Skip to content

Trump Says He’ll Give TikTok a 90-Day Reprieve. The App Threatens to Shut Down at Midnight. (barrons )

How Buffett and Munger helped Americans become savvy investors (nypost )

Voters Want MAGA Lite From Trump, WSJ Poll Finds (wsj )

Trump Told Advisers He Wants to Visit China as President (wsj )

Bank of Japan Is Set to Raise Interest Rates, Trump Permitting (bloomberg )

Perplexity Said to Submit Bid to Merge With TikTok’s US Unit (bloomberg )

Trump Says He’ll Likely Visit California Next Week, NBC Says (bloomberg )

Walgreens CEO Admits That Locking Merchandise Away From Shoplifters Makes Regular People Not Buy It (futurism )

The Single Biggest Individual Financier In The World. The Richest Woman In America: Hetty Green (founders )

Your Guide to Trump’s Day-One Agenda — From Taxes to Tariffs (bloomberg )

Traders Pile into Bullish China ETF Wagers After Trump-Xi Call (bloomberg )

What Trump is planning for day one — and what could matter most for investors (yahoo )

Trump, China’s Xi Discuss Trade, TikTok Before Inauguration (bloomberg )

Why Trump’s Plan to Escalate Tariffs Has So Many Haters (bloomberg )

S&P 500 Has Its Best Week Since November Election (bloomberg )

Can an EV Ever Really Be a Muscle Car? (bloomberg )

Sources Say Intel Is An Acquisition Target (semiaccurate )

SLB Stock Jumps on Earnings. AI Is the ‘X Factor’ for Energy-Tech Industry. (barrons )

Chinese Stocks in Hong Kong Cap Best Week in Three Months (bloomberg )

This Gorgeous Lamborghini Miura Is Up For Grabs (maxim )

China’s fourth-quarter GDP grows at 5.4%, beating market expectations as stimulus measures kick in (cnbc )

China Home Prices Fall at Slower Pace as Stimulus Takes Hold (bloomberg )

EV, hybrid sales reached a record 20% of U.S. vehicle sales in 2024 (cnbc )

How Hershey Stock Could Gain 9% (barrons )

US Retail Sales Broadly Advance, Capping a Solid Holiday Season (bloomberg )

Fed may cut rates sooner and faster than expected if inflation keeps cooling, key official predicts (nypost )

Trump Is Making a Last-Ditch Attempt to Save TikTok. Meta and Snap Stocks Fall. (barrons )

DuPont Stock Is Rising. ‘Deal Limbo’ Might Be Over. (barrons )

Disney Stock Will Take a Hit From L.A. Fires, High Costs, and More. This Analyst Says It’s Still a Buy. (barrons )

Treasury yields end at lowest levels in weeks on rate-cut possibilities (marketwatch )

Where Does L.A.’s Luxury Home Market Go From Here? (wsj )

From Cartier to Target, Investors Find Cheer in Holiday Spending (wsj )

Cartier Owner Richemont’s Sales Beat Buoys Luxury Stocks (wsj )

TSMC Expects Continued AI-Driven Growth After Ending 2024 Strong (wsj )

Economic Toll of Los Angeles Fires Goes Far Beyond Destroyed Homes (nytimes )

E-Commerce Boom to Drive 10% Freight Growth, Qatar Airways Says (bloomberg )

“Chinese President Xi Jinping will skip US President-elect Donald Trump’s inauguration on Monday but will send Vice President Han Zheng instead, the country’s Foreign Ministry said. An announcement Friday from an unnamed ministry spokesperson confirming Han’s participation said China wanted a “stable, healthy and sustainable relationship” with the US and was ready to work with the new American government to “find the right way for the two countries to get along with each other.” (bloomberg )

Commentary: China’s economic resilience makes a case for faith (cn )

Chicago Fed President Sees Promising Progress on Inflation (barrons )

Intuitive Surgical Stock Jumps. ‘Da Vinci’ Robots Guide the Future. (barrons )

Short Seller Hindenburg Research Closes Up Shop (barrons )

Balance of Power Shifts Back Toward Bosses (wsj )

Even Harvard M.B.A.s Are Struggling to Land Jobs (wsj )

Where Does L.A.’s Luxury Home Market Go From Here? (wsj )

TikTok may get reprieve from Trump over US ban — after vow to go dark on Sunday (nypost )

Strong Winds Ease in L.A. as Fire Crews Make Progress (nytimes )

Chinese imports spiked as US buyers prepared for tariffs (usatoday )

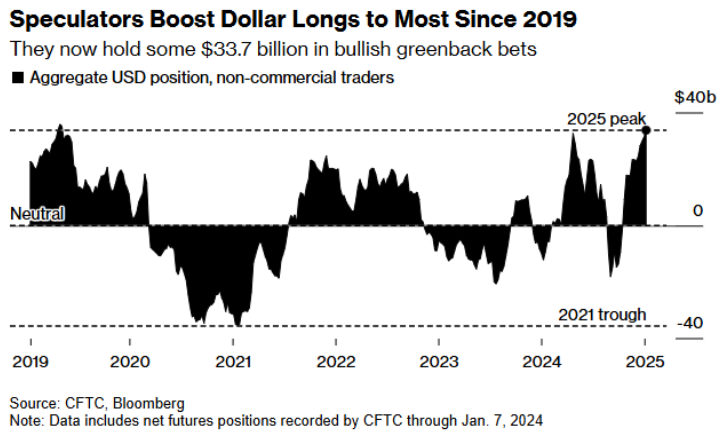

Bessent to Say Dollar’s Global Status Is Critical to US Economy (bloomberg )

Goldman Sachs CEO Solomon says IPO market is ‘going to pick up’ along with dealmaking (cnbc )

10-year Treasury yield pulls back after core inflation is light in December (cnbc )

Disney wins the 2024 box office as year-end receipts offer a welcome boost (cnbc )

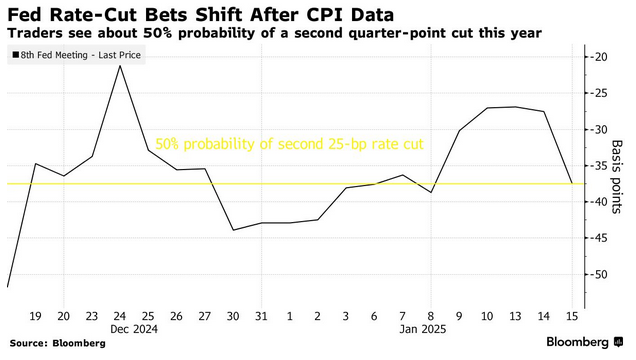

Treasuries Surge as Easing Inflation Boosts Fed Rate-Cut Bets (bloomberg )

China Faces Harsh Dilemma as Its Currency Comes Under Pressure (wsj )

Consumer & Technology Stocks Lead China Rally (chinalastnight )

China stocks rise on report that Trump is considering a gradual approach to tariffs (yahoo )

Joseph Tsai: BABA-W Imports US$50B Worth US Goods Annually to Help Cushion Trade Deficit (aastocks )

Microsoft pauses hiring in U.S. consulting unit as part of cost-cutting plan, memo says (cnbc )

Meta announces 5% cuts in preparation for ‘intense year’ — read the internal memo (cnbc )

Intel to spin off venture capital arm as chipmaker continues to restructure (cnbc )

Odds of Multiple Rate Cuts in 2025 Are Rising (barrons )

Treasury Yields, Dollar Fall Following December Inflation Data (barrons )

Trump Plans ‘Energy Dominance’ Executive Orders After Inauguration (wsj )

Access to Your Airport Lounge Is Getting Even Harder (wsj )

‘Red Note,’ a Chinese App, Is Dominating Downloads, Thanks to TikTok Users (nytimes )

Housing Costs Show Signs of Cooling But Remain Sticky (bloomberg )

China State Grid Plans Record $89 Billion Spend Amid Green Surge (bloomberg )

Wall Street Sees Best CPI Day Since October 2023: Markets Wrap (bloomberg )

How Scott Bessent Won Over MAGA and Wall Street (bloomberg )

‘Accidents waiting to happen’ in private credit, says Wellcome Trust (ft )

Investors pour billions into S&P equal weight fund as tech fears rise (ft )

Dow adds more than 350 points, but Nasdaq closes lower as investors rotate out of tech (cnbc )

Trump Team Studies Gradual Tariff Hikes Under Emergency Powers (bloomberg )

Buy on dips in this Chinese internet stock, JPM says (investing )

US Wholesale Inflation Surprisingly Eases on Drop in Food Prices (bloomberg )

Producer Inflation Cooled Slightly in December (barrons )

Palantir Stock Is Down This Year After an Incredible 2024. Why Jefferies Remains Bearish. (barrons )

Manufacturers Could Shine in 2025. Eight Stocks to Watch. (barrons )

Growth Stocks Are Getting Crushed. Here Are 8 Bargains. (barrons )

Large-cap U.S. stocks may be heading for a lost decade, this contrarian warns. What to buy instead. (marketwatch )

Which insurance companies have the most exposure in California? (foxbusiness )

An out-of-the box idea for China and Trump (ft )

A Bond Selloff Is Rocking the World. You Might Want to Take the Other Side. (wsj )

China Boosts Yuan Support With Warning, Capital Control Tweaks (bloomberg )

China’s Trade Surplus Reaches a Record of Nearly $1 Trillion (nytimes )

Boeing Stock Would Benefit From a Breakup, Specialist Says (barrons )

China and the U.K. have the opposite problem. They just struck a deal. (marketwatch )

The bull market is still intact. This pullback is just the cost of doing business, says strategist (marketwatch )

Goldman Sachs Is All-In on the American Exceptionalism Trade (barrons )

Moderna Stock Sinks. It Disappoints With Covid-19 Vaccine Forecast. (barrons )

China Downplays Deflation Troubles. Bond Vigilantes Aren’t Buying It. (barrons )

The Car Market’s Hottest Deal: The Cheap EV Lease (wsj )

Stocks Are Close to Wiping Out Trump Bump as Rate Fears Kick In (bloomberg )

Investors Hope Earnings Season Can Revive Faltering Stock Rally (wsj )

We’re ‘cautiously optimistic’ about the economic outlook, says JPMorgan’s Gabriela Santos (cnbc )

December Imports Increase On Domestic Demand (chinalastnight )

China’s Export Boom Means Trump Tariffs Would Hit Beijing Where It Hurts (wsj )

Meet Trump’s Economic Whisperers (nytimes )

China Securities Regulator Vows Efforts to Stabilize Market (bloomberg )

China’s imports post surprise growth in December; exports beat expectations as higher tariffs loom (cnbc )

Opinion: The stock market’s ‘Trump bump’ will be back. Just be patient. (marketwatch )

There goes 80% of the market, says one reaction to new White House microchip rules (marketwatch )

Trump should declare California an ‘opportunity zone’: Jeff Sica (foxbusiness )

Natural-Gas Stocks Are Set to Beat the Market. Here’s Why. (yahoo )

‘Ready to talk’ Greenland leaders open to speak with Trump after prez-elect expressed interest to make territory part of America (nypost )

Stock market’s ‘Trump bump’ nearly erased thanks to bond selloff. What’s next. (marketwatch )

On Bubble Watch (oaktreecapital )

Why the odds may favor value stocks (oakmark )

Chick-fil-A’s Lemon-Squeezing Robots Are Saving 10,000 Hours of Work (bloomberg )

Can American Drivers Learn to Love Roundabouts? (bloomberg )

How Much Would Buying Greenland Cost? (nytimes )

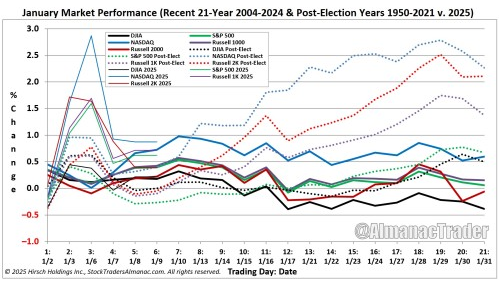

Stocks Wrestle with Rates Typical January Action So Far (almanactrader )

A Bond Selloff Is Rocking the World. You Might Want to Take the Other Side. (wsj )

Tariff fears trump modest jobs growth (scottgrannis )

Fundstrat’s Tom Lee on why rise in yields might be false flag (cnbc )

Meet Alibaba’s AI coder: an automated system that can build an app ‘in minutes’ (scmp )

Biotech Stocks Prepare For Action In 2025. Weight-Loss Drugs, AI And Trump 2.0 Are The Catalysts. (investors )

Opinion: The stock market has one more chance to fight off the bears (marketwatch )

The Market Is Overreacting. Don’t Lose Your Head. (barrons )

S. stocks are expensive ‘on almost any valuation metric.’ Why they could remain so for a while. (marketwatch )

ASML Is the Chip-Equipment Leader. Its Stock Is Poised to Bounce Back. (barrons )

China’s Central Bank Beefs Up Support as Yuan Nears 16-Month Low (wsj )

Self-Driving Cars Don’t Do Snow. Goodyear Says the Solution Is Smarter Tires. (wsj )

Warren Buffett Prepares His Middle Child for the Job of a Lifetime (wsj )

Detroit Auto Show flaunts the old and the new at iconic car show (usatoday )

Macy’s lists 66 ‘underproductive’ stores set for closure; over 80 closures still to come (usatoday )

Hershey Seeks New CEO With Michele Buck Departing Next Year (bloomberg )

Blowout Jobs Report Fuels Wall Street Fear of ‘Lose-Lose’ Market (bloomberg )

China Vows Proactive Fiscal Policy, Bigger Deficit to Aid Growth (bloomberg )

Delta Cracked the Code for Post-Pandemic Profits (bloomberg )

G Sachs Chief Economist Expects Trump to Slap ~20% Extra Tariffs on Most CN Goods on Avg. Only (aastocks )

Intel Stock Has Been Beaten Down. How a New CEO Could Shake Things Up. (barrons )

Home Insurers Are Exiting California. The Wildfires Could Make It Worse. (barrons )

Hollywood Hills and Other L.A. Fire News: 5 Dead; Economic Toll Nears $60 Billion (barrons )

Dividends Will Keep Growing in 2025. Where to Find Them. (barrons )

Trump’s Team Is Stocked With Billionaires. Why the Super Rich Are Taking Over Washington. (barrons )

Can DOGE Really Slash $2 Trillion? Even Elon Musk Says This Number Is More Likely. (barrons )

Bank of America Bond Losses Could Top $100B (barrons )

Fed Minutes Suggest Officials Will Hold Rates Steady for Now (wsj )

S. Dockworkers and Port Employers Reach Labor Deal (wsj )

Ozempic, Lego Bricks and Hearing Aids: What Trump’s Greenland Plan Could Hit (nytimes )

Former President Jimmy Carter credited his longevity to his happy marriage: ‘Marry the best spouse’ (cnbc )

December jobs report forecast is 155,000. But here’s the number investors really should watch. (marketwatch )

Why Donald Trump wants Greenland (ft )

China steps up defence of renminbi against Wall Street bets (ft )