Deeper Dollar Rout as Currency Nears 2023 Low (bloomberg)

- Dollar’s correlation with Treasury yields breaks down (ft)

- Making 6,600 on the S&P seems more achievable today than it did in February: Fundstrat’s Tom Lee (youtube)

- Europe Defense Stocks Hit Fresh Record as UK to Ramp Up Spending (bloomberg)

- Neglecting Grids Would Be the Ultimate Power Failure (bloomberg)

- Boeing enjoys a Trump bump (economist)

- Kelly Ortberg: Boeing should not be an ‘unintended consequence’ of trade war (ft)

- Air India in talks for major new narrow-body jet order, sources say (reuters)

- The contest to cash in on Chinese AI heats up (economist)

- China’s crazy reverse-credit cards (economist)

- Europe Stocks Stage World-Beating Rally as Trade War Backfires (bloomberg)

- Survey of key market fundamentals (scottgrannis)

- Why A Strong May Could Have Bulls Smiling (carsongroup)

- Why this analyst sees a major box office rebound this summer (yahoo)

- Canada Goose: Vertical manufacturing an edge against tariffs (yahoo)

- Johnny Miller’s simple crash course for ball-striking excellence (golf)

- The Best Golf Courses in Every State (golfdigest)

- China’s Consumers Are Spending in Smaller Cities. It’s the Power of the New Middle Class. (barrons)

- Chinese Listing Spree Sparks Revival Hopes in Hong Kong Stocks (bloomberg)

- The U.S. Plan to Hobble China Tech Isn’t Working (wsj)

- China Violated Trade Deal, but U.S. Will ‘Work That Out’ With Xi, Trump Says (barrons)

- Stocks Soar To Best May Since ’90; Gold Gains As Dollar Dumps To Three-Year-Low (zerohedge)

- Fed’s Daly Says Still Comfortable With Two Rate Cuts in 2025 (bloomberg)

- Tariff Confusion Has Investors in Search of the Boring (barrons)

- Investors must not let the tariff drama cloud their judgment (ft)

- The 10 Best Companies to Invest in Now (morningstar)

- Walt Disney theme parks explains massive expansion plans (thestreet)

- There are 500,000 more people selling their homes in the U.S. than those looking to buy them (fortune)

- Redfin says housing market bubble could deflate this year (thestreet)

- Volkswagen flags ‘massive’ US investments and says tariff talks constructive (reuters)

- Etsy’s CEO shares two key steps he took early in his career that set him up for later success (fortune)

- Drinks groups mount fightback as alcohol faces ‘tobacco moment’ (ft)

- Non-alcoholic beer projected to overtake ale as the second-largest beer category worldwide this year (cnbc)

- Boeing to resume airplane deliveries to China next month, ramp up Max production, CEO says (cnbc)

- US FAA extends program allowing Boeing to conduct agency tasks like inspections (reuters)

- Boeing to Weigh Big 737 Max Output Jump Later This Year (bloomberg)

- Turkey, nuts and Spam are appealing to ‘strained’ consumers, Hormel says (marketwatch)

- Disney+ Expands Subscriber Perks, Including Movie Premieres (bloomberg)

- ‘Trickle’ of global inflows to Chinese stocks could become a ‘flood’: Cambridge Associates (scmp)

- Chinese tech groups prepare for AI future without Nvidia (ft)

- Exclusive | China’s world-beaters in tech, energy sectors are focus of investors, JPMorgan says (scmp)

- Bessent Says US-China Talks ‘Stalled,’ Pushes for Trump-Xi Call (bloomberg)

- European Stocks Set for Biggest Monthly Advance Since January (bloomberg)

- The End of the Easy US Stock Bet Has Been Good to Contrarians (bloomberg)

- Citi: U.S. stocks now least preferred among global asset managers (streetinsider)

- Investors see US stocks rally broadening, even as ‘Magnificent Seven’ rebound (reuters)

- Interest-Rate Cuts Could Resume With Trade Deals, Says Chicago Fed President Austan Goolsbee (barrons)

- Bank of America CEO Brian Moynihan on What Makes the U.S. ‘Fundamentally Strong’ (barrons)

- GDP Shrank Less Than First Reported Last Quarter. This Is Why. (barrons)

- Inflation rate slipped to 2.1% in April, lower than expected, Fed’s preferred gauge shows (cnbc)

- Dollar set for fifth monthly drop on trade, fiscal uncertainty (streetinsider)

- For First Time Since 2019, Trump Invites Powell To White House To Discuss Economy (zerohedge)

- The Stock Market Is Crushing an Old Wall Street Cliché (barrons)

- Retailers, Ducking Trade-War Curveballs, Stick to Their Plans (wsj)

- Ulta Raises Full-Year Outlook as Consumers Keep Spending on Beauty (wsj)

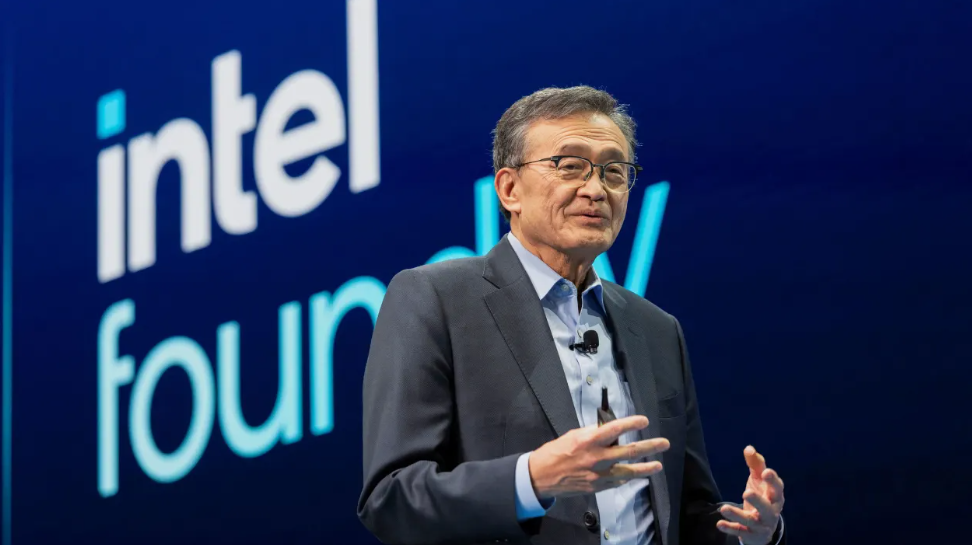

- Intel CEO Lip-Bu Tan has a long track record in the chip industry. Now he needs a big customer (cnbc)

- Nvidia CEO Warns That Chinese AI Rivals Are Now ‘Formidable’ (bloomberg)

- Toyota Sales Hit Second Monthly High on US Tariff Rush (bloomberg)

- General Motors CEO Defends Trump Auto Tariffs (wsj)

- Federal trade court strikes down Trump’s reciprocal tariffs (cnbc)

- Buying the stock market dip hasn’t paid off this much in 30 years (yahoo)

- The Best Energy Stocks to Buy Now (morningstar)

- How a Shortage of Transformers Threatens Electricity Supply (bloomberg)

- Boeing aims to certify 737 MAX variants by year-end, CEO tells Aviation Week (reuters)

- US suspends engine sales to Chinese planemaker COMAC, New York Times reports (reuters)

- “Race To The Bottom”: BYD Price Slashing To Prompt Chinese EV Consolidation (zerohedge)

- Record Foreign Demand For Blowout 5Y Treasury Auction (zerohedge)

- Will Tariffs Bring Manufacturing Back? BofA Says It’s Too Late. (barrons)

- Americans’ Finances Remain Solid. It’s the Job Market. (barrons)

- European stocks to scale new heights in 2026, trade tensions temper loftier hopes (reuters)

- This market wants to go higher, Carson Group’s Ryan Detrick (youtube)

- Hormel Foods tightens annual profit forecast amid weak retail demand (reuters)

- Citi’s Fraser Says Clarity From Trump Would Unleash IPO Markets (bloomberg)

- China Tech Ambitions Won’t Hurt Consumption Pivot, Keyu Jin Says (bloomberg)

- Alibaba Weighs Options to Reduce Stake in ZTO Express (bloomberg)

- Alibaba touts rapid growth in fast-delivery service in heated race with Meituan, JD.com (scmp)

- Alibaba’s healthcare AI model scores as high as senior-level doctors in medical exams (scmp)

- DeepSeek Gave China AI a Jumpstart. How Today’s Players Stack Up. (barrons)

- Why Value Investing Has Worked Better Outside the US (morningstar)

- Path of Least Resistance for Stocks Is Higher, Barclays Says (bloomberg)

- Wall Street Bets the Worst of Trump’s Trade War Is Behind It (wsj)

- A dollar crunch is looming — but probably not until next year, says strategist (marketwatch)

- Hollywood Notches Record Memorial Day Weekend at Box Office (barrons)

- Home Prices Keep Climbing. What Could Slow Them Down. (barrons)

- Why Berkshire, Coca-Cola, and Other Low-Volatility Stocks Are Killing It in 2025 (barrons)

- Goldman Unexpectedly Finds Signs Of Life In Working-Poor Consumer (zerohedge)

- Conference Board Consumer Expectations Surge Most In 14 Years After Tariff ‘Pause’ (zerohedge)

- China Turns to Consumers to Boost Growth, but Households Are Wary (wsj)

- Alibaba’s new ‘instant commerce’ portal passes 40 million daily orders (reuters)

- Don’t underestimate the Chinese consumer (ft)

- China’s Industrial Profit Growth Picks Up Despite US Tariffs (bloomberg)

- Temu-Owner PDD Misses Earnings Estimates. The Stock Falls 14%. (barrons)

- Bernstein says U.S. gas supercycle is coming (streetinsider)

- Corporate America Forging Ahead With Capex Plans Buoys Stocks (bloomberg)

- EU Agrees to Fast-Track Trade Talks With U.S. (wsj)

- Eurozone’s Economic Outlook Picks Up After Tariff Turmoil Abates (wsj)

- Businesses are finding a workaround for tariffs — and it’s entirely legal (cnbc)

- My underlying bullishness remains intact, says Ed Yardeni (youtube)

- Exclusive: Nvidia to launch cheaper Blackwell AI chip for China after US export curbs, sources say (reuters)

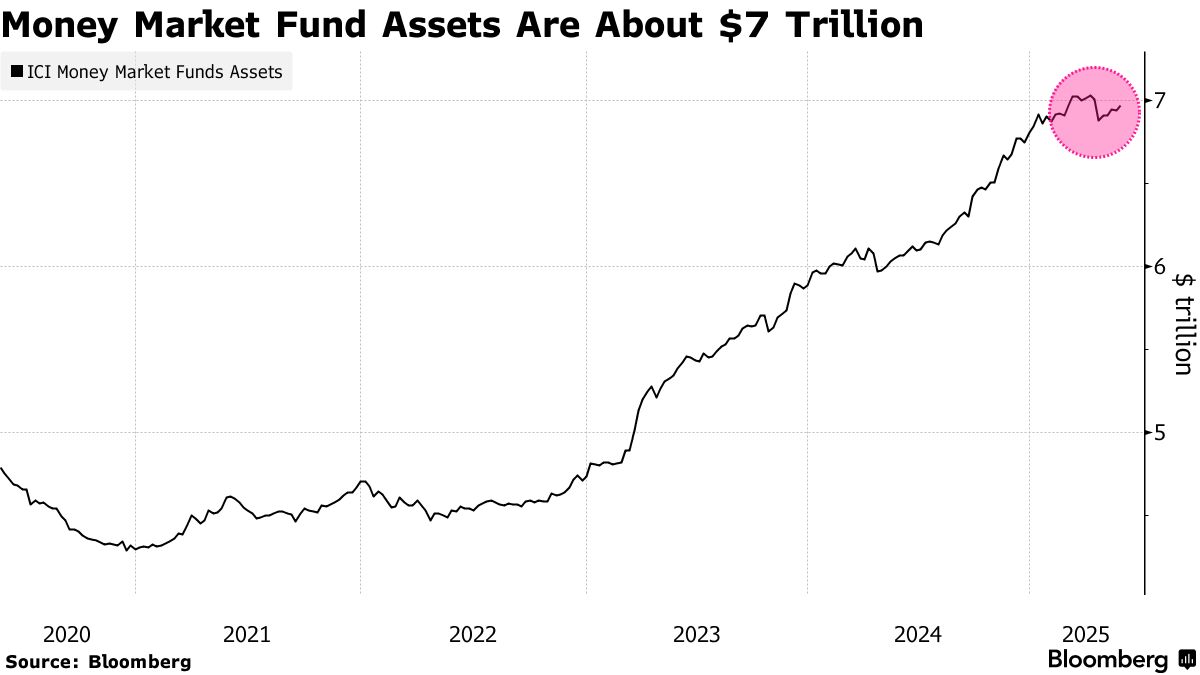

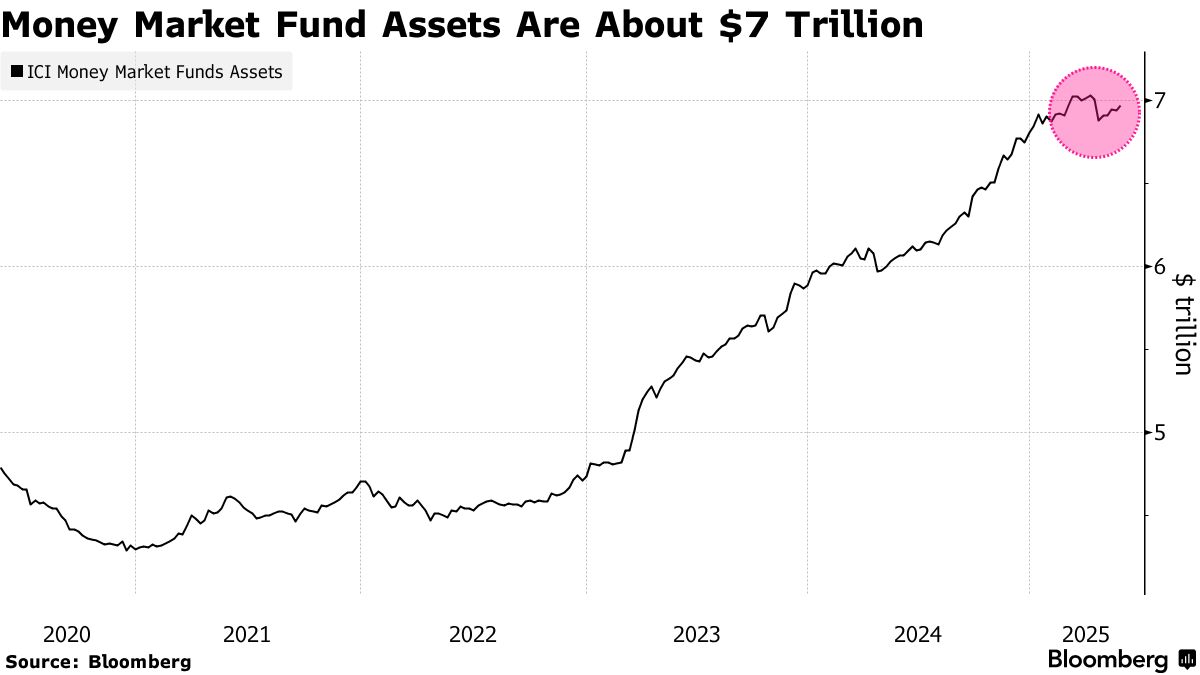

- Investors With $7 Trillion Cash on the Sidelines Await Nvidia (bloomberg)

- ‘Lilo & Stitch,’ ‘Mission: Impossible’ Fuel Memorial Day Record (bloomberg)

- Cricket gives Disney-Ambani unit in India almost as many users as Netflix (ft)

- Goldman Sachs Expects Stronger Yuan to Boost Chinese Stocks (bloomberg)

- Alibaba chairman Joe Tsai says company on a ‘good path’ after years of setbacks (scmp)

- Wealthy investors see ‘time to buy’ Hong Kong stocks amid trade war: Standard Chartered (scmp)

- Chinese tech giants reveal how they’re dealing with U.S. chip curbs to stay in the AI race (cnbc)

- Alibaba’s Amap offers ride-hailing function catering to foreign visitors in China (scmp)

- American Homes Are Shrinking. Why Are They Still So Unaffordable? (wsj)

- Housing market shift: 80 major markets that are seeing falling home prices (fastcompany)

- Memorial Day weekend will see a surge in road trips with record-breaking travel expected (fastcompany)

- Trump Pushes Back Deadline on EU Tariffs to July 9 (wsj)

- Warren Buffett will retire as a CEO—but still plans to go into the office: ‘I’m not going to sit at home and watch soap operas’ (cnbc)

- Investors Pile Into ETFs at Record Pace Despite Market Turmoil (wsj)

- These 10 Charts Keep Us From Getting Bearish (zerohedge)

- Soaring bond yields threaten trouble (economist)

- US Wins First World Hockey Title Since 1933 With Victory Over Switzerland (bloomberg)

- Alex Palou Conquers the Indianapolis 500 and Finally Wins on an Oval (roadandtrack)